- 3 Big Scoops

- Posts

- Wrap Up: Q1 of 2024

Wrap Up: Q1 of 2024

S&P 500, Nasdaq, and the Dow

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

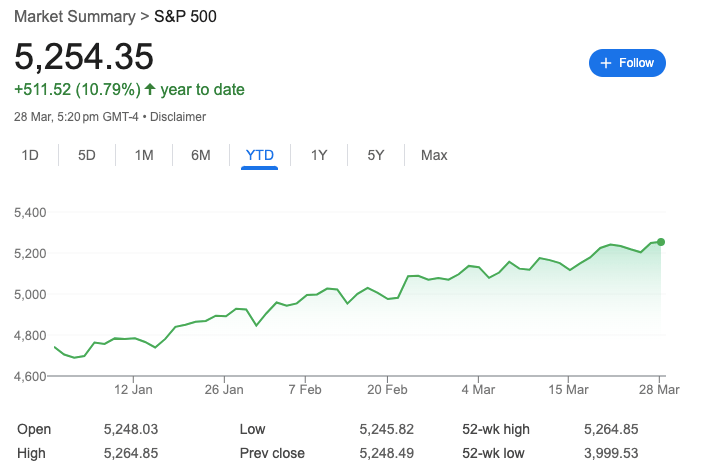

S&P 500 @ 5,254.35 ( ⬆️ 0.11%)

Nasdaq Composite @ 16,379.46 ( ⬇️ 0.12%)

Bitcoin @ $70,487.40 ( ⬇️ 1.08%)

Hey Scoopers,

Rise and shine. Its Monday! Your gateway to a week of financial wisdom starts here. Here’s what we’re covering today 👇

👉 Nvidia drives the S&P 500 index

👉 Consumer spending will be under pressure

👉 Bitcoin halving on the horizon

So, let’s go 🚀

Market Wrap 📉

The S&P 500 rose in the last trading session of March 2024, registering its best Q1 performance since 2019. In the March quarter, the S&P 500 index added 10.2%, its best Q1 performance since rallying 13.1% in the same period five years back.

All 11 sectors of the flagship index ended March in positive territory, with the energy sector driving the majority of these gains. Oil stocks gained 10% in Q1, followed by materials and utilities, which rose by 6% and 5.9%, respectively.

The rally surrounding the equity market is poised to continue in 2024, given the S&P 500 has finished higher in 10 out of the 11 previous times it gained over 10% in Q1.

Additionally, initial filings for unemployment in the previous week (ended on March 16th) came in at 210,000, lower than estimates of 211,000.

Further, the personal consumption price index rose 2.8% in February, which was in line with expectations.

It indicates that inflation is slow-moving, which might result in higher-than-expected interest rates in the near term. Typically, the Fed keeps rates higher than inflation.

Trending Stocks 🔥

RH - Shares of the luxury retail giant gained over 17% after it issued strong full-year forecasts for demand and revenue growth.

Reddit - The social media stock sank over 10% after the company’s management offloaded over 1 million shares.

AMC Entertainment - Shares tumbled over 14% after the theater chain said it would raise $250 million in additional equity capital.

Nvidia Gains and Tesla Sinks

The S&P 500 index has delivered gains of over 10% for the second consecutive quarter. The last time it finished with two consecutive quarters of more than 10% gains was in 2012.

