- 3 Big Scoops

- Posts

- Boeing Hits Turbulence

Boeing Hits Turbulence

PLUS: Japan's Nikkei rises to 33-year high

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 4,763.54 ( ⬆️ 1.41%)

Nasdaq Composite @ 14,843.77 ( ⬆️ 2.2%)

Bitcoin @ $46,724.36 ( ⬆️ 7.1%)

Hey Scoopers,

Fasten your seatbelts! Here’s Tuesday’s breakdown 👇

👉 Boeing stock nosedives

👉 Japan’s Nikkei hits 33-year high

👉 Bitcoin inches towards $50,000

So, let’s go 🚀

FAA Grounds Boeing 737 Max 9 Jets

Last Friday night, an Alaska Airlines flight (a Boeing 737 Max 9 jet) was forced to land just 10 minutes after take-off after a window panel blew out. While no passenger or crew was seriously injured, it raises questions about the safety issues for Boeing’s portfolio of jets.

Source: Getty Images

The seats near the blowout were vacant, and as the plane was still climbing at 16,000 feet, passengers would still be wearing seatbelts.

The FAA has ordered the temporary grounding of 171 Max 9 jets in the U.S. until its inspection is complete. Alaska Airlines canceled 163 flights, while United Airlines canceled 180 flights associated with the Max 9.

Since 2012, there have been over a dozen equipment problems involving Boeing. The airline manufacturer introduced the fuel-efficient “Max” jets category in 2016 to increase its market share, which was lost to Airbus.

Two 737 Max 8 jets crashed less than five months apart between 2018 and 2019, killing 346 passengers, after which several countries grounded these jets for roughly 18 months.

Whistleblowers have accused Boeing of sacrificing safety for profits, resulting in repeated and serious failures.

Boeing shares fell over 8.5% yesterday.

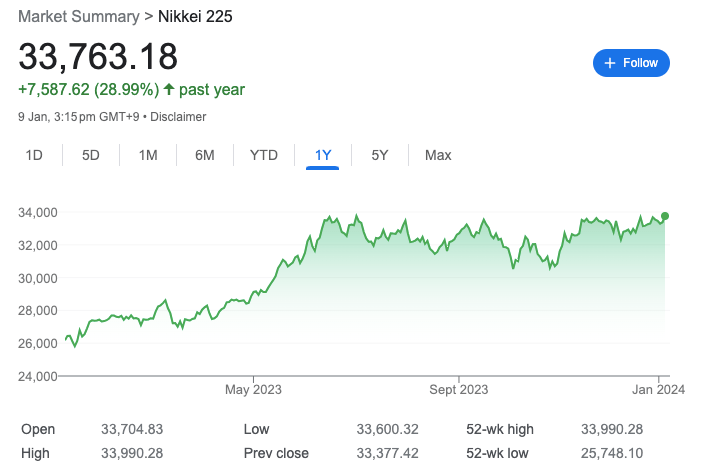

Japan’s Stock Market Continues to Climb

Most equity markets in the Asia-Pacific region are trading higher today, rebounding from a sell-off in the previous session.

The Nikkei 225 index (equivalent to the S&P 500 in the U.S.) hit a fresh 33-year intra-day high on the back of gains in the tech sector.

Shares of semiconductor company Tokyo Electron rose 4.87%, while those of chip equipment supplier Advantest surged 8.36% today.

Video game company Nintendo was also among the top performers, rising 4.7% as it is scheduled to release a new gaming console in 2024.

Investors also assessed Japan’s inflation numbers for December in the capital city of Tokyo, which is a leading indicator for countrywide inflation.

Tokyo’s inflation rate slowed to 2.4% in December from 2.6% in the previous month. After adjusting for fresh food prices, inflation remained unchanged and aligned with estimates of 2.1%.

Tokyo’s inflation rate slowed for the second straight month in December and is at an 18-month low.

The Nikkei index has been on an absolute tear, rising close to 30% in the last 12 months.

Warren Buffett remains bullish on Japanese equities and holds five stocks from the country in his portfolio.

