- 3 Big Scoops

- Posts

- Google's Under Pressure

Google's Under Pressure

PLUS: Bitcoin rips through $56k

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

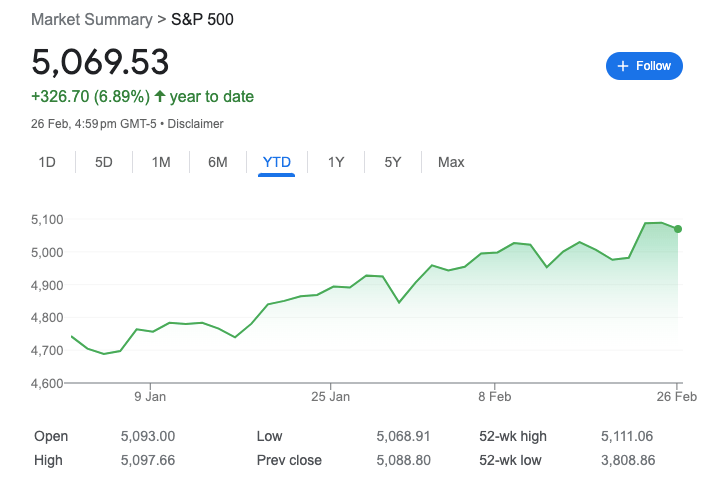

S&P 500 @ 5,069.53 (⬇️ 0.38%)

Nasdaq Composite @ 15,976.25 ( ⬇️ 0.13%)

Bitcoin @ $56,239.60 ( ⬆️ 4.12%)

Hey Scoopers,

Happy Tuesday! Here’s today’s breakdown:

👉 Google stock falls over 4%

👉 Small caps might gain pace

👉 Bitcoin rises (again!)

So, let’s go 🚀

Market Wrap 📉

The S&P 500 index moved lower on Monday as the broader indices retreated from record highs notched last week.

Amazon joined the 30-stock Dow Jones index yesterday, replacing Walgreens Boots Alliance. The Dow holdings are weighted according to stock price and not market cap, as is the case with the S&P 500.

Treasury yields inched higher on Monday, increasing the pressure on equities. The 10-year Treasury yield stood at 4.276%.

Trending Stocks 🔥

Coinbase - Shares of the cryptocurrency exchange soared almost 17% primarily due to the rally in Bitcoin prices, which should increase trading volumes and commissions.

Freshpet - Shares of the pet food company soared 16% after it reported Q4 revenue of $215.4 million, above estimates of $204.6 million. Its EBITDA also beat estimates by a wide margin.

Uber - The ride-hailing company is all set to replace JetBlue Airways in the Dow Jones Transportation Index.

