- 3 Big Scoops

- Posts

- Warren Buffett Unloads Apple

Warren Buffett Unloads Apple

PLUS: Coinbase beats Q4 estimates

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

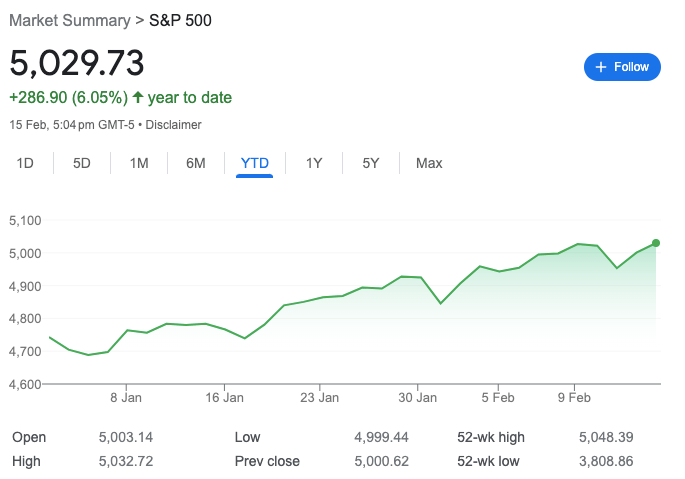

S&P 500 @ 5,029.73 (⬆️ 0.58%)

Nasdaq Composite @ 15,906.17 ( ⬆️ 0.30%)

Bitcoin @ $52,277.40 ( ⬆️ 0.66%)

Hey Scoopers,

We’ve made it to Friday. Here’s what we’re covering today 👇

👉 Warren Buffett trims position in Apple

👉 Michael Burry goes bottom fishing

👉 Coinbase gains big

So, let’s go 🚀

Market Wrap 📉

The last four trading sessions have seen investors assess the direction of the U.S. economy, particularly after hotter-than-expected inflation data and a steep decline in retail sales for January surprised Wall Street.

The three major indexes ended Thursday’s session in the green, with the S&P 500 notching up another record high.

According to Blackrock, investors can expect the equity market to deliver double-digit returns in 2024 as inflation moderates while allowing the economy to post nominal GDP growth of 4%.

Trending Stocks 🔥

DoorDash - Shares of the food delivery giant are down 6.8% in pre-market on a wider-than-expected loss.

Trade Desk - The digital advertising company saw its stock pop by almost 20% after topping analysts’ revenue estimates in Q4 while offering an upbeat outlook for Q1.

Applied Materials - Shares of the semiconductor equipment manufacturer also jumped 12% on positive earnings results.

Berkshire Hathaway Sells Apple Stock

Warren Buffett's Berkshire Hathaway sold ten million Apple shares last quarter, presumably determined not to let one bad stock ruin the whole bunch.

Source: Hustle

What does this mean?

Buffett first joined the legions of Apple aficionados in 2016, buying shares that turned out to be among his best, now making up around a fifth of Berkshire’s entire portfolio. And while Buffett did sell some of that stock a few years back, he said the decision was “probably a mistake” in 2021.

One worth repeating, apparently, because Buffett just revealed that he trimmed around 1% of his Apple shares toward the end of last year. Mind you that means Berkshire’s still the proud owner of a 5.9% stake, worth roughly $167 billion.

The Oracle of Omaha was more ruthless elsewhere, slashing Berkshire’s stakes in HP and Paramount by 78% and 32%, respectively, and ditching eight companies completely during the year, including General Motors, UPS, and Procter & Gamble.

Why should I care?

For markets: The Apple fell a little far from the tree.

Apple handed Microsoft the accolade of the most valuable US company earlier this year after regulators started scrutinizing App Store policies and sales slipped in China – one of the firm’s biggest markets.

Now, investors haven’t ditched the favorite of their five-a-day just yet, but if Apple can’t shake off those qualms, they may well get their fix elsewhere.

The bigger picture: Buffett’s tapped in.

Buffett stayed mum on any of Berkshire Hathaway’s brand-new additions, but he can’t hide his obvious penchant for the oil and gas sector. Berkshire Hathaway bought a bigger stake in industry giants Chevron and Occidental Petroleum during the final quarter of last year.

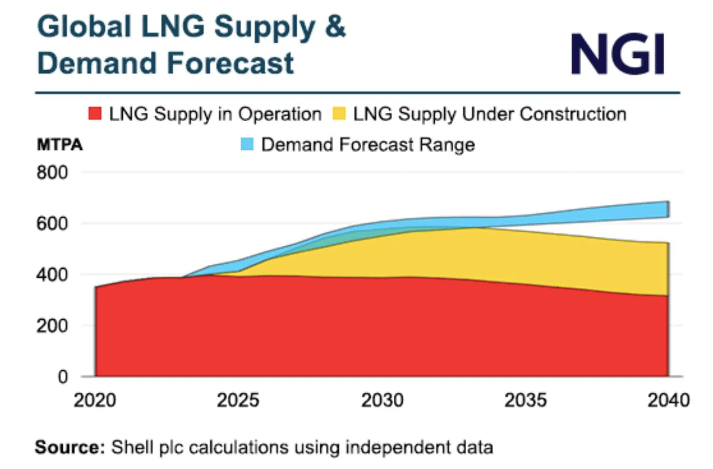

Some psychic powers may have been at play: Shell predicted on Wednesday that the world will want 50% more liquified natural gas by 2040 as developing Asian countries – not least China – tuck into the cleaner alternative to traditional fuel.

