- 3 Big Scoops

- Posts

- 🗞 Nike Stock Tanks Over 5%

🗞 Nike Stock Tanks Over 5%

while geopolitical tensions drag the S&P 500 lower

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

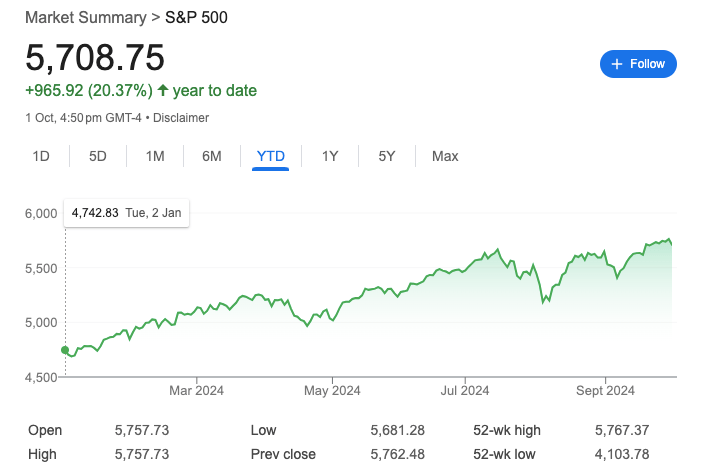

S&P 500 @ 5,708.75 ( ⬇️ 0.93%)

Nasdaq Composite @ 17,910.36 ( ⬇️ 1.36%)

Bitcoin @ $61,613.55 ( ⬇️ 3.87%)

Hey Scoopers,

Happy Wednesday! Are you ready to tackle the midweek mania?

👉 Investors wary of tensions in the Middle East

👉 Nike withdraws guidance

👉 CVS Health announces strategic review

So, let’s go 🚀

Market Wrap

Equities retreated on Tuesday as growing tensions in the Middle East dampened investor enthusiasm following a strong Q3.

The Dow Jones fell by 0.41%

The S&P 500 pulled back 0.93%

The Nasdaq tumbled 1.53%

West Texas Intermediate oil spiked after the Israel Defense Forces confirmed Iran fired around 200 missiles at the country. The VIX index, also known as Wall Street’s fear gauge, topped 20, showcasing the rising concerns among traders.

Around 60% of S&P 500 stocks traded in the red. The decline was offset by the energy sector, which gained over 2%.

Tech was the worst-performing sector as it shed 2.7%, recording its worst session in nearly a month. Notable losers included Apple, Nvidia, Microsoft, and Tesla.

Trending Stocks 🔥

Ford Motor - The automaker climbed almost 2% after Goldman Sachs upgraded the stock to “buy” from “neutral” due to its growing software and services business and Super Duty vehicles.

Energy stocks - Shares of energy companies such as Hess, Occidental Petroleum, and Halliburton jumped due to higher oil prices.

Defense stock - Defense stocks such as Lockheed Martin and L3Harris Technologies advanced due to a volatile geopolitical environment

