- 3 Big Scoops

- Posts

- Bitcoin ETFs Are Here !

Bitcoin ETFs Are Here !

Bitcoin, Coinbase, and fossil fuels

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 4,783.45 ( ⬆️ 0.57%)

Nasdaq Composite @ 14,969.65 ( ⬆️ 0.75%)

Bitcoin @ $46,122.25 ( ⬆️ 0.26%)

Hey Scoopers,

Thursday is here. Get ready for a day filled with opportunities

👉 The SEC approves 11 spot Bitcoin ETFs

👉 Is Coinbase under threat?

👉 India and China drive demand for coal

So, let’s go 🚀

Smart Money Flows Into Bitcoin

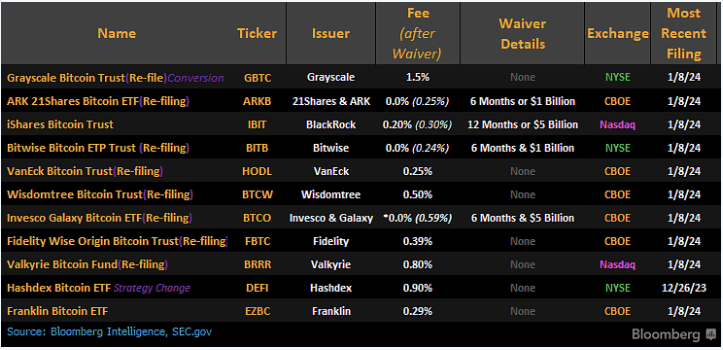

Yesterday, the Securities and Exchange Commission (SEC) approved 11 applications for Bitcoin exchange-traded funds from some of the world’s largest asset managers, including BlackRock, Fidelity, and Invesco.

So, how does this impact the average retail investor?

In several cases, investors will pay lower fees for purchasing Bitcoin than they would have paid if they bought it on a crypto exchange such as Coinbase, Binance, or Kraken.

An ETF allows investors to buy a product tied to the price of Bitcoin, a mechanism used to purchase other asset classes such as stocks, bonds, and gold.

It also eliminates the need to manage these holdings, which might involve holding Bitcoin in a crypto wallet or in cold storage.

Will Bitcoin prices rally?

Over 52 million Americans own cryptocurrency, and the slew of approvals should attract new retail and institutional investors waiting on the sidelines to gain easier access to this disruptive asset class.

RIAs, retirement funds, and other institutions might consider adding crypto to their portfolio due to the recent approval.

The wealth management industry in the U.S. manages $30 trillion in assets. Multiple Bitcoin ETFs are expected to launch today, bringing in billions of dollars in investments in 2024.

How much should you allocate towards Bitcoin?

Cryptocurrencies are still highly speculative. However, you can consider allocating a small portion of your investment portfolio (less than 5%) towards the digital asset.

In addition to its volatility, cryptocurrencies don’t produce any cash flows compared to traditional investments and are worth as much as someone is willing to pay for them.

Bitcoin ETFs Threaten Coinbase?

Is Coinbase’s position under threat now that the SEC has approved multiple Bitcoin ETFs?

Coinbase has been named a custodial partner for several asset managers, including BlackRock, Franklin Templeton, and WisdomTree. It means Coinbase will be central to the storage and safekeeping of Bitcoin purchased on the ETFs.

Source: Coinbase

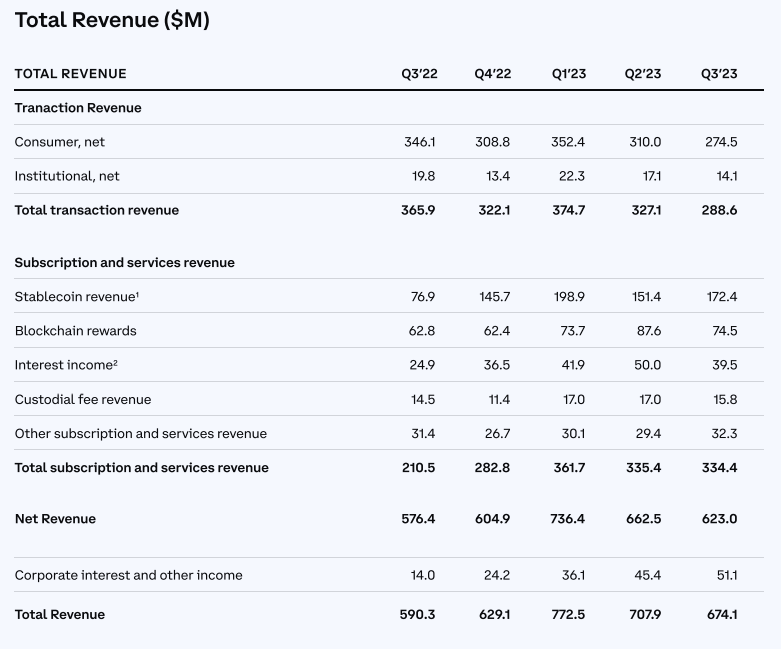

While custody sales will diversify Coinbase’s revenue stream, analysts are worried that its core transaction business is at risk.

In 2022, Coinbase generated 75% of its sales from transaction fees, and this number fell to 46% in Q3 of 2023.

Coinbase stock rallied almost 400% last year, valuing the company at $36 billion by market cap. Most of these gains were due to Bitcoin’s impressive run, as the digital asset surged 150% in 2023.

In a research report published in December 2023, Bernstein predicted that 10% of the global supply of Bitcoin (around $300 billion) will be managed by ETFs in the next five years.

However, Coinbase remains bullish as the company expects the ETF approval to add credibility to the market, resulting in higher liquidity and market stability.

