- 3 Big Scoops

- Posts

- Nvidia, Meta Drive Gains

Nvidia, Meta Drive Gains

PLUS: Solana's big move

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

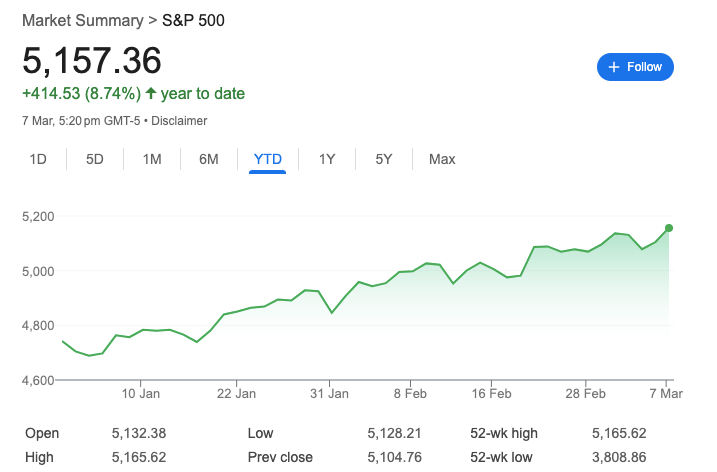

S&P 500 @ 5,157.36 (⬆️ 1.03%)

Nasdaq Composite @ 16,273.38 ( ⬆️ 1.51%)

Bitcoin @ $66,988.70 ( ⬆️ 1.1%)

Hey Scoopers,

Happy Friday! We’ve made it. Here’s what we are covering today:

👉 Nvidia & Meta push indices to all-time highs

👉 Will gold prices continue to rally?

👉 Why is Solana on fire?

So, let’s go 🚀

Market Wrap 📉

Equities rose yesterday, pushing the S&P 500 and Nasdaq Composite indices to record highs on the back of tech gains and easing inflation numbers.

Wall Street’s midweek bounce was driven by companies part of the information technology and communication services even as semiconductor giant Intel soared over 3%.

Paramount and Warner Bros. Discovery led the communication services sector upward as the two stocks rallied over 3%. Every information technology stock traded higher in the session, led by On Semiconductor which advanced more than 9%.

Just two of the 11 sectors - real estate and financials - traded lower on Thursday.

Trending Stocks 🔥

Victoria’s Secret - Shares of the intimate apparel company plunged 30% to record its worst day ever following Q4 results. It anticipates a low-single-digit decline in sales for 2024 versus the 0.4% decline forecast by analysts.

Novo Nordisk - Shares of the pharma giant surged over 8% after it reported positive Phase 1 trial data for its new experimental weight-loss drug.

American Eagle Outfitters - The stock spiked 13% in early-market trading after the apparel retailer reported Q4 results that beat estimates. It earned $0.61 per share on sales of $1.68 billion. Analysts forecast earnings at $0.50 per share on revenue of $1.67 billion.

Get the best stock ideas

Our AI tool scours the internet every day for the best stock ideas that we share with you each morning in our free, daily email.

We find stock ideas from:

Billion-dollar hedge funds

Professional analysts

Millionaire investors

and more…

We’ve already found stock ideas like:

Carvana ($CVNA) - +822% in 4 months

Myomo ($MYO) - +507% in 3 month

ImmunityBio ($IBRX) - +313% in 1 month

and a ton more…

Subscribe to our free, daily email to start getting the best stock ideas sent to your inbox each morning.

