- 3 Big Scoops

- Posts

- Nvidia Marches On 💰

Nvidia Marches On 💰

PLUS: OpenAI hits $2 billion in ARR

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

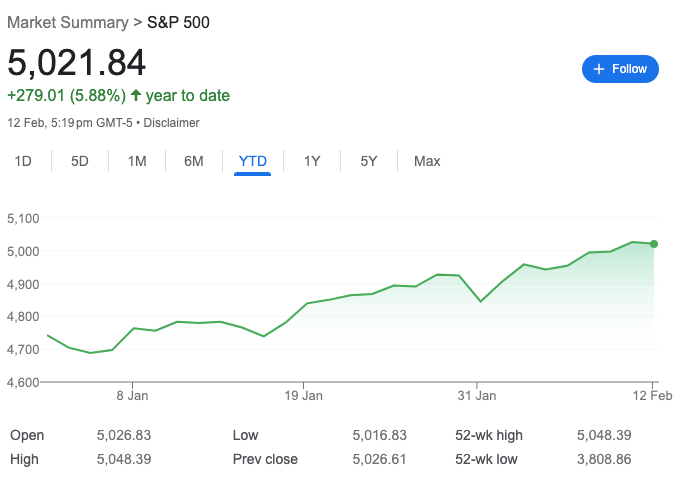

S&P 500 @ 5,021.84 (⬇️ 0.095%)

Nasdaq Composite @ 15,942.54 ( ⬇️ 0.30%)

Bitcoin @ $50,078.40 ( ⬆️ 1.45%)

Hey Scoopers,

Happy Tuesday. Here’s what we’re covering today 👇

👉 Nvidia’s impressive gains

👉 MSCI bets big on India

👉 Bitcoin at $50k

So, let’s go 🚀

Market Wrap 📉

Stock futures are trading marginally lower this morning as investors prepare for a key inflation report. While futures tied to the S&P 500 index are down 0.18%, Nasdaq 100 futures and Dow Jones futures have fallen by 0.21% and 0.1%, respectively, at the time of writing.

Investors and the Federal Reserve will closely watch January's consumer price index report for the latest read on price pressures.

Headline inflation is forecast to rise 0.2% compared to December 2023, indicating a 2.9% increase compared to last year. Core prices, which exclude food and energy components, are forecast to rise 0.3% over December and 3.7% year over year.

Today, beverage giant Coca-Cola will report Q4 earnings, in addition to toymaker Hasbro, e-commerce heavyweight Shopify, and hotel chain Marriott International.

Trending Stocks 🔥

Arm Holdings - Shares of the semiconductor company surged by 29% yesterday and have almost doubled since Arm reported Q4 results last week.

Avis Budget Group - The stock is down 2% in early-market trading today after missing revenue estimates for Q4.

JetBlue - The airline stock spiked 16% after activist investor Carl Icahn reported a 10% stake in the company.

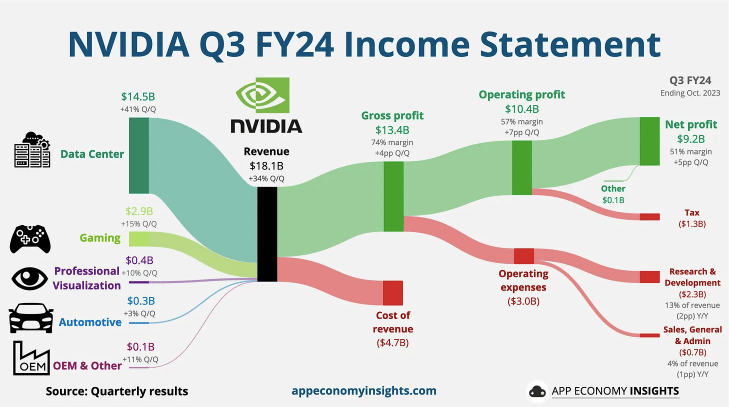

Nvidia Stock Surges 50% In 2024 🚀

Shares of semiconductor giant Nvidia have surged 50% in 2024 and have gained 231.6% in the past year. Valued at $1.78 trillion by market cap, Nvidia has returned 1,800% in the last five years and a staggering 17,000% in the past decade.

