- 3 Big Scoops

- Posts

- Deep Dive: Costco Stock

Deep Dive: Costco Stock

Is the retail giant still a good buy?

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 5,123.69 ( ⬇️ 0.65%)

Nasdaq Composite @ 16,085.11 ( ⬇️ 1.16%)

Bitcoin @ $71,622.80 ( ⬇️ 3.76%)

Hey Scoopers,

Monday magic unleashed! Today, we analyze the pros and cons of investing in Costco, one of the largest companies in the world.

So, let’s go 🚀

Costco Has Created Massive Wealth

Valued at $322 billion by market cap, Costco is among the most recognizable brands in the world.

The big-box retailer has already created massive wealth for shareholders, rising:

👉 54% in the past year

👉 134% in the last three years

👉 247% in the last five years

👉 684.6% in the last 10 years, and

👉 2,770% in the last 20 years

Despite its stellar gains, shares of the retail giant are down 8% from all-time highs, as investors were unimpressed following its fiscal Q2 of 2024 (ended in February) results.

Let’s see if it makes sense to invest in Costco stock at its current valuation.

An Overview of Costco

Costco operates membership warehouses and e-commerce websites, offering its members lower prices on a selection of nationally-branded and private-label products across categories.

Source: Getty Images

Costco benefits from high sales volume and rapid inventory turnover. When combined with operating efficiencies achieved by volume purchasing, efficient distribution, and reduced handling of merchandise, this volume and turnover enable the company to operate profitably at lower gross margins.

Costco operates 875 warehouses, including 603 in the U.S. and Puerto Rico, 108 in Canada, 40 in Mexico, 33 in Japan, and 29 in the UK. It also has a presence in markets such as Korea, Australia, and Europe.

