- 3 Big Scoops

- Posts

- Tesla Tanks Again!

Tesla Tanks Again!

Tesla, Microsoft, and United Health

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 5,205.81 ( ⬇️ 0.72%)

Nasdaq Composite @ 16,240.45 ( ⬇️ 0.95%)

Bitcoin @ $66,278.52 ( ⬇️ 1.01%)

Hey Scoopers,

Welcome to Wednesday - midweek milestone achieved. Here are our top stories for the day 👇

👉 Tesla’s Q1 deliveries decline

👉 India’s stock market is booming

👉 Bitcoin attracts inflows

So, let’s go 🚀

Market Wrap 📉

Stocks are off to a rough start in Q2 of 2024 as sticky inflation data and strong economic data sent yields higher while reducing the possibility of interest rate cuts this June.

Initially, analysts expected the Fed to lower interest rates at least four times in 2024. However, a resilient economy, strong consumer spending, and robust employment rates have meant inflation is still above the Fed's 2% target.

Yesterday, oil stocks surged due to a recovery in crude oil prices. Alternatively, stocks part of the semiconductor and healthcare sectors pulled back significantly.

Trending Stocks 🔥

GE Vernova - Shares rose over 3% after GE Vernova began trading on the NYSE under the ticker “GEV,” following its spin-off from General Electric.

ChampionX - Shares of the oilfield equipment maker soared more than 8% after it agreed to be acquired by SLB for $7.7 billion.

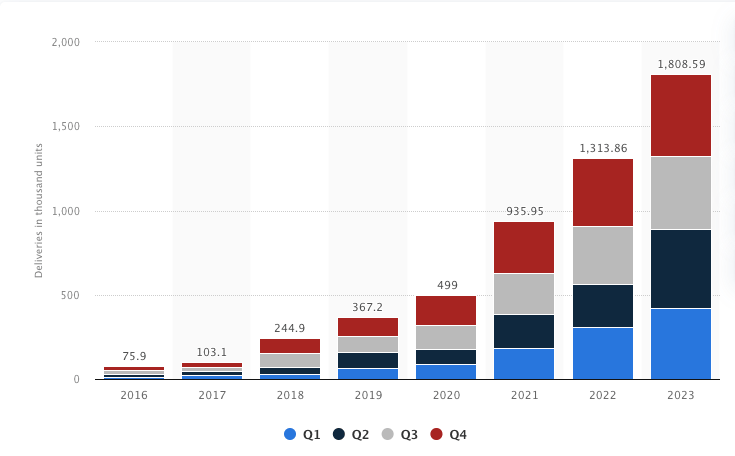

Tesla Disappoints Wall Street

Shares of Tesla fell close to 5% yesterday after the company reported a drop in vehicle deliveries in Q1 of 2024. This marked its first annual decline since 2020 when the COVID-19 pandemic disrupted production.

Here are key vehicle numbers for the EV giant:

👉 Total Q1 deliveries: 386,810

👉 Total Q1 production: 433,371

Vehicle production numbers fell 1.7% year over year and were 12.5% lower than the December quarter.

Tesla’s Vehicle Deliveries

Source: Statista

Tesla has been among the worst-performing stocks on the S&P 500 in 2024, losing over 30% year-to-date. It’s the biggest decline for the stock since the end of 2022 and the third-steepest quarterly plunge since its IPO in 2010.

In recent quarters, Tesla lowered vehicle prices to boost consumer demand amid rising interest rates and inflation. However, it negatively impacted the profit margins and cash flow of the EV giant.

In addition to lower demand, Tesla is wrestling with competition from other EV manufacturers such as Byd, Nio, and Volkswagen.

