- 3 Big Scoops

- Posts

- Boeing vs. Airbus

Boeing vs. Airbus

Boeing, Evergrande, and Bitcoin

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 4,890.97 ( ⬇️ 0.065%)

Nasdaq Composite @ 15,455.36 ( ⬇️ 0.36%)

Bitcoin @ $42,260.70 ( ⬆️ 0.54%)

Hey Scoopers,

Happy Monday! Here’s the line-up for today👇

👉 Boeing is under pressure

👉 Evergrande will file for bankruptcy

👉 Bitcoin gains over the weekend

The airline manufacturing segment is a duopoly with two major players- Airbus and Boeing. In the last few years, Airbus has gained significant traction over Boeing, currently accounting for 67% of the airline manufacturing market.

Source: Airbus

In 2023, Airbus cemented its position as the world’s largest plane maker for the fifth consecutive year, securing more orders than Boeing.

Boeing, on the other hand, is wrestling with several incidents related to its lineup of 737 Max planes. Moreover, with $40 billion in balance sheet debt, Boeing shares are down 20% in 2024 as investors are wary of its weak financials and the ongoing crisis.

Global airlines continue to expand their fleets to meet post-COVID-19 demand, as Airbus bagged 2,094 aircraft orders in 2023.

Air India ordered 250 Airbus planes, while IndigGO, India’s largest aircraft carrier, agreed to buy 500 jets from the European manufacturer.

Airbus ended 2023 with a backlog of 8,600 planes, much higher than the backlog of 5,626 planes for Boeing.

However, both companies have grappled with supply chain issues recently. For instance, Airbus delivered 735 planes to carriers and leasing companies in 2023, which was at the upper end of its guidance and higher than the 528 planes delivered by Boeing.

Airbus emphasized that it will be sold out until the end of this decade for single-aisle jets and through 2028 for its wide-body A350 planes.

The global airline fleet is expected to grow by 33% in the next decade as carriers are forecasted to operate 36,000 aircraft by 2033, up from 27,400 jets today.

China Halts Trading of Evergrande Shares

Shares of China’s real estate giant Evergrande were halted after plunging roughly 20% in early market trading today as a Hong Kong court ruled to liquidate the property developer.

Once among China’s largest property developers, Evergrande failed to reach a deal over the weekend to restructure its debt.

Evergrande first defaulted on its debt in 2021, and last March, it announced an offshore debt restructuring program.

China’s property sector, which accounts for a sizeable portion of the country’s GDP, is struggling with surging debt levels, so policymakers are scrambling to stem the crisis.

Last week, the Chinese government announced a slew of measures to help boost liquidity positions for property developers, which should enable them to tide over a cash crunch and bloated debt levels.

The ongoing crisis has set off contagion fears that China’s property sector issues could spill over to other parts of the world’s second-largest economy.

Bitcoin Picks Up Pace

Bitcoin gained over 7% over the weekend and is currently trading at $42,260 at the time of writing.

Investors patiently waited for the SEC to approve multiple spot Bitcoin ETFs or exchange-traded funds this year, resulting in a surge of almost 45% in the last six months.

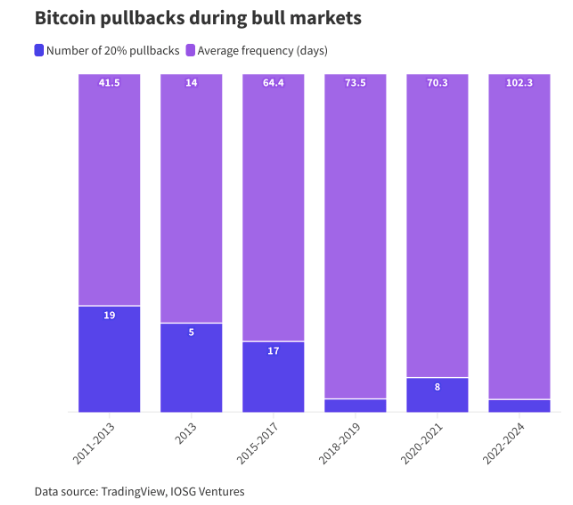

While the Bitcoin bull run has begun, investors should continue to brace for pullbacks of 20% due to the volatility associated with the digital asset.

Source: Blockworks

Between 2011 and 2013, 19 corrections of 20% or more occurred every 41.5 days. Between 2020 and 2021, 8 drawdowns of over 20% occurred every 70.3 days.

However, as the adoption of Bitcoin has grown over the years, the number of 20% pullbacks has declined while the number of days between the pullbacks has increased.

Headlines You Can’t Miss!

Sony invests in African gaming startup

Holcim eyes $30 billion valuation with North American spin-off

Oil prices surge as Iran-linked drone kills U.S. troops

China’s luxury market might bounce back in 2024

UK dark web dealer forfeits $340 million in Bitcoin

Chart of The Day

Source: Visual Capitalist

In the last decade, Microsoft and Apple have been constantly switching places as the world’s most valuable companies in terms of market cap.

In the 1990s, Microsoft was briefly the most valuable company in the U.S., supplanting General Electric for a couple of years due to the emphatic success of Windows.

In that period, Apple was on the brink of bankruptcy due to competition in the personal computer space and a lack of innovative products. In fact, Microsoft bailed out Apple in 1997.

In 2004, Microsoft was valued at $291 billion and was much larger than Apple, which was valued at $26 billion.

The iPhone launched in 2007 was a game-changer for Apple, increasing its market cap to $297 billion by the end of that decade. Apple held the title of the most valuable company for the better part of the last decade. But the tide might turn once again.

Microsoft became the world’s most valuable company in 2024 as the iPhone maker’s shares have had a weak start to the year due to growing concerns over slowing demand in China.

On the other hand, Microsoft has been buoyed by its early-mover advantage in artificial intelligence due to its multi-billion-dollar investment in OpenAI.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.