But according to Evercore ISI’s Julian Emanuel, this monstrous rally is fueling a fear of missing out in the market.

Emanuel explained clients are worried about being underinvested in Nvidia rather than overexposed despite its lofty valuation.

The investment banker has warned clients about the ongoing rally primarily fueled by the AI megatrend. According to Emanuel, there are similarities to the dot-com bubble as Wall Street remains highly bullish on AI.

In an interview with CNBC, he stated, “The sentiment is very, very bullish. The bears have been eliminated. It's time to think more about risk than reward until we get just a little cooling off.”

Our Take

Nvidia’s rally is supported by its staggering growth rates. Analysts expect Nvidia to more than double its sales to $59 billion in fiscal 2024 (ended in January), while earnings are on track to more than triple to $12.33 per share.

Analysts expect earnings to expand to $115 per share by fiscal 2028. So, if the stock is valued at 30x forward earnings, Nvidia should trade around $3,450, indicating an upside potential of 377% from current prices.

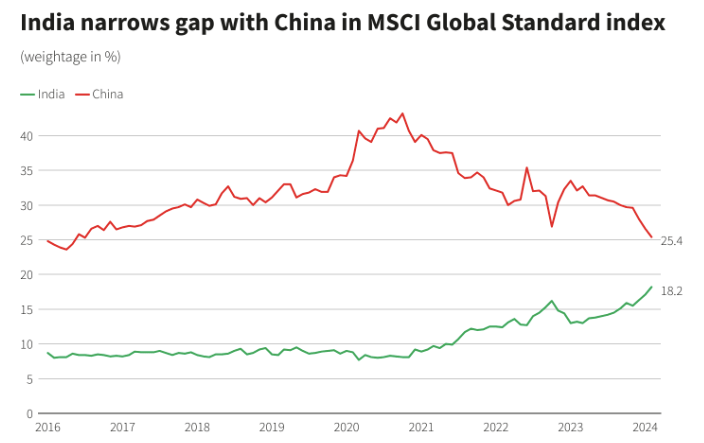

India’s MSCI Weightage at Record High 👀

Index provider MSCI has raised India’s weightage in its Global Standard index to 18.2%, a record high. The report states India’s weightage in the index has nearly doubled since November 2020.

Source: Reuters

MSCI confirmed it has added five Indian securities to the index. Notably, 66 Chinese securities were taken off the index, while only five were added.

India has narrowed the gap with China in the index, which tracks emerging market stocks for investors. According to Reuters, the increase in weightage could lead to inflows of $1.2 billion.

India could surpass a 20% weight on the MSCI index in the first half of 2024 as the country’s equity markets continue to touch record highs.

