- 3 Big Scoops

- Posts

- Evercore Upgrades Alphabet

Evercore Upgrades Alphabet

Google, gold and Bitcoin

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

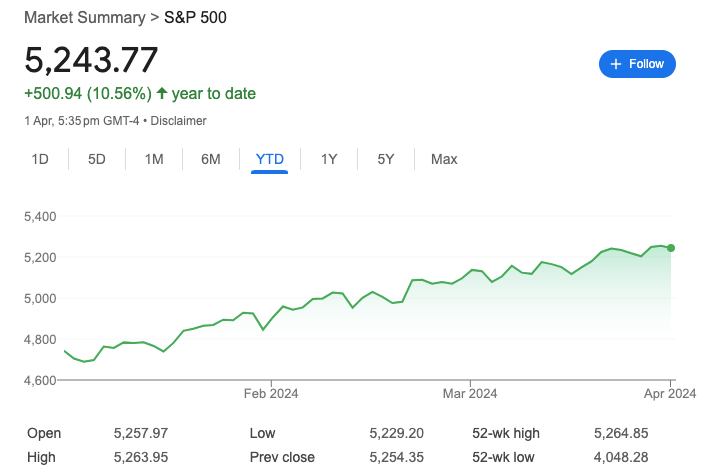

S&P 500 @ 5,243.77 ( ⬇️ 0.20%)

Nasdaq Composite @ 16,396.83 ( ⬆️ 0.11%)

Bitcoin @ $66,806.80 ( ⬇️ 4.08%)

Hey Scoopers,

Fasten your seatbelts! Here’s Tuesday’s breakdown 👇

👉 Analyst upgrades Alphabet

👉 Gold touches all-time highs (again!)

👉 Bitcoin stocks are under pressure

So, let’s go 🚀

Market Wrap 📉

Equity markets were mixed yesterday. The S&P 500 and Dow Jones indices moved lower, while the tech-heavy Nasdaq index ticked higher.

Wall Street continues to weigh fresh inflation data amid fears that the market rally could decelerate. Investors also remain cautious about the Federal Reserve’s rate-cutting timeline in 2024 as the regulators want to bring inflation under 2%.

Right now, economic growth remains strong, and inflation is elevated, lowering the probability of a rate cut to 58% in June.

Trending Stocks 🔥

Semtech - Shares of the semiconductor manufacturing company surged over 6% as it beat estimates in Q4. It reported sales of $192.9 million, compared to estimates of $190.7 million.

Trump Media & Technology - The social media stock sank over 20% after it reported revenue of $4.1 million and a net loss of $58.2 million in 2023. In 2022, its revenue stood at $50.5 million, with a net income of $1.47 million.

3M - Shares of the manufacturing giant rose 3% as it completed the spin-off of healthcare company Solventum and announced a $10 billion settlement with public water suppliers in a chemicals lawsuit.

