- 3 Big Scoops

- Posts

- Southwest Airlines Nosedives

Southwest Airlines Nosedives

PLUS: Will the S&P 500 rally continue?

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

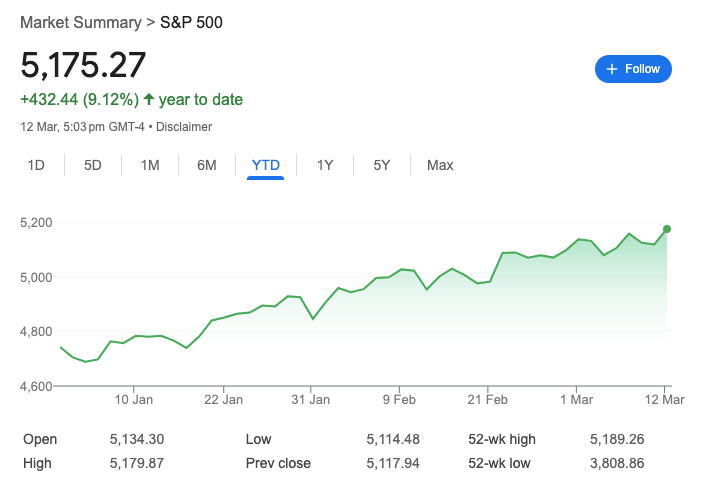

S&P 500 @ 5,175.27 ( ⬆️ 1.12%)

Nasdaq Composite @ 16,265.64 ( ⬆️ 1.54%)

Bitcoin @ 73,482.40 ( ⬆️ 2.81%)

Hey Scoopers,

Happy Wednesday! Here’s what we’re breaking down in this issue:

👉 Southwest Airlines is under pressure

👉 Will the rally for the S&P 500 index continue?

👉 GBTC set to launch another Bitcoin fund

So, let’s go 🚀

Market Wrap 📉

Stocks jumped on Tuesday after fresh inflation data in the U.S. was in line with expectations, paving the way for investors to resume buying big-tech names such as Nvidia, Microsoft, and Meta Platforms.

The S&P 500 index touched a new record high yesterday, driven by the rally in tech stocks.

In an interview with CNBC, Skyler Weinand, chief investment officer at Regan Capital, stated, “It’s proving difficult to see what may stop the market’s momentum, as earnings, inflation, and interest rates are moving in the right direction.”

The CPI, or consumer price index, climbed 0.4% in February and 3.2% year over year compared to estimates of 0.4% and 3.1%, respectively.

Investors now turn their attention to the producer price index report due later this week and the Fed’s next monetary policy meeting scheduled later this month.

Trending Stocks 🔥

Boeing - Shares of the airline manufacturer plunged over 4% after a report from the New York Times said the company failed 33 of 89 audits on its 737 Max jet.

3M - The stock gained 4% after the company announced the former CEO of L3Harris Tech, William Brown, will become 3M’s new CEO.

Rumble - Shares of the online streaming platform surged over 18% after it announced the launch of a new cloud computing service. Further, a potential ban on TikTok also drove optimism higher.

Southwest Airlines Stock Tanks

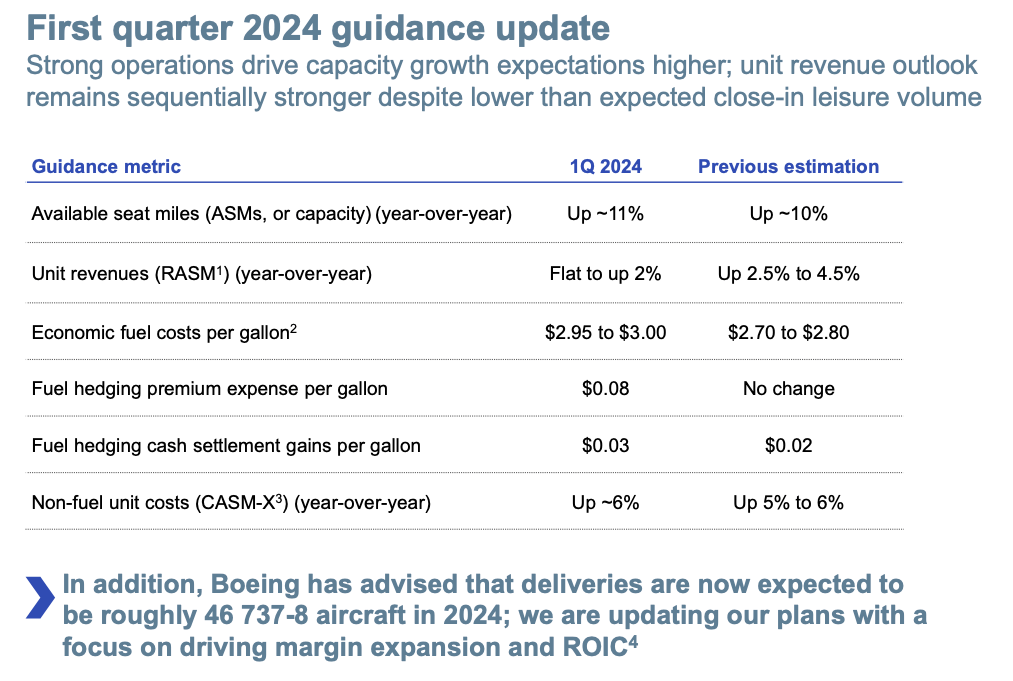

Southwest Airlines headed for its worst day in four years after the company said its previous full-year financial outlook was questionable.