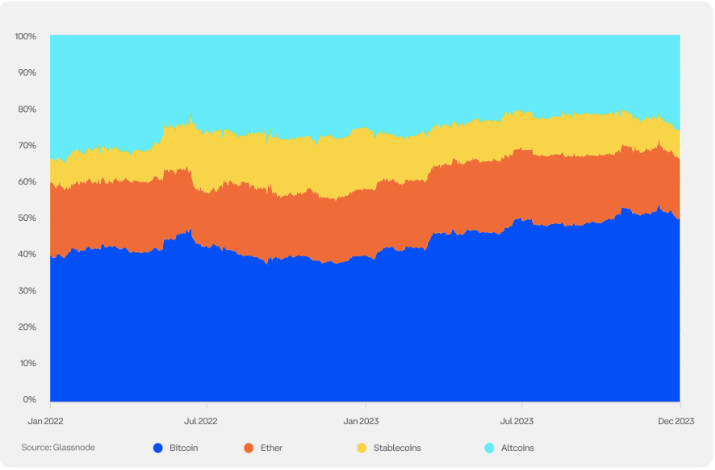

Bitcoin Moves Higher

At the time of writing, Bitcoin prices have surged over 7% in the last 24 hours, breaching the $47,000 threshold for the first time in almost two years.

Valued at $917 billion by market cap, BTC prices are now down 32% from all-time highs.

Bitcoin Dominates Crypto Market

Source: Coinbase

Bitcoin has almost tripled in value since the start of 2023, and its dominance in the crypto market has risen in the last 12 months with a flight to quality as the approval of spot Bitcoin ETFs is almost inevitable.

Several market participants also view the upcoming halving event in April 2024 as a positive price catalyst for the world’s largest cryptocurrency.

With an exception in 2022, Bitcoin has historically shown low correlations with traditional asset classes, indicating it can be a source of idiosyncratic risk.

Headlines You Can’t Miss!

Samsung warns Q4 profits might decline by 35%

Juniper Networks stock jumps on potential HPE acquisition

Unity Software to layoff 25% of its workforce

Shein’s revenue is more than $30 billion

Bitcoin ETF approval odds surge to 95%

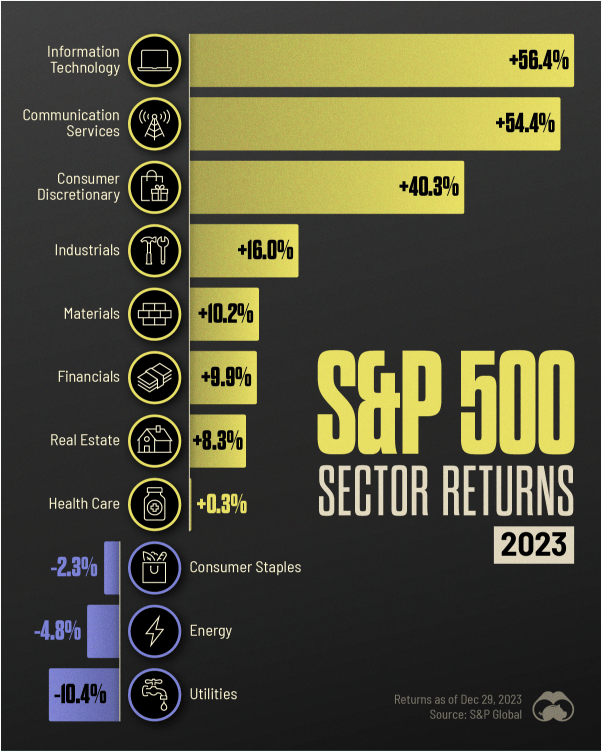

Tech Sector Key Driver of Bull Run In 2023

Despite an uncertain macro environment, all three major indices in the U.S. ended on a positive note last year, reversing the trend in 2022.

But which sectors outperformed the S&P 500, a flagship index that rose over 20% in 2023?

Well, the three biggest winners in 2023 included sectors such as information technology, communication services, and consumer discretionary, all of which gained over 40%.

The AI megatrend drove shares of tech stocks higher with semiconductor giants such as Nvidia and AMD posting triple-digit gains in 2023. Other Big Tech stocks such as Apple and Microsoft also gained over 50% last year.

In the communication services sector, companies that thumped the S&P 500 include:

👉 Meta which ⬆️ 188%

👉 Netflix which ⬆️ 63% and

👉 Alphabet which ⬆️ 57%

After a forgetful year in 2022, Netflix's crackdown on password-sharing led to a growth in subscribers. Moreover, its ad-supported model diversified the revenue base while expanding the subscriber count.

Gains in stocks such as Amazon and Tesla meant the Consumer Discretionary sector came in at third place. Travel-oriented companies such as Royal Caribbean, Carnival, and Booking Holdings also saw strong returns.

Alternatively, sectors such as consumer staples, energy, and utilities all closed in the red.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.