- 3 Big Scoops

- Posts

- When Microsoft Saved Apple

When Microsoft Saved Apple

and it cost them "just" $150 million

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 4,894.16 ( ⬆️ 0.53%)

Nasdaq Composite @ 15,510.50 ( ⬆️ 0.18%)

Bitcoin @ $40,109.15 ( ⬆️ 0.55%)

Hey Scoopers,

Happy Friday! We made it.

In today’s newsletter, we go down memory lane to a time when two tech stalwarts collaborated more than 30 years back.

So, let’s go 🚀

Microsoft Invests in Apple

The rivalrous friendship of Bill Gates and Steve Jobs is the stuff of tech lore. But a poignant moment arrived in their relationship when Microsoft had to step in and save Apple from bankruptcy 💀.

“Bill, thank you. The world’s a better place”, Jobs told Gates shortly after Microsoft invested $150 million in Apple.

Today, Apple is a multi-trillion-dollar juggernaut and the second-largest publicly listed company in the world. But the ride to its valuation peak has been far from easy.

The Birth of Apple

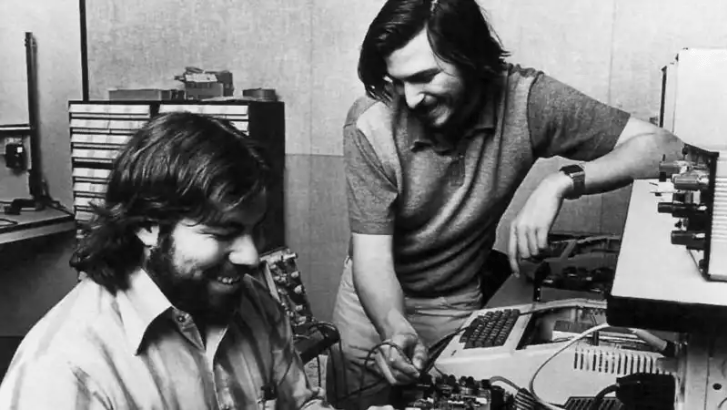

Steve Jobs and Steve Wozniak co-founded Apple in a garage back in 1976, where they developed a unique business strategy.

The two men had a clear breakdown of responsibilities as Jobs handled business and creativity while Wozniak engineered these creations.

Jobs and Wozniak were young men without real-world business experience and the two needed guidance to get Apple off the ground. So, they appointed a team of directors to help them with key business decisions.

Apple began to churn out revolutionary computer products led by the two geniuses. In 1983, Jobs recruited John Sculley as the CEO of Apple, who previously led Pepsi.

Within two years, Jobs and Foley had a fallout, after which Jobs wanted to be Apple’s CEO. However, the board pushed back due to Jobs’ behavior, which was described as terrible and autocratic.

Apparently, Jobs pushed people too hard, rubbing them the wrong way and burning several bridges along the way. Yes, Jobs did build an incredible business, but made everyone around him unhappy.

In 1985, Jobs was fired from the company he built.

Return of the King

By the mid-1990s, Apple struggled with falling sales, internal conflicts, and a lack of direction.

Steve Jobs was requested to return as the company’s interim CEO in August 1997. Once at the helm, Jobs canceled products such as the Newton and Cyberdog to limit Apple’s losses and reduce cash burn rates.

Source: Fulvio Obregon

He then reached out to Bill Gates for a game-changing deal that shocked Wall Street. Microsoft stepped in as an unexpected ally, investing $150 million in Apple in the form of non-voting shares.

As part of the deal, the two tech disruptors agreed to a cross-licensing patent agreement, allowing the companies to use each other’s patents without legal disputes.

Microsoft committed to releasing the MS Office for Macintosh computers for at least five years, ensuring the availability of essential productivity tools for Apple users.

Apple’s fortunes took a 360-degree turn with the return of Steve Jobs and the launch of revolutionary products such as the iPhone and the iPod soon after. The bail-out proved pivotal in tech history, enabling Apple to become the powerhouse it is today.