The airline giant said it is re-examining full-year guidance for 2024 due to delays from Boeing, its sole aircraft supplier. It also claimed leisure bookings in Q1 were weaker than anticipated.

Source: Southwest Airlines

Southwest expects unit revenue to be flat in Q1, down from an earlier estimate where it forecast a 4.5% year-over-year improvement.

Southwest stock fell almost 15% as it expects to receive 46 Boeing 737 Max 8 planes in 2024, down from 58. Boeing’s quality control crisis and production problems are weighing heavily on Southwest and other airline companies.

For instance, Alaska Airlines also confirmed its 2024 capacity is in flux due to uncertainty around the timing of aircraft deliveries due to the increased scrutiny by the FAA (Federal Aviation Administration) on Boeing.

Southwest confirmed it would stop hiring pilots, flight attendants, and other employees and expects to end 2024 with a lower headcount than last year.

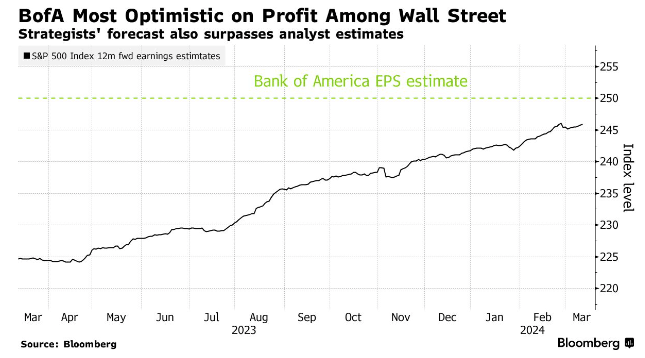

BoA Raises S&P 500 Earnings Outlook

Bank of America raised its earnings outlook for the S&P 500 index from $235 to $250, indicating a 12% growth year over year.

The move comes as companies delivered a strong beat for Q4. Moreover, BoA’s economists increased GDP growth forecasts to 2.7% for 2024, up from 1.4%. The GDP increase translates to five percentage points in additional earnings growth.

While 2023 was a transition year for corporates, companies seemed to have adjusted to higher interest rates and a tepid demand environment.

Moreover, big tech giants such as Microsoft, Amazon, and Alphabet are entering a reinvestment cycle and are forecast to spend $180 billion in capital expenditures.

BoA is also forecasting EPS at $275, suggesting a 10% year-over-year growth.

Grayscale Might Launch Lower-fee Bitcoin ETF

Yesterday, Grayscale filed an application to launch a lower-fee Bitcoin exchange-traded fund through a spin-off of its flagship Grayscale Bitcoin Trust (GBTC) ETF. It, however, did not disclose what the potential fees would be.

GBTC currently charges a management fee of 1.5%, which is quite steep compared to other ETFs that charge up to 0.5%. Since the other nine ETFs were launched in January, GBTC has seen outflows of more than $10 billion.

The move comes amid a rally in Bitcoin as the world’s largest cryptocurrency is hitting new all-time highs almost every day, primarily due to growing demand from ETFs and the upcoming BTC halving event.

Headlines You Can't Miss!

Britain swings to economic growth in January

Adidas warns of falling sales in North America

Bank of Japan may exit negative rate policy

Boeing’s 737 Max crisis a blow to airlines

Spot Bitcoin ETF inflows surge over $1 billion

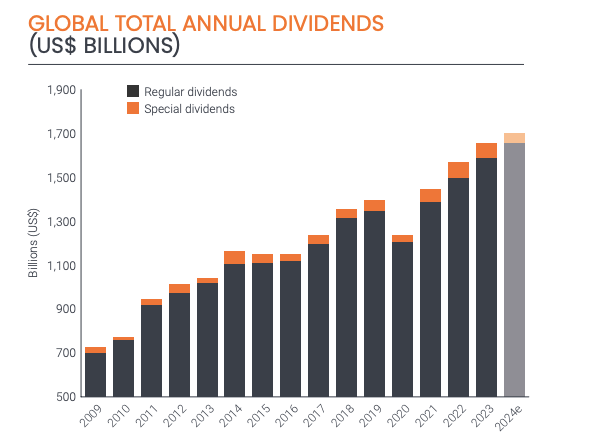

Chart of The Day

Source: Janus Henderson

Global dividend payouts to shareholders hit a record $1.66 trillion in 2023, according to a new report from Janus Henderson, a British asset manager.

These payouts rose 5% year over year, primarily driven by contributions from the banking sector, which accounted for almost half of the world’s dividend growth as higher interest rates boosted profit margins for lenders.

Last year, most banking giants such as JPMorgan, Wells Fargo and Morgan Stanley announced plans to raise quarterly dividends after clearing annual stress tests.

Here are some interesting numbers from the report:

👉 Roughly 86% of listed companies either increased or maintained dividend payouts in 2023

👉 A total of 22 countries, including the U.S., Canada, France, Italy, and Germany, saw record payouts last year

👉 Europe was described as a key engine for growth, with payouts rising 10.4% year over year

👉 Janus Henderson expects dividends to hit $1.72 trillion in 2024, indicating a growth of 5%

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.