- 3 Big Scoops

- Posts

- Tesla Can't Catch a Break

Tesla Can't Catch a Break

PLUS: Will gold surge to $3k?

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

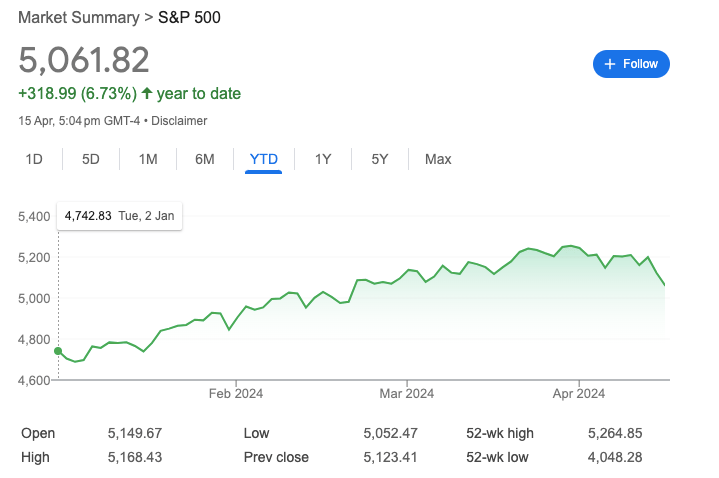

S&P 500 @ 5,061.82 (⬇️ 1.20%)

Nasdaq Composite @ 15,855.02 ( ⬇️ 1.8%)

Bitcoin @ $63,522.10 ( ⬇️ 3.02%)

Hey Scoopers,

We’re off to a busy start this Tuesday. Here’s your finance edge in 5 minutes 👇

👉 Tesla cuts workforce by 10%

👉 Gold prices might continue to rally

👉 Hong Kong approves crypto ETFs

So, let’s go 🚀

Market Wrap 📉

Stocks retreated on Monday as rising yields and worries over the conflict in the Middle East overshadowed strong earnings from Goldman Sachs and better-than-expected retail sales data.

While indices such as the S&P 500 and Nasdaq slumped more than 1%, the Dow Jones Industrial pulled back 0.65%. The Dow Jones has now fallen for the sixth straight session, a streak not seen since last June.

The yield on the 10-year Treasury rose above 4.6%, surging to its highest level since mid-November.

Yields ticked higher after data showed retail sales for March rose by 0.7%, indicating retail consumption remains resilient amid inflationary pressures. Retail sales were higher than consensus estimates that forecast a 0.3% growth.

Trending Stocks 🔥

Salesforce - Shares of the software company slumped over 7% on reports that it was in talks to acquire data management firm Informatica.

Goldman Sachs - Shares of the investment bank surged close to 3% after it reported revenue of $14.21 billion and earnings of $11.58 per share, topping estimates of $12.92 billion and $8.56 per share.

Reddit - Shares fell over 5% after Morgan Stanley initiated coverage of the social media platform with an equal weight rating, emphasizing that the stock was trading at a fair value. JPMorgan and Goldman Sachs also issued neutral ratings on Reddit.

Tesla Stock Slumps 5.6%

Tesla shares fell 5.6% on Monday after the company’s CEO, Elon Musk, disclosed plans to reduce the global workforce by at least 10%.

Source: CNBC

Musk emphasized that the layoffs were necessary as Tesla aims to reduce costs amid a challenging macro environment and prepares for the “next phase of growth.”

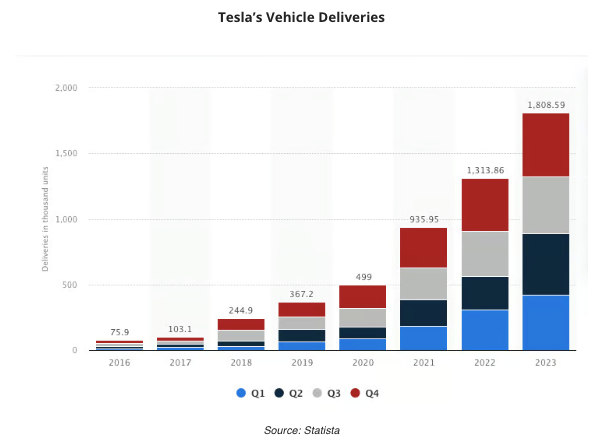

Tesla stock has grossly underperformed the broader markets, falling 31% year-to-date and trading 60% below all-time highs. While EV sales continue to gain traction worldwide, manufacturers have experienced slowing sales in recent months.

China is the largest EV market in the world. However, several brands are also rolling out cheaper battery-powered vehicles there.

China’s BYD temporarily dethroned Tesla in Q4 of 2023 as the world’s top EV maker, while Xiaomi disclosed plans to sell its first EV at a much lower cost compared to Tesla’s Model 3.

Tesla reported its first annual decline in vehicle deliveries since 2020, as Q1 deliveries fell to 386,810 units, indicating a fall of 1.7% year over year.

Tesla has lowered vehicle prices to boost demand, but it has come at a cost. For instance, its operating margin narrowed to 8.2% in Q4 of 2023 from 16% in the year-ago quarter.

The EV giant warned investors that volume growth in 2024 may be lower while claiming it is currently between two major growth waves.

Could Gold Prices Surge to $3,000?

Gold prices are hovering at all-time highs after tensions in the Middle East flared over the weekend, boosting the precious metal's safe-haven appeal.

