- 3 Big Scoops

- Posts

- Pepsi Disappoints In Q4

Pepsi Disappoints In Q4

Plus: Bitcoin is flying 🚀

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 5,026.61 (⬆️ 0.57%)

Nasdaq Composite @ 15,990.66 ( ⬆️ 1.25%)

Bitcoin @ $47,890.80 ( ⬆️ 1.45%)

Hey Scoopers,

Brace yourself for some Monday morning madness. Here’s what we’re covering today 👇

👉 Pepsi’s Q4 earnings

👉 Inflation should cool off in 2024

👉 Bitcoin inches closer to $50k

So, let’s go 🚀

Market Wrap

Stocks continued to gain on Friday after December’s revised inflation reading came in lower than estimates. The S&P 500 closed above 5,000 for the first time, adding 1.4% last week.

All three major indices, including the S&P 500, Dow Jones, and the Nasdaq, have notched their fifth consecutive week of gains. The indices have now moved higher in 14 of the last 15 weeks.

A solid earnings season, easing inflation, and resilient consumer spending have contributed to the stock market rally in 2024.

The S&P 500 index crossed 4,000 in April 2021, which means it has returned 25% in less than three years.

Trending Stocks

Pinterest - Shares of the image-sharing company fell 11% after it issued softer-than-expected guidance for Q1 of 2024.

CleanSpark - The bitcoin miner gained 34% after surpassing Wall Street estimates in the December quarter.

Expedia - Shares of the travel booking company fell 18% as Q4 earnings failed to beat consensus estimates.

Semiconductor stocks gained pace on Friday, with Nvidia leading the pack, rising 3%

25 S&P 500 stocks, including Nvidia, Microsoft, ServiceNow, and Eli Lilly, hit new all-time highs last Friday.

Pepsi Loses 3.55%

Shares of Pepsi fell by more than 3.5% on Friday after it posted mixed results in Q4. In the December quarter, the beverage giant reported:

👉 Revenue of $27.85 billion vs. estimates of $28.4 billion

👉 Earnings per share of $1.78 vs. estimates of $1.72

Pepsi attributed tepid top-line numbers to falling income for consumers and a shift in consumer behavior.

Source: BrandHopper.com

Pepsi’s organic sales were up 4.5% in Q4 due to higher prices. However, an uptick in product prices hurt demand across business segments. In fact, Pepsi’s volume, which excludes pricing and currency changes, fell again in Q4.

Pepsi emphasized high borrowing costs and lower personal savings are squeezing consumer budgets in North America. The beverage leader also said consumers are choosing smaller product pack sizes due to lower price points.

Pepsi expects organic sales to rise about 4% in 2024 as it expects a weak first half to impact revenue.

Economic Growth Might Gain Pace

According to the latest Survey of Professional Forecasters, economic growth in the U.S. is poised to accelerate as inflation cools and the labor market holds strong.

The quarterly outlook indicates the U.S. GDP (gross domestic product) growing at 2.1% in Q1, up from the earlier estimate of 0.8%. Moreover, GDP is forecast to grow by 2.4% in 2024, up from an earlier estimate of 1.7%.

The forecasters expect the consumer price index to gain 2.5% in Q1 and 2024, while unemployment rates might inch to 3.9% this year.

Investment bank UBS is optimistic about the equity market as it forecasts the Federal Reserve will start cutting interest rates in May.

It seems the trifecta of economic growth, disinflation, and rate cuts in 2024 to support equity valuations, which might seem lofty, especially for mega-cap tech stocks.

While the S&P 500 is expensive compared to historical levels, valuations are a poor predictor of market reversals. In fact, if you look beyond big tech, valuations remain relatively cheap across other sectors.

Bitcoin Flirts With $1 Trillion Valuation

Bitcoin recently flirted with a $1 trillion valuation in terms of market cap, rising over 8% in the last five days.

A key driver of BTC prices could be fund inflows for spot Bitcoin exchange-traded funds or ETFs launched last month. According to a report from BitMex Research, spot Bitcoin ETFs have attracted over $10 billion in assets under management.

The top ETFs include:

BlackRocks’s iShares Bitcoin Trust with BTC worth $4 billion

Fidelity’s Wise Origin Bitcoin Fund with BTC worth $3.4 billion

The ARK 21Shares Bitcoin ETF with BTC worth $1 billion.

Meanwhile, the Grayscale Bitcoin Trust, or GBTC, saw outflows of $6.3 billion last month.

Headlines You Can’t Miss!

Germany’s economy is under pressure

China’s chip expansion faces headwinds

OpenAI touches $2 billion in annual revenue run rate

Revolut competes with telecom giants in the UK

Ethiopia’s cheap electricity attracts Chinese Bitcoin miners

Chart of The Day

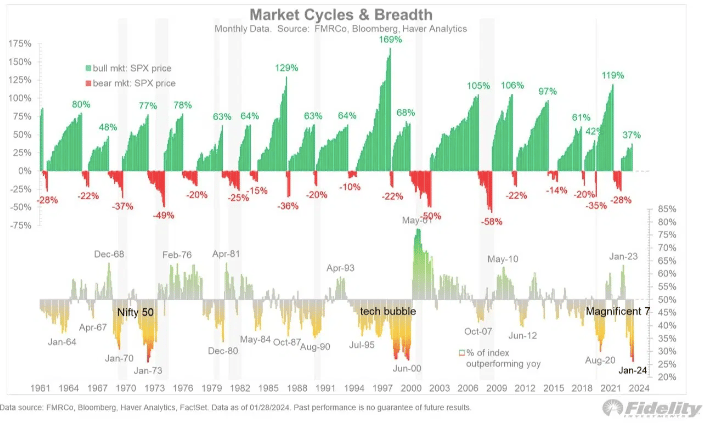

The S&P 500’s current rally is being driven by an incredibly small number of stocks (hello, Magnificent Seven), and that has some folks convinced that this narrow “market breadth” is a big warning sign.

And it’s not hard to see their point. A wider market breadth – which would have more of the index’s 500 stocks rising at once – would make the rally seem altogether more sustainable.

It would suggest that more industries and businesses are doing well, which would imply greater confidence in the economy. It would also mean that the market is less vulnerable to the ups and downs of just a few companies.

With just 26% of stocks outperforming the broader index, the breadth is at a low that’s rarely been seen before (bottom half of the chart).

In fact, the last two times leadership was this narrow were in the Nifty 50 period of the 1970s and during the dotcom boom of the late 1990s. In those cases, stocks did continue to rise for a while. But it eventually ended in tears, with stock prices dropping 50%.

Here’s my view: this is a warning I’d pay attention to, but I wouldn’t lose sleep over it. Pinpoint timing has never been this signal’s strong suit, and there are plenty of other factors driving this market.

Yes, it may point to an alarming precedent, but it’s also a sample size of two. So keep this market breadth in mind, but keep in context: it’s a piece of the puzzle, not the whole picture.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.