- 3 Big Scoops

- Posts

- Nvidia Stuns Wall Street

Nvidia Stuns Wall Street

PLUS: Japan's Nikkei at record high

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

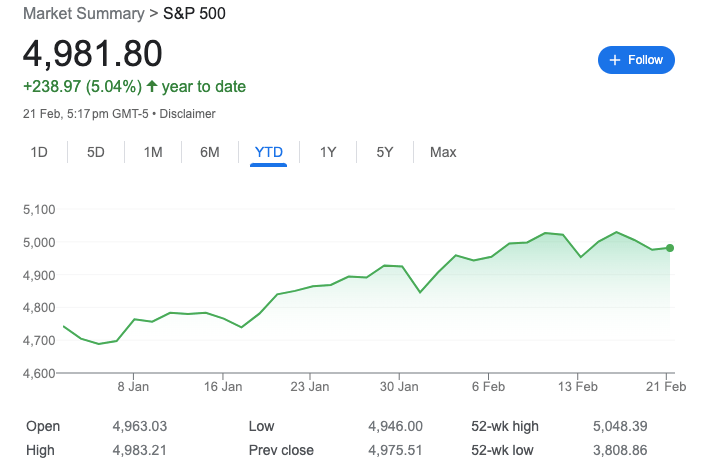

S&P 500 @ 4,981.90 (⬆️ 0.13%)

Nasdaq Composite @ 15,580.87 ( ⬇️ 0.32%)

Bitcoin @ $51,557.30 ( ⬇️ 0.57%)

Hey Scoopers,

Get ready for a wild ride! 🎢 Today’s issue is loaded with thrilling updates:

👉 Nvidia beat estimates

👉 Japan’s Nikkei surpasses 39k

👉 MicroStrategy’s Bitcoin bet

So, let’s go 🚀

Market Wrap 📉

S&P 500 futures are trending higher in early-market trading today following a bump in Nvidia’s shares as the semiconductor giant reported record sales and issued upbeat guidance (more on this later).

The minutes from the Federal Reserve’s last meeting showed officials remained cautious about lowering interest rates without carefully assessing inflation data.

Investors should understand that the road to lower inflation (under 2%) will remain choppy, given steady unemployment rates and strong consumer demand.

Today, Wall Street will closely watch weekly jobless claims data and existing home sales data for January.

Trending Stocks 🔥

Lucid Group - Shares of the electric vehicle manufacturer are down 9% after it posted a revenue miss on widening losses. It reported revenue of $157 million, lower than estimates of $180 million.

Rivian Automotive - The stock is down 15% after the company reported steep losses and announced it would slash its workforce by 10%. Rivian expects EV production in 2024 to be lower than estimates due to slowing demand.

Etsy - Shares of the e-commerce company are down roughly 8% after it reported earnings of $0.62 per share in the recent quarter, below estimates of $0.77 per share. Its revenue stood at $842.3 million, higher than estimates of $827.7 million.

