- 3 Big Scoops

- Posts

- Costco Misses Q4 Estimates

Costco Misses Q4 Estimates

PLUS: OpenAI losses forecast at $5 billion

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 5,738.17 ( ⬇️ 0.13%)

Nasdaq Composite @ 18,119.59 ( ⬇️ 0.39%)

Bitcoin @ $64,519.10 ( ⬇️ 1.68%)

Hey Scoopers,

Happy Monday! Are you ready for an exciting newsletter?

👉 Costco stock moves lower

👉 OpenAI to raise $5 billion

👉 Chinese stocks are rallying

So, let’s go 🚀

Market Wrap

Each of the three major averages extended their gains to a third week, with the S&P 500 and Dow Jones rising about 0.6% last week, while the tech-heavy Nasdaq rose 1%.

The S&P 500 is up 5.1% in Q3, stretching its year-to-date gains to over 20%. Moreover, October has a troubling history with investors and has witnessed periods of extreme volatility, with some of the more notable Wall Street drawdowns occurring during the month.

Last week, August’s personal consumption expenditures price index came in at 2.2%, the lowest since February 2021, increasing investor confidence w.r.t. additional rate cuts from the Fed. Additionally, initial jobless claims numbers releases fell less than expected, signaling strength in the labor market.

Consumer discretionary is on pace to be the S&P 500’s best-performing sector in September, rising 7.3%, followed by utilities at 6%. Meanwhile, financials, healthcare, and energy sectors are in the red.

Trending Stocks 🔥

Wynn Resorts - The stock rose 7% due to an upgrade to “overweight” from “equal weight” at Morgan Stanley.

Rocket Lab USA - The aerospace and defense stock added 12.5% following a price target increase from KeyBanc Capital Markets, which retained an overweight investment rating.

Cassava Sciences - The biotech company fell 10.6% after agreeing to pay $40 million to settle a case with the U.S. Securities and Exchange Commission.

Costco Misses Revenue Estimates

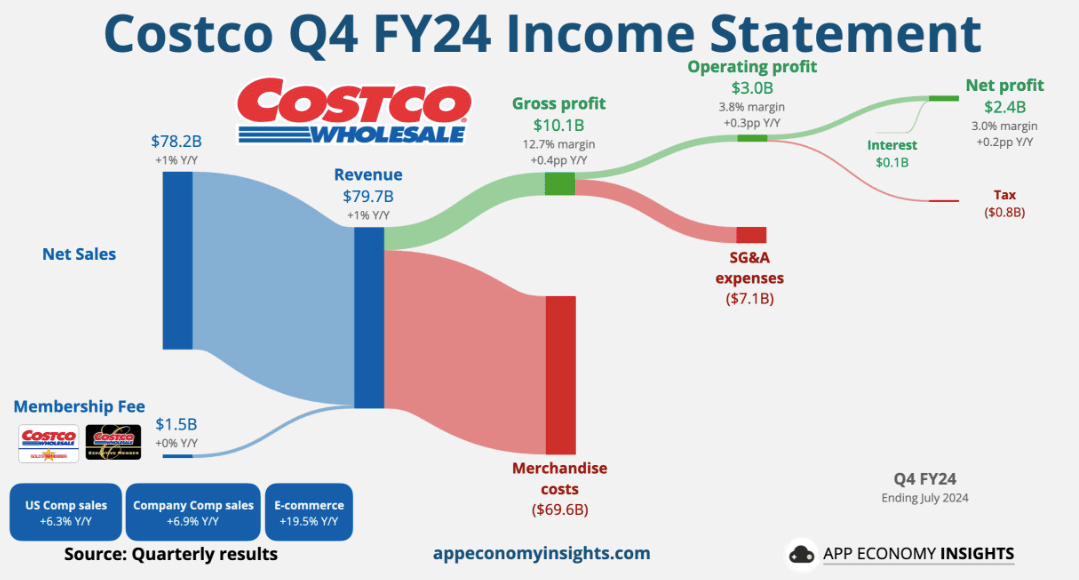

Big-box retailer Costco reported revenue of $79.69 billion and adjusted earnings of $5.29 per share in fiscal Q4 of 2024 (ended in August). Comparatively, Wall Street forecast revenue at $79.91 billion and earnings at $5.08 per share.

In the year-ago period, Costco reported earnings of $4.86 per share, while sales were around $78.9 billion.

Costco opened 14 new warehouses in Q4, including 10 in the U.S. However, its comparable sales growth of 5.4% was below estimates of 5.7%.

One of the bright spots in Costco’s report was its same-store sales growth, which measures sales at locations open for more than a year. Costco increased same-store sales by 6.9%, above estimates of 6.4%, which indicates that the company continues to attract and retain customers amid inflation concerns.

Notably, its e-commerce business increased sales by 19.5% year over year, just below estimates of 19.63%. Costco is successfully expanding its online presence and should benefit from changing consumer shopping habits.

Costco’s membership revenue stood at $1.51 billion, lower than estimates of $1.55 billion. Its membership business is the primary driver of profit margins, and the business ended fiscal 2024 with a renewal rate of almost 93% in the U.S. and Canada.

Costco recently hiked its membership fee for the first time since 2017. It raised the price of its Gold Star membership by $5 to $65, while Executive membership increased by $10 to $130.

Costco ended fiscal 2024 with 891 warehouses globally and continues to expand steadily. While the stock fell 1.5% on Friday, it has surged almost 40% in 2024.

