- 3 Big Scoops

- Posts

- The Fed Slashes Interest Rates

The Fed Slashes Interest Rates

PLUS: The bull case for CrowdStrike

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

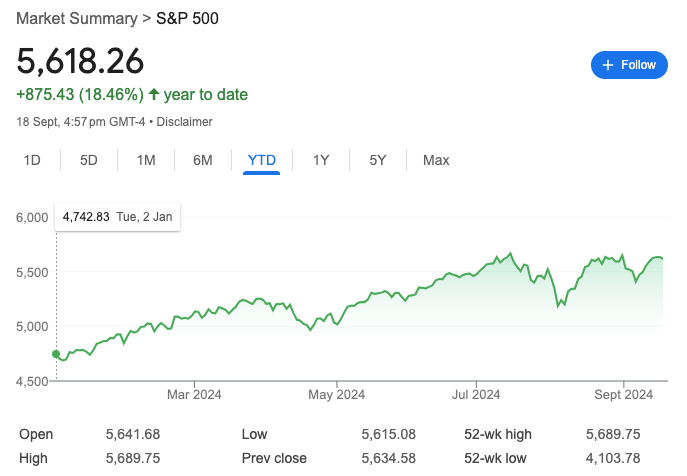

S&P 500 @ 5,618.26 ( ⬇️ 0.29%)

Nasdaq Composite @ 17,573.30 ( ⬇️ 0.31%)

Bitcoin @ $62,017.20 ( ⬆️ 4.12%)

Hey Scoopers,

Happy Thursday! Are you ready for an exciting newsletter?

👉 The Fed cuts interest rates by 50 bps

👉 Is the worst over for CrowdStrike?

👉 Homebuilders ETF soar to record highs

So, let’s go 🚀

Market Wrap

Equities closed lower on Wednesday in a volatile session as the Federal Reserve lowered interest rates by half a percentage point.

Traders initially cheered the outsized rate cut, which raised concerns that the Fed was trying to get ahead of potential economic weakness.

The central bank lowered its overnight lending rates to 4.75% and 5% from 5.25% to 5.5%. This was the first rate cut since 2020, as inflation levels eased over the last two years.

Our Take

Interest rate cuts will likely benefit companies across multiple sectors, especially if the U.S. economy can avoid a recession. Moreover, rate cuts will boost the valuations of growth stocks as they can borrow capital at lower rates to fuel expansion plans.

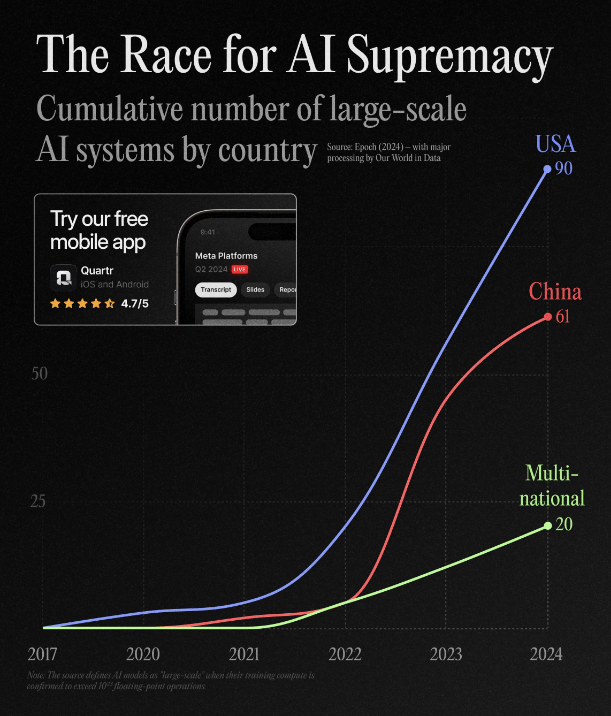

The AI megatrend, which began in late 2022 with the launch of large language platforms, should dominate the stock market narrative in the near term.

Earnings growth will remain the key driver of valuations. A report from BMO Capital forecasts the S&P 500 companies to grow their earnings by 11% in 2024 and by 8% in 2025.

Trending Stocks 🔥

Intuitive Machines - Shares soared 38% after the space exploration company secured a $5 billion space network contract from NASA.

United States Steel - The U.S. steel producer saw a 1.5% gain after a regulatory panel granted Nippon Steel permission to refile its plans to purchase the firm for $14.1 billion.

Victoria’s Secret - The intimate apparel maker gained 3.5% after Barclays upgraded the stock from “underweight” to “equal weight”, citing a more balanced risk/reward backdrop.

🦾 Master AI & ChatGPT for FREE in just 3 hours 🤯

1 Million+ people have attended, and are RAVING about this AI Workshop.

Don’t believe us? Attend it for free and see it for yourself.

