- 3 Big Scoops

- Posts

- Airline Stocks Are Feeling the Heat

Airline Stocks Are Feeling the Heat

Boeing, United and Southwest

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 4,765.98 ( ⬇️ 0.37%)

Nasdaq Composite @ 14,944.35 ( ⬇️ 0.19%)

Bitcoin @ $42,692.84 ( ⬇️ 0.54%)

Hey Scoopers,

Welcome to Wednesday- midweek milestone achieved. Here are our stories for the day👇

👉 Boeing remains under pressure

👉 China’s tepid economic growth

👉 Bitcoin attracts over $1 billion

So, let’s go 🚀

Boeing Faces Turbulence

Earlier this month, a window blew out of a Boeing 737 Max 9 aircraft. The widely covered incident led to the temporary grounding of almost 200 Boeing planes for safety inspections.

Currently, Boeing’s fleet of Max 9’s are used by just two airline operators in America which include Alaska Air and United Airlines.

Prior to this incident, Max 9 deliveries were delayed due to potential manufacturing flaws which involved loose bolts in the rudder-control system.

Back in 2018 and 2019 two Boeing 737 Max 8 planes crashed resulting in the death of 346 passengers. The planes were then grounded for two years.

The two fatal crashes cost Boeing $20 billion in settlement and fines, including a $2.5 billion criminal investigation settlement related to safety issues.

Boeing shares are down 24% in the last month and are expected to remain under pressure in the near-term.

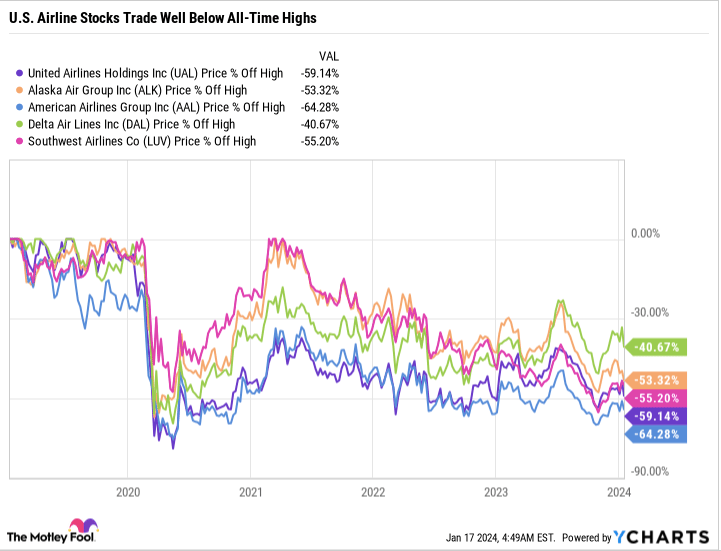

Airline stocks with exposure to the Boeing 737 Max 9 such as United Airlines and Alaska Airlines are also trading 12% and 16% lower respectively from all-time highs.

Airline stocks lost significant value during COVID-19 as travel came to a standstill. A debt-heavy balance sheet and negligible travel demand resulted in mounting losses for airline companies in 2020 and 2021.

Today, airline stocks are trading at a cheap valuation and were forecast to stage a comeback in 2024. But rising interest rates, higher oil prices and inflation continue to act as near-term headwinds.

China’s Economic Growth to Decelerate In 2024

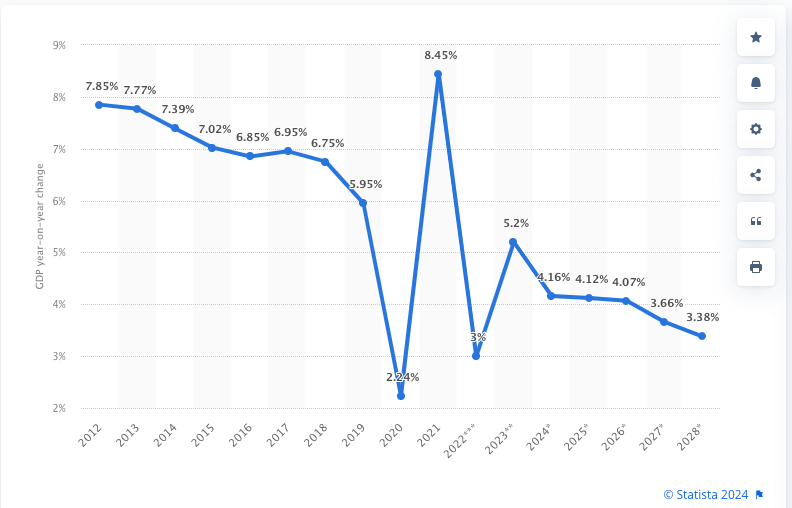

Several investment banks expect China’s economy to grow at a slower pace in 2024, compared to 2023.

China’s GDP Growth Estimates

The average prediction by these banks point to a 4.6% increase in real GDP rates in 2024, down from 5.2% forecast for 2023.

China is the world’s second largest economy and experienced several years of double-digit growth in the last four decades, as it became the manufacturing hub globally.

