- 3 Big Scoops

- Posts

- AI Fuels Stock Market Rally In 2023

AI Fuels Stock Market Rally In 2023

PLUS: Housing market is on the mend

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 4,781.58 ( ⬆️ 0.14%)

Nasdaq Composite @ 15,099.18 ( ⬆️ 0.16%)

Bitcoin @ $43,274.53 ( ⬆️ 2.12%)

Hey Scoopers,

Thursday is here. The weekend is on the horizon, and we’re wrapping up.

Here’s what’s on today’s menu 👇

👉 An AI-fueled rally

👉 Interest rate cuts

👉 Bitcoin stocks

So, let’s go 🚀

Tech Stocks Have a Blockbuster Year

One sector stole the show in 2023: tech. The advent of ChatGPT late last year spurred a host of artificial intelligence-related developments, with the tech sector catapulting the Nasdaq 100 up 54% and giving the S&P 500 a 24% boost.

But while it’s impressive that very few companies are leading this charge, that very fact may become a cause for concern next year.

The S&P 500 index is more concentrated than ever, with Apple alone on the verge of outshining France's entire stock market. That means investors are hitching a ride on a shrinking number of companies for their returns.

In fact, the top ten companies are now worth as much as the bottom 415. That number was 294 a decade ago.

We’ve seen tech dominate like this before, during the dot-com bubble. The key difference is that this time, the “Magnificent Seven” companies are swimming in cash, raking in profit, and boasting growth rates and margins double that of the rest of the market.

Those fundamentals arguably justify high valuations, and Big Tech companies are trading fairly in line with their historical values. Plus, given their unique competitive advantages, this concentration trend might stick around for a while.

A top-heavy market doesn’t necessarily mean future returns will take a hit. Far from it: history says market gains often come from a handful of companies.

And even after the top-five stocks have had their moment, the S&P 500 has historically risen by an average of 6.7% in the next six months.

Goldman’s not worried anyway, having recently raised its 2024 S&P 500 target by 8%, forecasting that falling inflation and weakening interest rates will be a buoy for US stocks.

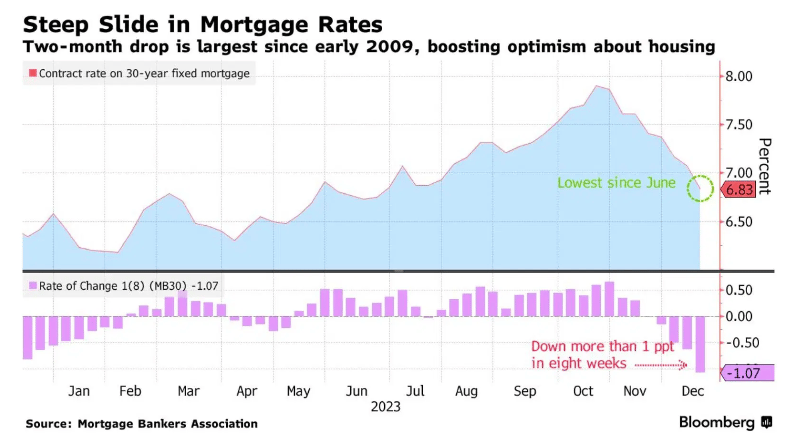

Mortgage Rates Move Lower in the U.S.

Sky-high mortgage rates have put Americans off the housing market, forcing them to forgo the dream of a yard and swing set for a little longer.

But with the Federal Reserve hinting at potential rate cuts next year, investors have been buying Treasuries to lock in the benefits of higher rates before they decline.

Moreover, mortgage rates just hit their lowest since June after a five-week slide. So now, Americans have been lining up outside open houses again. Plus, housing construction is up, sales of pre-owned homes have picked up from a 13-year low, and builders are feeling optimistic about future business.

Economists don’t book psychic appointments; they use the housing market as their crystal ball.

