- 3 Big Scoops

- Posts

- 🗞 Nvidia Invests in OpenAI

🗞 Nvidia Invests in OpenAI

PLUS: Tesla, Ford, and GM

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 5,709.54 ( ⬆️ 0.014%)

Nasdaq Composite @ 17,925.12 ( ⬆️ 0.082%)

Bitcoin @ $61,314.10 ( ⬇️ 0.42%)

Hey Scoopers,

Happy Thursday! Are you ready for an exciting newsletter?

👉 OpenAI raises $6.6 billion

👉 Tesla misses Q3 delivery estimates

👉 GM vs. Ford

So, let’s go 🚀

Market Wrap

The major equity indices ended just above the flatline on Wednesday as rising tensions in the Middle East weighed on markets.

Trading is off to a rough start in October as escalating tensions in the Middle East is dampening investor enthusiasm. Stocks tumbled on Tuesday after Iran launched a missile attack on Israel.

West Texas Intermediate crude oil rose for the second straight day, meaning energy stocks outperformed again. The energy sector rose 1%, notching its fourth straight positive session.

ADP data showed better-than-expected private payroll growth in September. All eyes will now be on Friday's nonfarm payroll report, which could play a key role in the market’s direction and the Fed’s next rate move as its cutting cycle begins.

Trending Stocks 🔥

Levi Strauss - The denim maker plunged 11% in pre-market after reporting revenue of $1.52 billion and earnings of $0.33 per share vs. estimates of $1.55 billion and $0.31 per share. Levi also trimmed its guidance and disclosed plans to sell its Dockers business.

Humana - The healthcare stock plummeted close to 12% following its preliminary 2025 Medicare Advantage data. An 8-K filing noted that 25% of total members are enrolled in plans rated 4 stars and above for next year.

Nike - The sneaker maker tumbled 6.8% after it pulled full-year guidance ahead of its CEO change.

Free Daily Trade Alerts: Expert Insights at Your Fingertips

Master the market in 5 minutes per day

Hot stock alerts sent directly to your phone

150,000+ active subscribers and growing fast!

Open AI is Valued At $157 Billion

OpenAI, the parent company of ChatGPT, closed its long-awaited funding round of $6.6 billion at a valuation of $157 billion. Thrive Capital led the funding round, which included Big Tech giants such as Microsoft and Nvidia.

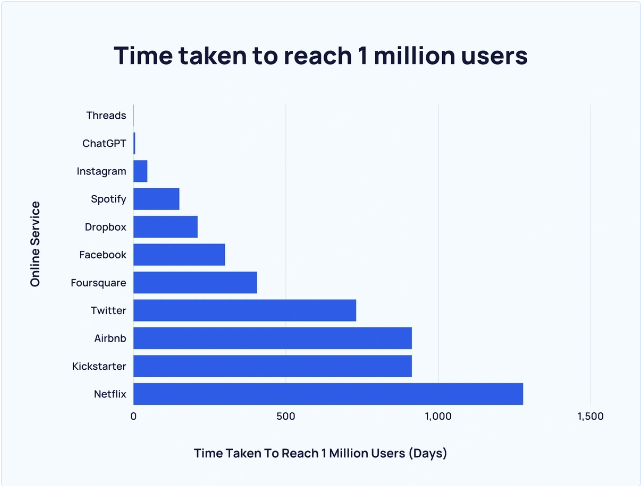

Source: Statista

OpenAI’s meteoric rise began with the launch of ChatGPT two years back, paving the way for tens of billions of dollars of investments in AI infrastructure.

Here are some key numbers for OpenAI:

OpenAI generated $300 million in revenue last month, up 1,700% since the start of 2023

Sales are forecast to touch $3.7 billion in 2024 and $11.6 billion in 2025

OpenAI has 250 million weekly active users, which includes 11 million ChatGPT Plus subscribers and 1 million paying business users

OpenAI was valued at $29 billion in 2023 and at $80 billion in early 2024

While ChatGPT has successfully gained traction, training the generative AI platform is expensive, as OpenAI expects to lose $5 billion in 2024.

Notably, OpenAI is experiencing plenty of growing pains, including the loss of key executives, a trend that continued through last week.

