- 3 Big Scoops

- Posts

- Income Allocation: 101

Income Allocation: 101

PLUS: What's your retirement number!

Bulls, Bitcoin & Beyond

Hello Folks,

Happy Cyber Monday!!

Today, we aim to provide you with the best options to allocate your hard-earned income.

Moreover, we look at the magic retirement number for individuals.

Let’s go 🚀.

Income Allocation: An Overview

You primarily go to work to lead a comfortable life in retirement. So, let’s see where you should allocate your income to create long-term wealth and accelerate your retirement plans.

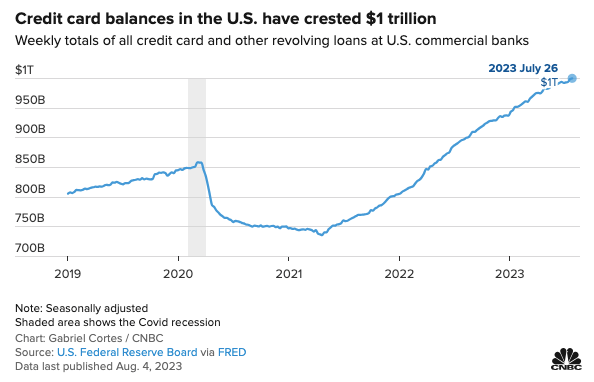

Pay high-interest debt first

We live in a credit-based society. It means you can take debt to fund purchases ranging from a smartphone to a mortgage.

But once you take on debt, ensure to make regular interest and principal payments.

Individuals need to prioritize their debt schedule. So, you need to repay the most expensive loans first. Let’s say you have the below outstanding loans:

👉 A car payment of $5,000 at 7%

👉 A credit card payment of $5,000 at 20% and

👉 A student loan of $5,000 at 5%

Here, you need to prioritize repaying your credit card bill first, followed by the auto loan and then the student loan.

Pay for Your Utilities

Payments such as rent, food, healthcare, and utilities are recurring in nature and are unavoidable. But make sure that these bills account for less than 50% of your gross income.

Start an Emergency Fund

You need to allocate between three and six months of your monthly expenses towards an emergency fund.

The macro economy is sluggish and the threat of a recession looms large over the global economy as interest rate hikes and inflation have tightened the noose on corporate earnings.

In case you lose your job, it would be better to have a liquid emergency fund in place. Or else you would have to dig into your savings and sell some of your investments, which should be avoided.

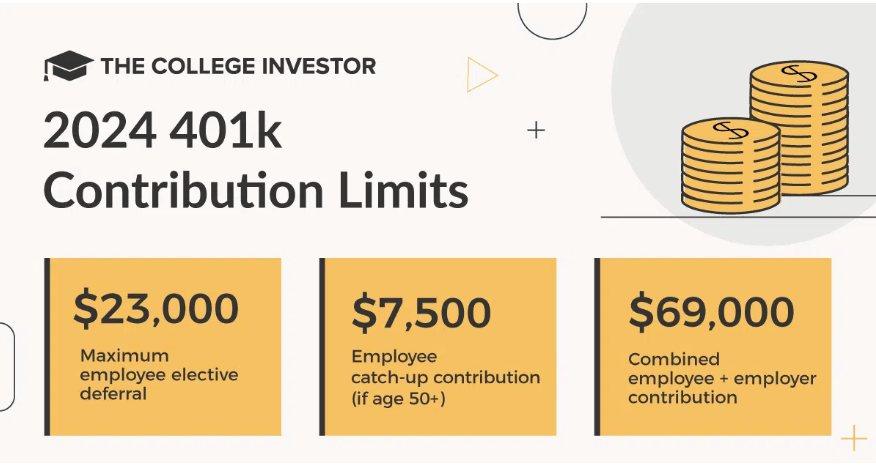

Invest in a Retirement Fund

Whether it is the 401k in the U.S., the workplace pension in the U.K., or the registered retirement savings plan (RRSP) in Canada, investing in a retirement fund is non-negotiable.

Typically, a retirement account is tax-advantaged, and regular investments can help you lower your tax bill significantly each year. Moreover, the employer may match your retirement contribution up to a certain amount, which is basically free money.

You need to save at least 10% of your income in a retirement account. For instance, the median income in the U.S. is $55,000. If you contribute $5,500 (10% of $55,000) each year in a 401k for 35 years, your portfolio would be worth over $1 million, given historical stock market returns.

As the retirement account is long-term in nature, you can allocate a significant portion of your investments in equities, an asset class that has outpaced inflation consistently over time.

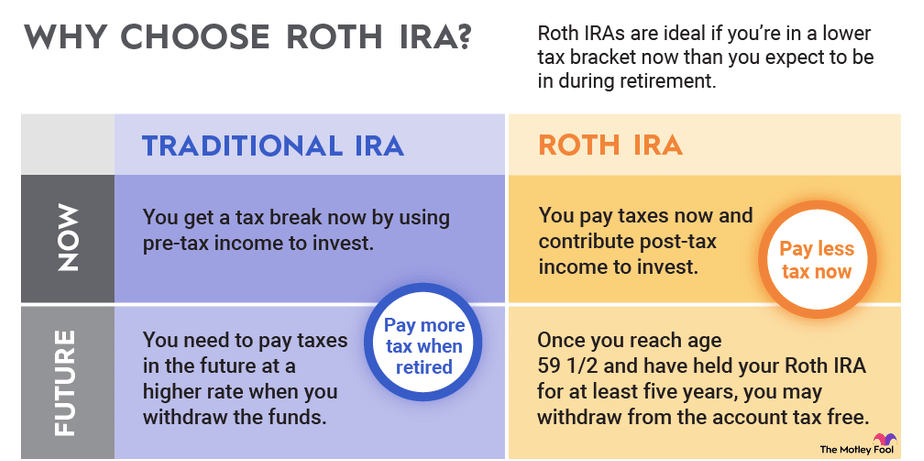

Invest in Tax-Sheltered Accounts

Tax-sheltered accounts such as the Roth IRA/TFSA (Tax-Free Savings Account) can help you earn significant returns without paying a single dollar in taxes to the regulators.