Michael Burry Bullish on Chinese Tech Stocks

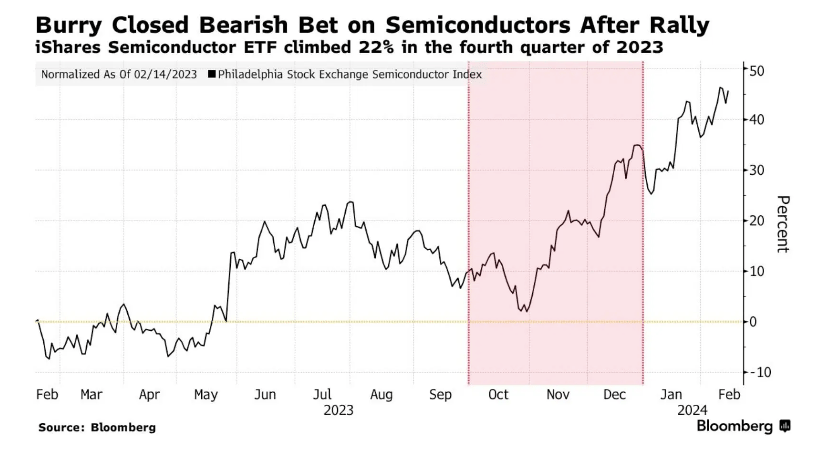

Michael Burry tends to zig when everyone else zags, making him the sort of maverick that would inspire a star-studded feature film introducing technical trading to the masses.

This time, his investment firm Scion Asset Management upped its stake in e-commerce giants Alibaba and JD.com by 50% and 60%, respectively.

That, at a time when most investors are cleaning their hands of Chinese stocks. Burry did fall in line when it came to US tech, mind you, stopping a bet against an exchange-traded fund that included Nvidia and buying more shares in Alphabet and Amazon.

Investors have been giving Chinese stocks a wide berth, sending them into a freefall that’s lasted since 2021. After all, with a seemingly endless property market crisis, hard-to-fix deflation, and mounting political tensions, the country hardly seems like a safe bet.

Bear in mind, though, that Buffett has always said to “be greedy when others are fearful”. So, if you believe that China just needs some time, this could be your chance to nab a bargain: even big-name stocks may now be selling at discounts too low to ignore.

Coinbase Stock Gains 14%

Shares of Coinbase are up over 14% in pre-market trading today following the company’s Q4 results, where it reported revenue of $953.8 million and adjusted earnings of $1.04 per share.

Coinbase’s sales rose by 51.6% year over year in Q4, while it reported an adjusted loss of $2.46 per share in the year-ago period.

Analysts forecast Coinbase to report revenue of $732 million and earnings of $0.95 per share in the December quarter.

Its trading volume stood at $154 billion, above estimates of $116.4 billion. Coinbase stock has almost tripled in the last year due to a recovery in Bitcoin prices.

Headlines You Can't Miss!

DraftKings revenue falls below estimates

Jeff Bezos sells Amazon stock worth $1 billion

Toast to lay off 10% of employees

Shake Shack beats estimates in Q4

Bitcoin reclaims $1 trillion valuation

Chart of The Day

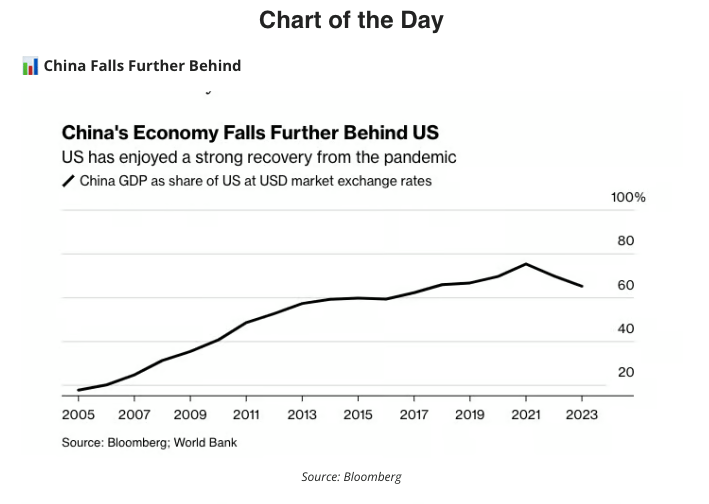

After decades of stellar economic growth, China is now facing the heat due to a real estate crisis, lower consumer spending, and higher unemployment rates.

The US has pulled further ahead of China in the race for the world’s biggest economy in the last two years. In 2023, nominal GDP growth for the U.S. stood at 6.3%, outpacing China’s growth of 4.6%.

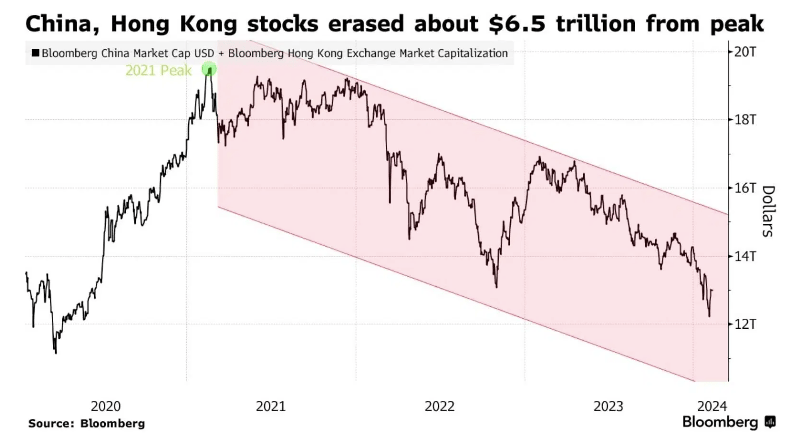

The economic outperformance is reflected in the stock market returns of both countries. While U.S. indices are trading at all-time highs, Chinese equities are mired in a bear market rout totaling $6 trillion and counting.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.