- 3 Big Scoops

- Posts

- 🗞 Micron Stuns Wall Street

🗞 Micron Stuns Wall Street

PLUS: Mira Murati leaves OpenAI

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

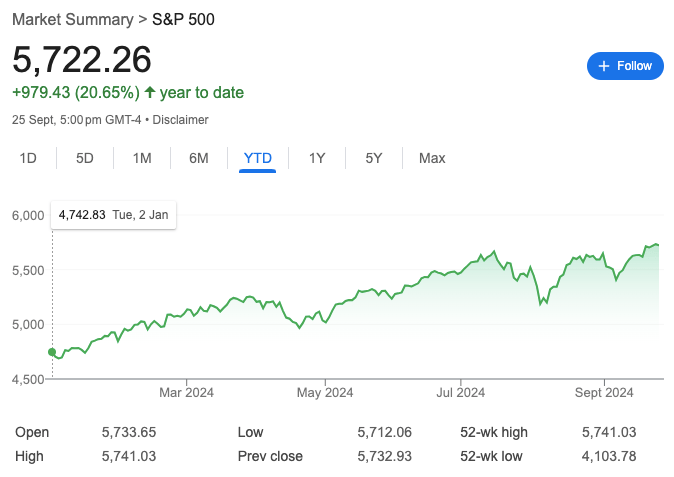

S&P 500 @ 5,722.26 ( ⬇️ 0.19%)

Nasdaq Composite @ 18,082.20 ( ⬆️ 0.043%)

Bitcoin @ $63,404.10 ( ⬇️ 0.49%)

Hey Scoopers,

Happy Thursday! Are you ready for an exciting newsletter?

👉 Micron rallies over 14%

👉 Mira Murati exits OpenAI

👉 Ford and General Motors pullback

So, let’s go 🚀

Market Wrap

Equity indices such as the S&P 500 and the Dow Jones Industrial Average slid on Wednesday, retreating from their latest all-time highs.

Nine of the 11 sectors in the S&P 500 index ended the day in negative territory, led lower by energy stocks as U.S. crude oil futures dipped.

The tech sector was a bright spot in the market as chip powerhouse Nvidia added 2.2%, bringing its market capitalization over the $3 trillion mark.

Meanwhile, Hewlett Packard Enterprise advanced by over 5% following an upgrade from Barclays, citing strong AI data center demand.

All three averages are on track for a positive September, though fears of a slowing economy still linger after last week’s rate cut from the Federal Reserve.

The central bank’s move on interest rates has helped the S&P 500 defy what is usually a weak September.

Trending Stocks 🔥

H.B. Fuller - The adhesives company is down 9% in pre-market after it reported revenue of $918 million and adjusted earnings of $1.13 per share in fiscal Q3.

Concentrix - The stock is down 14% after the customer experience solutions company posted fiscal Q3 adjusted earnings of $2.87 per share, below estimates of $2.93 per share.

Flutter Entertainment - The sports betting stock rose over 5% after it announced a $5 billion share buyback program and forecast total revenue at $21 billion in 2027.

Master the market in 5 minutes per day

Hot stock alerts sent directly to your phone

150,000+ active subscribers and growing fast!

Micron Jumps On Robust AI Demand

Micron stock is up close to 15% in pre-market after the memory chip maker swung to a profit of $887 million or $0.79 per share in fiscal Q4 of 2024 (ended in August) from a loss of $1.43 billion or $1.31 per share in the year-ago period.

Its revenue almost doubled to $7.75 billion in Q4 and topped consensus estimates.

Source: Bloomberg

Micron forecast revenue between $8.5 billion and $8.9 billion in the current quarter, compared to estimates of $8.28 billion.

Micron emphasized that strong demand for its high-bandwidth memory chips, which are used by the AI industry, should drive revenue in the near term.

Along with Samsung and SK Hynix, Micron is one of the three providers of HMB chips, allowing it to capitalize on the demand for semiconductors that help power generative AI platforms.

