- 3 Big Scoops

- Posts

- Tesla Gains Big 🚀

Tesla Gains Big 🚀

even as it misses Q1 estimates

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

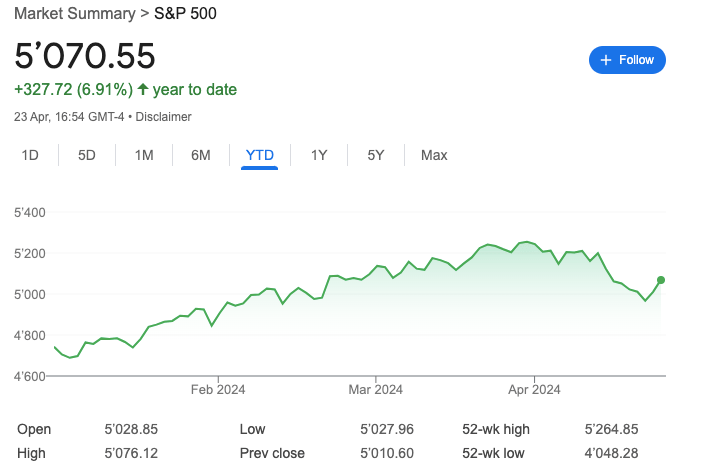

S&P 500 @ 5,070.55 (⬆️ 1.20%)

Nasdaq Composite @ 15,696.64 ( ⬆️ 1.59%)

Bitcoin @ $66,739.50 ( ⬆️ 0.43%)

Hey Scoopers,

Are you managing the midweek hustle? Then gear up for an exciting newsletter today!

👉 Tesla misses estimates in Q1

👉 Home sales tick higher in March

👉 Crypto assets see outflows

So, let’s go 🚀

Market Wrap 📉

Stocks moved higher for the second consecutive trading session yesterday, helped by strong corporate earnings and easing investor concerns over higher interest rates.

Around 20% of the companies in the S&P 500 index have reported Q1 earnings, of which 76% have beaten consensus estimates.

Goldman Sachs analyst David Kostin expects earnings will be higher in 2024 amid multiple headwinds, such as higher inflation and concerns over margin pressures.

The equity strategy explained that he expects inflation to eventually move lower this year, which should translate to interest rate cuts, boosting corporate earnings growth.

Trending Stocks 🔥

Global Life - Shares of the life insurance company surged over 14% as it raised full-year earnings guidance. It expects earnings per share between $11.50 and $12, up from a prior range of between $11.30 and $11.80.

GE Aerospace - Shares jumped over 8% after the company reported earnings of $0.82 per share in Q1, higher than estimates of $0.65 per share. It also raised earnings forecasts to between $3.80 per share and $4.05 per share in 2024.

Spotify - Shares of the music-streaming company gained over 11% after topping earnings estimates in Q1.