But lately, the country has been impacted by COVID-19 restrictions and a slump in its real estate market.

While China is optimistic about growth in sectors such as tourism, electric cars and chip manufacturing, its real estate crisis may delay its economy recovery by a few years.

Bitcoin Fund Flows Move Higher

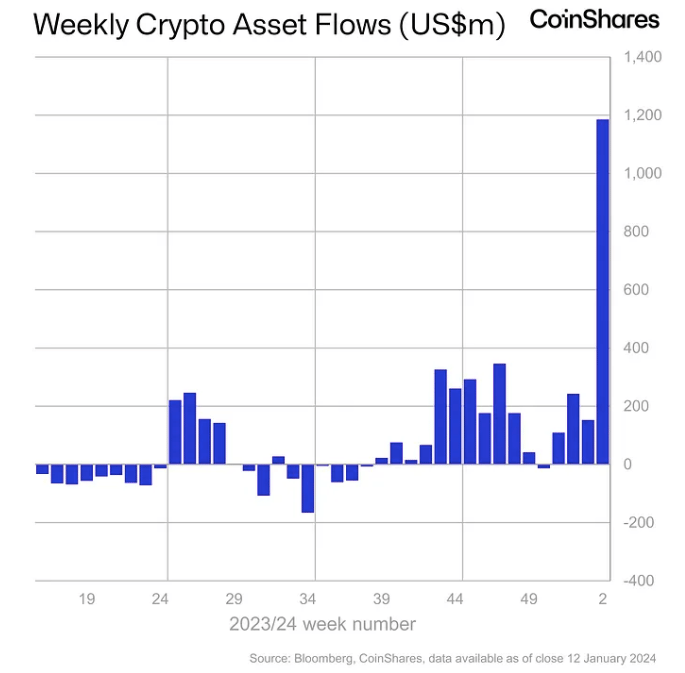

Last week, digital asset investment products hit trading volumes of $17.5 billion, which is the highest weekly volume on record. Comparatively, the average weekly trading volume in 2023 was just $2 billion.

Moreover, digital asset investment products saw inflows totaling $1.18 billion, an increase of 3x compared to any weekly inflows from last year.

The Bitcoin ETF launched last week attracting a few billion dollars in investments.

Large institutional investors including BlackRock, Fidelity and Invesco have launched spot Bitcoin ETFs, making it easier for retail investors to access the cryptocurrency.

While weekly BTC inflows were $1.14 billion, Ethereum inflows were much lower at $26 million.

Headlines You Can’t Miss!

UK’s inflation rate spikes to 4%

Air freight rates might move higher in 2024

Amazon launches AI tool for online shoppers

AMD shares gain 8% as AI chip demand is robust

Crypto company Ripple explored IPO options outside the U.S.

Chart of The Day

Source: Visual Capitalist

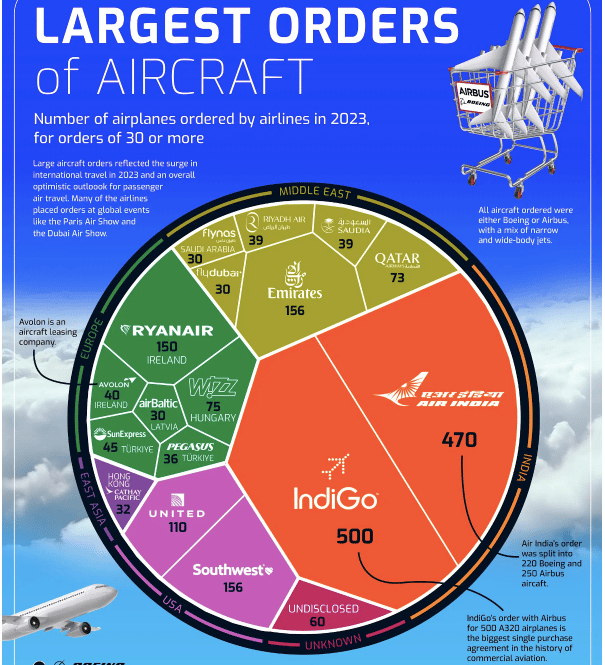

India’s airline sector is taking off.

India’s top two airlines by market share Indigo and Air India which have ordered close to 1,000 commercial jets in the last year.

These two airline companies have purchased more jets that the next 12 countries combined.

India’s discretionary spending accounted for 24% of household consumption in 2020, up from just 12% in 2000 while the country’s travel demand is forecast to grow 5x between 2019 and 2042.

Commercial jet orders hit a record high in 2023 due to solid travel demand. Southwest Airlines and United Airlines also purchased more than 200 jets cumulatively, as U.S. air travel hit a record of 16.3 million flights last year.

Riyadh Air, which is a new airline from Saudi Arabia brought 39 jets as the country is focused on boosting international tourism.

The airline manufacturing industry is run by a duopoly between Boeing and Airbus. There is a good chance for Airbus to gain significant market share from Boeing in the upcoming decade, given the safety concerns associated with the latter.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.