OpenAI Expects $5 Billion in Losses

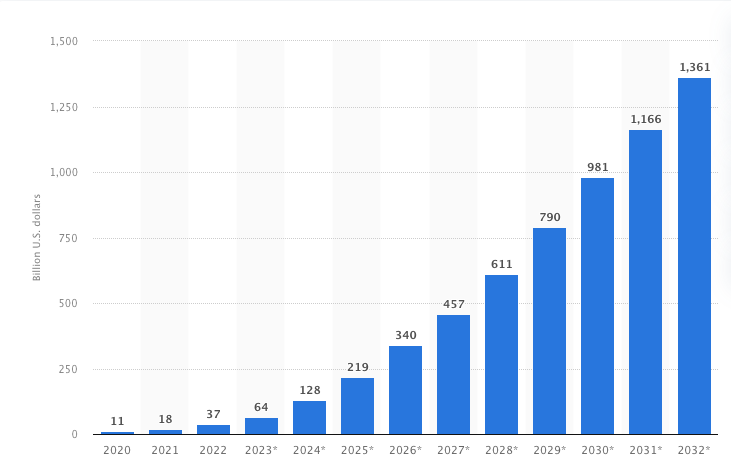

OpenAI, ChatGPT's parent company, expects revenue of $3.7 billion and losses of $5 billion in 2024. In August, it generated $300 million in sales, an increase of 1,700% since the start of 2023. Further, the AI leader forecasts 2025 sales to be $11.6 billion.

Global Generative AI Revenue Forecast

Source: Statista

OpenAI is backed by Microsoft and is pursuing a $5 billion funding round that would value the company at $150 billion. Thrive Capital is leading the round, while other tech giants such as Apple and Nvidia might also invest in OpenAI.

The funding round is oversubscribed amid the high-profile departure of Mira Murati, the company’s technology chief. Further, OpenAI plans to restructure the firm to a for-profit business and retain its nonprofit segment as a separate entity.

OpenAI’s services gained massive traction after ChatGPT was launched in late 2022. The company sells subscriptions to various tools and licenses, powering the generative AI boom.

China’s Equities Rally and Japan Tanks

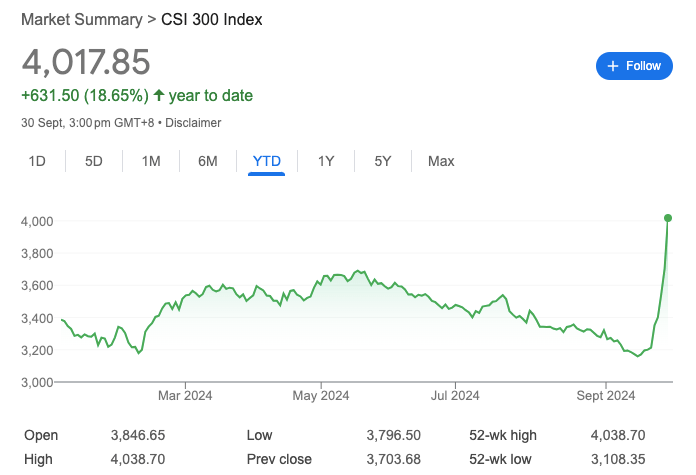

Stocks in mainland China are up more than 7%, while Japan’s Nikkei tumbled over 4% today as investors assessed key economic data from the two countries.

China’s purchasing managers index reading for September came in at 49.8, above estimates of 49.5.

However, it was the fifth consecutive month of contraction for the manufacturing sector in China. The China CSI 300 index was up 7%, and the property sector rose close to 8%.

Elsewhere, the Nikkei 225 index declined due to losses in real estate stocks, while industrial production fell by 4.9% year over year in August, higher than the 0.4% decline in the prior month.

Headlines You Can't Miss!

Major CVS shareholder plans activist push

China eases homebuying restrictions, property stocks rally

The U.S. aims to triple nuclear power by 2050

Mark Cuban warns Elon Musk about Donald Trump

Bitcoin on track to surge over 10% in September

Chart of The Day

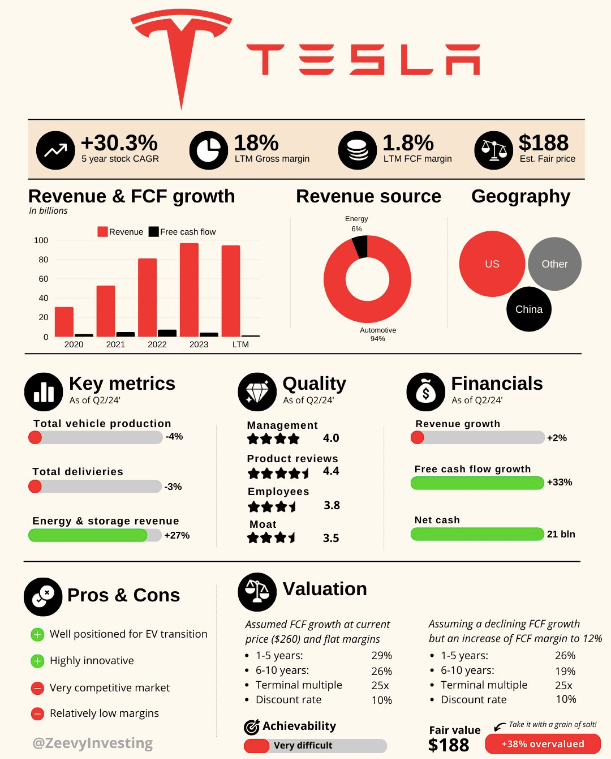

Tesla will be reporting its Q3 delivery numbers tomorrow. Wall Street expects deliveries to rise by 7% year over year to 465k.

Tesla increased its deliveries by 9% in Q1 and 5% in Q2.

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.