Nvidia Close to Bear Market Territory

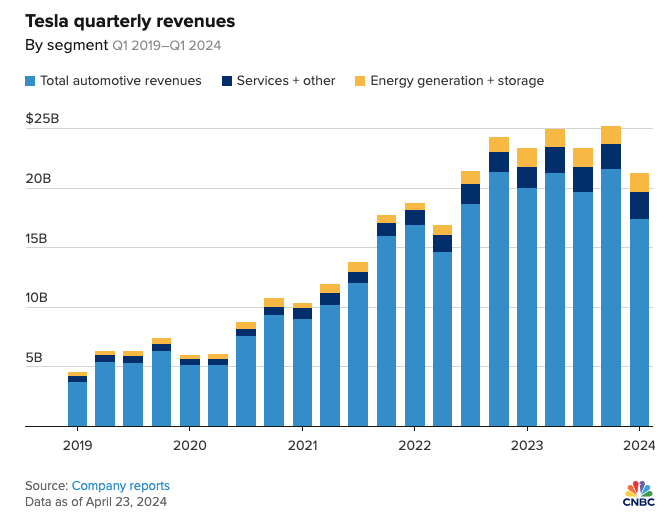

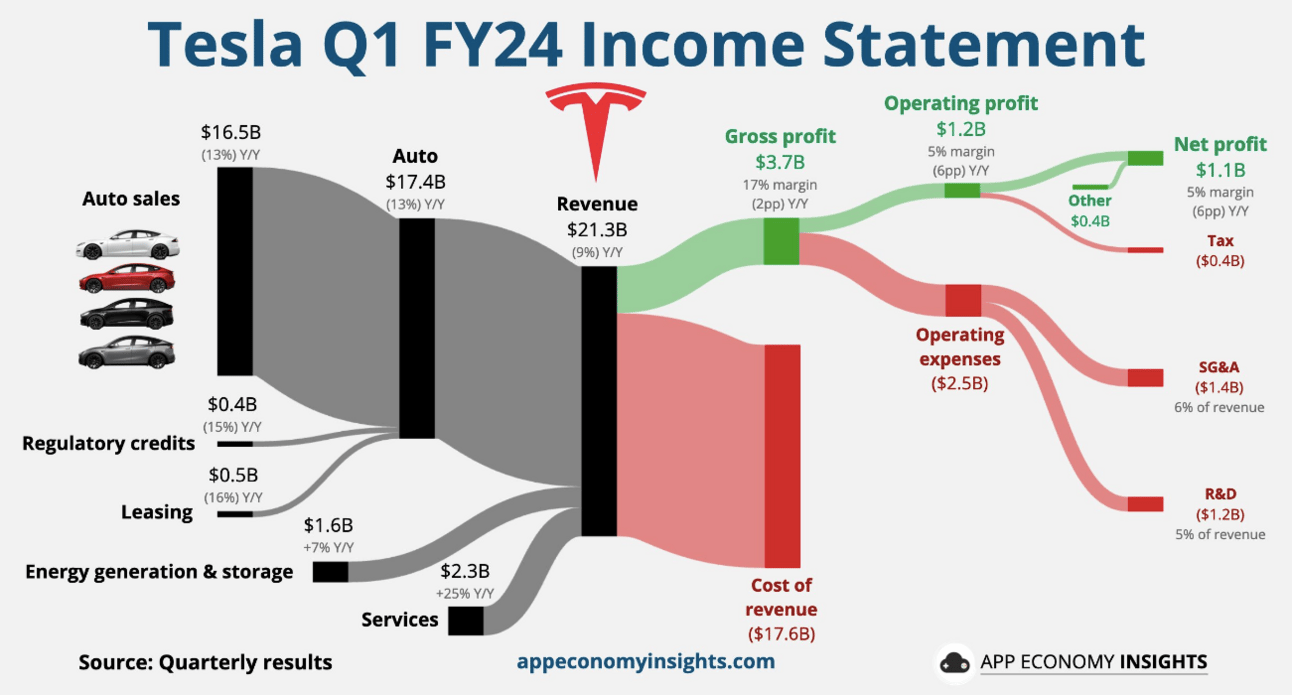

Tesla reported a 9% decline in Q1 sales, its largest drop since 2012, as it missed consensus estimates in the March quarter.

Despite the earnings miss, Tesla stock is up over 13% in pre-market trading as CEO Elon Musk claimed the production of new affordable EV models would begin sooner than expected.

In Q1 of 2024, Tesla reported:

👉 Revenue of $21.3 billion vs. estimates of $22.15 billion

👉 Earnings per share of $0.45 vs. estimates of $0.51

In the year-ago period, Tesla reported revenue of $23.33 billion while earnings per share stood at $0.73.

Musk stated that Tesla plans to begin production of cheaper EV models by late 2024 or early 2025, and the volume growth rate will be notably lower this year than in 2023.

Additionally, Musk disclosed Tesla is in talks with a major automaker to license its driver assistance system, unlocking another revenue stream for the EV giant.

Prior to the 13% jump, Tesla stock slumped over 40% in 2024, due to:

Slowing vehicle deliveries

Rising competition in China and

Ongoing price cuts

Earlier this year, Tesla reported an 8.5% decline in vehicle deliveries in Q1 as sales growth across EVs is slowing. Tesla and its peers have slashed EV prices to boost demand, but the move has negatively impacted profit margins. For instance, gross profits for Tesla fell 18% in Q1.

To lower costs, Tesla recently embarked on a capital restructuring plan, cutting over 10% of its global workforce.

