- 3 Big Scoops

- Posts

- Apple Fined $2 Billion by EU

Apple Fined $2 Billion by EU

Apple, Tesla, and Bitcoin

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

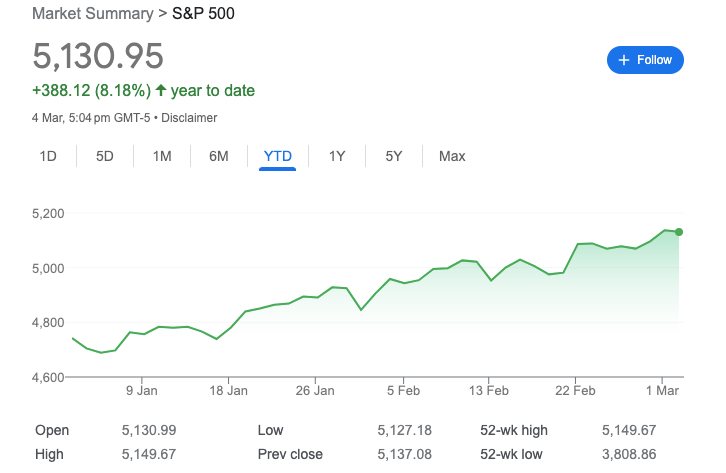

S&P 500 @ 5,130.95 (⬇️ 0.12%)

Nasdaq Composite @ 16,207.51 ( ⬇️ 0.41%)

Bitcoin @ $66,785.90 ( ⬆️ 2.2%)

Hey Scoopers,

Fasten your seatbelts! Here’s Tuesday’s breakdown:

👉 Apple and Tesla under pressure

👉 China sets 2024 GDP target

👉 Bitcoin nears all-time high

So, let’s go 🚀

Market Wrap 📉

Despite the rally in artificial intelligence stocks, including Nvidia, equities retreated yesterday, pushing the S&P 500 and Nasdaq Composite index off all-time highs.

This week, traders will look for clues about the direction of interest rates from Jerome Powell, the chairman of the Federal Reserve. Powell is expected to deliver monetary policy updates in the next two days.

Other macroeconomic data that will drive the markets include the ADP Employment Survey and job openings data for January, both of which will be released on Wednesday.

Moreover manufacturing and nonfarm payrolls data for February are due this Friday.

Trending Stocks 🔥

Macy’s - Shares surged over 13% after Arkhouse Management and Brigade Capital raised their offer for the department store.

Super Micro Computer, Deckers Outdoor - The tech firm and the athletic footwear designer saw their stock prices rally after it was revealed the two stocks would be added to the S&P 500 index this month.

Lyft - The ride-sharing platform added 4.5% after RBC upgraded the stock to an “outperform rating” from “sector perform.”

Apple Hit With Massive Fine

The European Commission, the European Union’s executive arm, hit Apple with a 1.8 billion euro ($1.95 billion) antitrust fine for abusing its dominant position related to the distribution of music streaming applications.

Source: Economic Times

The regulatory body found Apple applied restrictions on app developers, preventing them from informing iOS users about alternative and cheaper music subscription services outside the app.

Moreover, the tech giant allegedly banned developers of music streaming apps from providing instructions about how users could subscribe to cheaper offers. It was the first antitrust fine levied on Apple, driving its stock lower by 2% yesterday.

Tesla slumps too

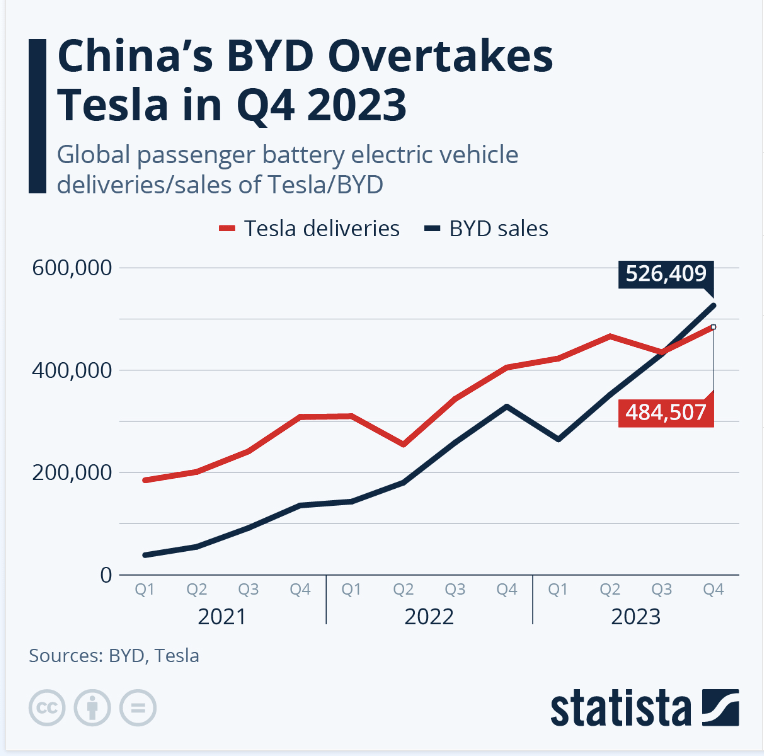

Shares of Tesla, the largest electric vehicle manufacturer in the U.S., fell over 7% yesterday after the company unveiled new incentives such as insurance subsidies and discounts to woo consumers in China.