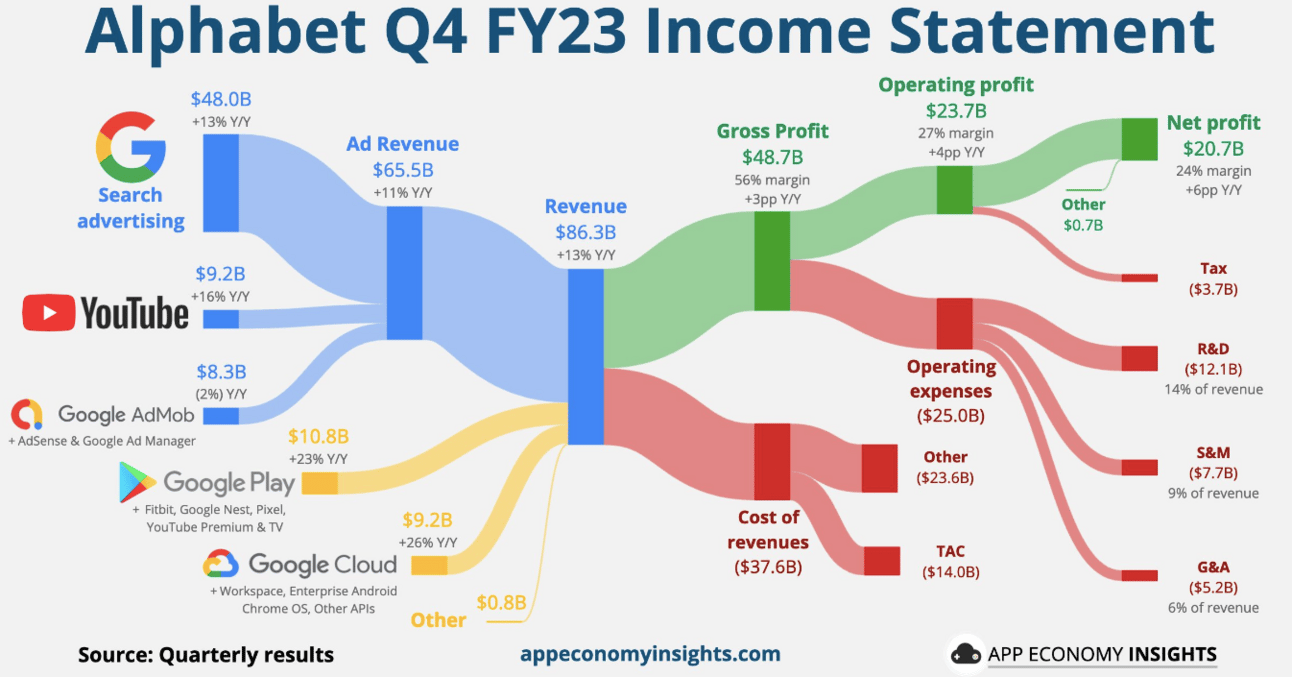

Alphabet Loses $75 Billion in Market Cap

Shares of Alphabet, Google’s parent company, fell 4.5% yesterday on the back of mounting criticism for its image-generation AI (artificial intelligence) tool on Gemini.

In the past week, users have discovered a range of historical inaccuracies and questionable responses from the image generator.

Due to the widespread backlash on social media, Google was forced to temporarily take the feature offline and work on improving its responses.

Currently valued at $1.7 trillion by market cap, Alphabet is one of the largest companies in the world and part of the “Magnificent 7,” which includes big tech giants such as Microsoft, Apple, Amazon, Meta, Nvidia, and Tesla.

The pullback in share prices has meant Alphabet is now the cheapest stock among the Magnificent 7 in terms of the forward price-to-earnings multiple.

Alphabet is a well-diversified company with a stellar record of implementing AI-based solutions and generating massive amounts of free cash flow, which it uses to build innovative products and fuel organic growth.

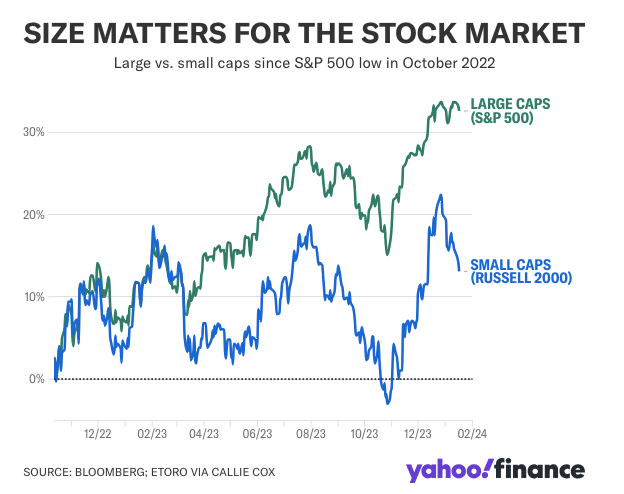

Small Caps All Set to Rally?

Bank of America’s annual survey of Merrill financial advisors indicated a decline in recessionary fears and improved bullish sentiment.

Just 4% of the respondents expect a recession to hit the U.S. in 2024, compared to 85% of respondents last year. More than 50% of the respondents expect a soft landing, while 31% expect above-trend GDP and disinflation.