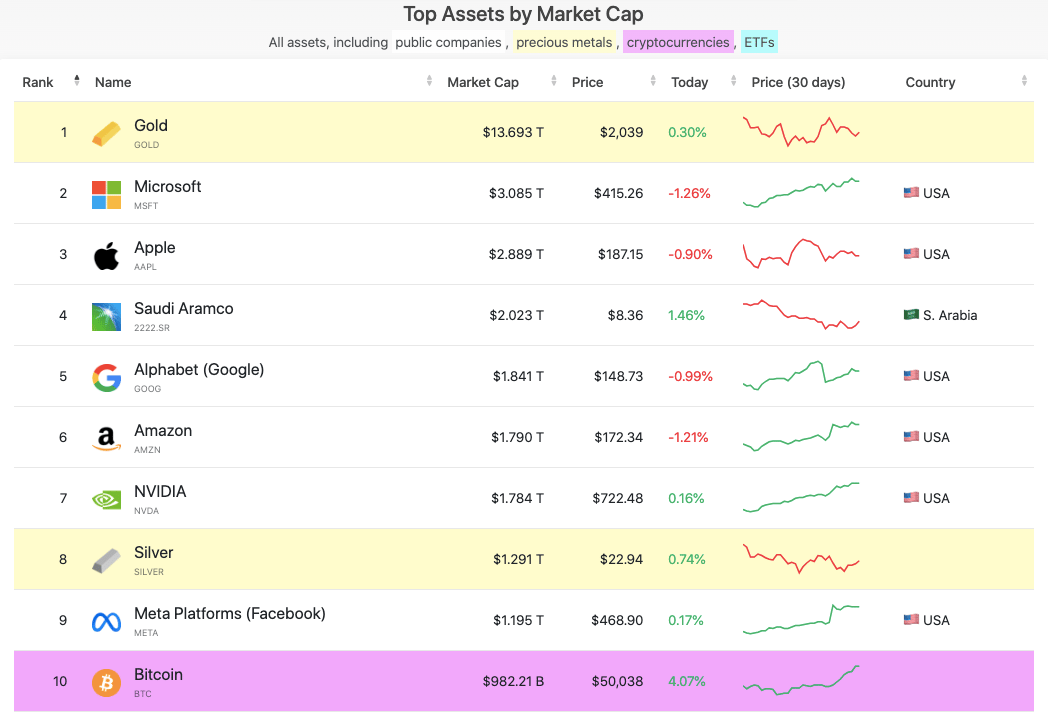

Bitcoin Breaks Into Top 10 🤑

Bitcoin just blew past $50,000 and is currently valued at $980 billion by market cap, making it the 10th largest asset globally.

Source: CompaniesMarketCap

The world's largest cryptocurrency has gained 13% in 2024 and is up 129% in the past year.

A key driver of BTC prices in the last month has been the launch of multiple spot Bitcoin ETFs or exchange-traded funds.

These funds attracted $1.1 billion in capital last week and over $10 billion to date.

Headlines You Can't Miss!

Travel giant TUI smashes Q4 earnings

Superbowl LVIII was the most-watched TV show ever

Nikkei breaches 38k for the first time since 1990

Investors remain underconfident on China

Bitcoin could surge to $112k in 2024

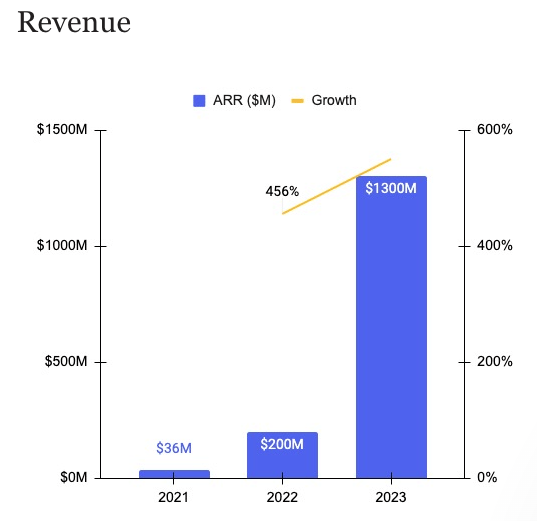

Chart of The Day

Open AI Revenue Growth

Source: Sacra

Open AI’s December revenue put it on course to bring in $2 billion a year, a major milestone that puts the ChatGPT creator in the history books – and not for destroying humanity (yet).

What does this mean?

OpenAI is, ironically, not the most forthcoming with information. But on Friday, two loose-lipped sources pushed back the veil of ignorance, as head honcho Sam Altman would say.

They revealed that OpenAI's “run rate” – the amount a firm would make if every month were the same – was $2 billion based on December’s figures, making it one of only a few tech firms to hit the $1 billion-plus mark in their first five years.

That adds up: plenty of the biggest US firms already rely on OpenAI’s ChatGPT service to save time, make more money, and plan vacation itineraries. A cozy relationship with Microsoft, the world’s biggest company, won’t hurt either.

AI skeptics are warning that the furor looks eerily similar to the tech bubble of 1999.

There’s one key difference, though. Back then, investors snapped up anything with “dot-com” in its name, regardless of sales or profit. Runaway companies, in comparison, are practically bleeding profit.

So, while 1999’s vintage was chronically unstable, today's tech firms really have legs.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.