- 3 Big Scoops

- Posts

- Avoid Investing in Megatrends

Avoid Investing in Megatrends

PLUS: Yahoo's fall from grace

Hello Folks,

Happy Thursday!!

Today, we talk about the pitfalls associated with investing in megatrends and how Yahoo wiped off significant investor wealth over time.

Let’s go.

What is Megatrend Investing?

The term “megatrends” was coined by John Naisbitt in the 1980s to describe long-term changes that have a transformative impact on businesses.

By the early 2000s, several investment managers adopted this approach, which has accelerated in recent years.

In the past decade, investors have bet big on megatrends such as work-from-home, plant-based meat, cannabis, and even artificial intelligence.

But here’s why investing in megatrends is quite risky.

Beyond Meat is among the most prominent companies operating in the plant-based meat segment. Shares of Beyond Meat surged from $66 in May 2019 to $235 in July 2019.

Investors were optimistic about Beyond Meat’s widening portfolio of products, expanding addressable market, and stellar revenue growth.

However, its unit economies remained poor, and as sales growth decelerated, the noose tightened further for shareholders.

BYND stock is currently trading at $7.34. So, investors who brought the stock at all-time highs need it to surge over 2,000% to recover losses.

Aurora Cannabis is a stock I bought four years back, soon after Canada legalized marijuana for recreational use. Shares of the cannabis giant rose from $2.5 in August 2015 to $128 in January 2018.

However, Canada’s cannabis sector is wrestling with structural issues ranging from lower-than-expected demand, oversupply of products, cannibalization from the illegal market, overvalued acquisitions, and rising competition.

These factors have driven Aurora Cannabis stock lower by 99% from all-time highs, and it would need to gain over 25,000% to reclaim record prices.

One of the hottest stocks during the COVID-19 pandemic was Zoom Video. Demand for Zoom’s tools peaked, driving shares from $66 in early 2020 to $560 in October 2020.

As economies reopened and larger players such as Microsoft gained traction in the enterprise collaboration vertical, Zoom stock fell by more than 80% in the past three years.

Investors are Betting on the AI Megatrend

In 2023, the artificial intelligence megatrend captured Wall Street's imagination, driving shares of Nvidia higher by 240% year-to-date.

Currently valued at a market cap of $1.20 trillion, Nvidia is selling shovels in a gold rush. Basically, its chips and data centers are used to power AI-based products. Priced at 28 times forward earnings, can Nvidia sustain its steep valuation?

Due to its wide competitive moat, Nvidia might be a solid ancillary AI investment option for shareholders.

But there are several other AI-based stocks trading at steep multiples and are poised for a massive pullback in the next 12 months.

Yahoo Was Part of the Dot.com Megatrend

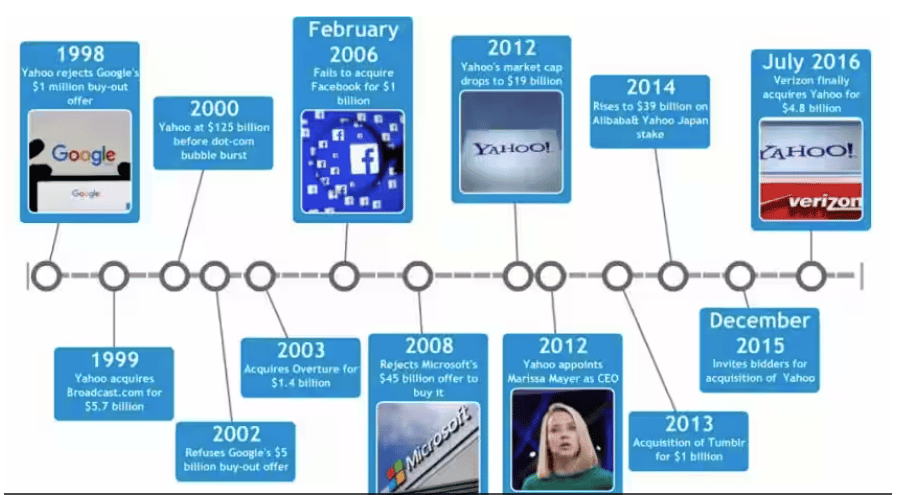

Yahoo was among the largest companies globally at the start of this millennium. Valued at $120 billion by market cap, Yahoo was literally on top of the world.