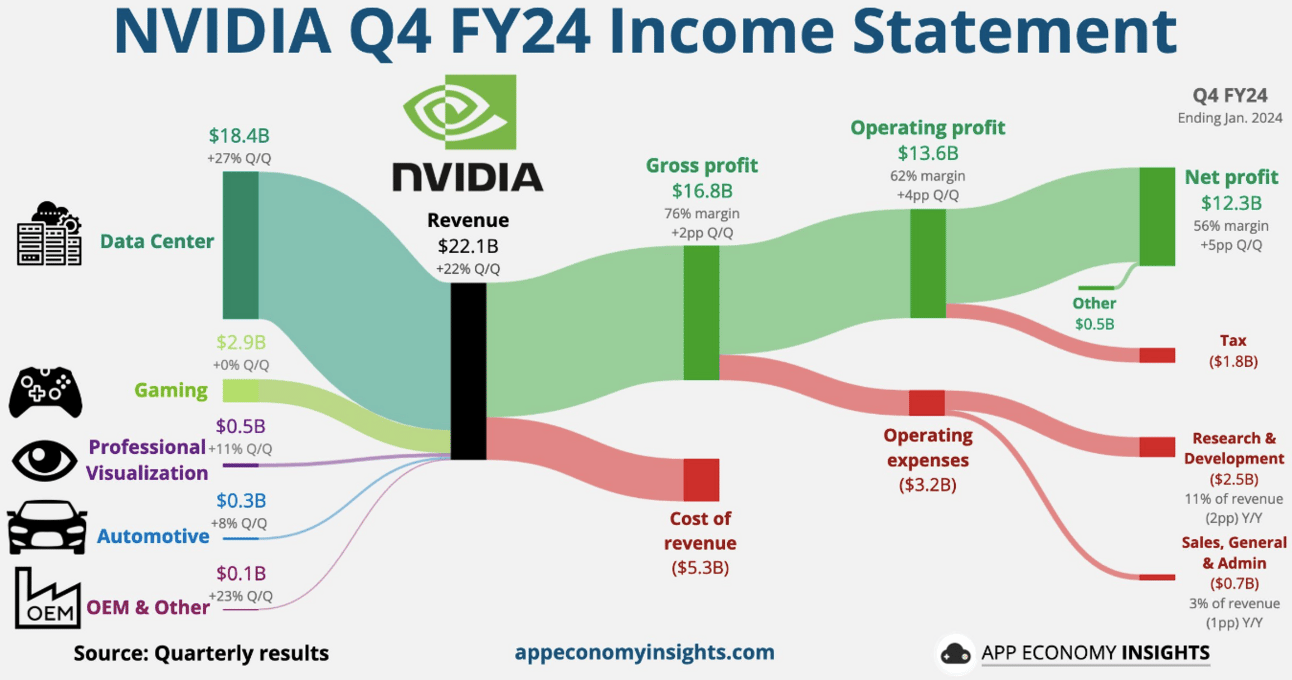

Nvidia Is On Fire

Nvidia just reported its fiscal Q4 of 2024 (ended in January) results that beat consensus estimates by a wide margin. It also issued a better-than-expected revenue guidance for Q1, sending shares of the chip heavyweight higher by 10% in early-market trading.

In fiscal Q4, Nvidia reported:

👉 Revenue of $22.1 billion vs. estimates of $20.62 billion

👉 Earnings per share of $5.16 vs. estimates of $4.64

Nvidia also forecast Q1 sales at $24 billion, compared to estimates of $22.17 billion.

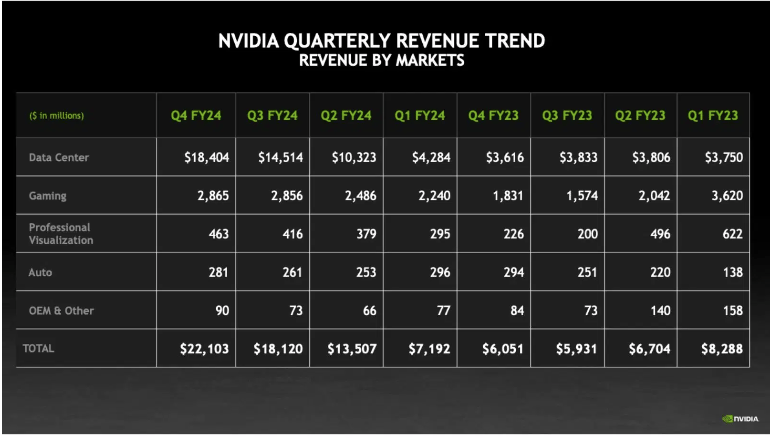

The company has been a key beneficiary of the global obsession with large AI (artificial intelligence) models developed on its high-end graphic processors. This megatrend has allowed Nvidia to grow sales by 265% year over year in Q4.

However, Nvidia CEO Jensen Huang cautioned investors that it may be unable to keep up this growth in the upcoming quarters.

Nvidia’s data center business was a key driver of sales, rising 409% to $18.4 billion in Q4. This segment includes the H100 graphics cards widely used to power AI models such as ChatGPT.

The chip ban left a nasty dent in Nvidia’s sales and could cause more problems down the road. China is expected to make up less than 10% of its sales, down from 20% last year.

And even if stateside sales make up the difference, Nvidia missed the chance to have a foothold in the Chinese market. That said, with cloud companies like Microsoft and Amazon as loyal customers and plenty of governments keen to line their industries with AI solutions, Nvidia’s hardly going it alone.

Japan’s Nikkei Gains 2%

Japan’s flagship index, the Nikkei 225, touched a record high today, powered by banking, electronics, and consumer stocks. The index surged 2% to hit 39,029, surpassing the previous high of 38,915.87 reached in 1989.

The Nikkei has been a standout performer in recent months, rising 25% in 2023 and over 10% year-to-date.

The rally has been supported by a weaker yen, down 6% against the USD, and is on track to drop to 33-year lows.

Japan’s earnings for the December quarter surged 45% year over year and were 14% higher than estimates, on average, sparking the rally in 2024.