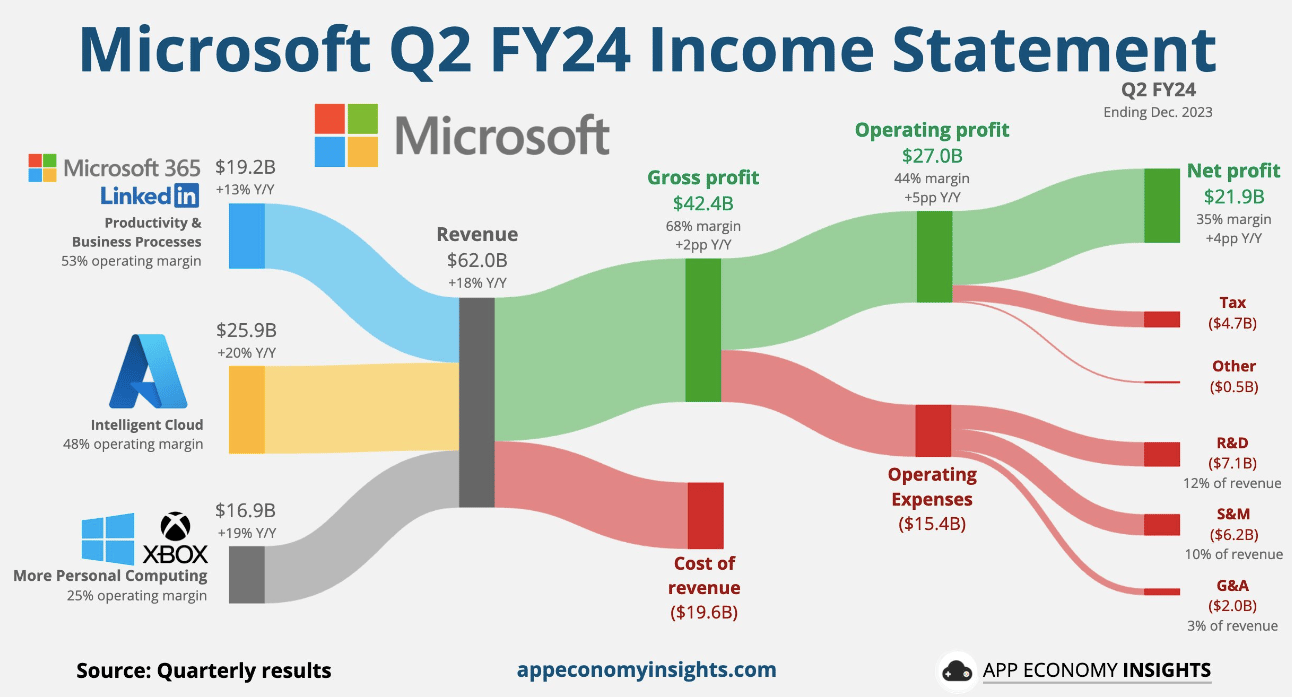

Microsoft Unbundles Teams

Yesterday Microsoft disclosed plans to split up its Teams and Office bundles following scrutiny from regulators in the European Union.

It means customers will now have to pay more money to gain access to the same features. For instance, new clients subscribing to Office 365 E3 will pay an additional $3 per person every month due to the split.

According to Mizuho Securities, while customers believe Zoom to be a superior platform compared to Teams, the bundling of MS Teams to Office 365 has driven subscription numbers higher for the world’s largest company.

Microsoft’s collaboration rivals, including Zoom and Salesforce, are set to benefit after the latter filed an antitrust complaint to the European Commission four years back, stating it was illegal to bundle Teams with Office.

In 2023, Microsoft earned roughly $43 billion from Office, including Teams, an increase of 14% year over year. Microsoft Teams has more than 300 million monthly active users and gained massive traction since the onset of COVID-19.

Insurance stocks are under pressure

Several health insurance stocks, including United Health, pulled back after the Centers for Medicare & Medicaid Services finalized capitation rates for Medicare Advantage.

Government payments to Medicare plans will increase by 3.7% on average or more than $16 billion next year. The final rate of 3.7% is unchanged from January’s proposed rate, disappointing analysts who expected between 50 basis points and 100 basis points of improvement.

Shares of Humana, CVS Health, Cigna Group, and Elevance Health also moved lower on Tuesday.