Gold is viewed as a hedge against inflation and performs well in periods of economic and geopolitical turmoil, forcing investors away from riskier asset classes such as equities.

Source: CNBC

Bullion prices touched an all-time high of $2,448.80 per ounce last week, rallying 15% in 2024 due to:

👉 A global central bank splurge

👉 Geopolitical tensions and

👉 Expectations of rate cuts in the U.S.

Citi expects gold prices to surge to $3,000 per ounce over the next six to 18 months. Moreover, Goldman Sachs referred to the gold market as an “unshakeable bull market,” revising the price target for the yellow metal to $2,700 per ounce by the end of 2024.

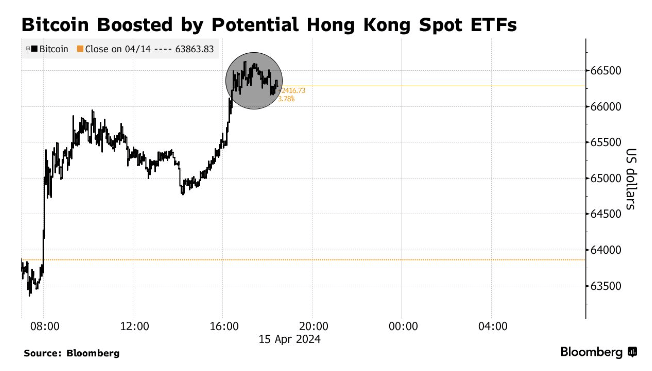

Hong Kong Approves Spot Crypto ETFs

Yesterday, Hong Kong regulators approved the launch of three spot bitcoin and ether exchange-traded funds (ETFs).

Mainland China banned crypto trading in 2021, cracking down on the disruptive sector. However, Hong Kong aims to make itself a regulated crypto hub to compete with regions such as Dubai and Singapore.

It will be interesting to see if investors from mainland China will be allowed to invest in these funds.

The surprising move came three months after the U.S. securities regulators approved multiple spot BTC ETFs, which have already attracted billions of dollars of inflows.

A Bitcoin ETF allows investors to gain exposure to the digital asset without the risk of owning the underlying cryptocurrency.

Headlines You Can't Miss!

China’s economy grew 5.3% in Q1

Baidu’s generative AI platform attracts over 200 million users

Apple CEO Tim Cook visits Vietnam

Asia markets sell-off amid escalating tensions

U.K set to announce comprehensive crypto market regulation by July

Chart of The Day

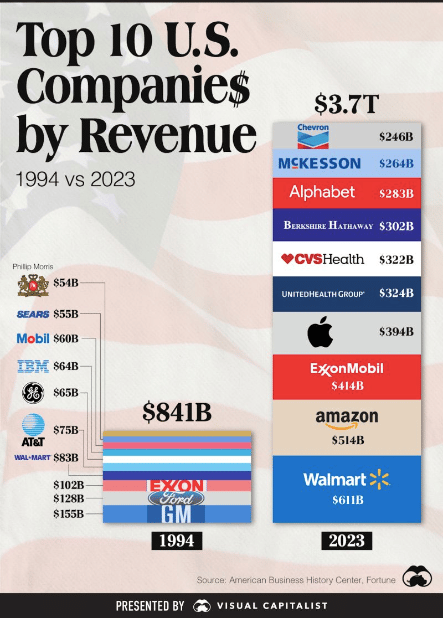

The world of business and finance has changed drastically in the last three decades.

These changes can be seen in the above chart, which ranks the top 10 U.S. companies by revenue in 1994 and 2023.

Back in the early 1990s, auto manufacturers such as General Motors and Ford raked in billions of dollars in sales, followed by Exxon Mobil and Walmart.

In fact, Exxon Mobil and Walmart are the only two companies that feature on both lists.

In 2023, Walmart brought in $611 billion in sales, followed by Amazon at $514 billion and Exxon Mobil at $414 billion.

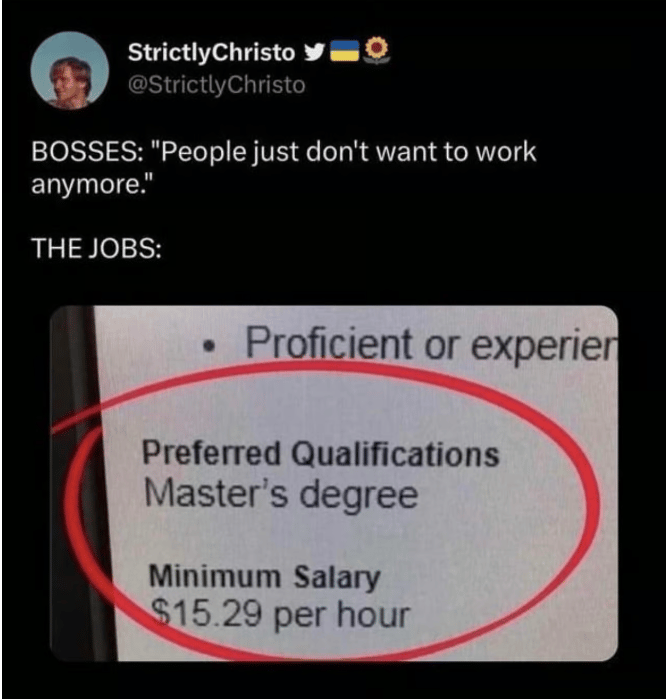

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.