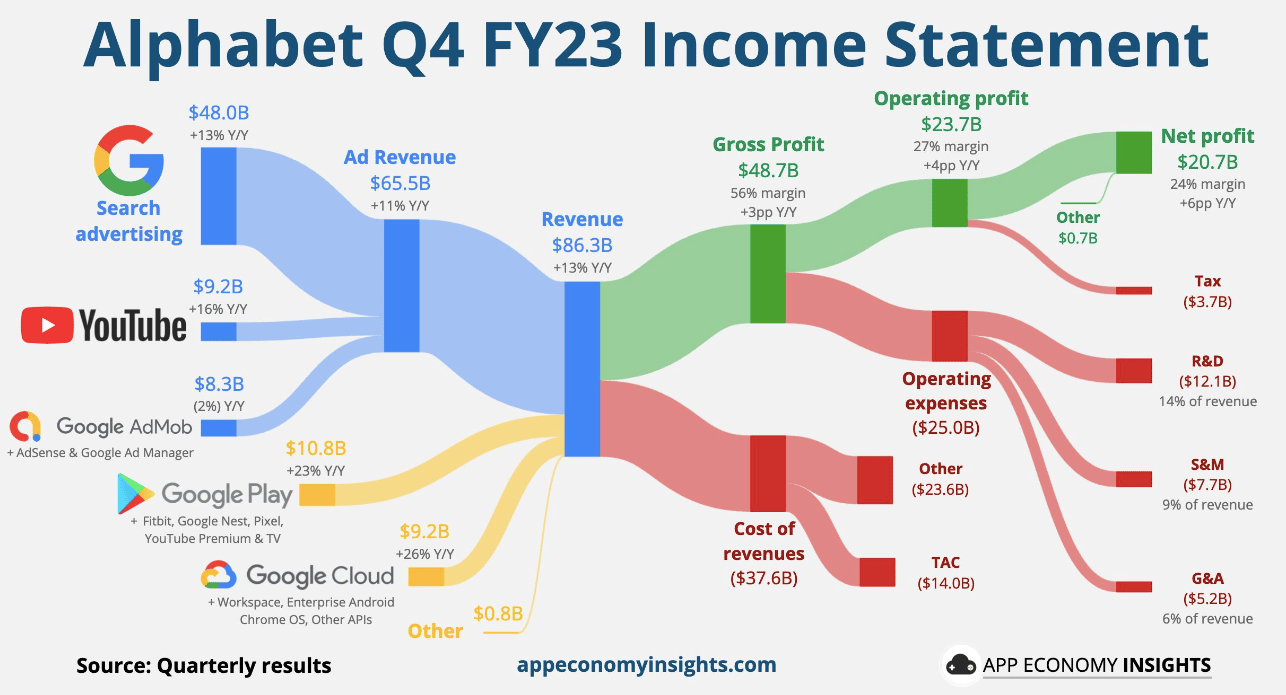

Alphabet Is Poised to Gain Big

According to Mark Mahaney, Evercore ISI’s senior managing director, Alphabet’s work in the generative artificial intelligence space is getting pushed to the side by market participants.

Mahaney has a 12-month price target of $160 for Alphabet, indicating an upside of less than 4% from current levels. However, the investment bank noted the stock could surge to $200, rising 30% from current prices.

Mahaney emphasized Alphabet’s AI tool Gemini is underappreciated as an AI asset. In an interview with CNBC, Mahaney stated, “I know we had some controversy … but the tool is extremely powerful.”

There are a lot of competitors to Alphabet within the AI space which includes OpenAI, a company backed by Microsoft. However, the high bar for resources required to work at a large scale limits the competition significantly.

Mahaney added, “Google is in this race. But I think they’re sort of more perceived by the market as Gen AI roadkill rather than as a derivative play.”

Moreover, Mahaney explained he would prefer investing in Alphabet rather than in Meta, given current valuations, while Amazon remains his top pick.

Priced at 22.8 times forward earnings, Alphabet stock is fairly valued, given analysts expect earnings to increase by 19% annually in the next five years.

Micron Continues to Surge

Shares of Micron Technology jumped over 6% after Bank of America raised its price target on the chipmaker. The investment bank expects demand for high-bandwidth memory technology to grow to over $20 billion by 2027.

Micron stock has more than doubled in the last year, valuing the company at a market cap of $137 billion.

Despite its market-beating gains, Micron stock is priced at 16.6 times forward earnings, which is quite cheap.

Goldman Sachs Upgrades Cameco

Shares of uranium producer Cameco rose over 7.5% after Goldman Sachs initiated coverage on the stock with a “buy” rating while providing a price target 25% higher than the current price.

Cameco offers you exposure to uranium, a commodity that is expected to experience robust demand in the next two decades as countries are moving away from fossil fuels.

In the last five years, Cameco stock has gained over 300%.

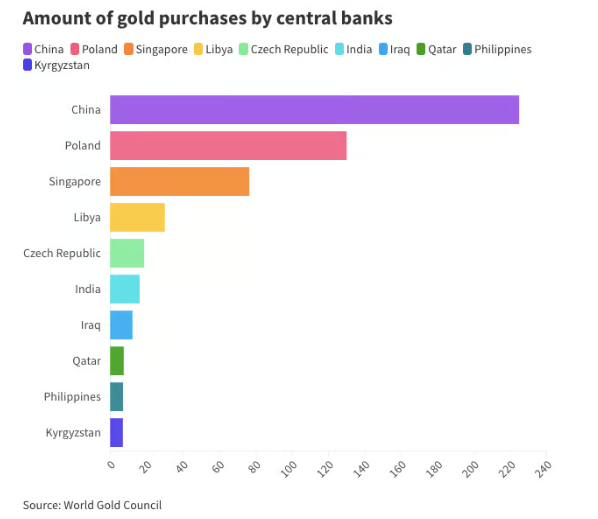

Gold vs Equities: Will the Rally Continue?

Gold prices touched another record high yesterday to trade at $2,240.04 per ounce. The yellow metal has gained momentum in recent months due to a combination of geopolitical tensions and the possibility of interest rate cuts.

Gold prices have an inverse relationship with interest rates. As interest rates fall, investors turn to gold as fixed-income instruments would yield lower returns.

Additionally, the gold rally has been sparked by purchases from global central banks, including India and China, as countries look to diversify their reserve portfolios due to a weak U.S. dollar, inflation, and other macro headwinds.