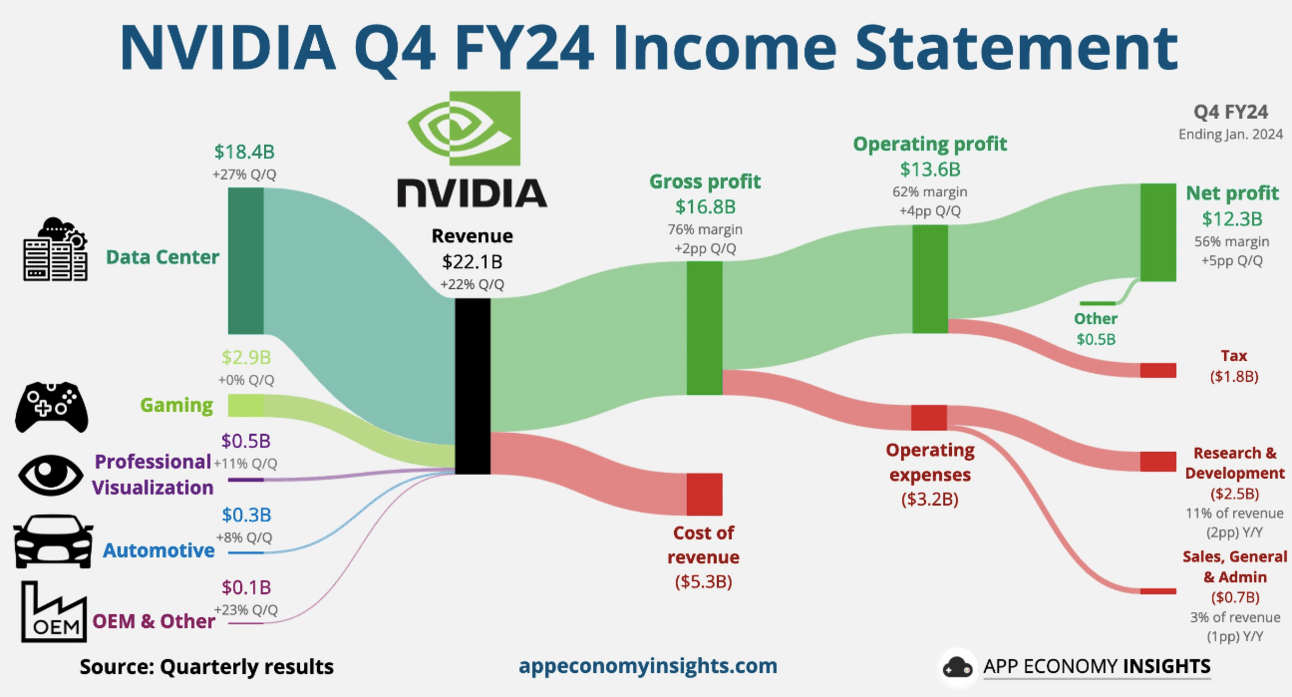

A majority of the gains in Q1 can be attributed to investor optimism surrounding the artificial intelligence megatrend, as semiconductor giant Nvidia was the top performer, rising more than 80% in Q1.

Alternatively, mega-cap stocks such as Apple and Tesla trailed the market by a significant margin. Apple is wrestling with slowing revenue growth, tepid demand from China and a lack of a compelling AI-powered product.

Meanwhile, Tesla shed close to 30% in Q1 and was the worst-performing stock on the S&P 500. In the last 12 months, Tesla is down 6.7% while the index has gained a remakarbale 32%.

Tesla has been struggling with sluggish demand, pricing pressure, and rising competition from China-based manufacturers.

Nasdaq Composite Gains 9.3%

The tech-heavy Nasdaq Composite index is up 10% in Q1. In addition to Nvidia and the usual suspects such as Meta, Microsoft, and Amazon, semiconductor stocks such as Micron and ASML Holdings surged higher.

Other notable winners include CrowdStrike, Netflix, and Advanced Micro Devices, all of which gained over 23% year-to-date, while food delivery giant DoorDash jumped over 40%.

Aside from tech, energy stocks such as Constellation Energy and Diamondback Energy recorded Q1 returns of 58% and 27%, respectively.

