- 3 Big Scoops

- Posts

- Siri Meets Gemini

Siri Meets Gemini

Apple, Alphabet, and AI

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

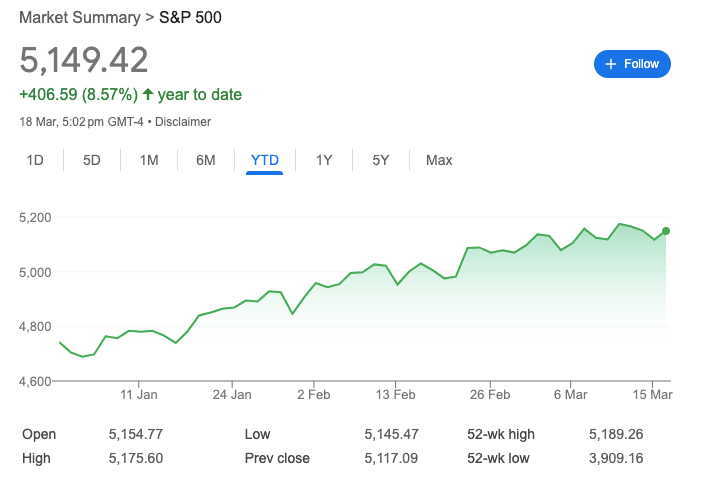

S&P 500 @ 5,149.42 ( ⬆️ 0.63%)

Nasdaq Composite @ 16,103.45 ( ⬆️ 0.82%)

Bitcoin @ $64,426.10 ( ⬇️ 4.71%)

Hey Scoopers,

Welcome to Tuesday’s treasure trove of financial insights. Here’s what we are covering today:

👉 Alphabet teams up with Apple

👉 Japan’s interest rates inch higher

👉 Bitcoin pulls back

So, let’s go 🚀

Market Wrap 📉

The equity markets moved higher yesterday after a bounce back in tech stocks ahead of Nvidia’s inaugural artificial intelligence conference.

The S&P 500 index broke a three-session slump and entered Monday riding a two-week losing streak.

Wall Street is now awaiting guidance on the path forward for monetary policy as the Federal Reserve begins its two-day policy meeting today.

A slew of worrying inflation reports have investors concerned that the central bank could signal interest rates might remain higher for longer than expected.

Currently, the market expects the Fed to cut interest rates in the second half of 2023.

Trending Stocks 🔥

Nvidia - Shares of the chip manufacturer moved higher as investors evaluate the news from its first-ever AI conference.

Tesla - Shares of the EV manufacturer spiked over 5% on news that it might raise vehicle prices.

StoneCo - Shares of the fintech company are down over 10% in pre-market trading following its results for Q4 of 2023.

Google Partners with Apple

Alphabet shares closed more than 4% higher on Monday, following a Bloomberg report that Apple is in talks to license Gemini for iPhones released in 2024 and beyond.

Gemini is Google’s suite of generative AI tools that includes chatbots and coding assistants. Basically, Google will license the Geminin AI engine to the iPhone manufacturer.

In Apple’s annual shareholder meeting in February, CEO Tim Cook said the company is investing heavily in AI and claimed, “Later this year, I look forward to sharing with you the ways we will break new ground in generative AI, another technology we believe can redefine the future.”

Apple’s investors have been hoping for an AI breakthrough worthy of the company’s signature launch events. So far, though, the firm hasn’t revealed anything worth lining up for – and now, it’s considering fitting out iPhones with Gemini.

Apple will be hoping investors respect the innovation, no matter whose name is on the patent: the stock’s down over 6% this year, its worst performance against the Nasdaq 100 index at this time of year in over a decade.

Google’s investors won’t mind the collaboration, of course. The deal would be Gemini’s highest-profile partnership to date – so long as Apple doesn’t sidle up to another competitor like OpenAI before signing the dotted line.

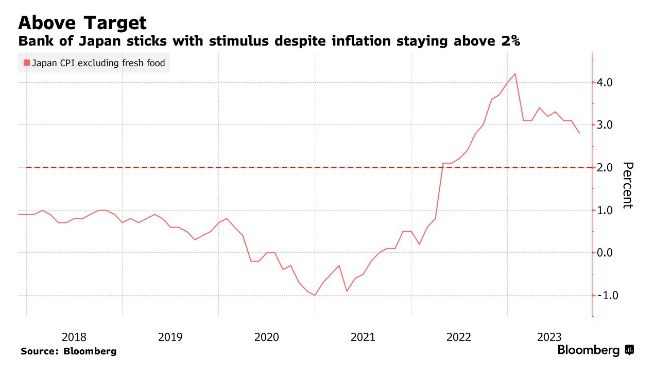

BoJ Ends the World’s Only Negative Interest Rate Regime

Japan’s central bank raised interest rates today for the first time in 17 years, ending the only negative interest rate regime globally.

Over the years, the BoJ (Bank of Japan) has enacted several unconventional policy easing measures to combat deflation.

The changes mark a historic shift representing a sharp pullback in one of the most aggressive monetary easing exercises globally, which aimed to boost the Japanese economy.

In a press conference, BoJ’s governor Kazuo Ueda explained, “The likelihood of inflation stably achieving our target has been heightening ... the likelihood reached a certain threshold that resulted in today’s decision.”

However, the BoJ cautioned it would not embark on aggressive rate hikes as the country continues to wrestle with tepid growth.

