- 3 Big Scoops

- Posts

- Nvidia Key to S&P 500 Gains

Nvidia Key to S&P 500 Gains

Nvidia, Adobe, and TikTok

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

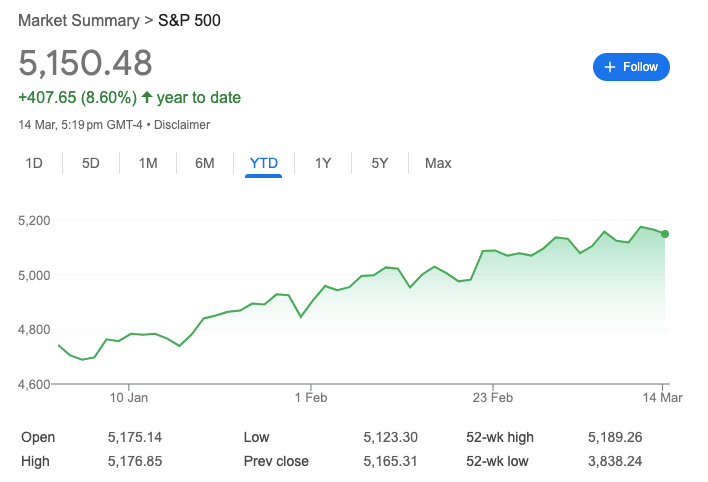

S&P 500 @ 5,150.48 ( ⬇️ 0.29%)

Nasdaq Composite @ 16,128.53 ( ⬇️ 0.30%)

Bitcoin @ $67,707.40 ( ⬇️ 5.12%)

Hey Scoopers,

Happy Friday! We have an exciting issue for you today:

👉 Nvidia drives S&P 500 higher in 2024

👉 Adobe tanks over 10%

👉 Memecoins gain big!

So, let’s go 🚀

Market Wrap 📉

The broader indices moved lower yesterday after the release of hotter-than-expected U.S. inflation data sent Treasury yields higher.

The producer price index, a measure of wholesale inflation, advanced 0.6% last month. After excluding food and energy prices, the core PPI climbed 0.3% in February. Economists expected the PPI to rise by 0.3% and forecast a 0.2% increase for the core reading.

Wall Street expects bond rates to move lower in the second half of the year. But will sticky inflation numbers delay the onset of interest rate cuts in 2024?

The hot inflation report sent bond yields higher, with the 10-year Treasury rising to 4.29%.

Despite the volatility in recent days, the S&P 500 has closed at all-time highs for 17 of the 50 trading sessions in 2024. The last time the index saw more closing highs in the first 50 sessions was in 1998 when it finished at record levels for 20 of the 50 days.

Trending Stocks 🔥

Dick’s Sporting Goods - Shares of the sporting goods retailer surged over 15% after it posted Q4 results that exceeded estimates. It reported revenue of $3.88 billion with earnings of $3.85 per share. Analysts forecast revenue of $3.80 billion and earnings of $3.35 per share.

Lennar - Shares of the homebuilder slid 7.6% after it posted a revenue miss in Q1. Lennar reported revenue of $7.31 billion, weaker than estimates of $7.39 billion.

Fisker - Shares of the electric vehicle manufacturer plunged almost 52% to $0.15 per share after The Wall Street Journal reported the company has hired restructuring advisors to assist with a potential bankruptcy filing.

