- 3 Big Scoops

- Posts

- Tesla is Losing to BYD

Tesla is Losing to BYD

PLUS: Money goals for 2024

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 4,769.83 ( ⬇️ 0.28%)

Nasdaq Composite @ 15,011.35 ( ⬇️ 0.56%)

Bitcoin @ $45,355.50 ( ⬆️ 2.47%)

Hey Scoopers,

Happy New Year !!

Here’s what’s on the menu for today:

👉 Tesla vs. Byd

👉 Money goals for Millennials and Gen Z in 2024

👉 Bitcoin’s price predictions

So, let’s go 🚀

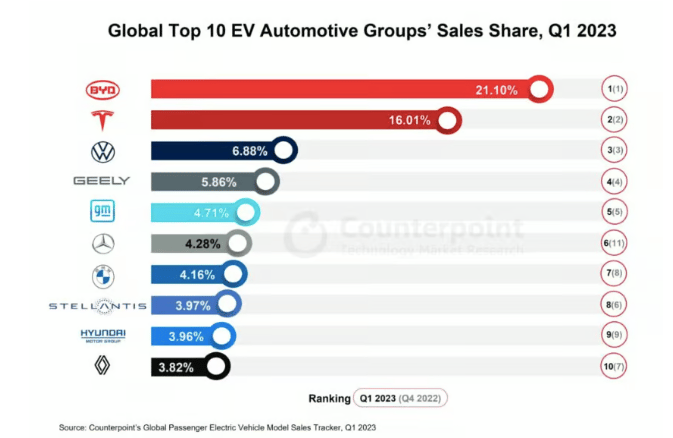

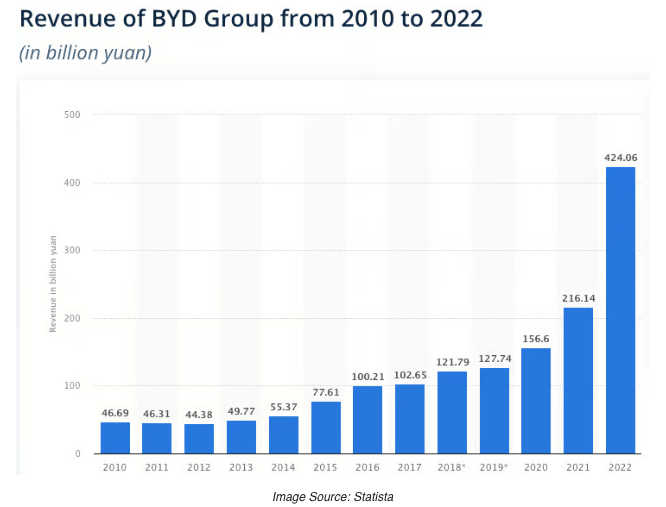

BYD- China’s electric vehicle (EV) manufacturer stated it produced more than three million new energy vehicles in 2023. It would mean Byd is on track to surpass Tesla’s production for the second consecutive year.

While Tesla is yet to release its full-year figures for 2023, it manufactured 1.35 million EVs in the first three quarters of 2023.

In 2022, Tesla produced 1.37 million vehicles, compared to BYD’s 1.88 million. While Tesla is a pure-play EV manufacturer, BYD’s new energy vehicles include battery-powered and hybrid models.

Most of BYD’s cars are priced at a much lower price range than Tesla, allowing the former to sell 1.6 million EVs and 1.4 million hybrid vehicles in 2023.

China is the largest EV market in the world, and Tesla has an 8% share in the country’s EV segment, compared to BYD, which leads with a 35% share.

Due to the rising adoption of EVs in China, several companies are entering this highly lucrative vertical. For instance, Chinese smartphone maker Xiaomi recently detailed plans to launch an EV to compete with Tesla.

After establishing a solid presence in China, Byd and other domestic manufacturers, such as Nio, aim to gain traction in international markets like Europe.

In 2023, BYD’s overseas vehicle sales stood at 242,000, accounting for 8% of total shipments. It tripled overseas vehicle shipments to 36,095 units in December 2023.

Further, BYD disclosed plans to build a new production center in Hungary. It already sells five vehicle models in Europe and will launch three more in 2024.

Our take

While China leads the global EV market, establishing an overseas presence would allow China’s EV manufacturers to increase market share and benefit from economies of scale over time.

China’s EV manufacturers offer vehicles at a much lower cost than their U.S. and European counterparts. For example, 20% of EVs in China are priced at less than $15,000. Comparatively, no EV model is on sale for less than $20,000 in the U.S. and Europe.

Top Money Goals In 2024

The millennial and Gen Z generations are placing financial goals on top of their resolutions list for 2024.

According to a survey by American Express, 57% of the respondents named personal finance their top personal goal for 2024, followed by wellness goals at 50% and mental health at 48%.

Here are the top three financial goals for the two generations.

Grow savings

Around 60% of the respondents have placed this financial goal on top of their resolutions list.

To get started, you should automate your savings. Basically, you should allocate a certain amount of money each month and transfer it to your savings account.

The type of account can make a significant difference. With interest rates at multi-year highs, it makes sense to hold money in a high-yield savings account and generate returns of almost 5% in 2024.

