- 3 Big Scoops

- Posts

- Investing in Airline Stocks

Investing in Airline Stocks

Delta, Airbus, Ryanair, and more

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 5,234.18 ( ⬇️ 0.14%)

Nasdaq Composite @ 16,428.82 ( ⬆️ 0.16%)

Bitcoin @ $66,958.80 ( ⬇️ 0.76%)

Hey Scoopers,

Happy Monday. In today’s issue, we look at the pros and cons of investing in airline stocks.

So, let’s go 🚀

An Overview of the Airline Sector

The airline industry is one of the most fascinating and essential sectors of the modern economy. Its companies can be broadly classified into two categories: no-frills low-cost carriers and full-service firms with complimentary meals, premium cabin options, and sought-after loyalty programs.

The postwar economic and technological boom saw global air passenger traffic inexorably increase to hit 4.6 billion passengers in 2019. And then came the coronavirus.

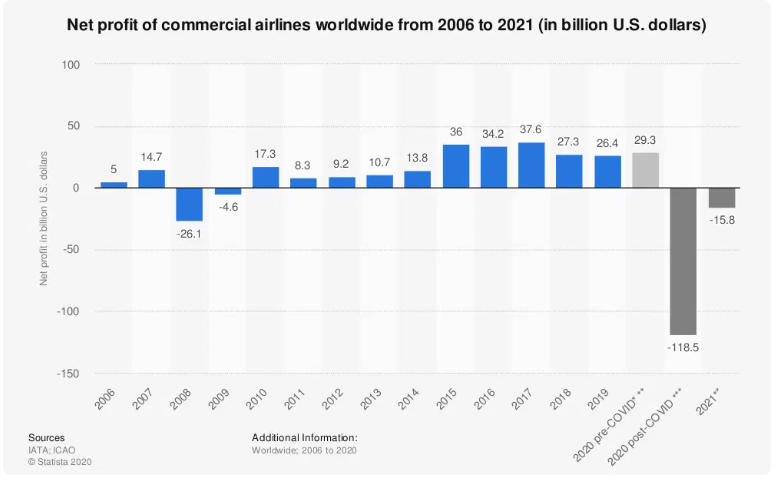

The pandemic slammed the industry particularly hard, more than 9/11 and the 2008 financial crisis put together: airlines around the world made an estimated $118 billion loss in 2020.

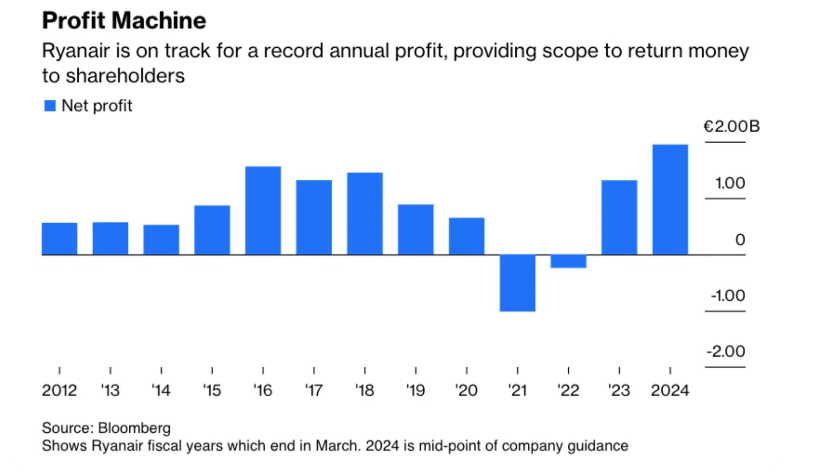

But as the chart above shows, the airline industry overall was previously enjoying healthy profitability. In fact, the past decade was the most profitable in its history.

While several airlines have gone bankrupt as a result of the pandemic, many have managed to weather the storm – and may arguably come out of it stronger than ever, with government aid in their pockets and less competition around.