The AI boom has also helped Micron cushion the impact of a memory chip inventory glut in PC and smartphone markets.

In June, Micron stated that its HBM chips were sold out through 2025. These chips are used in AI processors designed by Nvidia.

Mira Murati Exits OpenAI

After spending six and a half years with OpenAI, its Chief Technology Officer, Mira Murati, has announced her departure.

Source: Bloomberg

In a memo, Murati explained that she’s “stepping away because I want to create the time and space to do my own exploration.”

Later in the day, OpenAI CEO Sam Altman disclosed that research chief Bob McGrew and Barret Zoph, a research vice president, are also departing, as the high-value artificial intelligence startup continues to lose top talent.

Meanwhile, OpenAI’s board is considering plans to restructure the firm to a for-profit business while the company will retain its non-profit segment as a separate entity.

OpenAI, which is backed by Microsoft, is pursuing a funding round that would value the company at more than $150 billion. In addition to Microsoft, Nvidia and Apple might also invest in OpenAI.

Morgan Stanley Downgrades Auto Giants

Shares of automobile heavyweights such as General Motors and Ford tumbled yesterday after Morgan Stanley downgraded the stocks due to competition from China.

Source: Bloomberg

The analysts noted that China now produces nine million more cars than it buys, and this “butterfly effect” has upset the competitive balance in the West.

The investment downgraded General Motors from “equal weight” to “underweight,” reducing the price target from $47 to $42. It downgraded Ford from “overweight” to “equal weight,” reducing the target price from $16 to $12.

Morgan Stanley also downgraded the U.S. auto industry to “in-line” from “attractive” based on "a combination of international, domestic, and strategic factors that we believe may not be fully appreciated by investors.”

Despite the pullback, General Motors' stock is up 25% in 2024, while Ford's has declined by 15% this year.

Headlines You Can't Miss!

American Eagle sues Amazon over trademark infringement

Meta unveils $299 VR headset

SK Hynix to begin mass production of AI chips

PayPal expands services to allow merchants to buy and sell crypto

BlackRock owns $23 billion worth of Bitcoin

Chart of The Day

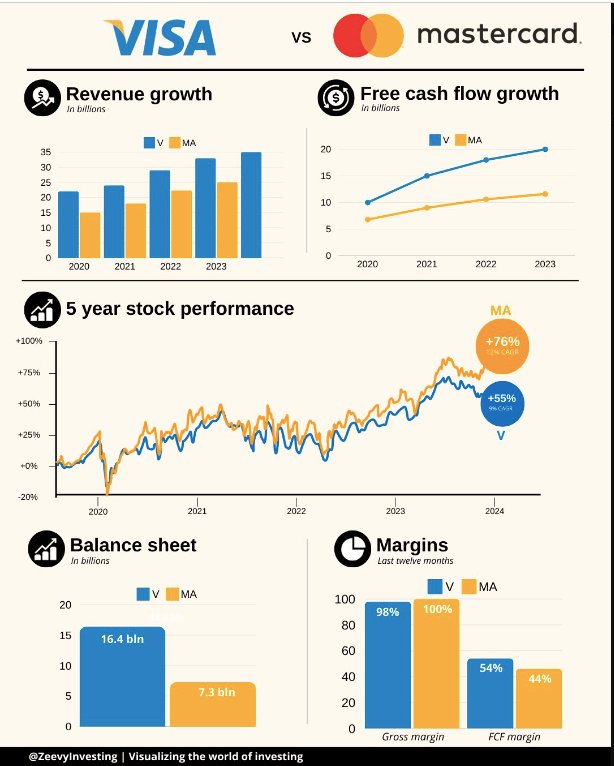

A side-by-side comparison of iconic duos, sector leaders, and lifelong rivals. Who’s your favorite?

Visa and Mastercard: A unique duopoly in the digital payments industry.

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.