- 3 Big Scoops

- Posts

- Nasdaq Reclaims Record High

Nasdaq Reclaims Record High

Another week, another record!

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

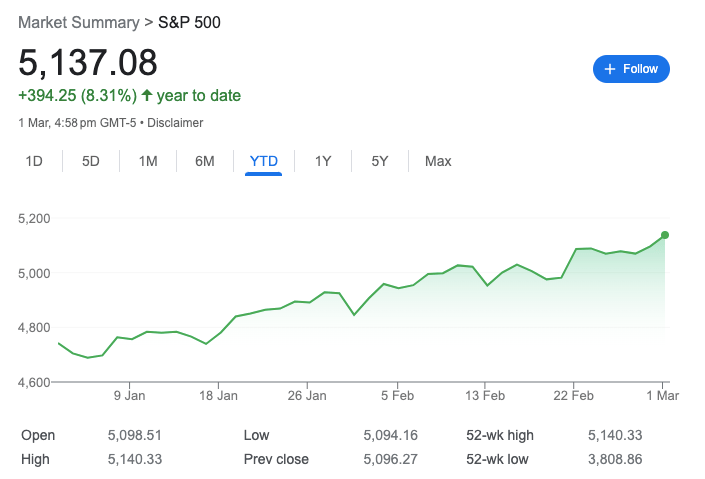

S&P 500 @ 5,137.08 (⬆️ 0.80%)

Nasdaq Composite @ 16,274.94 ( ⬆️ 1.14%)

Bitcoin @ $63,639.65 ( ⬆️ 1.3%)

Hey Scoopers,

Happy Monday! Here’s what we are covering today:

👉 Nasdaq’s stellar gains

👉 What next for equity investors?

👉 Ethereum’s price surge

So, let’s go 🚀

Market Wrap 📉

The equity market in the U.S. finished higher on Friday, with the Nasdaq Composite and S&P 500 indices closing at record highs.

The tech sector rose 2.4% last week and was the top-performing one, followed by the consumer discretionary sector, which rose 2.1%. Meanwhile, the healthcare sector trailed the broader market, falling 1.1% in the last five trading sessions.

Comparatively, the Dow Jones lagged the major indices last week due to notable declines in UnitedHealth, Amgen, and Nike.

Shares of UnitedHealth fell over 7% as one of its business segments faced a cyberattack. The healthcare giant experienced its worst week in almost 14 months.

Trending Stocks 🔥

Spirit AeroSystems - Shares surged more than 12% following a report stating that Boeing was in talks with Spirit to reacquire the fuselage supplier, almost 20 years after it spun into a seperate company.

Hewlett Packard Enterprise - The tech stock surged roughly 2% after its fiscal Q1 of 2024 earnings of $0.03 per share topped estimates. However, its revenue stood at $6.76 billion, below estimates of $7.11 billion.

Daimler Truck - Shares of the commercial vehicle manufacturer rose over 18% after reporting record profits and share buybacks worth $2.16 billion.

Nasdaq Composite At Record Levels

The impressive numbers surrounding mega-cap tech stocks have driven the rally in the Nasdaq Composite index, which notched a new high last week, primarily on the back of slowing inflation and the AI megatrend.

The recent gains can be attributed to the stellar performance of companies such as Nvidia, Microsoft, and Meta. In the last 12 months:

👉 Nvidia has gained 260%

👉 Microsoft has risen 62% and

👉 Meta is up 172%

The Nasdaq was, in fact, the last of the three major stock indices to reclaim its record high. In recent months, enthusiasm over AI has lifted mega-cap tech stocks and the broader markets.

Further, slowing inflation and the possibility of interest rate cuts in the second half of 2024 have contributed to the ongoing recovery after the indices entered a bear market in 2022.

In fact, all three major indexes notched their fourth straight month of gains. So, it’s only fair to ask iif the equity rally has run too hot, too fast.

Our take

The current equity bubble is not overly large in terms of price appreciation duration, sentiment, or valuation. Several experts are also disputing whether we are in a bubble right now, given earnings growth estimates remain robust.

Where Should You Invest Right Now?

There is a good chance for the equity market rally to cool down soon. March has historically been a good month for stocks, as the S&P 500 has posted an average return of 1.1%.