The S&P 500 Airlines Industry Index, however, has yet to resume its pre-2020 altitude.

So, assuming airlines can return to their previous profitability, now might be a great time to invest in a few of their stocks. Let’s dive deeper.

U.S. Airline Stocks Remain Risky

Airline stocks in the U.S. remain high-risk bets even though they trade at really cheap multiples.

Most airline companies in the U.S. are struggling with slowing growth and rising costs, which has resulted in lower cash flow estimates for 2024.

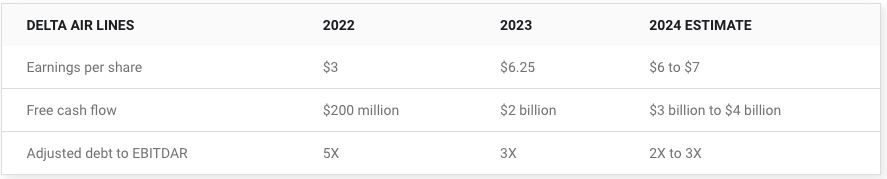

For instance, Delta Air Lines expects revenue in Q1 of 2024 to rise between 3% and 6% year over year compared to the 20% growth experienced in 2023. It also expects nonfuel cost per available seat mile to rise by 3%.

In Q1, Delta forecasts an operating margin of 5%, lower than the 9.7% margin in Q4 of 2023.

Source: Motley Fool

The COVID-19 pandemic forced Delta Air Lines and peers to increase balance sheet debt significantly to offset cash burn rates amid lockdowns.

Basically, investors are looking at debt-heavy companies that have lowered full-year guidance while wrestling with rising costs and slowing sales.

Delta stock is quite cheap and trades at 6.4x earnings and 8.3x free cash flow for 2024. Its debt is quite high at $29 billion, but it generates enough cash flow to meet interest expenses and reinvest in growth.

Verdict for Delta and other U.S. stocks: High-risk, high-reward

AI won’t take your job, but a person using AI might. That’s why 500,000+ professionals read The Rundown – the free newsletter that keeps you updated on the latest AI news and teaches you how to apply it in just 5 minutes a day.

Boeing vs. Airbus

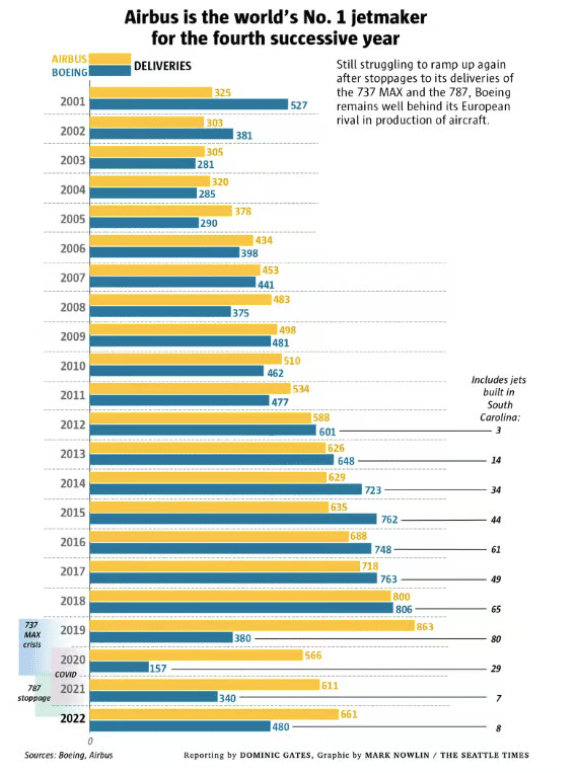

The airline manufacturing segment is a duopoly with two major players- Airbus and Boeing. In the last few years, Airbus has gained significant traction over Boeing, currently accounting for 67% of the airline manufacturing market.

In 2023, Airbus cemented its position as the world’s largest plane maker for the fifth consecutive year, securing more orders than Boeing.

