- 3 Big Scoops

- Posts

- Chipotle's Stock Split

Chipotle's Stock Split

Chipotle, gold, and Dogecoin

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

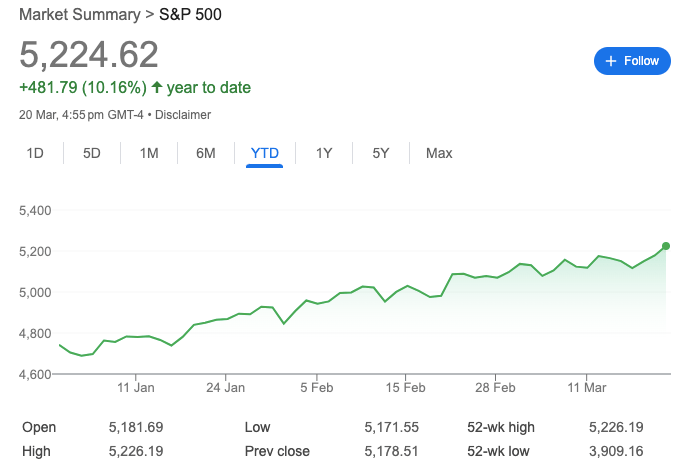

S&P 500 @ 5,224.62 ( ⬆️ 0.89%)

Nasdaq Composite @ 16,369.41 ( ⬆️ 1.25%)

Bitcoin @ $66,998.30 ( ⬆️ 2.71%)

Hey Scoopers,

What a day! Buckle up! We have quite the newsletter for you today. Here’s what we’re breaking down in this issue:

👉 Chipotle gains big

👉 Gold prices hit another record

👉 Dogecoin is rising

So, let’s go 🚀

Market Wrap 📉

The three major averages rallied to hit record levels on Wednesday after the Federal Reserve held rates at a 23-year high while maintaining expectations for three cuts this year.

The Fed disclosed plans to cut rates three times by the end of 2024, reaffirming its previous forecast from December. But the central bank also stated it needs greater evidence that inflation is cooling off before embarking on quantitative easing measures.

Yesterday, the central bank stated, “The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.”

Trending Stocks 🔥

Micron Technology - Shares of the chip manufacturer popped 13% as it beat estimates on revenue and gave strong guidance. It reported positive earnings while analysts were forecasting a loss.

Five Below - The value retailer tumbled 13% on weak Q4 results and outlook for the current quarter and full year.

Paramount Global - The stock surged over 11% after the Wall Street Journal reported Apollo Global Management offered $11 billion for the entertainment company’s film and TV studio business.

Chipotle Is Flying

Shares of Chipotle surged over 3% after the company’s board approved a 50-for-1 split of its common stock.

The California-based company stated the split was subject to shareholder approval at its upcoming annual meeting on June 6. If approved, shareholders will receive an additional 49 shares for each share held. Shares are expected to begin trading on a post-split basis on June 26.

Chipotle shares closed at a record high of $2,895 on Wednesday, surging 29% year-to-date and 78% in the last 12 months. Since its IPO in early 2006, the burrito maker has returned a whopping 6,760% to shareholders.

It means a $1,000 investment just after Chipotle’s IPO would be worth close to $70,000 today.

Despite an uncertain macro environment, the restaurant stock topped estimates for profit and sales in February.

Verdict

A stock split does not change a company's inherent fundamentals. However, as stock prices move lower due to a rise in the number of outstanding shares, liquidity should increase significantly due to higher retail participation.

A stock split is viewed as a positive development on Wall Street.