Customers purchasing existing inventories of Model 3 sedans and Model Y SUVs by the end of the month would be entitled to $4,807 worth of incentives. The EV giant also offered limited-time preferential financial plans that could save up to $2,400 for purchases of Model Y.

Tesla is wrestling with slowing demand and an increase in competition from China, the largest EV market in the world. Recently, BYD dethroned Tesla as the world’s top EV maker in Q4 of 2023.

While the broader markets are near all-time highs, Tesla stock is down 55% from record levels.

China’s GDP Forecast to Grow by 5% In 2024

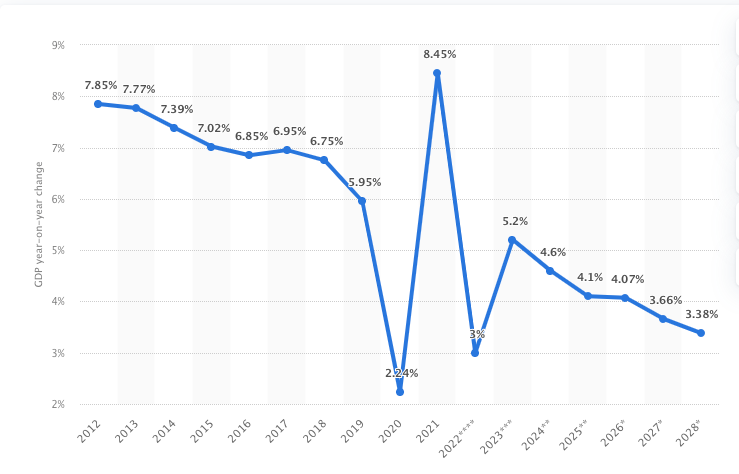

China expects its GDP (gross domestic product) to grow by 5% year over year in 2024. It also set a deficit-to-GDP ratio of 3.5% for 2024, lower than the 3.8% in 2023.

China’s GDP Growth Rates

Source: Statista

Moreover, China announced the issuance of “ultra-long” special bonds totaling $139 billion for major projects as the country aims to remove restrictions on foreign investment in manufacturing.

China’s economy grew by 5.2% in 2023 due to an overall rebound from the COVID-19 pandemic, offset by a slump in real estate and exports.

In 2024, China is targeting:

👉 An urban unemployment rate of 5.5%

👉 Creation of 12 million new urban jobs

👉 A consumer price index increase of 3%

Bitcoin Nears All-time Highs

Bitcoin’s impressive rally continues as the world’s largest cryptocurrency trades just below all-time highs.

Bitcoin has notched record highs in 14 of the top 20 currencies globally as 98% of all Bitcoiners are now profitable.

Currently valued at $1.3 trillion by market cap, BTC is up 50% in 2024 and 196% in the last year.

The launch of nine BTC spot exchange-traded funds has raised the demand for the digital asset in the past month.

For instance, BlackRock's Bitcoin ETF has already attracted $10 billion from investors. Comparatively, the first gold ETF took 20 years to hit capital inflows of $10 billion.

Headlines You Can't Miss!

Price wars dent EV stocks in China

Target all set to report quarterly results

Google messed up the Gemini image launch, says Sergey Brin

Former Twitter execs sue Elon Musk for $128 million

Darknet market crypto crime revenue totals $1.7 billion

Chart of The Day

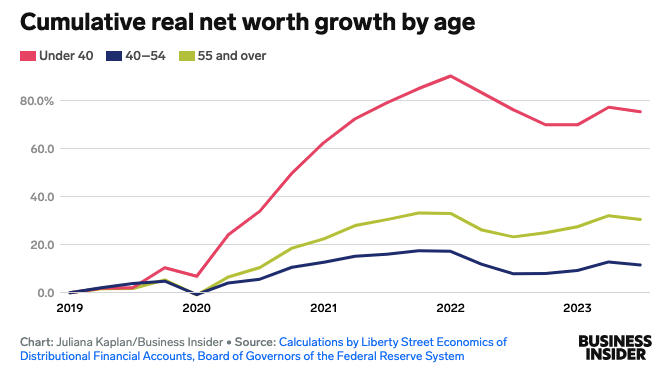

The COVID-19 pandemic was a boon for the youngest workers in the U.S.

According to a blog from Liberty Street Economics, Americans below 40 accounted for 6% of total wealth in the U.S. just before the pandemic. This age group saw their wealth skyrocket by 80% in the last four years.

The pandemic led to a boom-bust cycle for young Americans who had a cushion of savings. The COVID-19 pandemic resulted in lockdowns, leading to lower spending avenues for young adults.

Stimulus checks, unemployment benefits, and a pause on student loan payments also bolstered the savings rate.

Alternatively, consumer debt surged by an additional $212 billion in Q4 of 2023 as Gen Zs and millennials lead the pack in debt transitioning into delinquency.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.