Nvidia Gains Key to S&P 500

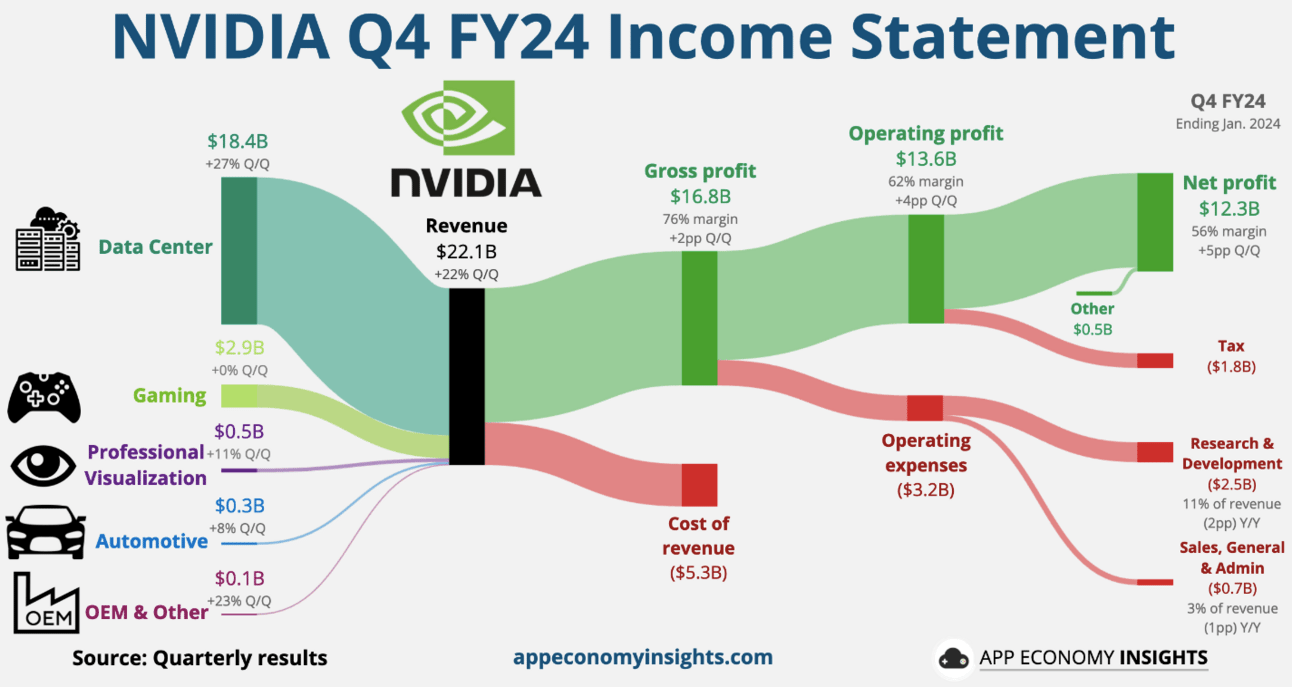

According to a research note from Barclays, around 20% of the S&P 500 gains in 2024 can be tied to Nvidia. The flagship index has risen by 8.6% year-to-date, while Nvidia shares have surged by an emphatic 83% in 2024.

Valued at a market cap of over $2 trillion, Nvidia is the third-largest company in the U.S. and has gained close to 700% since October 2022.

While Nvidia continues to touch new all-time highs this year, other mega-cap giants such as Apple, Alphabet, and Tesla have struggled to beat the market in 2024.

Basically, the number of mega-cap tech names holding the broader index has narrowed further in recent months.

The S&P 500 index has risen sharply (over 25%) since October 2023, but Barclays remains bullish for the following reasons:

👉 A majority of the increase in valuations is driven by earnings growth. For instance, despite Nvidia’s meteoric rise, its forward price-to-earnings multiple has moved lower in the past year.

👉 Barclays expects the U.S. jobless rate to peak at just 4% and without net job losses in the current cycle.

👉 When U.S. equities hit a record high, it's rare for them to pull back for the rest of the year.

Looking for visuals and charts, rather than words, to understand the daily news?

Bay Area Times is a visual-based newsletter on business and tech, with 250,000+ subscribers.

