- 3 Big Scoops

- Posts

- Is CrowdStrike Stock a Multi-Bagger?

Is CrowdStrike Stock a Multi-Bagger?

PLUS: Hedge funds record bumper profits in 2023

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 4,850.43 ( ⬆️ 0.22%)

Nasdaq Composite @ 15,360.28 ( ⬆️ 0.32%)

Bitcoin @ $39,693.90 ( ⬇️ 2.80%)

Hey Scoopers,

Happy Tuesday!

In today’s newsletter, we analyze whether CrowdStrike can surge 10x from its current price.

We also look at the spectacular profits reported by hedge funds in 2023.

So, let’s go 🚀

CrowdStrike- A CyberSecurity Giant

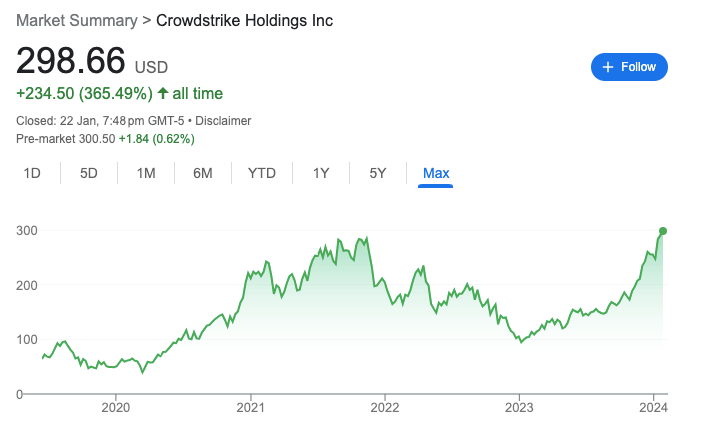

Valued at $71.7 billion by market cap, CrowdStrike is among the largest cybersecurity companies globally. After losing more than 60% in market value during the bear market in 2022, the tech stock almost tripled in 2023.

Growth stocks such as CrowdStrike offer investors an enviable risk-reward profile as they can potentially deliver outsized gains during bull markets. However, you also need to prepare for large drawdowns when sentiment is bearish.

As past returns are irrelevant, let's see if CRWD stock is a multi-bagger for current and future investors. Generally, a stock that can surge 1,000% is considered a multi-bagger.

An Overview of CrowdStrike

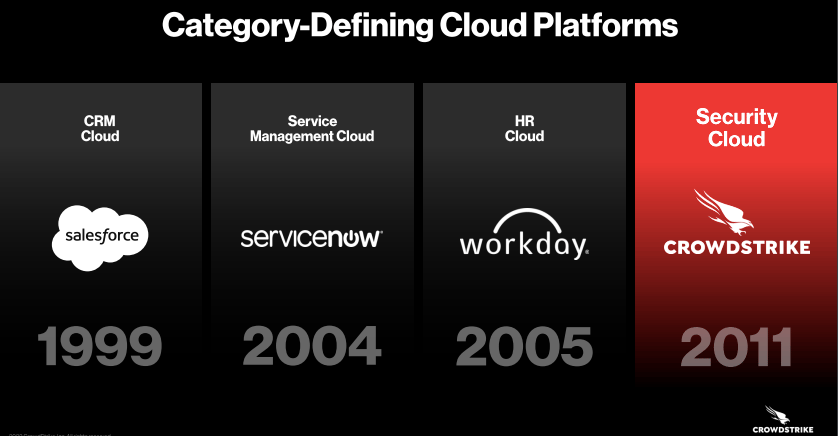

CrowdStrike was founded in 2011, and the company has gained significant traction over the years on the back of a robust portfolio of disruptive cloud-based solutions.

CrowdStrike built the Falcon platform to detect threats and stop breaches. It was also the first to introduce a multi-tenant, cloud-native intelligent security solution to protect workloads across environments while running on multiple endpoints.

In the past decade, CrowdStrike has expanded its portfolio of solutions and now offers 27 cloud modules to enterprises. Operating via a SaaS (software-as-a-service) model allows CrowdStrike to benefit from steady cash flows across market cycles.

Solid Financials

CrowdStrike has increased sales from $481 million in fiscal 2020 to $2.24 billion in fiscal 2023 (ended in January), indicating annual growth rates of 67% in the last three years.