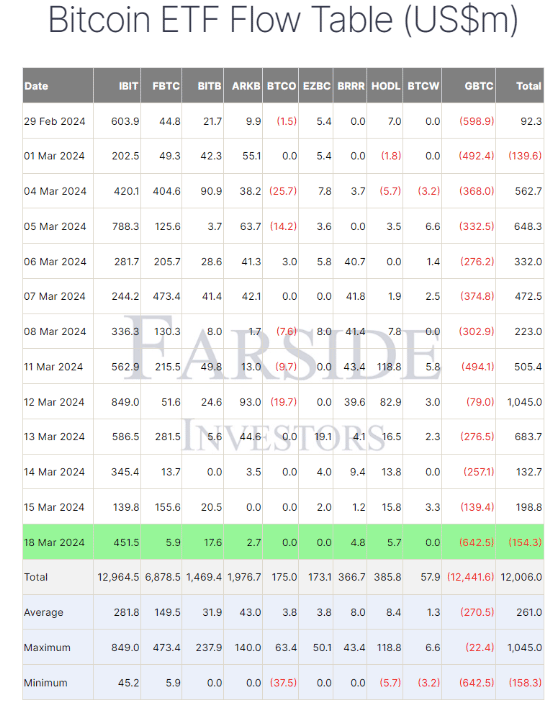

GBTC Sheds $642 Million

Bitcoin prices are down over 12% from all-time highs as more than $640 million worth of BTC flowed out of Grayscale’s spot Bitcoin ETF.

Grayscale is a crypto asset manager and experienced the largest day of outflows for the ETF since its launch in January.

Source: Farside Investors

Compared to other ETFs, Grayscale's management fee is quite high, forcing investors to shift their funds to other ETFs.

Grayscale’s outflows on March 18 totaled $642.5 million. Comparatively, inflows into the Fidelity Bitcoin ETF stood at $5.9 million, the lowest day, as per data from Farside investors.

Headlines You Can't Miss!

Unilever to spin off ice cream business unit

MrBeast partners with Amazon’s MGM

China tightens regulations on consumer finance companies

CrowdStrike inks deal with Nvidia

The world’s largest pension fund might invest in Bitcoin

Chart of The Day

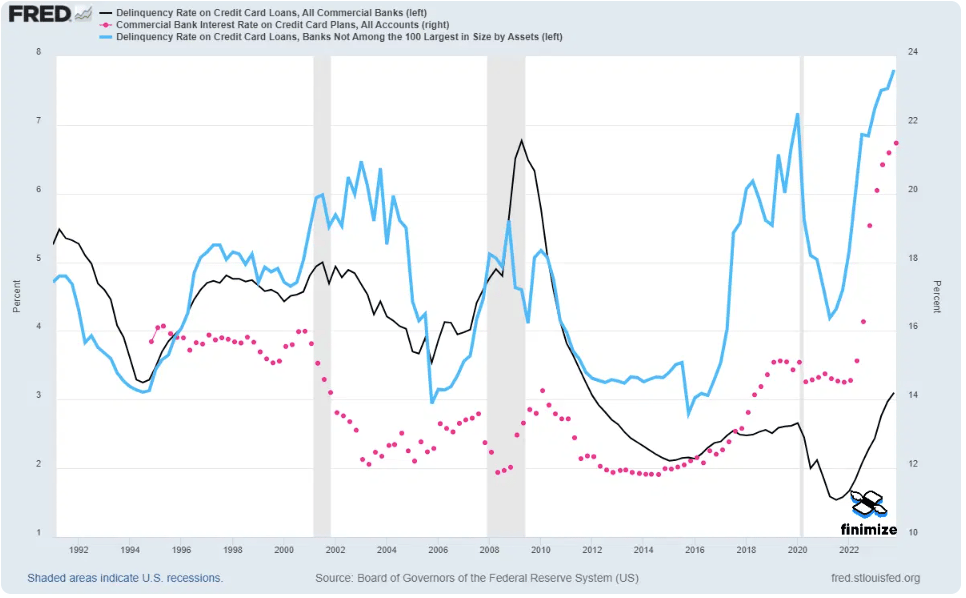

It’s easy to think of US consumers as a hardy, resilient force - after all, they’ve continued to spend and drive the economy even as inflation and interest rate hikes have made almost everything more expensive. But the truth is, there may be trouble brewing under the surface.

Credit card loan delinquencies at banks (black line) are currently at 3%, historically, a figure that’s hardly worth losing any sleep over. But they’ve just made a sharp pivot upward, slicing through a decade-long period of stability.

Even more concerning is that delinquencies at smaller banks (blue) have catapulted to nearly 8%, hitting levels never seen before.

We’re not in financial-horror-story territory here, but there’s an unmistakable sense of foreboding nonetheless. The initial impacts have been absorbed by more vulnerable consumers – the younger and the less wealth-off, who’ve been increasingly turning to plastic to make ends meet.

But, as banks start tightening the purse strings and jacking up interest rates even higher, even more folks could find themselves in a bind.

In fact, we may be getting closer to that point: credit card interest rates (pink, right-hand side) have been hopping to dramatic new heights, rising to nearly 22%. This could signal potential distress – a vicious cycle where high rates lead to more defaults, pushing rates even higher, in a kind of financial “doom loop.”

Put more simply, American consumers – who fuel over 70% of the US economy – are more fragile than they appear as the economy reaches a vital intersection.

Things could turn in their favor if growth holds steady but inflation falls further, allowing the US central bank to lower interest rates. But an unwelcome turn—a spike in unemployment or inflation, for example—could send them careening in an unfortunate direction.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.