- 3 Big Scoops

- Posts

- Target Spikes and Apple Slumps

Target Spikes and Apple Slumps

Target, Apple, and CrowdStrike

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 5,078.65 (⬇️ 1.02%)

Nasdaq Composite @ 15,939.59 ( ⬇️ 1.65%)

Bitcoin @ $65,685.70 ( ⬇️ 2.1%)

Hey Scoopers,

Happy Wednesday! Let’s see what’s moving the markets:

👉 Target beats estimates

👉 Cyclical stocks might rally

👉 Bitcoin falls after touching an all-time high

So, let’s go 🚀

Market Wrap 📉

Stocks fell for the second consecutive session on Tuesday due to steep declines in major tech names, dragging the broader market further from all-time highs reached last week.

Several mega-cap tech stocks, including Netflix and Microsoft, fell over 3%, while Tesla lost 4% in market cap. In fact, the technology index lost more than 2%.

It seems investors continue to digest the market’s recent rally powered primarily by optimism surrounding the artificial intelligence megatrend.

Despite the losses in the last two sessions, the three major indices have delivered impressive gains in 2024.

Trending Stocks 🔥

GitLab - Shares of the software company tumbled 21% following a weak forecast for the rest of the year.

Albermarle - Shares of the lithium producer plunged over 11% after it announced plans to raise $1.75 billion to expand lithium operations in Australia and China.

AMD - Shares of the semiconductor giant dipped briefly after Bloomberg reported the Commerce Department did not clear a chip intended to be sold in China.

Target Hits the Mark

Shares of Target, one of the largest big-box retailers globally, rose 12% yesterday following its strong holiday quarter (ended in January) results that topped Wall Street estimates, even though the company forecast another year of weak sales.

Target’s comparable sales declined for the third consecutive quarter while showcasing profit margin improvements.

Target expects comparable sales to drop between 3% and 5% in the current quarter, with adjusted earnings forecast between $1.70 and $2.10 per share. Comparatively, Wall Street forecast earnings at $2.09 per share in the April quarter.

Target explained while store and website traffic is declining year over year, these metrics improved for the second quarter in a row. Its profits jumped due to better inventory management and lower freight, supply chain, and e-commerce fulfillment costs.

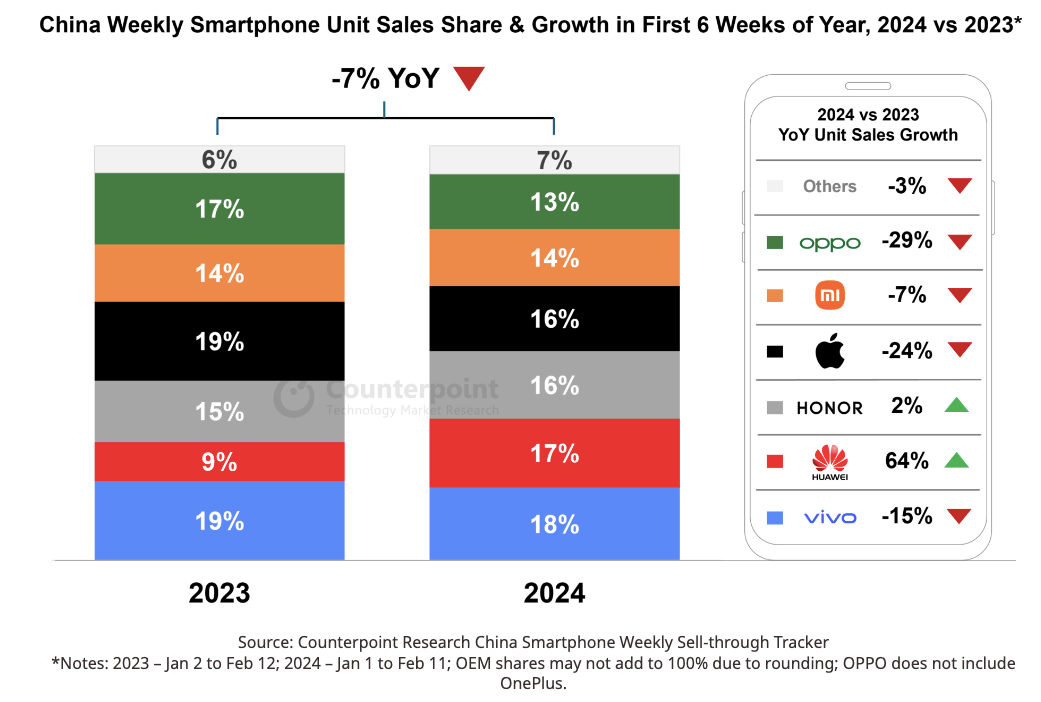

Apple’s China Sales Decline 24%

Apple’s iPhone sales in China fell 24% in the first six weeks of 2024, according to a report from Counterpoint Research.