Pay off debt

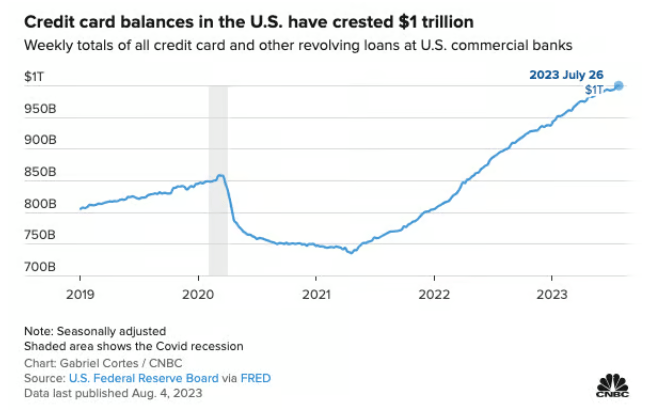

About 40% of millennial and Gen Z respondents named paying off their debts a top financial goal in 2024.

This does not come as a surprise, as paying off high-interest debt has become quite tricky since the FED began hiking interest rates in 2022.

There are multiple strategies you can use to pay off debt. For example, you can roll your debt onto a balance transfer credit card.

These cards typically offer an introductory period of 21 months with a 0% interest rate, allowing users to lower debt without any additional interest.

Another way to lower debt is via the snowball method, which focuses on paying small balances first. Alternatively, in the avalanche method, you first pay off debt with the highest interest rate.

Stick to a budget

Budgeting is the cornerstone of a financial plan, and 41% of respondents said following a budget is a crucial money goal this year.

Whether you budget on a mobile application or a spreadsheet, sticking to your plan may help you accelerate your financial goals by a few years.

The budget should be easy to understand so you don’t spend much time checking on it.

Regularly checking your budget will allow you to become comfortable with your spending habits and know when you overspend on an expense such as groceries.

Will Bitcoin Touch $500,000 in 2024?

Bitcoin staged a stellar comeback in 2023, surging over 150% last year. After touching all-time highs in November 2021, Bitcoin fell significantly in 2022 due to the collapse of multiple high-profile projects, bankruptcies, and liquidity issues.

FTX, the second-largest cryptocurrency exchange, filed for bankruptcy in late 2022. Moreover, Sam Bankman-Fried, the founder of FTX, was found guilty of seven criminal counts.

In 2023, Binance’s CEO Changpeng Zhao pleaded guilty to criminal charges and stepped down from the helm while paying a $4.3 billion fine to the U.S. Department of Justice.

Investors remain bullish on Bitcoin due to the upcoming halving event, which has historically acted as a massive tailwind for BTC prices.

The launch of multiple Bitcoin ETFs in 2024 will drive the adoption of Bitcoin higher, as it should attract billions of dollars in investments.

Let’s see what cryptocurrency experts are forecasting for Bitcoin in 2024 👇

👉 Mark Mobius: $60,000

👉 Bit Mining: $75,000

👉 CoinShares: $80,000

👉 Nexo: $100,000

👉 Standard Chartered: $100,000

👉 Carol Alexander: $100,000

👉 Matrixport: $125,000

👉 CoinFund: Upto $500,000

Headlines You Can’t Miss!

Investors are bullish on Asia in 2024

Xiaomi enters the EV space

U.S. crude oil falls 10% in 2023

New FAFSA launches after a long delay

The U.S. acts as a top cop for crypto regulations

Chart of the Day

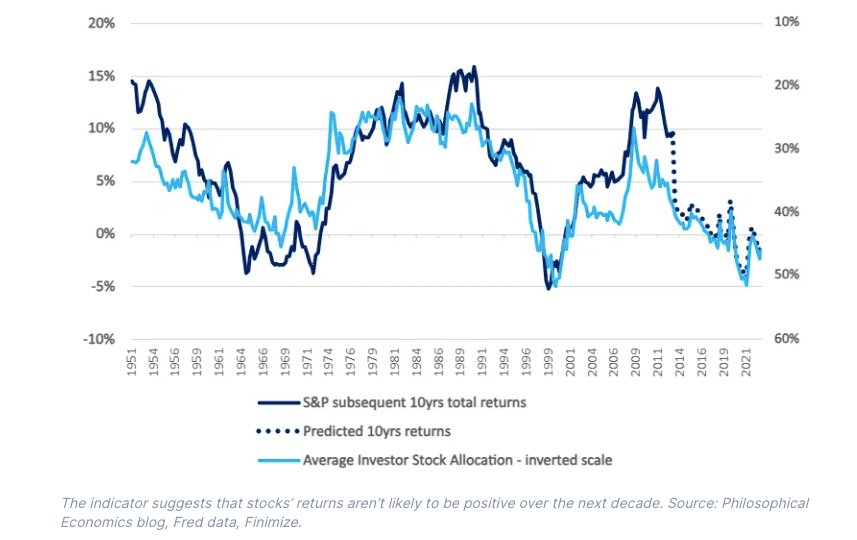

When investors allocate too much to stocks, stocks subsequently go down. When they allocate too little, stocks subsequently go up.

And right now, investors are holding an extreme amount of stocks, suggesting that future returns will be inferior – and even negative.

The stock allocation for investors, on average, is roughly 46%. While it is better than a year and a half ago (around 50%), it’s still above the dreaded 40% threshold.

To protect yourself, you could underweight stocks until investors’ average allocation to stocks drops below 40%.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.