- 3 Big Scoops

- Posts

- Is Nvidia Stock Still Undervalued?

Is Nvidia Stock Still Undervalued?

PLUS: Money saving tips for 2024

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 4,739.21 ( ⬇️ 0.56%)

Nasdaq Composite @ 14,855.62 ( ⬇️ 0.59%)

Bitcoin @ $42,844.76 ( ⬆️ 0.51%)

Hey Scoopers,

Happy Thursday!

In today’s newsletter, we analyze whether Nvidia can continue to deliver outsized gains in 2024.

We also provide you with some money-saving and investing tips for 2024.

So, let’s go 🚀

Nvidia- A Semiconductor Giant

Nvidia was among the hottest stocks in 2023, surging roughly 240% last year. Currently valued at $1.4 trillion by market cap, Nvidia is one of the largest companies in the world.

Part of the semiconductor sector, Nvidia deals in programmable graphics-processor technologies.

Its business segments include graphics processing units, media and communications processors, and handheld consumer electronics.

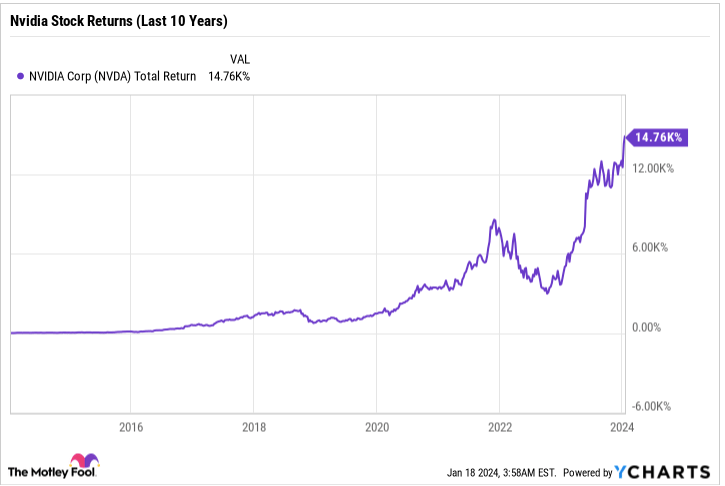

Due to the worldwide shift towards digitization, the demand for chips grew exponentially in the last decade, allowing Nvidia shares to surge by almost 15,000% in this period.

It suggests a $10,000 investment in Nvidia back in January 2014 would be worth around $1.5 million today.

The tech titan gained significant momentum in 2023 as investors remain bullish on the artificial intelligence (AI) megatrend. Let’s see if Nvidia stock remains a top investment choice at current multiples.