Emerging Economies Drive Global Coal Demand

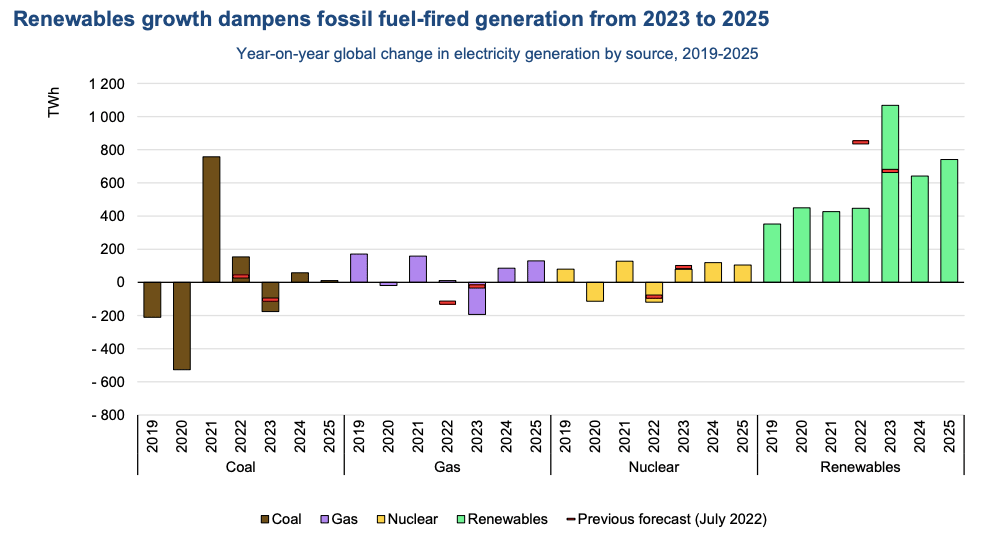

China and India’s growing economies will drive coal demand in the next decade, even though the two countries are transitioning towards clean energy. China is the world’s largest energy consumer, followed by the U.S. and India.

China’s share of global electricity consumption is forecast to jump to 33% by 2025, up from 25% in 2015. Right now, 60% of its energy is generated by coal.

Here are some mind-boggling numbers for you 👇

👉 Global coal usage touched record highs in 2023, surpassing 8.5 billion tons

👉 India’s coal production rose 15% to 893 million tons

👉 China’s raw coal production rose 2.9%

👉 The amount of coal the U.S. consumes each day fell 62% to 2.8 million tons

India’s carbon emissions rose 8% last year, and the country expects to generate 50% of its electricity demand from renewables by 2030, up from 22% currently.

Headlines You Can’t Miss!

China’s EV stocks are under pressure

Citigroup might report a quarterly loss in Q4

iRobot stock slumps 19%

Inflation report will suggest the pathway for rate cuts

MicroStrategy’s BTC profits are near $3 billion

Chart of The Day

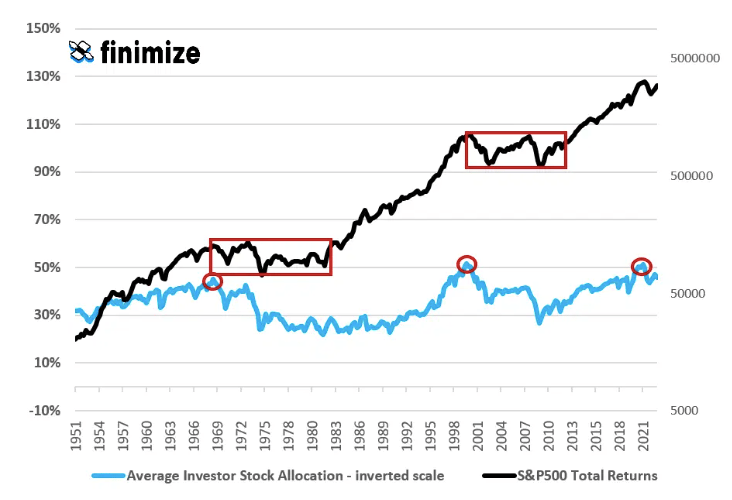

A lot of things can influence short-term stock returns: interest rates, economic data, geopolitical stuff, investor sentiment – even weather.

But for long-term returns, one factor rules them all: the proportion of assets that investors are parking in stocks.

This ratio has proven to be the most reliable predictor of stock returns over a ten-year horizon, outshining even heavyweight factors like valuations.

It says that when investors go big on stocks, their long-term returns tend to be below average. That’s because investors typically aim for a steady mix of stocks versus other assets, historically between 30% and 40% (blue line).

When they over-allocate, three things can bring the proportion back down: liabilities grow, more shares are issued, or prices fall. Usually, the adjustment happens via falling share prices.

There are three important takeaways from this. First, stocks don’t perpetually climb: they can have “lost decades” – times when stocks fluctuate but ultimately don’t deliver positive returns.

This has happened even to the best-performing assets: US stocks (as you can see from this chart’s shaded rectangles).

Second, investor over-allocation to stocks has been the most precise warning signal of those lost decades.

A spike in allocations to stocks (blue line, red shaded circles) preceded both the lost decade of the 1970s and the early 2000s. This may give you a pretty good idea when the odds aren’t in your favor.

Third, with the average allocation dangerously high right now, US stocks could face another lost decade.

Our take

If you expect investor allocations to stocks to return to their longer-term average, there are two things you could do to prepare for it. First, consider rebalancing your asset mix: less stocks, more bonds, commodities, and other assets.

Second, check out stock markets that have less extreme positioning – for example, in Europe, the UK, Japan, and emerging markets. It might not pay off immediately (certainly not in just one year), but in the long run, the odds look pretty promising.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.