Boeing, on the other hand, is wrestling with several incidents related to its lineup of 737 Max planes. Moreover, with $40 billion in balance sheet debt, Boeing shares are down 20% in 2024 as investors are wary of its weak financials and the ongoing crisis.

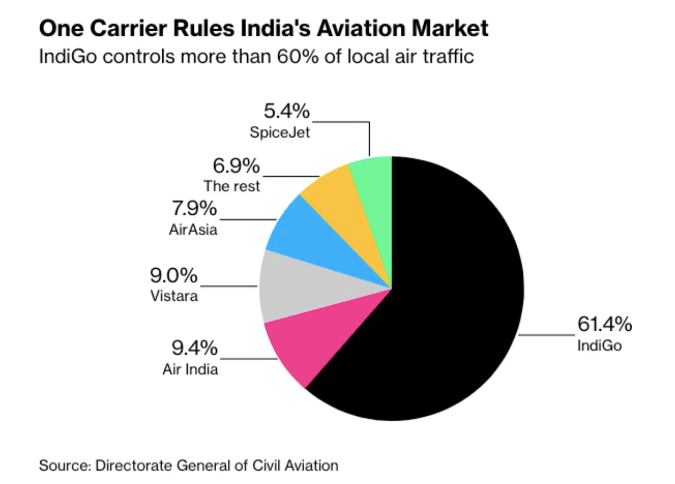

Global airlines continue to expand their fleets to meet post-COVID-19 demand, as Airbus bagged 2,094 aircraft orders in 2023. Air India ordered 250 Airbus planes, while IndigGO, India’s largest aircraft carrier, agreed to buy 500 jets from the European manufacturer.

Airbus ended 2023 with a backlog of 8,600 planes, much higher than Boeing's backlog of 5,626 planes. Moreover, Airbus emphasized that it will be sold out until the end of this decade for single-aisle jets and through 2028 for its wide-body A350 planes.

The global airline fleet is expected to grow by 33% in the next decade. Carriers are forecast to operate 36,000 aircraft by 2033, up from 27,400 jets today.

Verdict for Airbus: An excellent shovel play amid the gold rush

Verdict for Boeing: Don’t waste a penny on this stock

Ryanair Can be a Multibagger

Low-cost airline Ryanair unveiled plush results, demonstrating that strong books beat free pretzels every time.

What does this mean?

Ryanair has been coasting in style for the last few years despite being distinctively frill-free. The budget airline made nearly $2.5 billion in profit in the first half of fiscal 2024 (ending in March), 60% more than the same time last year.

That’s partly because the airline carried roughly 11% more passengers, presumably won over by non-existent window seats and the thrill of bank-busting fees for hand luggage that doesn’t quite fit in the metal measuring box.

And now that planes are full, Ryanair’s been able to pull up prices by about 15% this quarter, comfortable with the risk of scaring off a couple of customers.

Layer on the announcement of a €430 million dividend payout for shareholders, and you can see why the airline’s stock is up around 64% in the past year.

The bigger picture: No free lunches.

Ryanair’s outspoken CEO is known for being something of a maverick. He famously snaps up planes on the cheap when economic downturns have drained other airlines and turns what would be free perks elsewhere into paid-for extras.

That’s not only brought plenty of publicity but has also created a balance sheet that could be mistaken for a US consumer staples firm’s, making it the envy of the industry.

For markets: Confidence talks.

Ryanair’s first-class business model and books would lead you to believe that buying the stock would bleed you dry. But to match the brand’s discount-heavy image, shares actually trade relatively cheaply, at least according to the firm’s price-to-earnings ratio.

But this dividend payout might get investors more excited: the airline’s promise to dole out regular payments to shareholders is a sure sign of confidence about the company’s future.

And while Ryanair’s not the first airline to pay dividends, it may be the first to stay committed during both rough and smooth skies.

Verdict: Possibly the best airline stock on the planet!

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.