Job Openings, Oil, and India

While the ratio of positions to available workers fell, job openings were little changed in February.

The Job Opening and Labor Turnover Survey indicated positions stood at 8.76 million, in line with estimates of 8.8 million.

However, the ratio of openings to available workers fell from 1.43 to 1.35 last month, indicating a loosening of the labor market.

Oil prices move higher

Surging oil prices have pushed the commodity index to its highest level since the summer of 2022.

The prices of U.S. crude have gained 18% in 2024, while the CRB Commodity index is up 11%. In fact, the index closed at its highest level since August 2022.

The CRB index consists of 19 different raw materials, including crude oil, agri-based products, and precious metals.

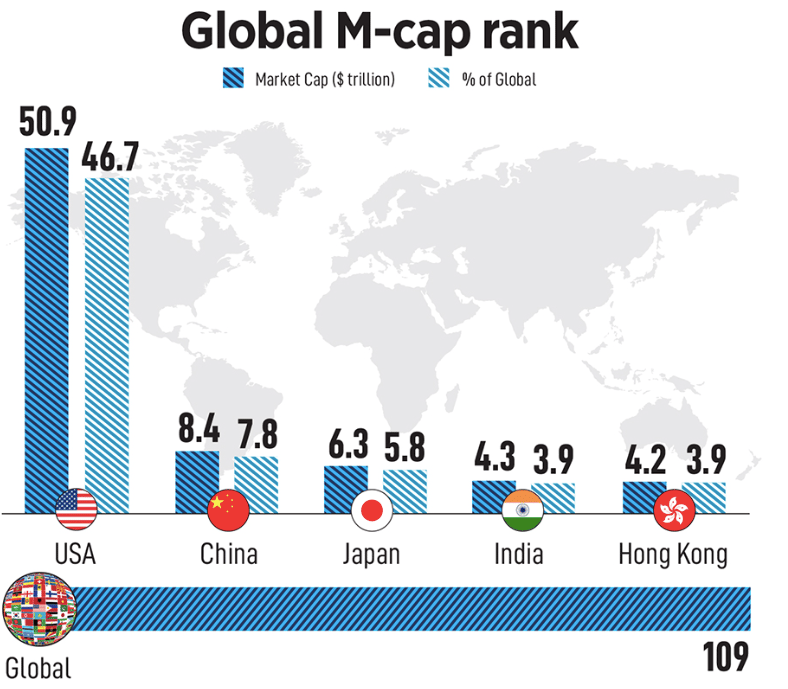

India’s equity market is booming

India's stock market growth is enviable when compared to China and Hong Kong.

Since 2021, equity markets in China and Hong Kong have lost $4.8 trillion in market cap.

Source: Forbes

Meanwhile, India recently overtook Hong Kong to become the fourth-largest stock market in the world in terms of market cap. If we account for transaction volume, it's the second-largest stock market globally.

The country's benchmark Nifty 50 index has now risen for eight consecutive years, gaining 20% in 2023.

Despite an uncertain macro environment, several Indian companies went public last year. In fact, India saw 220 IPOs in 2023, raising $6.9 billion in total proceeds, indicating a 48% increase in deal activity.

In 2019, India accounted for 6% of global IPO deals. This number rose to 27% in Q1 of 2024.