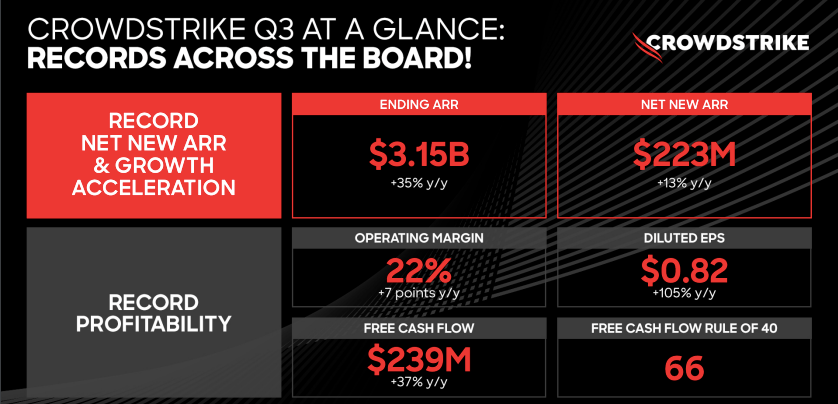

While growth rates have decelerated in recent months, it reported revenue of $786 million in fiscal Q3 of 2024, a solid increase of 35% year-over-year. The company’s subscription sales in Q3 stood at $733.5 million, up 35% from the year-ago period, accounting for 94% of total revenue.

Also, CrowdStrike ended Q3 with an annual recurring revenue of $3.15 billion, an increase of 35% year-over-year. It’s also a massive increase from its roughly $100 million ARR in fiscal Q3 of 2018.

The tech giant has successfully expanded its customer base and enjoys a strong customer retention rate.

In Q2, its dollar-based net retention rate stood at 125.3%, which suggests existing customers increased spending on the CrowdStrike platform by 25.3% in the last 12 months.

Around 63% of customers subscribe to more than five modules, while 26% subscribe to at least seven modules.

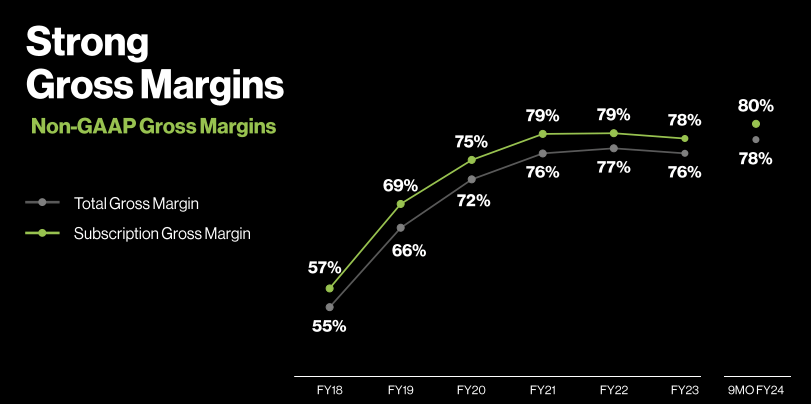

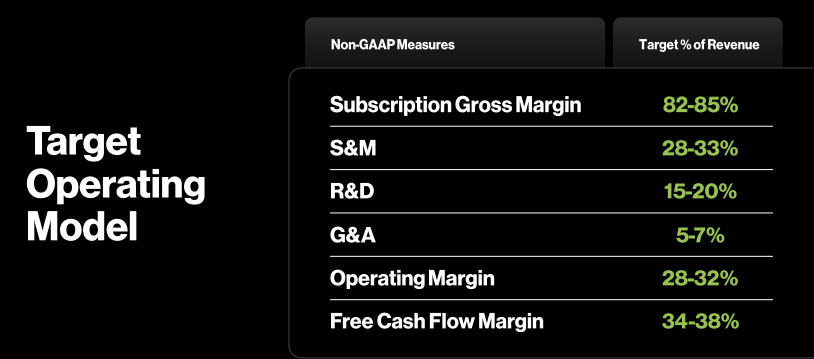

CrowdStrike reported a non-GAAP subscription gross margin of 80% in the last three quarters. An asset-light model allows tech companies, including CrowdStrike, to benefit from high operating leverage at scale.

For instance, in fiscal 2018, CrowdStrike’s sales & marketing expenses accounted for 87% of sales, followed by research and development at 46% and administrative costs at 21%.

In Fiscal 2023, these expenses accounted for less than 60% of revenue, allowing the company to report an operating profit margin of 22.4%

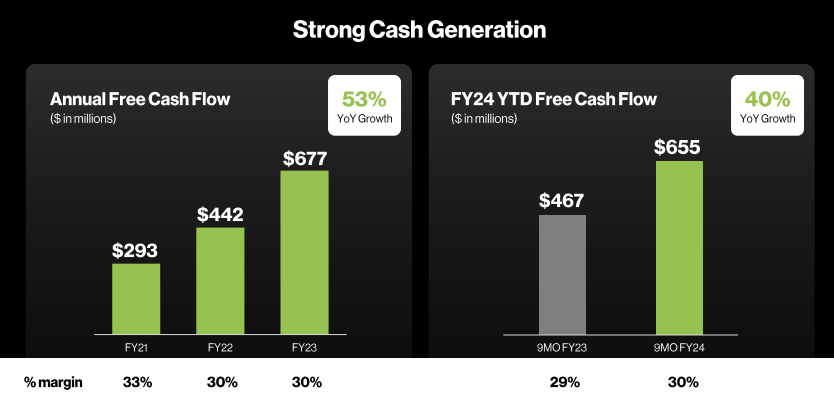

CrowdStrike also reports positive free cash flow (FCF), unlike other high-growth tech stocks.