Moreover, these accounts are quite flexible, allowing you to withdraw funds at any time. In the U.S., you can contribute $6,500 each year for those below the age of 50.

For those over 50, the contribution limit rises to $7,500.

Take Advantage of Taxable Investing Options

If you still have some money left, you may choose to diversify your investments and gain exposure to asset classes such as real estate, allowing you to create a passive income stream.

You can reduce your taxable income by more than $12,000 by taking advantage of mortgage-related tax breaks.

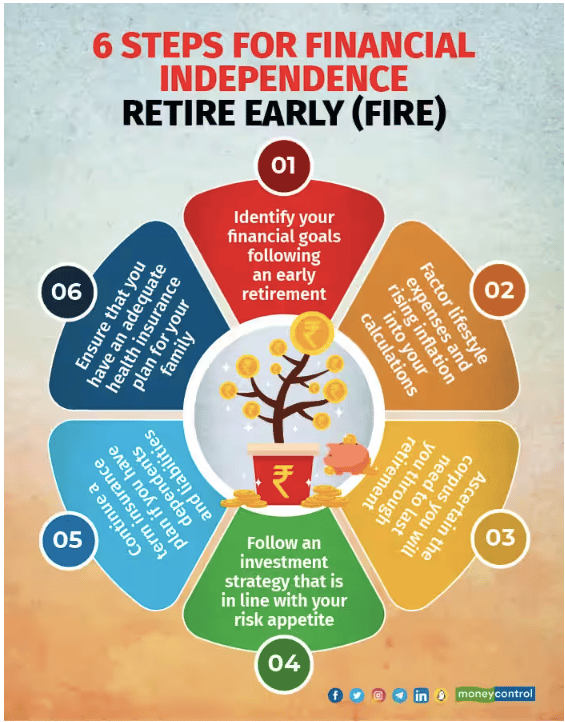

How Much Money Do You Need to Retire?

Retirement planning involves multiple considerations. For instance, you need to accommodate for inflation and a higher cost of living in later years.

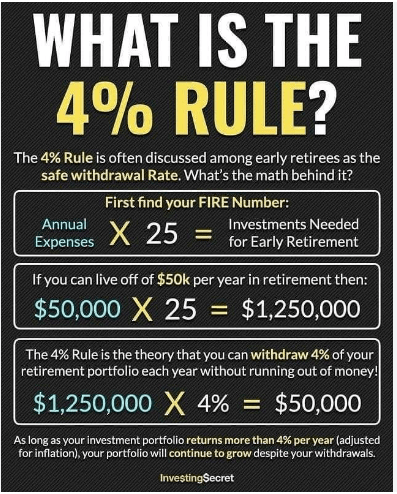

The 25x rule is an easy way to estimate the amount of money you need to save for retirement. Here, you calculate the annual retirement income you expect to provide from your own savings and multiply it by 25.

Let’s say you have settled on a retirement expense budget of $75,000 each year. Sources of income such as pension plans, social security, and even a part-time job or consultancy may help you offset a portion of these expenses.

In case you need to cover $50,000 per year, according to the 25x rule, you need to save at least $1.25 million to safely withdraw $50,000 of income in your first year of retirement.

Moreover, you may owe income or capital gains tax, depending on the type of account from where you withdraw the amount.

What’s the 4% rule

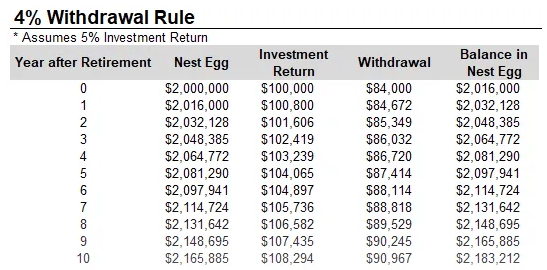

Back in 1994, a certified financial planner called William Bengen used historical market and inflation data to determine retirees could withdraw 4% of their portfolio without running out of money for a 30-year period.

Source: Pandora- Medium

Here, you also adjust for inflation rates for every subsequent annual withdrawal. So, if you withdraw $50,000 in the first year and inflation is 5%, your withdrawal in year two will be $52,500.

Keep in mind that the 4% rule isn’t a guarantee. There is a small chance that future markets and inflation could deplete a portfolio that follows this rule in less than 30 years.

Understand the initial withdrawal rate

The 4% rule is based on an initial withdrawal rate or IWR of 4%. But you may be comfortable to withdraw more or less from your portfolio in retirement.

If you have a low-risk appetite and are concerned about rising inflation, a conservative portfolio would mean you need to withdraw a smaller percentage of your portfolio annually.

So, if we decrease the IWR to 3%, you need to save 33x of your annual expense for retirement. Here, if your annual post-retirement expense is $50,000 based on the 33x rule, your retirement nest egg should be at least $1.65 million.

Alternatively, you might be optimistic about your portfolio returns and are comfortable about withdrawing a greater percentage of your savings. If we increase the IWR to 5%, you need to have 20x your annual expense in total savings.

So, what’s your retirement number?

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research