Adobe Sheds Over 10%

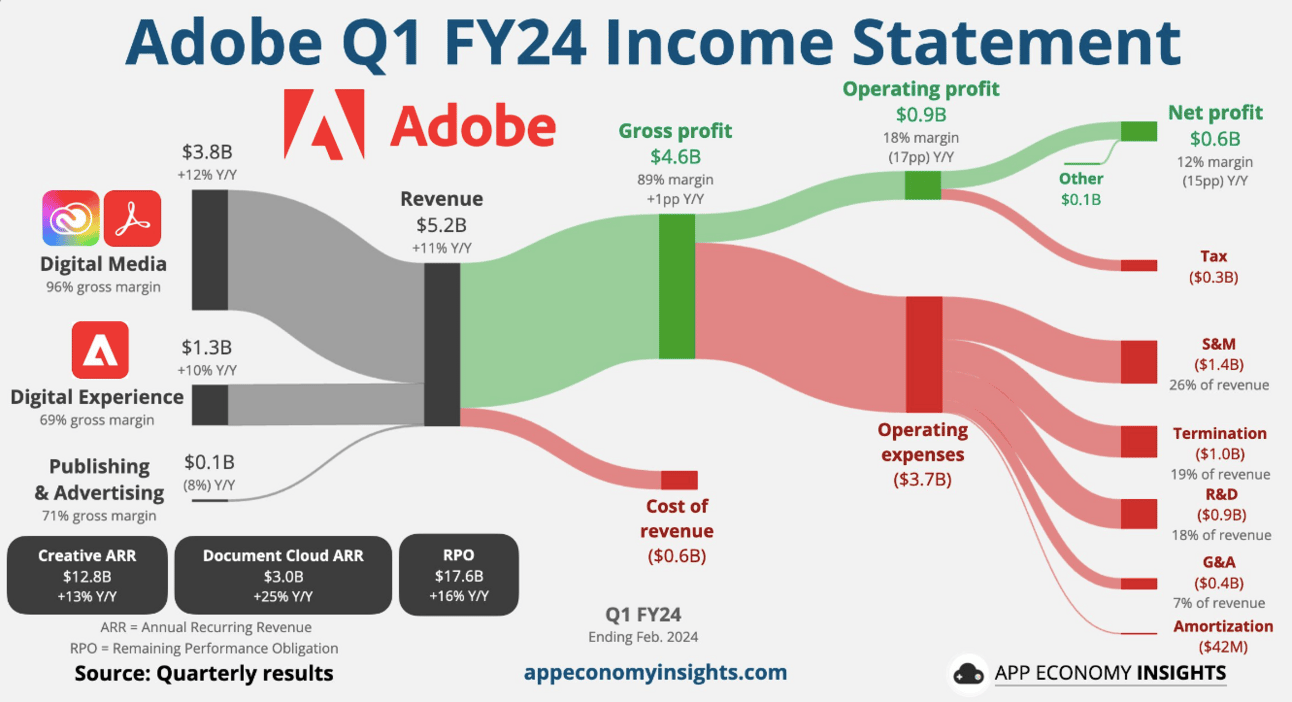

Shares of Adobe tumbled over 10% in pre-market trading after the design software company issued strong Q1 results but disappointed with its quarterly revenue guidance.

In fiscal Q1 of 2024 (ended in February), Adobe reported:

👉 Revenue of $5.18 billion vs. estimates of $5.14 billion

👉 Adjusted earnings of $4.48 per share vs. estimates of $4.38 per share

Adobe grew sales by 11% year over year while net income rose by 18% in the February quarter. In Q1, Adobe was forced to abandon its big-ticket acquisition of Figma, a design software start-up, after U.K. regulators raised competitive concerns.

In Q2, Adobe forecasts earnings between $4.35 and $4.40 per share with revenue between $5.25 billion and $5.30 billion. Comparatively, analysts forecast earnings per share at $4.38 and revenue at $5.31 billion.