The iPhone is a key revenue driver for Apple, accounting for 50% of sales, while China is the company’s second-largest market.

Apple is facing pressure primarily from Huawei, which saw a 64% increase in smartphone shipments.

While the S&P 500 index trades near all-time highs, Apple is down 14% from record levels.

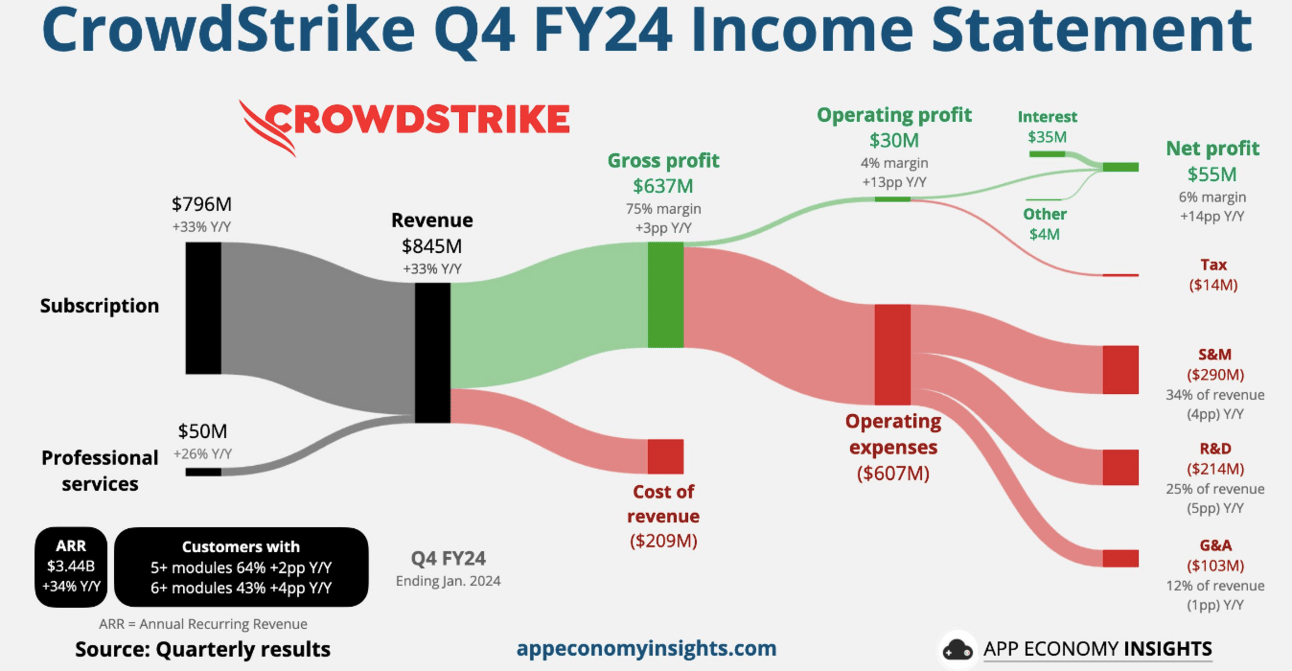

CrowdStrike Surges 21%

Shares of CrowdStrike are up 21% in pre-market trading after the cyber security giant reported stellar quarterly results.

In fiscal Q4 of 2024 (ended in January), CrowdStrike reported:

👉 Revenue of $845 million vs. estimates of $839 million

👉 Earnings per share of $0.95 vs. estimates of $0.82

CrowdStrike has now reported GAAP net income for four consecutive quarters as its revenue grew by 36% year over year to $3 billion in fiscal 2024.

CrowdStrike disclosed plans to acquire Flow Security for an undisclosed price in a cash-and-stock deal. Moreover, the company reiterated plans to end 2030 with annual recurring revenue of $10 billion, up from $3.4 billion in 2024.

Dive into our extensive analysis of CrowdStrike stock here.

Cyclical Stocks Might Make a Move

Investors should brace for a volatile equity market in the near term due to lofty valuations surrounding big-tech companies.

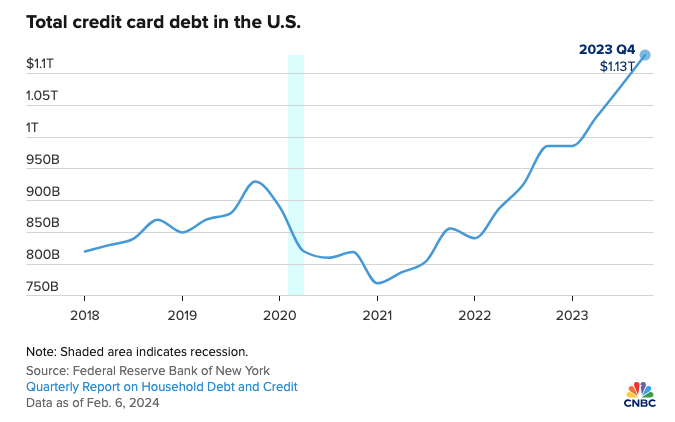

The broader indices trade near all-time highs despite elevated interest rates, sluggish consumer spending, rising credit card debt, and inflation.