Tesla is still the largest EV maker in the U.S. and spent $2.77 billion in capital expenditures in Q1, up 34% year over year. However, it meant the company ended Q1 with a negative free cash flow of $2.53 billion.

New Residential Home Sales Gain Pace

A report from the Commerce Department states new residential home sales in the U.S. accelerated in March at a faster-than-expected pace due to lower mortgage rates.

Single-family home sales totaled 693,000 in March, better than estimates of 669,000 and higher than sales of 637,000 in February.

After dipping in January, median home sale prices soared to $430,700, the highest level since August last year.

Notably, interest rates of 30-year mortgages edged lower in March to below 7%.

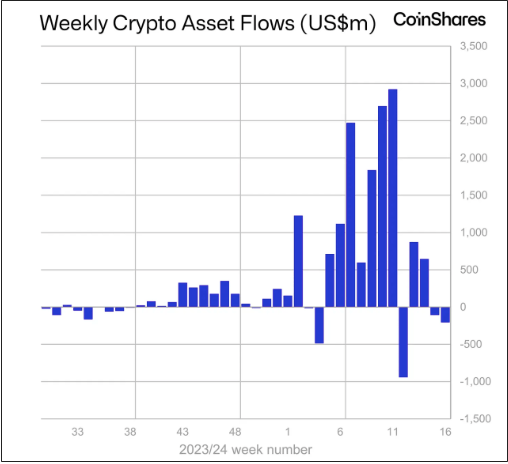

Crypto Outflows Total $206 Million

According to a report from Coinshares, digital asset investment products saw total outflows of $206 million last week. It was the second consecutive week of outflows, resulting in lower crypto prices.

Coinshares explained, “Appetite from ETP/ETF investors continues to wane, likely off the back of expectations that the FED is likely to keep interest rates at these high levels for longer than expected.”

Moreover, blockchain equities saw its 11th consecutive week of outflows totaling $9 million, while Ethereum outflows totaled $34 million.

Headlines You Can't Miss!

Sales and operating profits rise for Volvo Cars in Q1

Amazon is opening cloud regions in Southeast Asia to meet demand

World’s largest wealth fund issues inflation warning

What to expect from Boeing in Q1 of 2024?

Crypto industry groups sue the SEC

Chart of The Day

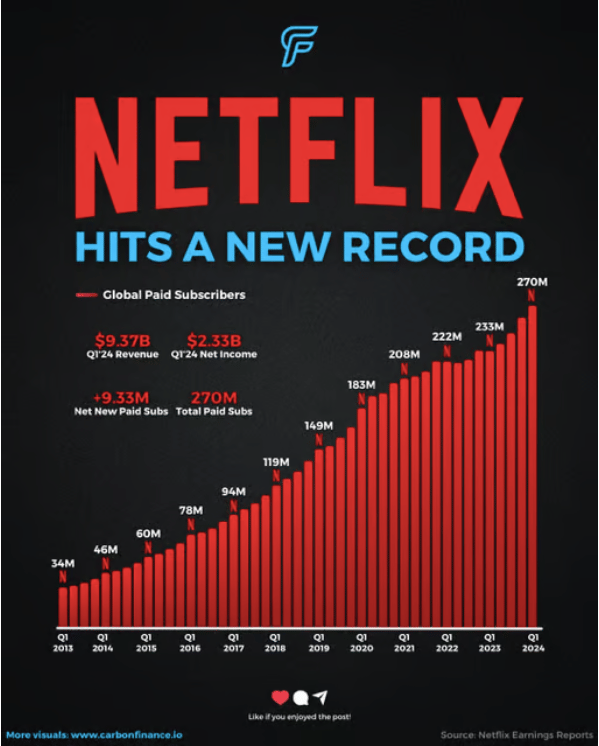

Last week, Netflix announced its Q1 of 2024 results, comfortably beating Wall Street estimates.

The streaming behemoth ended Q1 with 270 million subscribers, up from 46 million subscribers 10 years back.

Netflix has been among the hottest stocks in the past decade, rising a staggering 1,004% since April 2014.

Meme of the Day

Source: Wallstreetmemes

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.