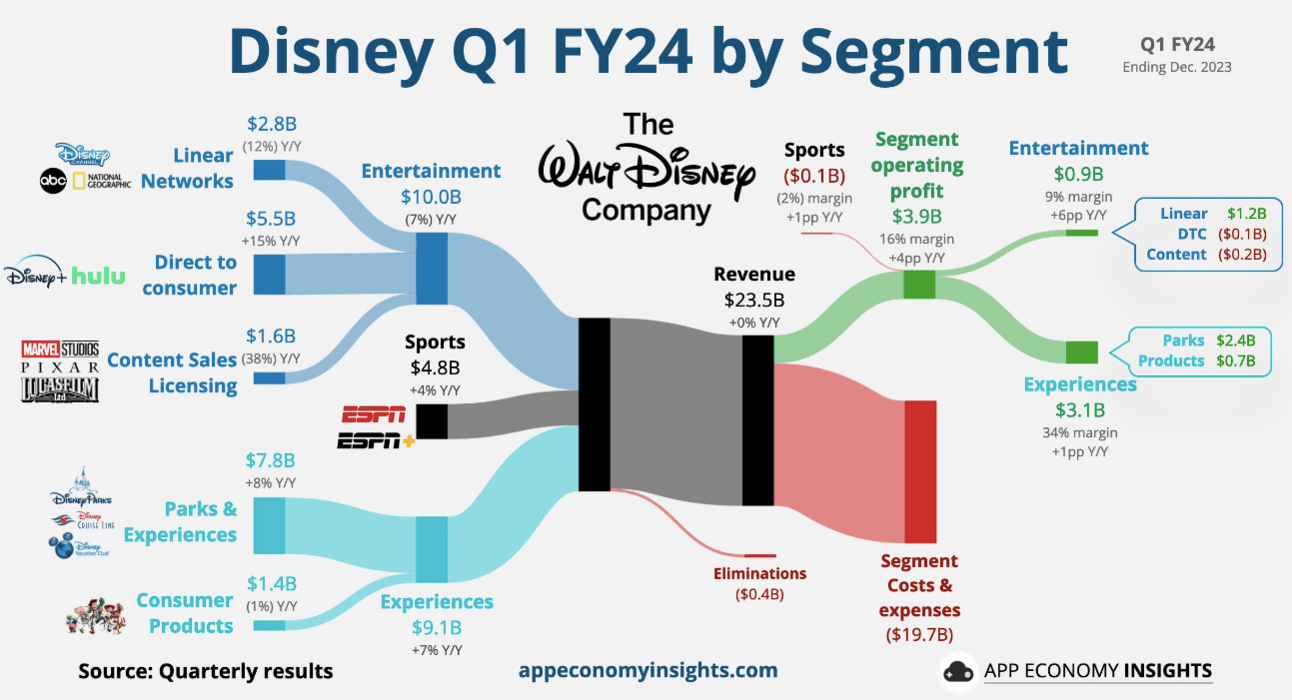

Disney leads the Dow

Disney was the top performer for the blue-chip index in Q1, as the stock gained more than 35%. Other large-cap stocks such as Caterpillar, American Express, Merck, and Travelers were among the largest gainers, climbing over 20%.

Around half of the companies part of the Dow Jones index recorded gains of at least 10% in Q1. Further, around 67% of stocks in the index ended the March quarter in the green.

Alternatively, sizeable losses from laggards such as Boeing, Nike, Intel, and Apple offset a portion of these gains.

Consumer Spending and Investment Trends

Investment bank Piper Sandler expects consumer spending to take a hit as consumers ramp up their savings. The Wall Street firm found that consumer liquid assets rose for the fourth consecutive quarter in Q1.

In an investor note last week, Piper Sandler explained, “Consumers are rebuilding their cash reserves in response to an uncertain job market — an incremental headwind for spending. We expect this trend to continue as labor market uncertainty intensifies.”

Alternatively, the strong performance of the equity market attracted $3.5 billion in investments from retail investors in the March quarter. In fact, retail traders showed the strongest buying impulse in more than a year in Q1.

While traders bet big on Nvidia, stocks such as Tesla and Advanced Micro Devices received the largest retail inflows.

Bitcoin Surged Over 50%

Bitcoin prices rose roughly 56% in Q1 of 2024, primarily due to the launch of multiple spot Bitcoin ETFs and the possibility of multiple interest rate cuts later this year.