Is the S&P 500 index overbought?

Last week, the S&P 500 index closed at an all-time record high. This means the flagship stock index has been in overbought territory for 50 consecutive trading days, according to Bespoke Investment Group.

Basically, the index has been trading greater than one standard deviation away from its 50-day moving average in the last 50 days.

It is the first time in 25 years that the S&P 500 has been in overbought territory after it notched a longer record (60-day streak) of overbought closes in April 1998.

Can the rally continue?

The S&P 500 saw more record closes in Q1 of 2024 in over a decade, according to Bespoke Investment Group.

Around two out of every five trading days in Q1, or 39.3%, ended at all-time highs for the index. This is the largest percentage of record closes since Q1 of 2013.

The S&P 500 index surged over 10% in Q1, which was its best first-quarter performance in five years.

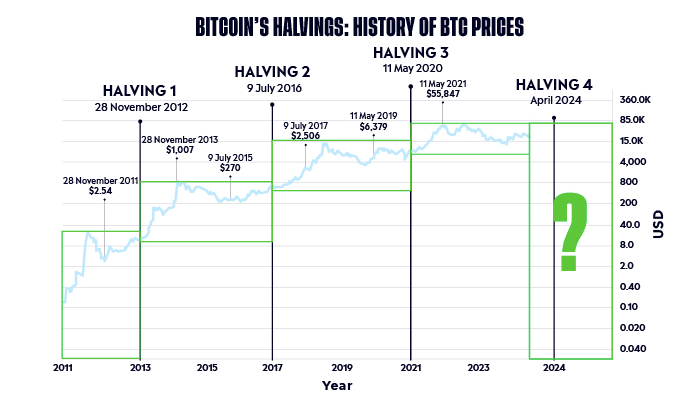

Bitcoin Slumps Prior to Halving

Bitcoin prices are down over 4% in the last 24 hours, dragging cryptocurrency stocks lower in the process. The world’s largest cryptocurrency pulled back as Treasury yields jumped and the U.S. dollar ticked higher.

Crypto exchange Coinbase fell over 5% while BTC mining stocks such as Marathon Digital and Riot Platforms also moved lower.

Source: eToro

The current month might be volatile for crypto stocks. Investors will closely watch the upcoming halving event, after which the mining rewards are cut in half.

While the halving event could impact the performance of miners, it has historically coincided with rallies of 300% or more in the months that follow.

Headlines You Can't Miss!

Xiaomi enters the EV race

India aims to displace China as a manufacturing hub

Rubrik files for IPO as sentiment improves

Natural gas oversupply might touch multi-year highs

Dormant wallet transfers $35 million worth BTC after 12 years

Chart of The Day

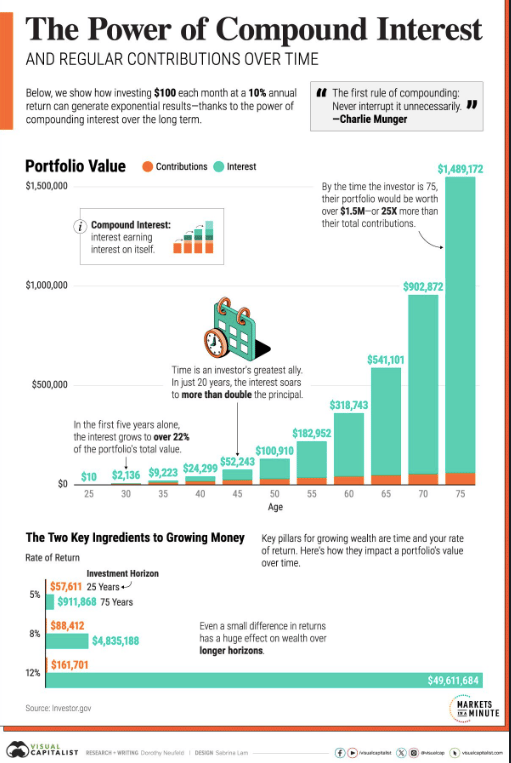

Albert Einstein once stated that the power of compounding is the eighth wonder of the world. Warren Buffett, one of the most famous investors in the world, also credited compound interest as a key ingredient to his success.

The above chart shows how you can compound your wealth over time. Initially, the returns might not seem too exciting. However, as the portfolio continues to grow, interest earned begins to exceed contributions after a few years.

The above chart shows us how you can grow your wealth to almost $1.5 million in fifty years by investing just $100 per month.

Basically, you need to be disciplined and allocate funds every month to a diversified index such as the S&P 500.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.