Highly Recommended: 🚀

Join this 3-hour Power-Packed Masterclass worth $399 for absolutely free and learn 20+ AI tools to become 10x better & faster at what you do

🗓️ Tomorrow | ⏱️ 10 AM EST

In this Masterclass, you’ll learn how to:

🚀 Do quick excel analysis & make AI-powered PPTs

🚀 Build your own personal AI assistant to save 10+ hours

🚀 Become an expert at prompting & learn 20+ AI tools

🚀 Research faster & make your life a lot simpler & more…

Is CrowdStrike Stock a Good Buy?

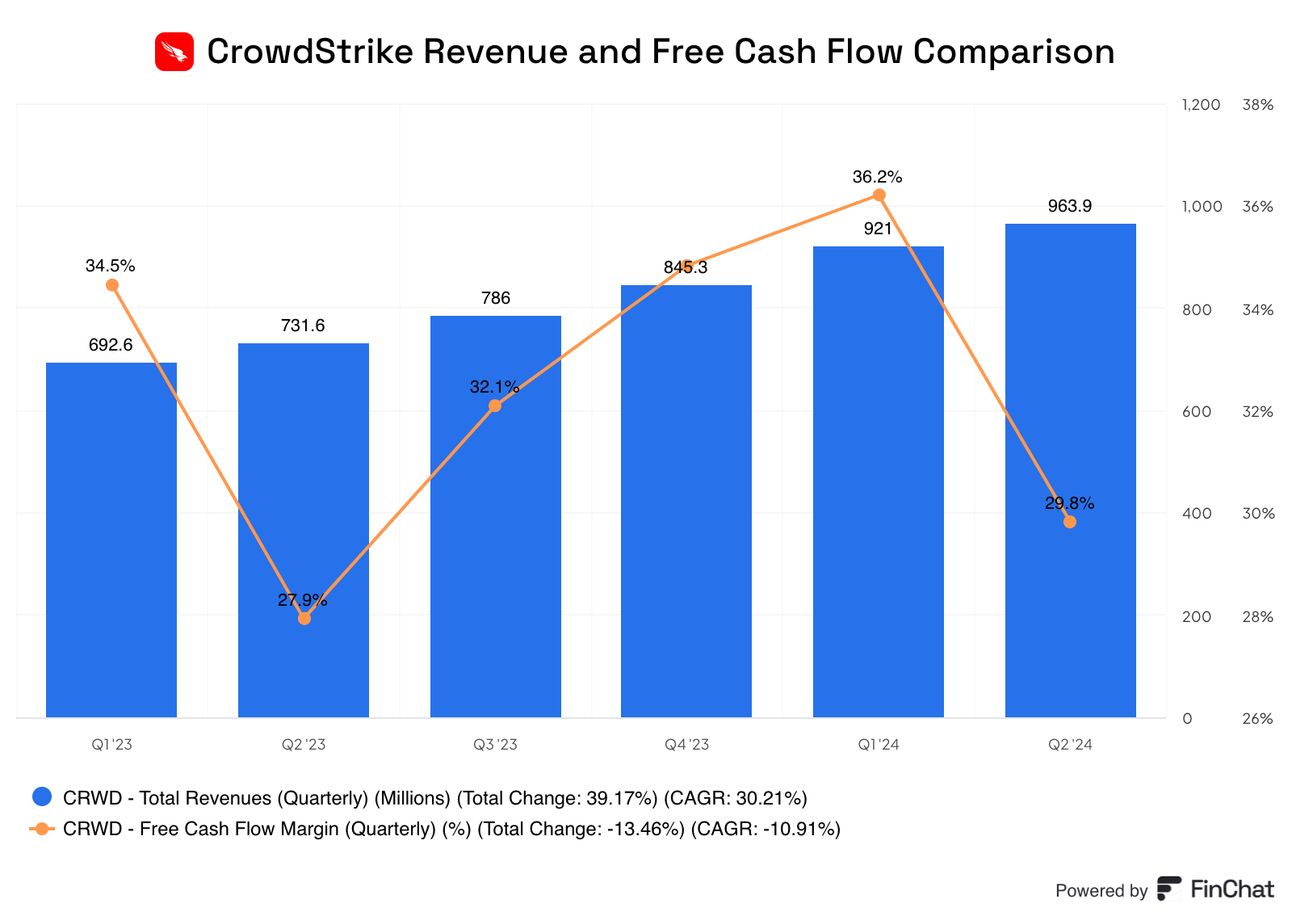

CrowdStrike is a cybersecurity giant with a market cap of $65.5 billion. It provides cloud-based protection for endpoints, cloud workloads, identity, and data.

The company offers threat intelligence, managed security services, IT operations management, and log management, among other products. These products are sold through subscriptions to its Falcon platform and cloud modules.