Mizuho Upgrades Nvidia

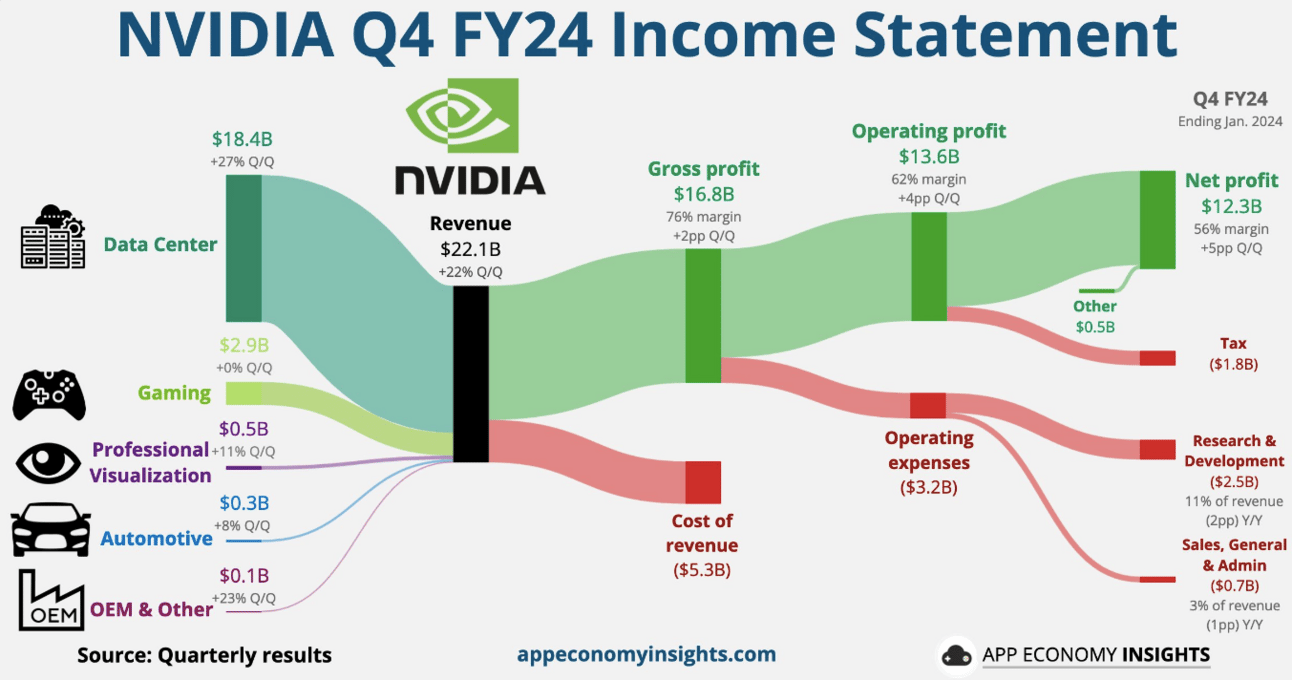

The Nasdaq index touched record levels helped by a 4.5% gain in Nividia, the artificial intelligence giant currently valued at $2.32 trillion by market cap.

Yesterday, investment bank Mizuho raised Nvidia's price target to $1,000, compared to its current trading price of $926.69.

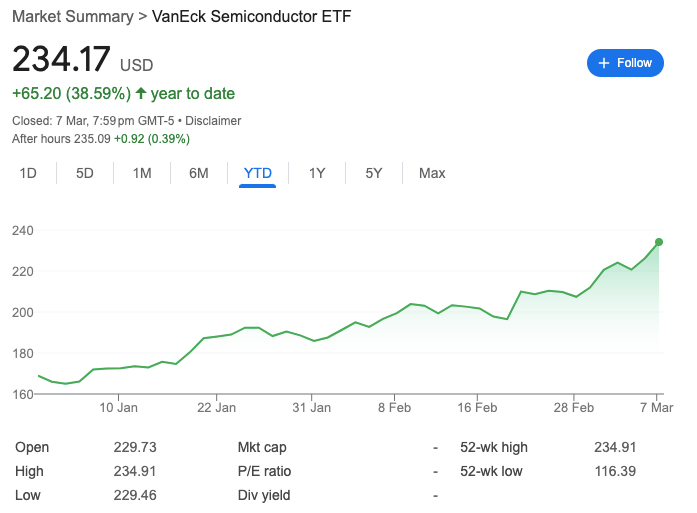

Mega-cap tech stocks have continued their upward trajectory as Nvidia has almost doubled in 2024. Comparatively, Meta, the social media giant, is up 48% year-to-date after gaining 3.25% yesterday.

The broader semiconductor index, the VanEck Semiconductor ETF (SMH), is up 39%, even as investors are concerned about the lofty valuations surrounding tech stocks.

However, Wolfe Research expects the AI rally to continue. In a research note it explains, “Our sense remains that stocks are likely to keep pushing higher, with AI-leveraged names, most of the ‘Mag 7,’ and Momentum outperforming, until fundamentals start to disappoint.”

Investors await the U.S. jobs report today for insights into the state of the labor market, which remains resilient amid multiple macro headwinds.

Will the Yellow Metal Continue to Shine?

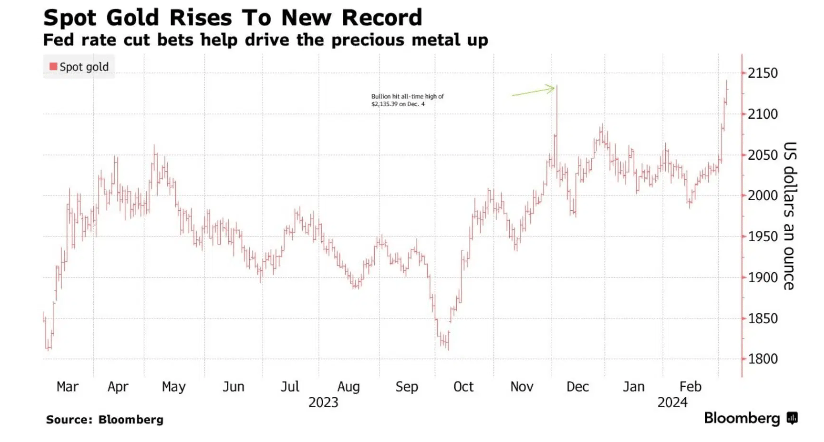

Gold touched an all-time high on Tuesday after investors decided to protect their portfolios with a long-lasting, resilient, good-lookin’ coating.