Costco Stock Takes a Step Back

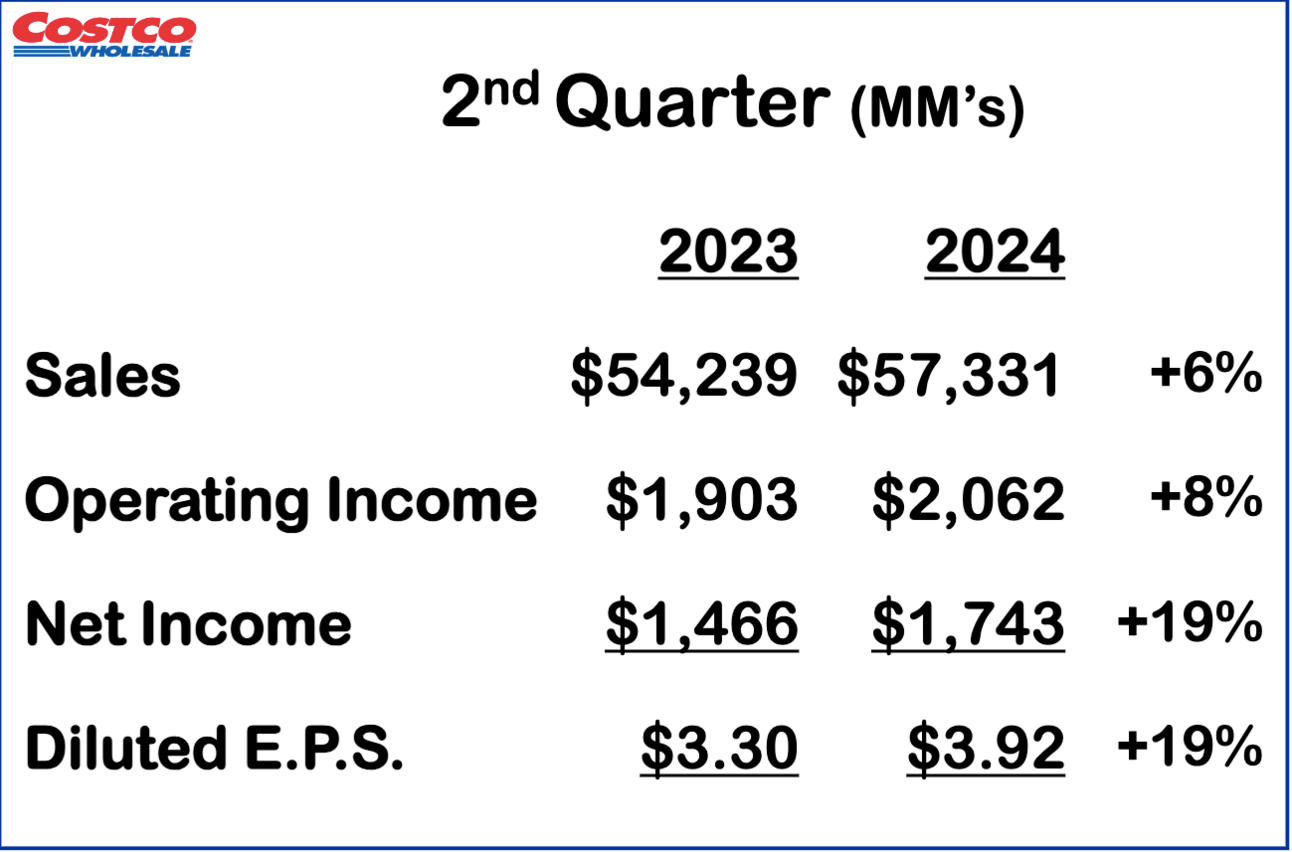

Costco shares took a step back last week after the membership-based warehouse chain reported its fiscal results for Q2.

In Q2, Costco reported:

👉 Revenue of $57.33 billion vs. estimates of $59.16 billion

👉 Adjusted earnings per share of $3.92 vs. estimates of $3.62

Investors were disappointed as Costco missed top-line estimates in Q2. The company generates 98% of its revenue from low-margin retail sales and 2% from membership fees.

Despite a challenging macro environment, Costco’s comparable sales rose by more than 5% year over year in fiscal Q2. Its online sales also grew by 18% and will be a key driver of top-line growth in the upcoming decade.

Costco is investing heavily to increase customer engagement rates in the e-commerce segment as mobile application downloads stood at 2.8 million in Q2.

Costco’s Membership Fee is Key

Costco has a differentiated business model. While it sells goods through its 875 stores, what makes it a special company is its membership model.

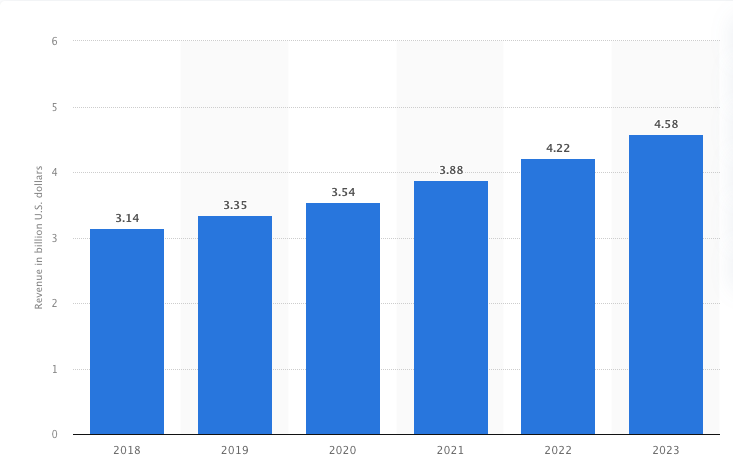

With 72 million membership households, Costco earned $4.6 billion of fee revenue in fiscal 2023. With a renewal rate of more than 90%, Costco has a very sticky customer base, resulting in recurring sales.

Costco Membership Fees Growth

Source: Statista

Costco is part of a recession-resistant sector, and it reported solid sales growth amid macro and pandemic disruptions.

The key driver of its stock price is its profit margins, which have steadily expanded over the years, allowing the company to fund the current dividend as well as pay shareholders special dividends, boosting overall returns.

For instance, in the last five years, Costco has increased earnings at an annual rate of 17.4, primarily due to the consistent increase in membership fees.

Its steady bottom line allows Costco to pay shareholders an annual dividend of $4.08 per share, indicating a forward yield of 0.56%. These payouts have risen at an annual rate of 12% in the last 20 years.

Costco Is Still Growing

Costco reported sales of $238 billion in fiscal 2023, making it the third largest retailer after Walmart and Amazon. Moreover, its sales have risen by 72% in the last five years.

Wall Street expects Costco to increase sales by 6.1% year over year between fiscal 2023 and 2026, while earnings are forecast to increase by 9.1% annually in the next five years.