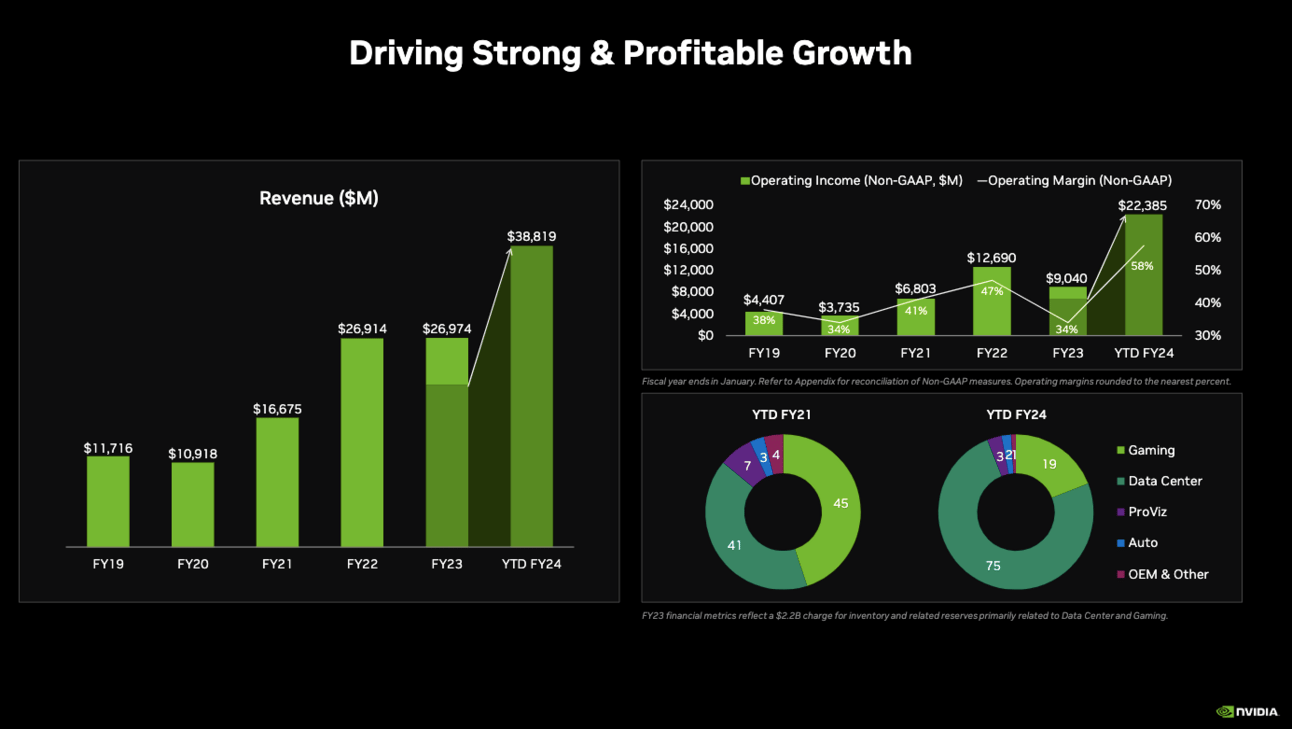

Key Revenue Drivers for Nvidia

Over the years, Nvidia gained significant traction on the back of its graphics processing units and advanced gaming hardware.

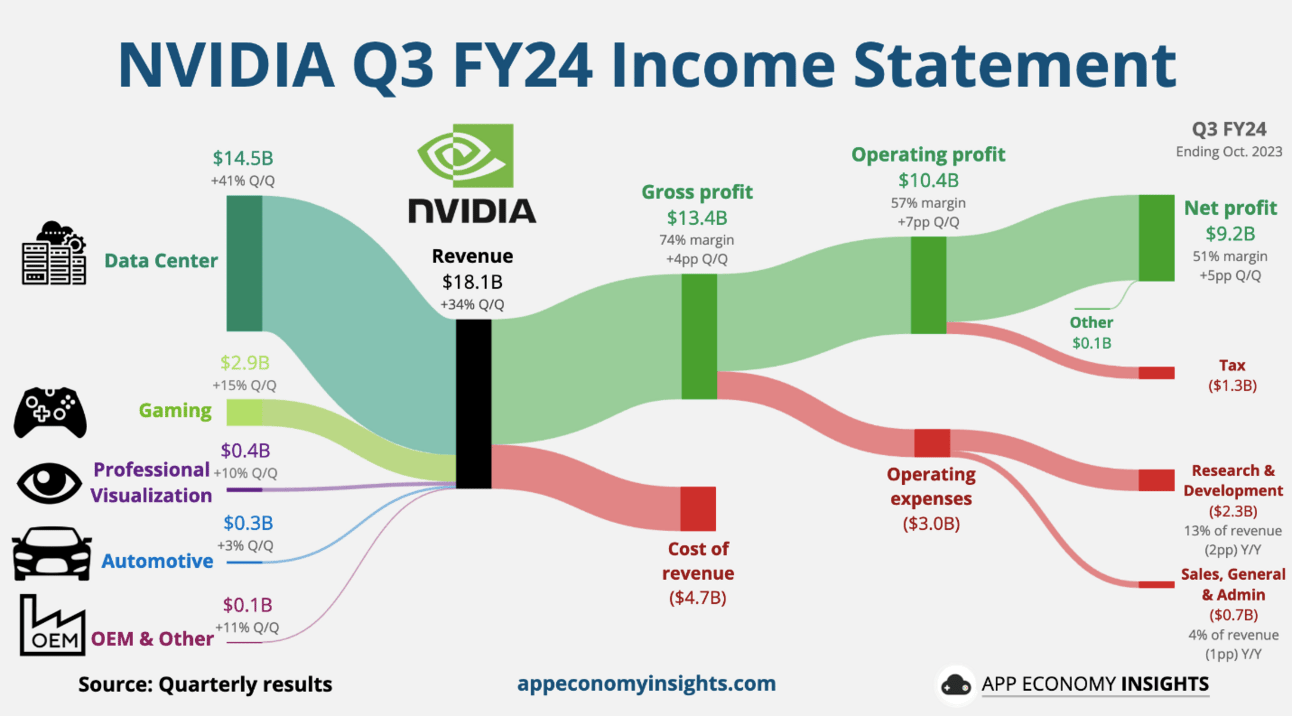

Today, several consumer internet companies and cloud service providers use Nvidia’s GPUs, networking technologies, and AI-powered software solutions to build infrastructure that runs complex generative AI applications.

The AI boom in 2023 raised demand for Nvidia’s GPUs as they became the preferred hardware for developers globally. Demand for these high-powered chips is likely to remain strong in 2024.

For instance, a report from Reuters stated that Yotta, a data center company from India, will purchase AI chips for Nvidia for $500 million, taking the total order book with the chipmaker to $1 billion.

Alternatively, Nvidia will have to contend with rising competition in this space. Several companies have entered the AI chip market following Nvidia’s meteoric rise in recent months.

Leading chip manufacturers, including Advanced Micro Devices and Intel, plan to ship new GPUs soon. Furthermore, behemoths such as Amazon, Microsoft, and Alphabet announced AI chip ventures in 2023.

With a market share of 80% in desktop GPUs, Nvidia will likely remain the undisputed leader, given that it continues to invest heavily in research and development.

Much more than AI

In addition to AI, Nvidia is part of other growth markets, such as gaming. In fiscal Q3 of 2024 (ended in October), Nvidia’s gaming sales rose 81% year over year to $2.86 billion.