What does this mean?

The word on the street is that central banks will start lowering interest rates later this year as long as inflation stays at bay. That might explain gold’s latest feat: the precious metal’s contract price for April tipped over $2,100 per ounce for the first time ever.

See, lower interest rates tend to indicate that an economy needs a leg up, so investors often flock toward “safe-haven” assets that can hold their value during periods of volatility to cover their backs.

That’s been compounded by last Friday’s weak manufacturing data from the US, which set an ominous tone for stocks, encouraging investors to swap them for more stable investments.

Why should I care?

Zooming out: We could learn a lot from the ‘80s.

World news is a bleak read these days, with rising political tensions and wars spreading across the globe. That uncertainty is practically an advert for gold, which has helped investors steady their finances for centuries.

There’s no limit for the metal, after all. Sure, the latest price is its highest ever, following a 600% increase since the start of the millennium. But its inflation-adjusted peak from 1980 would land over $3,000 today, putting that $2,100 price tag to shame.

Solana’s Up 600% In the Last Year

Valued at a market cap of $65 billion, Solana is the 5th largest cryptocurrency in the world. After rallying over 10,000% in 2021, Solana slumped more than 90% during the bear market. Today, it trades at 20-month highs and has gained pace in recent months.

One key driver for Solana in 2024 is Pantera’s upcoming investment of $250 million. Pantera launched the first crypto fund in the U.S. more than a decade back. It purchased Bitcoin in 2013, when BTC traded at just $100.

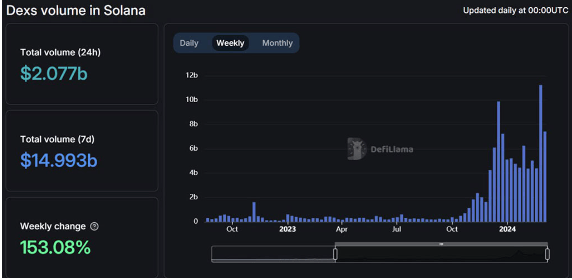

Source: DeFi Llama

The investment company is now raising funds and will deploy $250 million to purchase Solana tokens.

Last week, trading volumes on Solana-powered decentralized exchanges, or DEXs, surged to a record of $11.24 billion. This Tuesday, daily volumes hit a record of $2.85 billion on DEXs.

Headlines You Can't Miss!

China doubles down on manufacturing

U.S. CEOs are more optimistic about the economy

Rivian shares surge after it reveals new EV models and cost savings plan

Weak recovery could trigger China’s rating cut

AI crypto tokens may be overvalued, says Coinbase

Chart of The Day

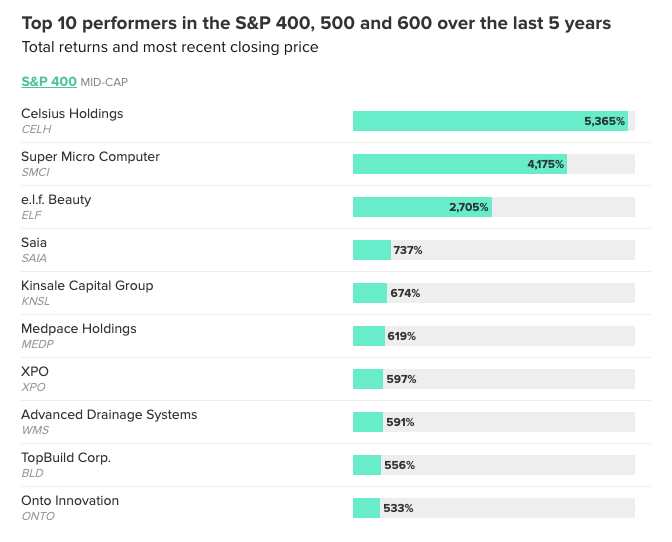

Source: CNBC

Nvidia has delivered game-changing returns to shareholders in the last five years, rising roughly 2,000% since 2019. While the AI megatrend is here to stay, there are several other stocks that have outpaced Nvidia in recent years,

For instance, since 2019, the top performers in the S&P 400 index include Celsius Holdings, Super Micro Computer, and e.l.f. Beauty.

While e.l.f Beauty operates in the retail space, Celsius Holdings is an energy drink manufacturer, and Super Micro Computer is a cloud-computing giant.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.