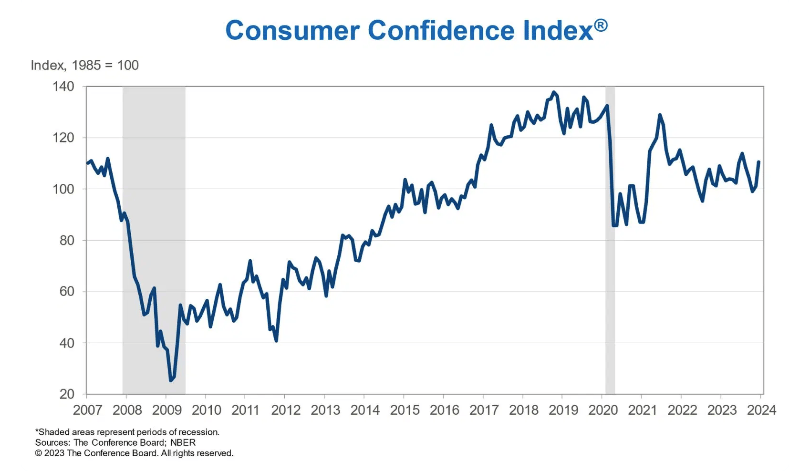

Stats like home sales, building permits, and house prices indicate how the economy is faring – and the latest promising signs are backed up by December’s US consumer confidence rising by the most since early 2021.

So, with the housing market seeming stable and Americans feeling financially confident, it’s no wonder Goldman Sachs pumped up its economic growth predictions for the last quarter of this year.

Homeowners in Britain won’t be quite as cheery, mind you: the average UK home turned 1.2% cheaper between this October and last, the quickest fall in over a decade.

The steepest price drops are happening in the capital, too, with folk swapping London life for cheaper, roomier abodes elsewhere.

But since the country’s inflation started falling in line in November, the Bank of England may feel pressure from testy homeowners to cut its 15-year-high interest rates.

Coinbase Stock Soars Over 450% In 2023

Shares of cryptocurrency exchange Coinbase have gained more than 450% year-to-date as Bitcoin prices have more than doubled this year.

Coinbase prices are tied to the performance of Bitcoin as the exchange generates a majority of its revenue from brokerage fees, which in turn depends on trading volumes.

Trading volumes move significantly higher during bull markets but nosedive when sentiment turns bearish. While Coinbase is looking to diversify its revenue base, the stock price will likely move in line with BTC in the near term.

Bitcoin has also driven shares of Bitcoin mining companies higher this year. For instance, in 2023, shares of:

👉 Hut 8 Mining has ⬆️ 2,017%

👉 Marathon Digital has ⬆️ 808%

👉 Riot Platforms has ⬆️ 450%

Headlines You Can’t Miss!

New York Times sues Microsoft and OpenAI

AI fails to propel cloud growth in China

Apple to begin Apple Watch sales again

Is a student debt crisis brewing?

Ethereum gains 6% as it plays catch-up to Bitcoin

Chart of the Day

Everyone in the market is talking about one thing: interest rate cuts next year from the Federal Reserve.

After all, the Fed’s now hinting at the possibility of three interest rate reductions in 2024, and that’s got investors thinking there could be even more.

Either way, it’s a huge deal: falling interest rates boost stock prices, especially for growth companies that depend on future earnings.

The last time the Fed began cutting interest rates (in 2019), the S&P 500 shot up by about 30%, and investment-grade bonds gave a solid 9% return.

And in the rare instance of a soft-landing scenario (when an interest rate hiking series has managed to bring down inflation without triggering a recession), the S&P 500 has jumped an average of 15% in the year following the first rate cut, according to data that goes back to 1965.

So the big question is: what does this all mean for your money?

It’s a good time to consider locking in some still-decent bond yields. With inflation settling and the Fed seemingly calling a wrap on its interest rate hikes, bond yields probably have peaked.

You may want to consider riskier assets – emerging market stocks in particular. The US dollar will likely weaken as interest rates fall, bringing Treasury yields down.

In the US, meanwhile, laggards like small-caps, value stocks, REITS, lower-quality tech stocks, and high-yield bonds could outperform in 2024, assuming the US can continue to keep itself out of a recession.

Don’t doubt the persistence of the market’s robust rally. With interest rates at multi-decade highs, investors have stashed nearly $6 trillion in cash in money markets and short-term instruments.

If borrowing costs decline in 2024, yields are likely to follow suit. This could channel a substantial portion of the $6 trillion in assets into stocks and other higher-risk investments, which could boost the market.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.