This uptrend should continue in 2024 as PC sales are forecast to grow by 8% in 2024, compared to a fall of 12.4% in 2023.

Another driver for Nvidia’s PC business is the constant upgrade of gaming systems. A survey by DCF Intelligence showed that 53% of respondents who built their PCs in 2020 plan to upgrade to a new PC within the next 12 months.

Is Nvidia Stock Cheap

Nvidia is the sixth-largest company in the world and needs to surge over 40% to reach a $2 trillion market cap. Is it possible to reach this lofty valuation in 2024?

Nvidia is forecast to finish fiscal 2024 (ending in January) with adjusted earnings per share of $12.25, up from $3.34 in fiscal 2023. Moreover, analysts forecast Nvidia stock to surge by another 63% in fiscal 2024.

In fact, Nvidia’s earnings are forecast to grow by 100% annually in the next five years. So, its earnings should expand to $114 per share in fiscal 2028.

Nvidia stock currently trades at 45x forward earnings. If the stock is priced at 30x forward earnings, it will surge to $3,420 by the end of fiscal 2028, indicating an upside potential of 500% from current levels.

Our Takeaway

Looking at Nvidia’s robust growth estimates and target price, the company may be valued at a whopping $8.5 trillion by 2028, making it the largest company on earth.

Nvidia enjoys pricing power and a competitive moat in the AI chip market. It is positioned to benefit from multiple secular tailwinds in the upcoming decade.

But please take these projections with a pinch of salt. To achieve this mind-boggling growth, Nvidia must keep beating Wall Street’s estimates while competing with other tech giants for market share.

Chart of the Day

Sure, it’s mid-January, but it’s never too late to make a New Year’s resolution about personal finance. So, if you want to really grab control of your finances and take better care of future you, here are seven tips that can help:

Get familiar with the 50/30/20 rule. This is a great place to start. It’s simple: use 50% of your income for essentials like rent and bills, 30% for fun stuff like dining out, and save the remaining 20% for savings and debt. It’s an easy, flexible way to balance necessities, leisure, and savings.

Automate your savings and investments. Regular monthly contributions are a smooth and effective way to grow your wealth over time.

Investing a little bit consistently, especially if you’re worried about economic ups and downs, can be a smart way to handle uncertainty in the coming year.

Reduce debts. A smart move is to clear your debts before you start investing. It’ll cut down on costly interest payments, particularly now, with rates a lot higher than they used to be.

Plus, this move frees up your cash for savings. If it’s going to take a while to pay off all your loans, think about refinancing to get lower interest rates wherever you can.

Maximize your tax allowances. Depending on where you live, you might have access to various tax breaks. These could include making tax-deductible contributions to your retirement or health savings account or even some tax-free investing options. Taking advantage of these allowances can supercharge your long-term returns.

Top up your retirement savings. In investing, long-term thinking pays off – and that means topping up your retirement savings whenever you can. In certain countries, you can earn income tax relief on the money you set aside.

To get started, you might consider low-cost target date funds that help you invest across stocks and bonds based on your target retirement age.

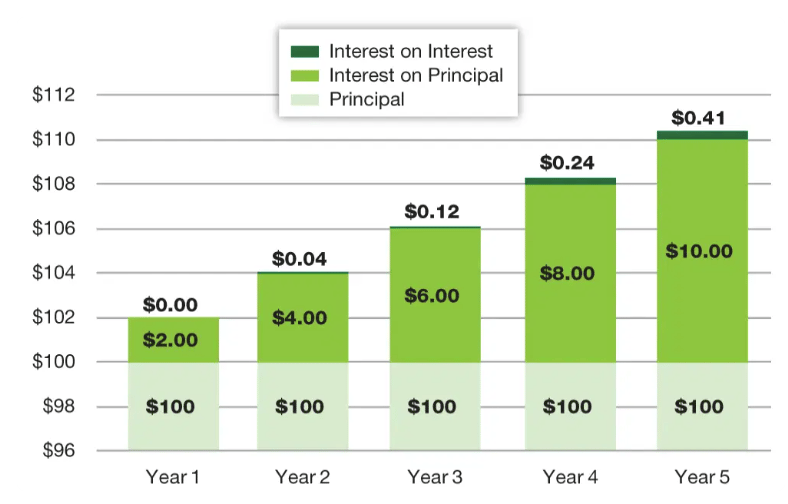

Reinvest dividends. Those little payments may seem small, but reinvesting them can result in a substantial boost to your overall returns. That’s because your returns will also earn returns – with the magic of compounding.

When you’re investing, consider “accumulating” ETFs or funds. These automatically put your dividends back into the fund, unlike “distributing” ones.

Make the most of cash-back and reward schemes. Whether in investing or shopping, it’s worth keeping an eye out for a good deal. After all, as Ben Franklin said, “a penny saved is a penny earned”.

Don’t be afraid to take full advantage of cash-back and rewards programs from credit cards or apps. These perks can really accumulate over time, helping to boost your savings and reduce costs.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.