Already part of the dot.com megatrend, Yahoo was now eyeing the search engine segment and wanted to acquire Google. But Yahoo turned down an offer to first acquire Google at $1 million in 1998 and then at $3 billion in 2003.

Yahoo instead acquired Mark Cuban’s Broadcast.com for $5.6 billion, which was shut down a few years later.

Further, Yahoo passed on an opportunity to acquire Facebook for $1 billion as it believed the social media giant was overvalued. Today, Google is worth more than $1.5 trillion, while Facebook is worth $855 billion.

In 2008, Microsoft offered to buy Yahoo for $44 billion, which was obviously turned down. Yahoo was finally sold to Verizon for $4 billion in 2016.

Be Safe and Invest in ETFs or Mutual Funds

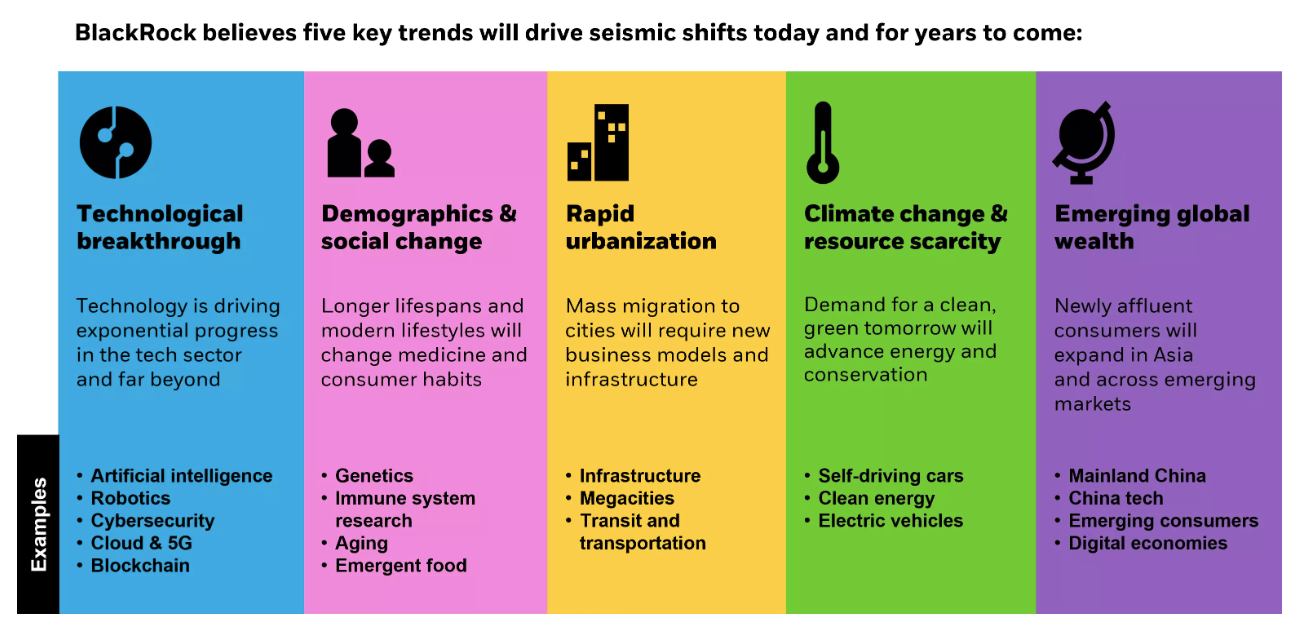

A Global Thematic Opportunities Fund invests in companies that benefit from long-term market themes.

With over $1 billion in assets under management, the fund manager identifies companies as part of megatrends such as AI, life sciences, demographics, and environment.

Sounds amazing, right? Except in the last five years, the fund has returned less than 4% annually to investors. It illustrates how the megatrend idea sounds great and obvious in theory but is difficult to implement.

It makes sense to diversify your investments and hold a basket of stocks across multiple sectors, lowering overall risk.

A majority of your equity investments should be geared toward low-cost ETFs (exchange-traded funds) and mutual funds. This strategy should allow you to derive inflation-beating returns over time.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.