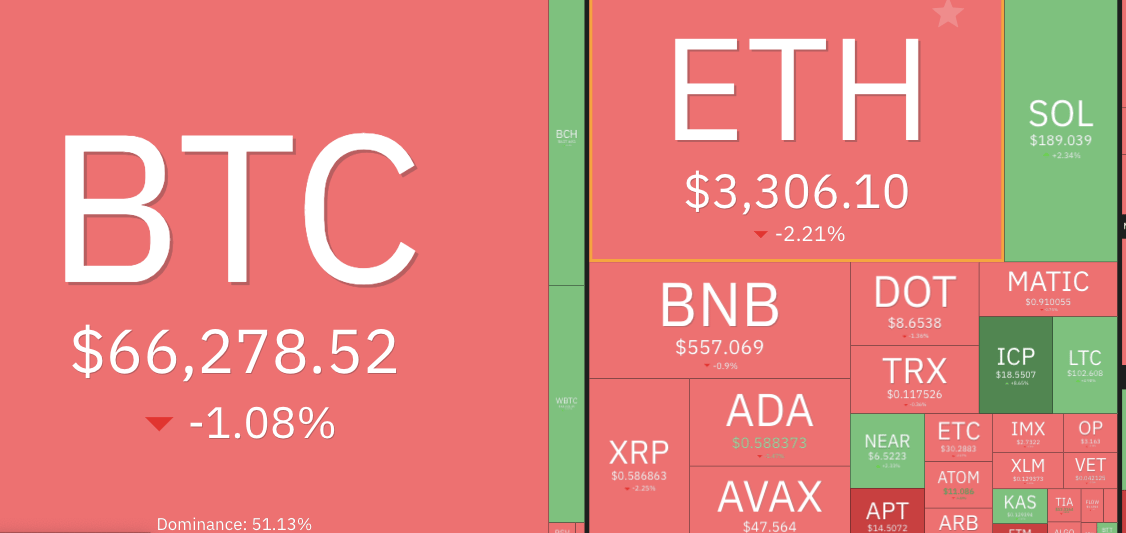

Crypto Funds Are Seeing Inflows

Last week, digital asset investment products saw total inflows of $862 million, according to a CoinShares report. Bitcoin led the way with inflows of $865 million on the back of strong demand from ETFs or exchange-traded funds.

Source: Coin360

Meanwhile, Ethereum saw its fourth straight week of outflows totaling $19 million.

Other major altcoins such as Solana, Chainlink and Polkadot also attracted customer funds in the last week.

Headlines You Can't Miss!

Around 50% of global adults are stressed about finances

Disney prevails over Trian in board fight

Intel reports $7 billion operating loss for its Foundry business

Byd’s EV sales fall over 13% in Q1

U.S. government moves $2 billion in Silk Road Bitcoin

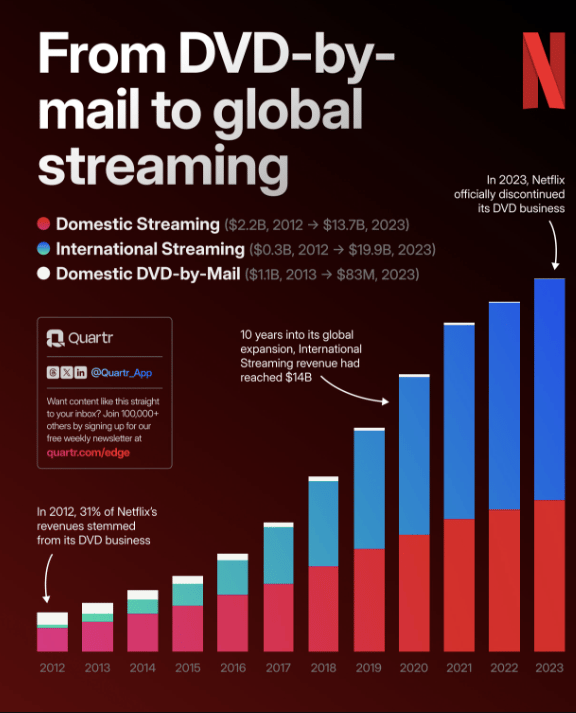

Chart of The Day

Netflix can easily be one of the best case studies for business schools, given how it transformed its business model over the last two decades.

The tech giant was initially a DVD-by-mail service and has since evolved to become the largest streaming platform globally.

Founded in 1997, Netflix launched its streaming service in 2007, allowing it to enjoy an early mover advantage.

However, in 2012, around 31% of Netflix’s sales were still tied to its legacy DVD-by-mail business.

Last September, Netflix officially shut down its DVD rental business as it dispatched the last DVD in the iconic red envelope.

Valued at a market cap of $266 billion, Netflix has grown its revenue by 23% annually in the past decade.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.