While CRWD stock has returned over 300% to shareholders since its IPO in 2019, the tech stock trades 32% below all-time highs. The pullback can be tied to a recent software outage that impacted millions of devices across industries.

However, the drawdown allows shareholders to buy the dip and gain exposure to a quality stock at a discount. For instance, it is forecast to expand sales from $3.06 billion in fiscal 2024 (ended in January) to $4.77 billion in fiscal 2026.

Its financial health is underscored by record operating cash flow and a rise in remaining performance obligations (RPOs), which rose by 50% to $4.9 billion. The RPO is a metric that reflects the total value of future contracts yet to be fulfilled and indicates strong customer demand.

A widening TAM

CrowdStrike is part of an expanding addressable market forecast to surge from $100 billion in 2024 to $225 billion in 2028.

Its leadership position in the cybersecurity business and AI capabilities should help CrowdStrike widen its customer base and drive sales higher.

In the July quarter, its LogScale module surpassed $100 million in annual recurring revenue, and total ARR might soon reach the $4 billion milestone.

With a cash flow margin of over 30%, CrowdStrike's free cash flow has increased to $1.16 billion in the last 12 months, up from just $19 million in fiscal 2020.

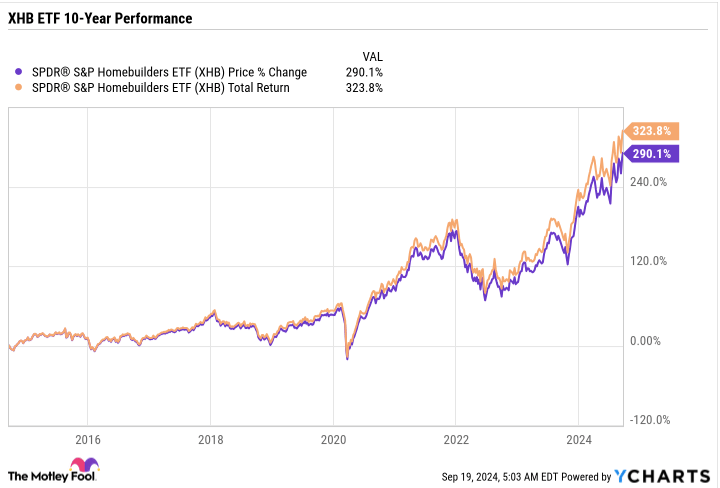

The SPDR S&P Homebuilders ETF Is Rallying

The SPDR S&P Homebuilders ETF (XHB) touched record highs yesterday, rising 27% in 2024 and nearly 324% in the last 10 years. The interest rate cut might lead to lower mortgage rates and higher demand.

Lower rates would make mortgages more affordable, stimulating home buying and construction activities. Limited inventory of existing homes has driven buyers toward new construction, with newly built homes accounting for a significant share of sales in recent quarters.

The housing market's overall resilience and strategic adjustments by homebuilders have kept investor confidence high. Companies like KB Home have reported strong sales despite higher construction costs and mortgage rates.

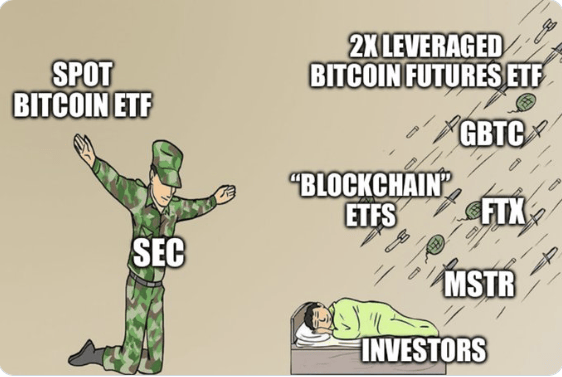

Smart Money Flows Into Crypto

The world’s largest cryptocurrency exchange, Binance, has seen a 40% increase in institutional and corporate investors joining the platform this year.

The growth reflects how the so-called smart money is warming up to Bitcoin and other cryptocurrencies, as Binance seems to have navigated a CEO ouster and a $4.3 billion settlement with the SEC in the last year.

Binance has pivoted from a founder-led company to one led by a board of seven directors, a structure the current CEO said regulators are more used to.

After years of regulatory uncertainty, the SEC approved the first exchange-traded funds for spot Bitcoin in January 2024. Two months back, it also allowed the trading of spot ETFs for Ether, the second-largest cryptocurrency.

These events should drive the adoption of digital assets higher, making Bitcoin a top investment choice in 2024.

Headlines You Can't Miss!

U.S. Treasuries rise despite jumbo rate cut

T-Mobile says iPhone 16 demand is strong year over year

Asian markets tick higher as investors digest rate cuts

YouTube unveils AI features from Google DeepMind

The SEC sues fake crypto exchanges

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.