Gold Continues to Shine

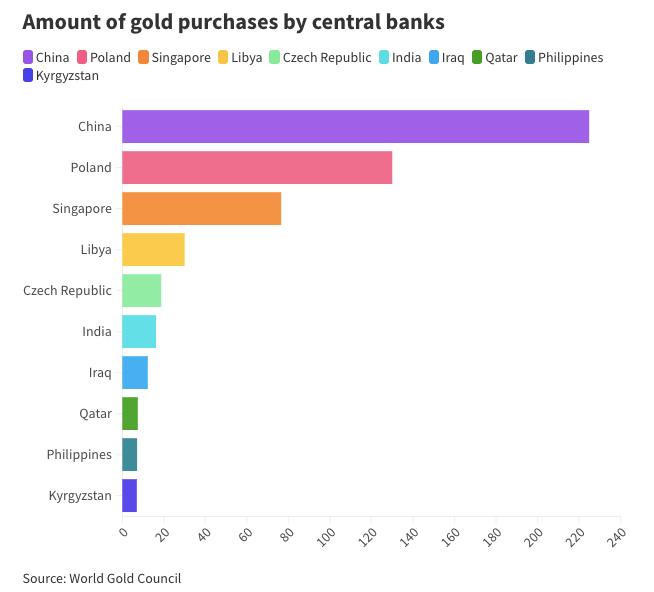

The rally in gold prices continues, with prices touching new all-time highs today. There’s room for it to move higher as central banks are purchasing bullion in record amounts.

Gold prices could surge to $2,300 per ounce in the second half of 2024, especially if interest rates are cut. Historically, gold prices and interest rates have an inverse relationship.

Central banks have been the primary buyers of gold as the yellow metal is viewed as a safe-haven asset amid geopolitical tensions.

The Bank of China was the largest buyer of gold in 2023, followed by Poland’s central bank, which snapped up 130 tons of the precious metal last year.

Coinbase to Launch Dogecoin Futures Contracts

Coinbase, one of the largest crypto exchanges globally, just disclosed plans to launch cash-settled futures contract products for Dogecoin, Litecoin, and Bitcoin Cash.

In several letters addressed to the United States Commodity Futures Trading Commission (CFTC), Coinbase outlined its plans while emphasizing the popularity of Dogecoin as a key factor in its decision.

Dogecoin was launched as a meme coin but is now the ninth-largest cryptocurrency in the world. Valued at $22 billion by market cap, Dogecoin prices surged by 15% in the last 24 hours.

Headlines You Can't Miss!

Reddit prices IPO at $34 per share

Fed raises GDP and inflation outlook

The Red Sea crisis could lead to a global tanker shortage

China’s Tencent posts weak revenue growth

Daily volume on the Base network surge over 50%

Chart of The Day

Source: Visual Capitalist

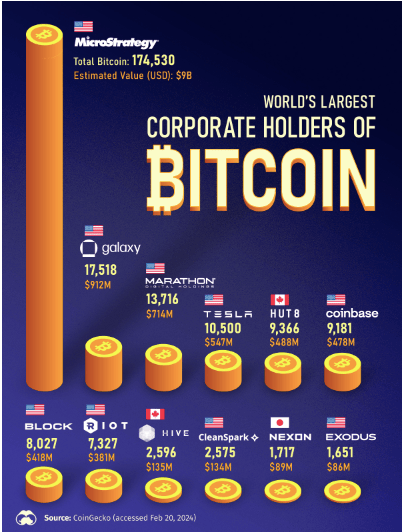

The above chart shows the largest corporate buyers of Bitcoin globally. The biggest corporate owner of BTC is MicroStrategy, which holds 174,530 Bitcoin as of February 22. This figure surpassed 200,000 in March.

Due to its exposure to the digital asset, shares of MicroStrategy have surged close to 800% since the start of 2023.

Tesla is the fourth largest holder of Bitcoin with 10,500 BTC. The electric car manufacturer initially bought $1.5 billion in bitcoin to boost its bottom line. However, a year later, it sold a portion of its crypto holdings at a steep loss during the bear market.

Two blockchain mining companies based out of Canada, Hut 8 and Hive Blockchain, are also the top holders of Bitcoin.

As BTC is forecast to end the year at all-time highs, corporate interest in the digital asset is bound to increase with a wider scope of buyers.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.