Tesla Tanks Over 3%

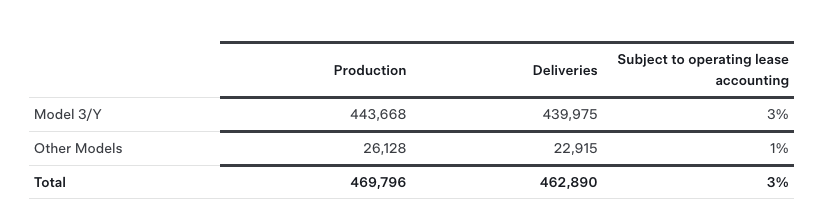

Tesla's shares fell by 3.5% after the electric vehicle manufacturer posted its Q3 production and deliveries report.

Here are the key numbers:

👉 Total deliveries Q3 2024: 462,890

👉 Total production Q3 2024: 469,796

Wall Street forecast Q3 deliveries at 463,310 and this metric is the closest approximation of units sold by the company. In the year-ago period, Tesla reported 435,059 deliveries and production of 430,488 EVs.

Tesla’s Q3 Production and Deliveries Report

Source: Tesla

In recent months, Tesla has faced competitive pressures from Chinese companies such as Nio, Byd, and Li Auto, in addition to other macro headwinds.

Tesla hasn’t issued specific guidance for 2024 deliveries but is expected to report a year-over-year shipment decline despite adding the Cybertruck to its lineup.

Tesla stock climbed 32% in Q3 but is still up just 4% in 2024, trailing the Nasdaq index, which has surged 19%.

Investors will await Tesla’s Q3 results to gauge if its profit margins are still under pressure. Tesla continues offering attractive financing options and incentives to drive sales volume in China and the U.S.

Ford Motor’s EV Sales Rise Over 12%

Source: CNBC

Ford Motor is losing its lead in EV sales to crosstown rival General Motors. Yesterday, Ford reported a 0.7% increase in U.S. new vehicle sales for Q3, which includes a 12.2% rise in EVs.

In the first nine months of 2024, Ford has sold 67,689 EVs. Notably, General Motors reported a 60% growth in EV sales in the September quarter, bringing its year-to-date EV sales to 70,450 units.

Ford and GM continue to trail Hyundai Motor, including Kia, by roughly 18,000 units or more, while Tesla remains the undisputed leader in this segment.

GM has increased the number of EV models to eight, while Ford only has three battery-powered models. Ford is focusing on expanding hybrid models in the near term, as its EVs and hybrid models cumulatively accounted for 14% of total sales in Q3.

Ford emphasized that its total vehicle sales in Q3 outpaced the sector, given industrywide automobile sales were down 2% year over year. In the last nine months, Ford has sold more than 1.5 million vehicles, an increase of 2.7% year over year.

Headlines You Can't Miss!

Costco adds platinum bars to its precious metals lineup

Stellantis U.S. auto sales in free fall

Hong Kong snaps six-day winning streak as China stimulus rally fizzles

Japan expected to stick to hiking cycle

Bitwise files with SEC to launch XRP ETF

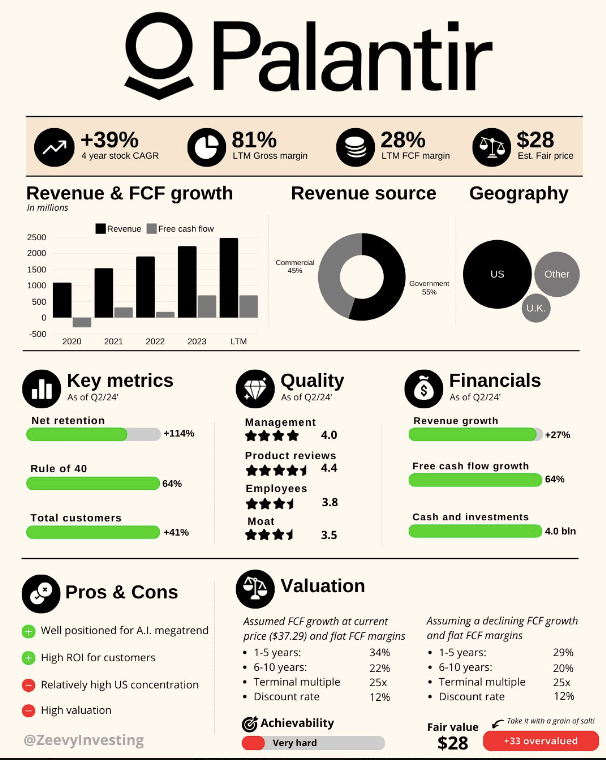

Chart of The Day

Palantir was listed on the equity markets four years back. During this period, it has 👇

Joined the S&P 500 index

Ended Q2 with 600 customers, up from 125

More than doubled its revenue to $2.5 billion

Reported a TTM Free Cash Flow of almost $700 million

The stock is up over 250%

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.