But during election years, average monthly returns move lower to just 0.4%.

Investors should understand it’s impossible to time the equity markets. The best way to gain exposure to this inflation-beating asset class is by creating a diversified portfolio of stocks.

For instance, most of your savings should be allocated towards blue-chip stocks, part of the S&P 500. Additionally, you may also include small caps, quality bonds, and international equities in your portfolio.

Right now, the 10 largest S&P 500 companies account for 32% of the index, and this narrow leadership in the U.S. market may be a cause of concern.

But the U.S. market is also one of the most diverse, underpinned by solid fundamentals.

Ethereum Gains 121% In Last 12 Months

Bitcoin is the world’s largest cryptocurrency, valued at a market cap of $1.3 trillion. The second largest digital asset is Ethereum, valued at $417 billion.

While Bitcoin is hogging the headlines due to its impressive comeback in the last 14 months, Ethereum prices have gained over 120% in the last year.

Ethereum currently trades at $3,470, well below its all-time high price of $4,850. There is a chance for multiple spot ETH ETFs to launch later this year, acting as a tailwind for the cryptocurrency.

Generally, spot ETFs provide an easier way for retail investors to access this disruptive asset class.

Ethereum is the leading blockchain network for building decentralized finance or DeFi applications. Due to its widening utility, Ark Invest’s Cathie Wood expects Ethereum’s market cap to touch $20 trillion by 2030.

Given the current circulating coin supply of 120 million, it indicates ETH prices might surge to a whopping $170,000. Wood expects Ethereum to outpace Bitcoin in the next crypto market rally and might potentially “flip” Bitcoin in terms of market cap.

Headlines You Can't Miss!

U.S. national debt soars past $34 trillion

Arkhouse, Brigade raise Macy’s buyout bid to $6.6 billion

Toyota to invest $2 billion in Brazil

U.S. crude touches $80 per barrel for the first time since November

Nigeria demands $10 billion from Binance

Chart of The Day

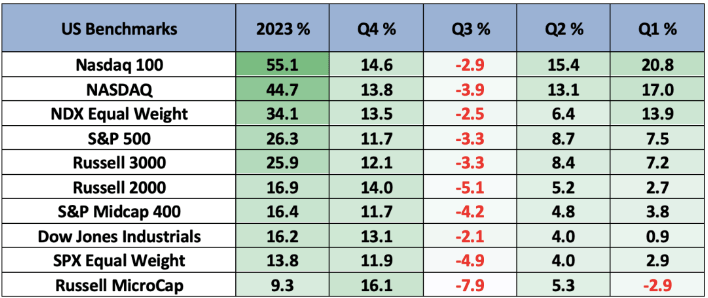

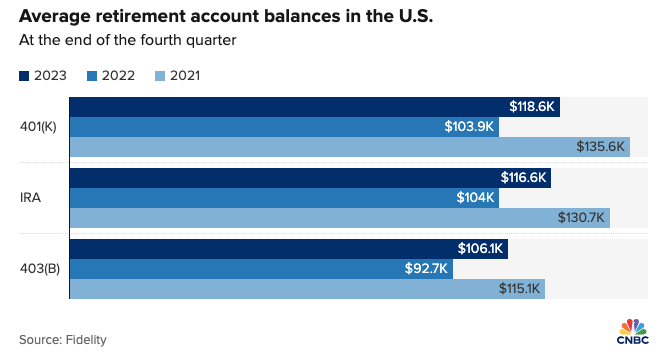

While 2023 defied equity market expectations, it helped retirement savers to reap the benefits.

For instance, retirement account balances nosedived in 2022 due to market volatility and have bounced back, according to data from Fidelity Investments, the largest provider of 401 (k) savings plans in the U.S.

Fidelity handles 45 million retirement accounts and stated the average 401 (k) balance rose by 14% year over year to $118,600 in 2023.

The average individual retirement account balance also rose 12% to $116,600 in Q4 of 2023.

Due to solid equity market gains, the number of Fideliy 401(k) plans with a balance of more than $1 million rose 11.5% year over year in Q4.

More than 33% of retirement savers increased retirement savings contributions, with an average contribution rate of 13.9%, just below the suggested savings rate of 15%.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.