Advisors also expect three rate cuts this year, and 77% are confident that the bull market will continue beyond 2024.

It's evident that investors expect the market rally to continue, but where should you invest today? While the Magnificent 7 has driven the S&P 500 index to all-time highs, it's time for the small-caps to shine.

The iShares Russell 2000 ETF (IWM) offers you exposure to small-cap stocks and attracted $1.4 billion of net inflows in the past week, the third-most among ETFs in the U.S.

The inflows are a notable shift as its outflows totaled $5 billion since the start of 2024.

Some of the money may be coming from investors who booked profits in big tech, as the Invesco QQQ Trust saw outflows of $3.5 billion in the last week.

Bitcoin’s Astonishing Comeback

The price of Bitcoin surpassed $56,000 after waking up from a week of lackluster trading. Bitcoin reached its highest level since November 2021, surging 140% in the last 12 months.

Yesterday was the settlement day for Bitcoin futures, which contributed to the price jump.

Another reason for the recent surge is that Bitcoin spot ETF trading volume touched $2.4 billion yesterday, boosting investor confidence in the asset class.

We are also approaching the period when traders position themselves ahead of the bitcoin halving scheduled in April 2024.

Bitcoin is an asset with a hard-coded supply compared to fiat currency, which is inflationary. With limited supply and rising demand from ETFs, it seems the rally is just kicking off.

Headlines You Can't Miss!

Concert economics drive tourism boom in Singapore

Jamie Dimon is cautious on the economy

Zoom shares soar as company beats Q4 estimates

China’s airlines to increase flights to the U.S.

Do Kwon to miss the start of SEC trial

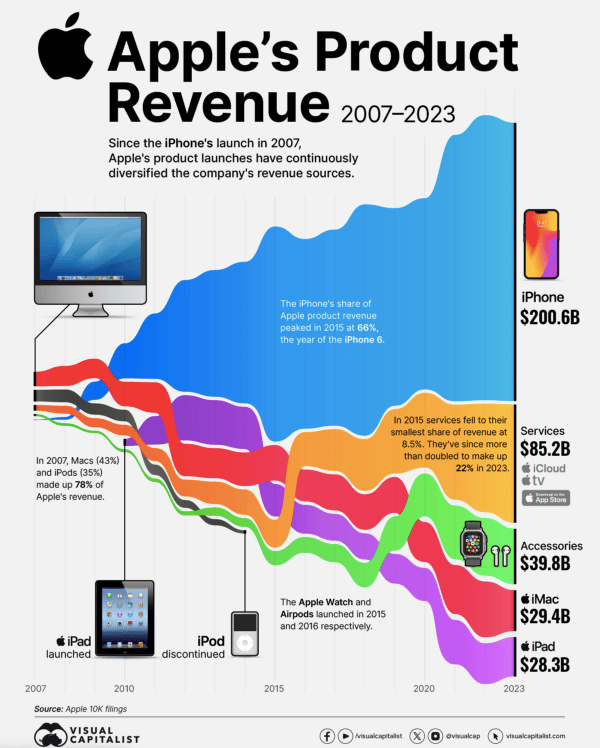

Chart of The Day

Apple has been a hardware company forever. But the product that massively moved the needle was the iPhone.

Launched in 2007, the iPhone was truly a revolutionary product. That year, iPhone sales accounted for 0.5% of total revenue. Today, the iPhone brings in more than 50% of the company’s revenue. In 2015, the hugely popular iPhone 6 accounted for 66% of total sales.

In the last 16 and a bit years, Apple has sold 2.3 billion iPhone units to 1.5 billion active users.

In recent years, Apple has also experienced a shift in product revenue. For example, the Macbook now accounts for just 8% of total sales, down from 43% in 2007.

Other devices such as the Apple Watch and AirPods have been a key driver of top line for the tech giant since 2015.

It will be interesting to see if the Apple Vision Pro can gain traction in the upcoming decade and bring in billions of dollars in revenue each year.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.