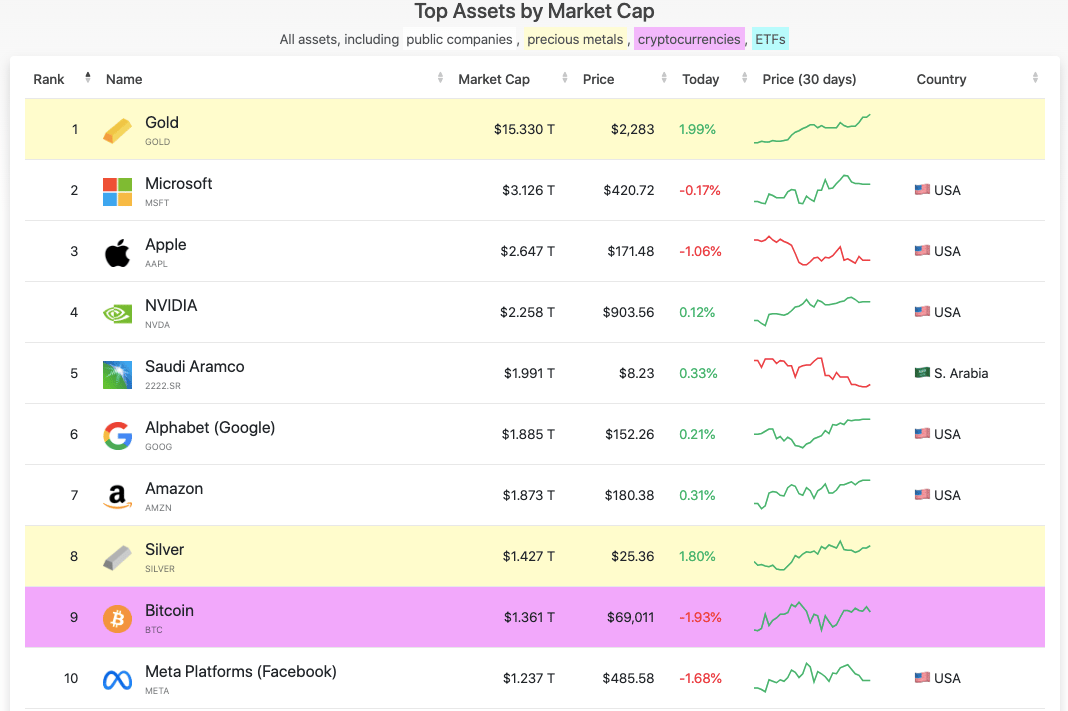

Source: CompaniesMarketCap

Valued at $1.36 trillion by market cap, Bitcoin is currently the ninth largest asset in the world. While spot ETFs drove the majority of the gains in Q1, the upcoming halving event will be in focus in the June quarter.

The next halving event will take place later this month where the number of Bitcoin mined each day will be reduced by 50%.

Generally, BTC prices move higher when mining rewards are cut in half, especially if demand remains the same or rises.

Headlines You Can't Miss!

Gold prices surge to record highs

China’s manufacturing sector gains pace in March

Cocoa prices might continue to soar in 2024

Oil prices remain high as supply tightens

Crypto investments touch 18-month high

Chart of The Day

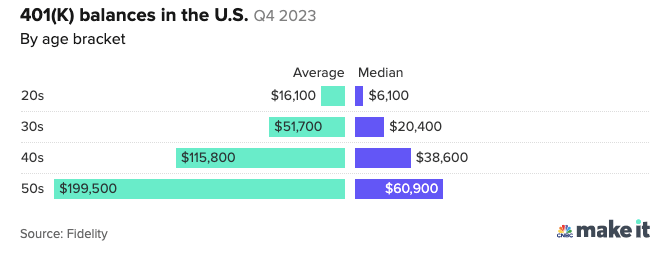

Americans in their 50s are inching closer to retirement, but it seems they don’t have enough saved up for their post-work years.

Fidelity Investments, the largest 401(k) provider in the U.S., explains if you earn $100,000 each year, you should have saved up close to $600,000 in your retirement account in your 50s.

However, the median 401(k) account balance for Americans in their 50s is $60,900 as of Q4 of 2023, while the average account balance is much higher at $199,500.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.De