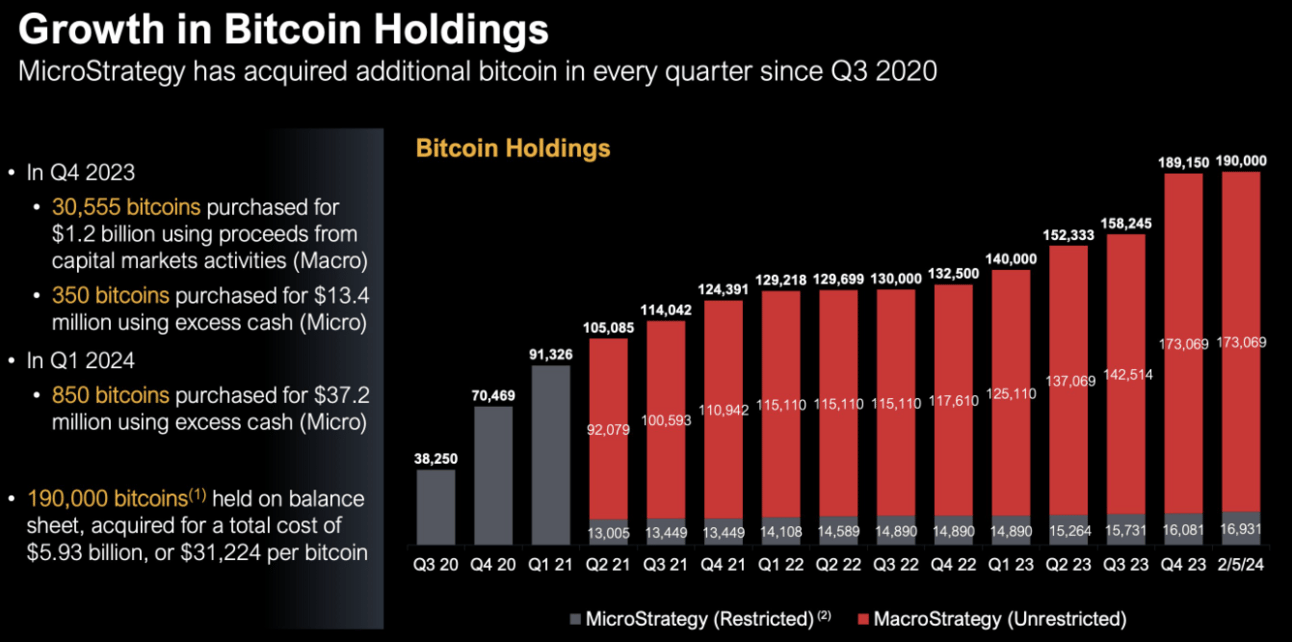

MicroStrategy’s Growing Bitcoin Portfolio

MicroStrategy is a data analytics software company. Just before the COVID-19 pandemic, it had $500 million in cash and was looking for avenues to invest. It tried to allocate resources towards organic growth and marketing, but these strategies failed to move the needle.

Moreover, in the decade prior to COVID-19, the company’s stock price was flat, trailing the broader markets by a wide margin.

The software company then embarked on a new strategy and turned to Bitcoin. It purchased Bitcoin worth $250 million in August 2020 and now holds over $10 billion worth of the digital asset.

In the last year, shares of MicroStrategy are up over 150%, and it emphasized it will continue to scoop up Bitcoin at regular intervals.

Headlines You Can't Miss!

Boeing claims the 737 Max is safe

China is driving the tourism boom in Asia

AI and chip stocks surge post Nvidia earnings

Capital One acquires Discover for $35.3 billion

Terra’s Do Kwon will be extradited to the U.S.

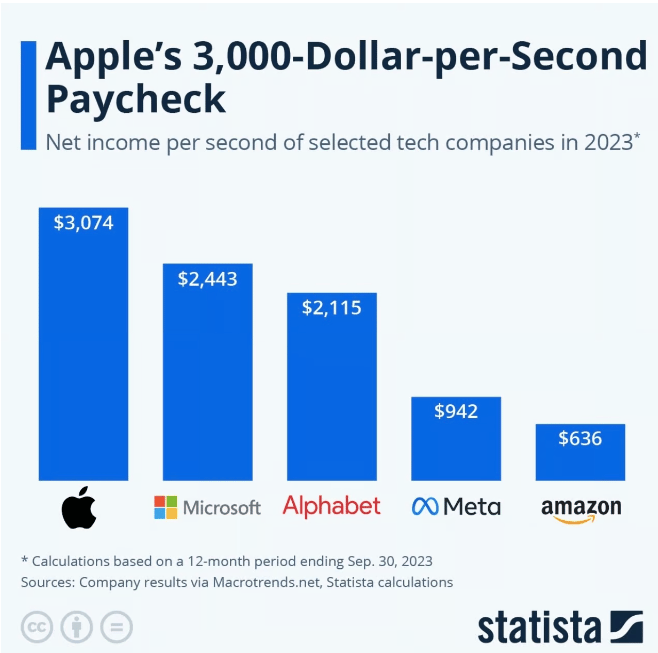

Chart of The Day

Tech companies’ net income each second

Asset-light big tech companies rake in billions of dollars in profits each year. But how much do they earn each second?

iPhone manufacturer Apple leads the pack, earning $3,074 each second, followed by Microsoft at $2,443.

One big name missing from the list is Nvidia, which should enter this cauldron very soon.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research