Nike Stock Is Down in Pre-Market

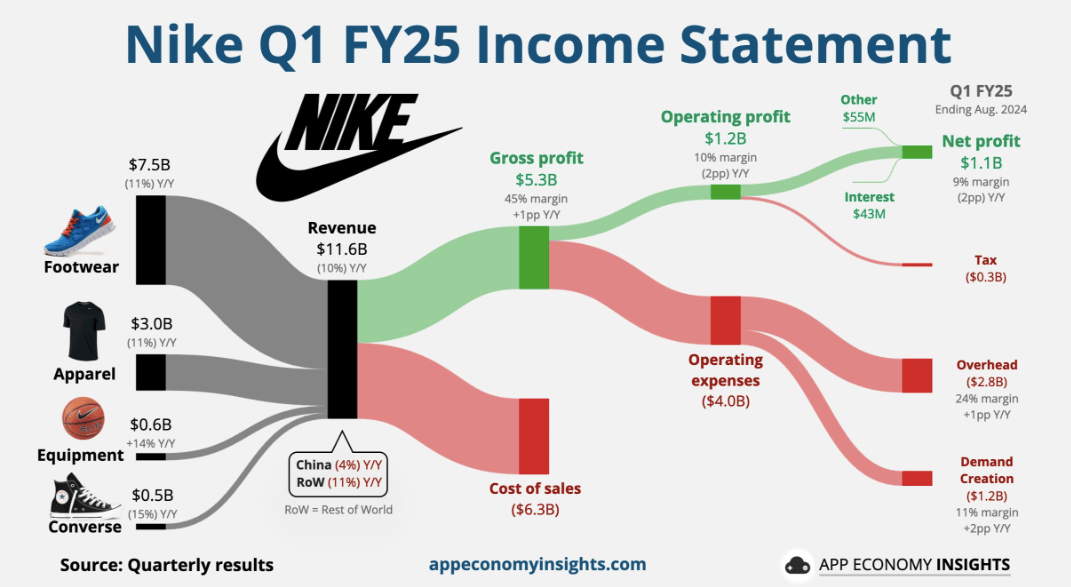

Retail giant Nike withdrew its full-year guidance and postponed its investor ay as it gears up for a new CEO to take charge.

While reporting its fiscal Q4 results in June, Nike lowered its guidance for fiscal 2025 as it forecast sales to fall by mid-single digits. In the current quarter, it expects revenue to decline between 8% and 10%, with a gross margin decline of 1.5 percentage points.

After the recent update, Nike stock fell more than 5% in pre-market and is down over 20% in 2024, trailing the broader markets by a wide margin.

In fiscal Q1 of 2025 (ended in August), Nike beat adjusted earnings estimates but saw a 10% decline in sales. While its gross margins improved by 1.2% percentage points, profits were down 28% year over year.

In the last year, Nike has been accused of falling behind on innovation and ceding market share to competitors as it focused on selling directly to consumers through its website rather than through wholesalers such as Foot Locker.

While the D2C strategy worked amid COVID-19, direct sales fell 13% to $4.7 billion in Q1. Outgoing CEO John Donahue also acknowledged the need to mend Nike's relationships with wholesalers who provide shelf space to competitors. In Q2, Nike’s wholesale revenue was down 8% to $6.4 billion.

Another headwind for Nike is the sluggish economy in China, which is the company’s third-largest market. In Q1, Nike posted revenue of $1.67 billion in China, above estimates of $1.62 billion.

Job Openings Were Robust in August

According to economic data released Tuesday, job openings totaled more than expected in August, while the U.S. manufacturing sector slipped further into decline during September.

The Labor Department’s Job Openings and Labor Turnover Survey showed that new positions rose to just over 8 million, an increase of 329,000 from July and better than the Dow Jones estimate of 7.7 million. The rate as a share of the labor force rose to 4.8%, up 0.2 percentage points.

However, hiring declined by 99,000 to 5.32 million, though total separations tumbled below 5 million for the first time since August 2020, putting the separations rate at 3.1%, tied for the lowest since December 2012.

The September ISM manufacturing reading was unchanged at 47.2%, representing the share of companies reporting expansion. That was slightly below the 47.5% forecast. The employment, inventories, and price indexes all declined while the production measure rose.

CVS Health Begins Strategic Review

Healthcare giant CVS Health has engaged advisors to conduct a strategic review of its business as it contends with potential activist pressure and a depressed stock price. One crucial action the company may take is breaking up its insurance and retail business.

CVS is struggling with higher medical costs, which have hampered its insurance business and driven a leadership change this year. In August, it announced a plan to slash $2 billion in expenses over several years.

Medical costs have jumped over the past year as more seniors return to hospitals to undergo procedures, including hip and joint replacements, that were delayed due to COVID-19.

The company’s pharmacy and consumer wellness division saw year-over-year sales growth in the second quarter, partly due to increased prescription volume. The unit dispenses prescriptions in more than 9,000 retail pharmacies across the U.S. and provides other pharmacy services, such as vaccinations and diagnostic testing.

However, the company said falling reimbursement rates for prescription drugs and decreased volume at the front of the retail store weighed on the unit’s sales for the quarter.

Inflation, softer consumer spending, theft, and competition from Amazon and grocery giants are putting pressure on the retail segment.

In August, CVS said same-store sales at the front of the store were down roughly 4% during the second quarter from the same period a year ago, which reflects a “general softening of consumer demand.”

Headlines You Can't Miss!

Port strikes could fuel inflation with a larger economic impact

GM reports 2.2% decline in Q3 sales

China files appeal with WTO over Canada’s EV tariffs

AI chipmaker Cerebras files for IPO

Bitcoin pulls back as tensions rise

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.