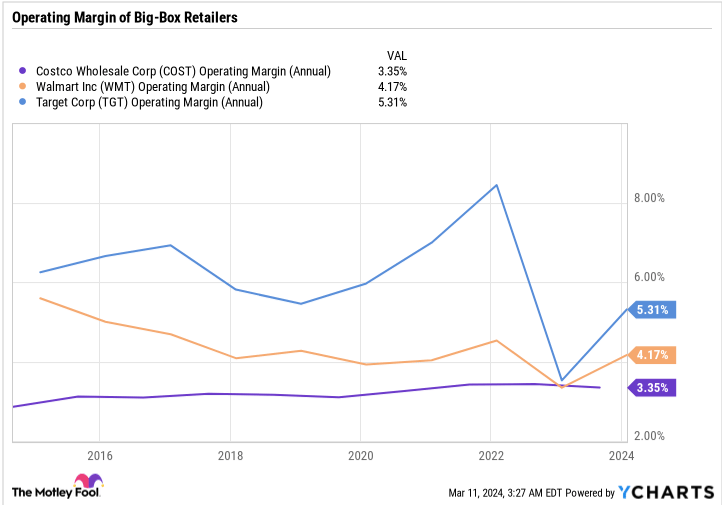

In the last decade, Costco’s operating margin has expanded from 2.9% to 3.3%, which might not seem much. But given its massive sales, Costco’s improving margins have moved the needle significantly.

Further, while Costco has a sizeable presence in North America, it is looking to gain traction in emerging markets such as China. In fiscal 2024, it plans to open 31 new warehouses, a majority of which will be in international markets.

Costco Stock Is Overvalued

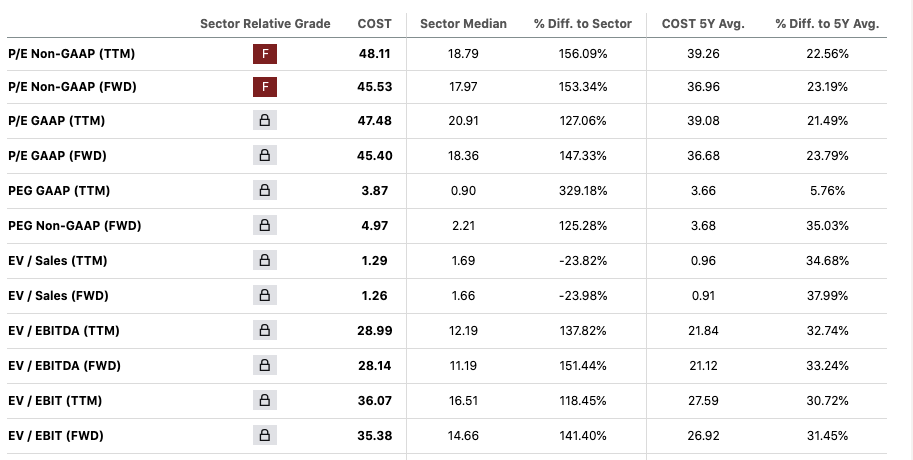

Costco is part of a mature, low-margin industry. Its recurring membership sales allow Costco to sell merchandise at rock-bottom prices. For example, the markup on its products is around 11%, much lower than other big-box retailers.

Source: Seeking Alpha

Investors looking to buy Costco at its current price should be wary of its lofty valuation. It trades at a forward price-to-earnings multiple of almost 50x, much higher than the sector average of just 17x.

The rally in Costco stock has made it extremely expensive, which suggests it will be difficult for the retail behemoth to replicate its historical gains.

The Takeaway

Investing in Costco stock at its current valuation may not offer you the opportunity to derive market-beating gains. It is better to gain exposure to Costco stock by investing in the S&P 500 index, which offers diversification while lowering investment risk.

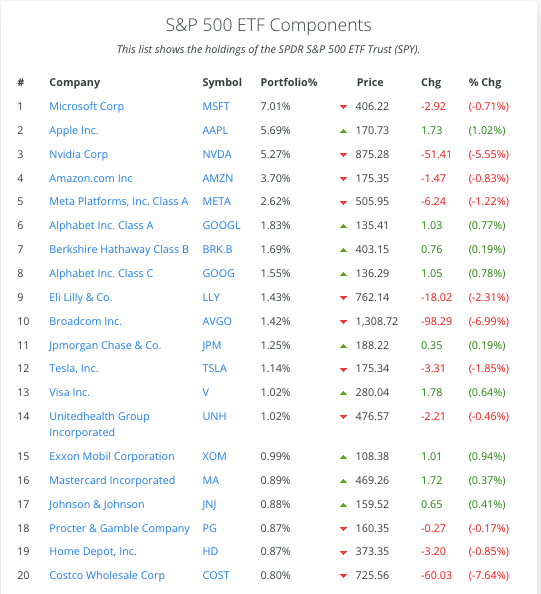

Source: SlickCharts

Costco accounts for 0.80% of the S&P 500, an index that has returned over 10% annually in the last five decades.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.