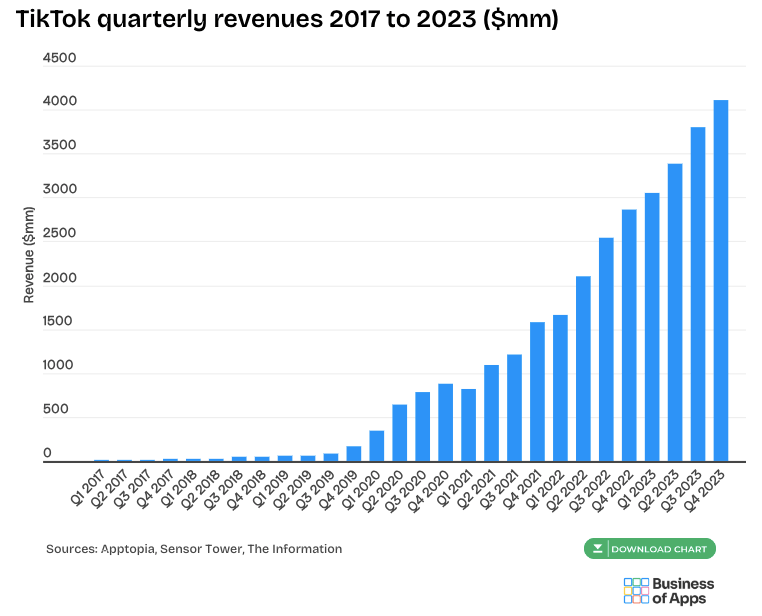

A TikTok U.S. Sale Seems Unlikely

The U.S. might force ByteDance, China’s tech giant that owns TikTok, to divest its U.S. business or ban the application. Earlier this week, The House approved a bill that requires ByteDance to divest TikTok within the next six months to remain functional in the U.S.

Washington has contended the China-based app poses a national security threat as data of U.S. consumers could get into the hands of the Chinese government.

China has alleged the bill is “at odds with the principles of fair competition and international trade rules.”

A potential sale of TikTok is complicated due to its robust algorithm, which recommends content to users to keep them engaged. It’s hard to imagine how TikTok’s U.S. business could be separated from the algorithm.

TikTok is among the largest social media platforms in the world and has significantly increased its market share in multiple global markets.

Memecoins Are Taking Over

Earlier this morning, Solana prices touched all-time highs due to the rising popularity of memecoins.

In an interview with The Block, Benjamin Stani, director of business development at Matrixport, explained, “It’s memecoin-led chain activity that’s driving SOL up.”

Solana blockchain-based memecoins, including Bonk, Popcat, and Dogwifhat, have gained massive traction in recent days. According to Stani, Bonk, and Dogwifhat are the first non-Ethereum meme tokens to hit a market cap of more than $1 billion, indicating the widening adoption and usage of Solana.

Solana is the fifth largest cryptocurrency, valued at a market cap of $80 billion.

Headlines You Can't Miss!

Nio plans to launch a mass-market EV brand in May

Here’s when the Fed is likely to cut interest rates

Is inflation here to stay?

HSBC is positive on China

Berachain raises $69 million, turns unicorn

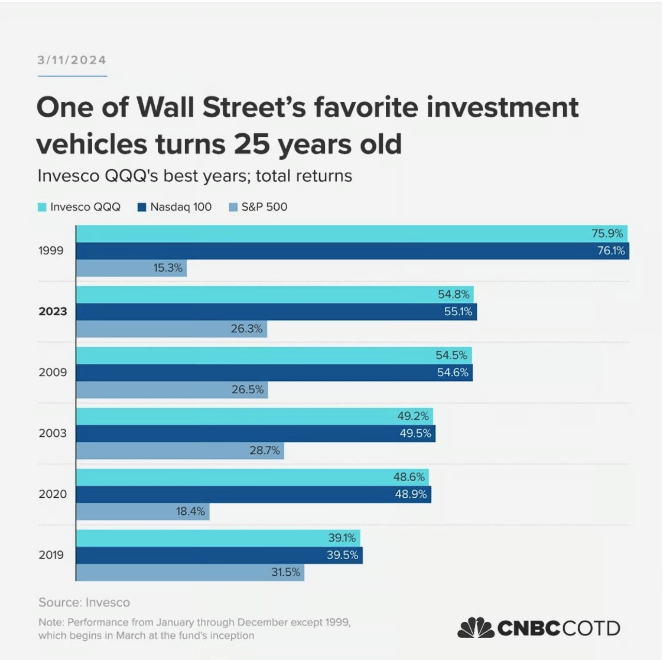

Chart of The Day

One of the most popular ETFs or exchange-traded funds, called the Invesco QQQ, just turned 25 years old.

Launched in March 1999, at the height of the dot-com bubble, the QQQ ETF tracks the Nasdaq-100 index, providing exposure to the 100 largest non-financial companies listed on the Nasdaq.

With $253 billion in assets under management, the QQQ ETF remains a top investment choice for passive investors on Wall Street, rising over 50% in 2023.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.