Its FCF has risen from $293 million in fiscal 2021 to $677 million in 2023. In the last three quarters, it has generated an FCF of $655 million, indicating an FCF margin of over 30%.

CrowdStrike is Part of a Rapidly Expanding Market

CrowdStrike is part of a rapidly expanding addressable market as the number of cyberattacks has increased exponentially in the last ten years.

A research report from CyberEdge Group forecasts the average downtime cost of a ransomware attack to be close to $5 million, after accounting for productivity costs and sales, in addition to legal fees and loss of customers.

Another report from Fortune Business Insights estimates the addressable market for cybersecurity solutions to rise from $153.65 billion in 2022 to $425 billion in 2030, indicating annual growth rates of almost 14%.

Clearly, CrowdStrike is well-positioned to benefit from multiple secular tailwinds, making it one of the hottest cyber security stocks in the world.

Moreover, companies are unlikely to lower their cybersecurity spending even during macroeconomic downturns, making CrowdStrike a recession-resistant investment.

Is CRWD Stock a Buy, According to Analysts?

Analysts tracking CRWD stock expect fiscal 2024 sales to increase by 36% year-over-year to $3.05 billion. Its adjusted earnings are forecast to rise by 91.6% to $2.95 per share.

Moreover, its sales are forecast at $3.94 billion, with earnings of $3.74 per share in fiscal 2025.

Priced at 80x forward earnings and 19x forward sales, CRWD stock is quite expensive. But growth stocks generally command a premium, and analysts remain bullish on the cybersecurity heavyweight.

The Final Takeaway

CrowdStrike is well-positioned to generate market-beating gains for shareholders. But can it surge 10x from its current valuation?

If CrowdStrike stock surges 1,000% from current prices, it will be valued at $710 billion by market cap. So, if the company is priced at 10x sales, it will need to end the year with annual sales of $70 billion.

Now, if the tech giant can grow its earnings by more than 15% annually for 20 years, its sales will surge past $70 billion. Despite its strong financials and stellar growth rates, this is quite a lofty goal, even for CrowdStrike.

While CrowdStrike may not be a multi-bagger, its improving profit margins, widening customer base, higher customer spending, and expanding market share make it a top investment choice right now.

Chart of the Day

Source: CNBC

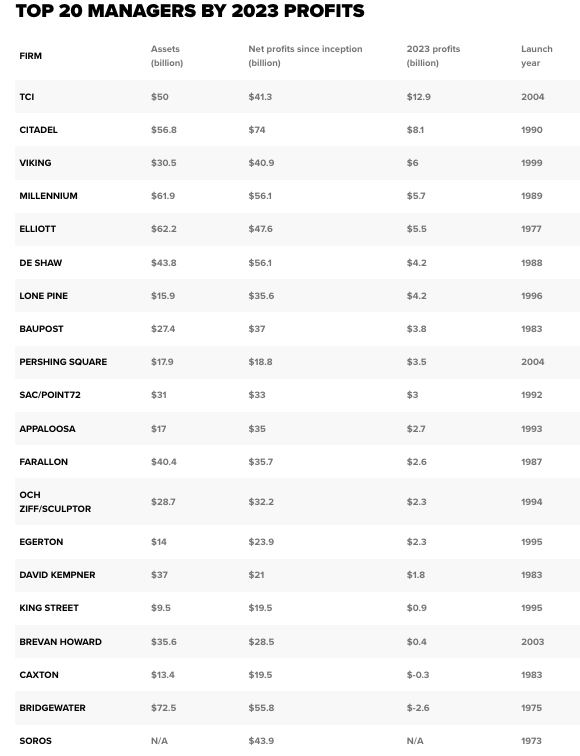

The stock market rally in 2023 allowed global hedge funds to rake in record profits last year.

According to a report from LCH Investments, the 20 leading fund managers made $67 billion in investor profits, higher than the $65 billion recorded in 2021.

After accounting for fees, the fund management industry recorded gains of $218 billion.

The top-ranking fund was TCI, which recorded gains of almost $13 billion, beating the S&P 500 index by nine percentage points. Some of the fund’s largest holdings include Alphabet, Canadian National Railway, Visa, and General Electric.

Citadel came in second with profits of $8.1 billion after it brought in $16 billion in 2022. Since its inception, Citadel has generated $74 billion in gains, making it the most successful hedge fund in history.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.B