- 3 Big Scoops

- Posts

- Adobe Dumps Figma

Adobe Dumps Figma

PLUS: U.S. oil drillers hit a new record

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 4,740.56 ( ⬆️ 0.45%)

Nasdaq Composite @ 14,905.19 ( ⬆️ 0.62%)

Bitcoin @ $43,063.22 ( ⬆️ 5.48%)

Hey Scoopers,

Fasten your seatbelts! Here’s today’s breakdown:

👉 Adobe and Figma part ways

👉 U.S. oil drillers raise production

👉 Bitcoin spikes again

So, let’s go 🚀

Adobe and Figma Call Off Acquisition

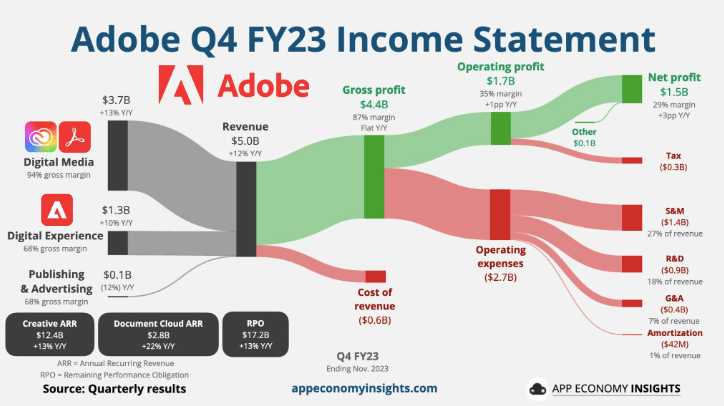

Adobe and Figma announced the termination of their $20 billion merger, given regulatory hurdles.

Antitrust regulators have scrutinized numerous tech deals across sizes in recent months.

For instance, this May, Meta was forced to sell Giphy to photo marketplace Shutterstock for $53 billion after the competition watchdog in the United Kingdom cited anticompetitive effects.

Our take

Adobe disclosed plans to acquire Figma in a cash-and-stock deal worth $20 billion, which sent shares of the tech giant spiraling downwards last year.

With just $200 million in annual sales, Figma forecasts its total addressable market at $16 billion. It meant Adobe acquired Figma at a hefty price to sales multiple of 100x.

Comparatively, Adobe’s free cash flow in the last four years has totaled $20 billion. Did Adobe know the acquisition was massively overvalued, given the chaotic macro environment, and then backed out after paying a termination fine of “just” $1 billion?

Adobe shares gained 2.5% yesterday following the news.

U.S. Ramps Up Oil Production

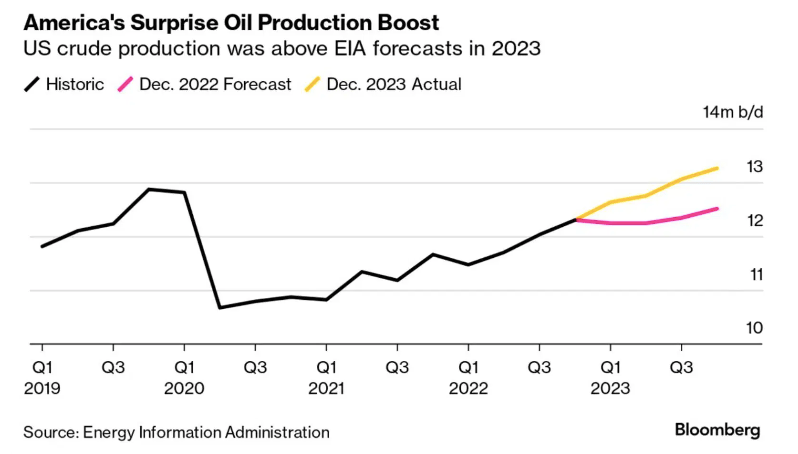

After months of quiet, the U.S. is ramping up shale oil production and elbowing in on OPEC’s market share.

What does this mean?

U.S. drillers are pushing out more oil than they even expected. The country was forecast to pump out 12.5 million barrels a day this quarter, but that figure was recently bumped to 13.3 million.

For OPEC, the timing couldn’t be worse as the group of oil-producing countries agreed to throttle back output to help stop prices from dropping.

Now, the unexpected supply growth is causing a stir and casting doubt over whether OPEC will stick to its supply-cutting plan.

Why should you care?

The 17-year boom in U.S. shale might have America feeling slick in its energy self-sufficiency. OPEC can agree to cut production all it wants, but that won’t stop the U.S. from flooding markets with the slippery stuff.

Case in point: OPEC’s latest supply cuts have done nothing to keep oil prices from sliding.

And American output has been tricky to predict – this surge happened despite the country working with 20% fewer rigs, thanks to production improvements.

Our take

Never bet against US efficiency: it’s a force to be reckoned with. Big Oil’s recent wave of mergers was all about growing productivity and turning up the heat on profit.

And if all this continues to send oil prices lower, all the better for emerging market stocks.

Lower oil prices will dampen inflation, boosting the developing economies that import a lot of the stuff: India, Thailand, and the Philippines. That could even fuel the next rally in those countries’ stocks.

The Bitcoin ETF is Certain (Almost!)

Bitcoin prices surged over $43,000, trading 5% higher in the last 24 hours at the time of writing.

BlackRock, the asset management giant, reportedly changed the policy around redemptions for its product to include BTC as an option.

In a filing with the SEC, BlackRock stated, “An in-kind redemption of some or all of a Shareholder’s Shares in exchange for the underlying bitcoin represented by the Shares redeemed generally will not be a taxable event to the Shareholder.”

This level of engagement with the SEC can only mean one thing. That a spot Bitcoin ETF is all set to launch in 2024, driving adoption of the world’s largest cryptocurrency higher.

Headlines You Can’t Miss!

Bank of Japan keeps interest rates unchanged

Oil prices mixed as shippers suspend Red Sea route

Google to pay $700 million to U.S. consumers

Nikola founder sentenced to four years in prison for fraud

Bitcoin ETF approval could bring in trillions

Chart of the Day

Source: CNBC

Despite rising interest rates, inflation, sluggish consumer spending, and a macroeconomic slowdown, job creation in the U.S. is not letting up.

In fact, payrolls for November grew faster than expected as the unemployment rate fell despite signs of a weak economy.

The unemployment rate fell to 3.7%, below forecasts of 3.9%, as the labor force participation rate edged higher to 62.8%.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.