While investors are optimistic about the AI megatrend, a lot depends on whether companies can navigate an uncertain macro environment in the next 12 months.

According to Stifel, cyclical value stocks should gain pace this year. According to the investment bank, solid economic growth and sticky inflation are rewarding for cyclical value stocks in sectors such as banking, capital goods, energy, materials, real estate, and transportation.

Bitcoin Retreats From Record Highs

Bitcoin prices briefly touched all-time highs yesterday. However, the peak was met with a steep pullback as the world’s largest cryptocurrency has already retreated by 5% from record levels due to a surge in the liquidation of leveraged positions.

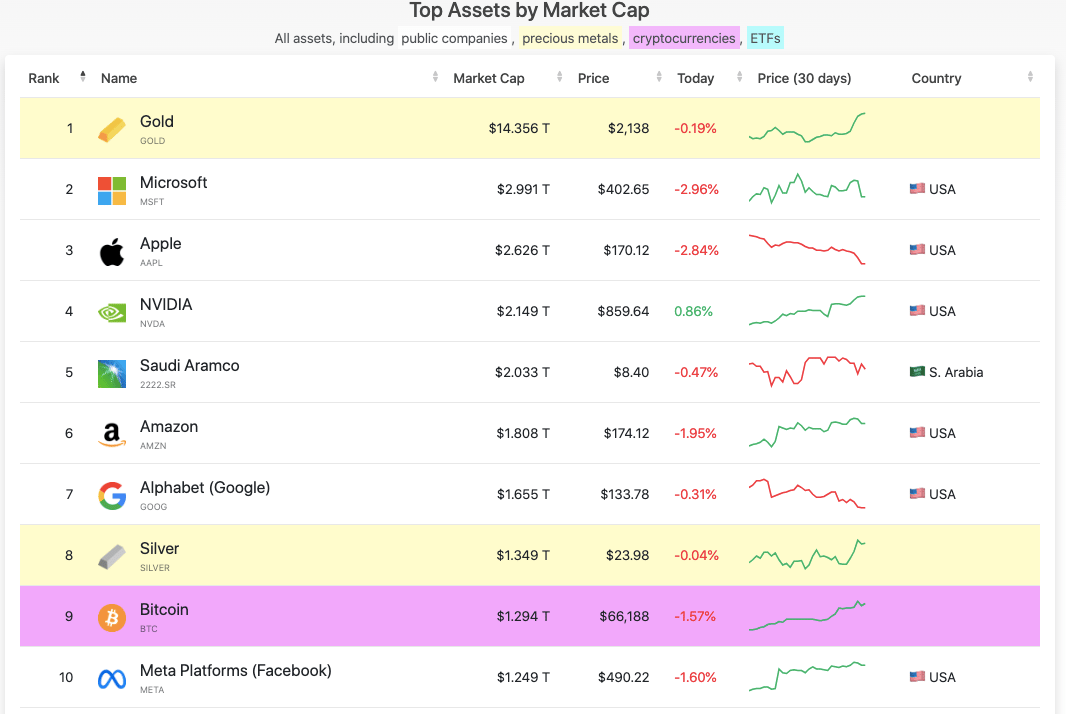

Source: CompaniesMarketCap

A report from The Block explains that price volatility led to liquidations worth $197 million of long positions on centralized exchanges.

The overall crypto market saw $383 million of liquidated long positions in the last 24 hours. Generally, liquidations occur when a trader is forced to close a position to cover losses.

Despite the pullback, the bitcoin market has entered a new market cycle, with prices almost tripling in the last 12 months.

Headlines You Can't Miss!

Asia’s tech sector benefits from chip boom

The U.S. government wants ByteDance to divest

OpenAI shares emails from Elon Musk urging the start-up to raise capital

Nordstrom warns of sales decline in 2024

DeFi TVL breaks $100 billion for the first time since May 2022

Chart of The Day

A Federal Reserve Bank of New York report showed credit card debt in the U.S. topped $1.13 trillion at the end of Q4 of 2023.

Credit card balances increased by 5% or $50 billion in Q4, resulting in a spike in delinquency rates among younger borrowers.

Consumers are feeling the heat of higher prices for food, gas, and housing. Additionally, cardholders are carrying debt from previous months or falling behind payments.

Due to interest rate hikes, credit card rates have spiked to more than 20%, an all-time high.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.