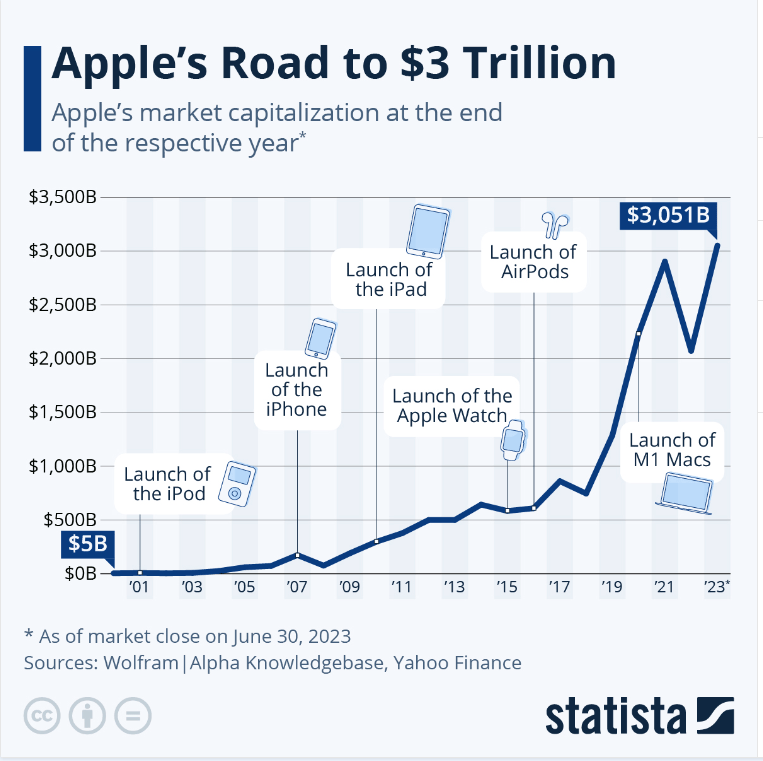

Today, Apple is valued at $3 trillion. In December 1997, its market cap stood at $1.6 billion.

Investing in Individual Stocks is Tricky

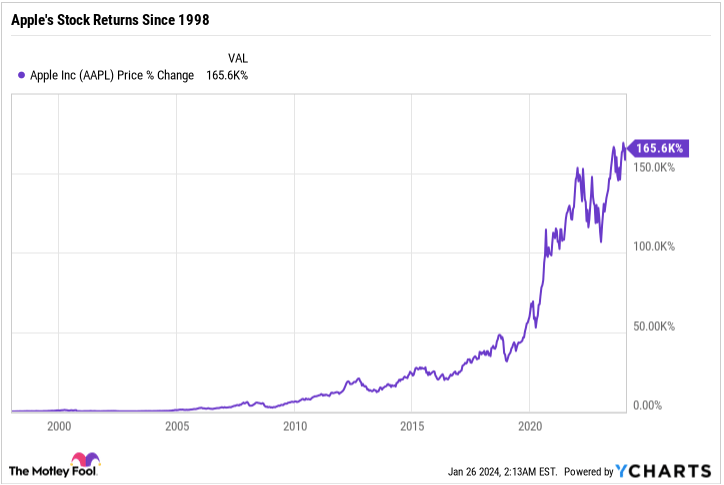

In the last 26 years, Apple has returned more than 165,000% to shareholders. But we can see that investing in individual stocks is quite tricky. In fact, it required multiple stints from Steve Jobs as Apple CEO for the company to earn its place as an S&P 500 giant.

Despite its outsized gains in the last two decades, Apple returned 0% to shareholders between April 1986 and May 1997.

It’s essential to understand that investing in individual stocks is quite tricky. For instance, out of the 28,114 publicly listed companies in the U.S., the top 25% of stocks have created a third of shareholder wealth since 1926.

So, how do you invest amid all this uncertainty? It makes sense to hold a majority of equity holdings in diversified index funds such as the SPY.

Around 90% of large-cap mutual funds have failed to beat the S&P 500, which makes index investing key to building long-term wealth.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.