- 3 Big Scoops

- Posts

- Apple Tops $3 Trillion

Apple Tops $3 Trillion

Apple, China, and Bitcoin

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 4,567.18 ( ⬇️ 0.057%)

Nasdaq Composite @ 14,229.91 ( ⬆️ 0.31%)

Bitcoin @ 43,984.32 ( ⬆️ 5.6%)

Hey Scoopers,

Welcome to Wednesday! Midweek milestone achieved.

Here’s our top stories for the day:

👉 Apple is valued at $3 trillion

👉 Moody’s downgrades China

👉 Bitcoin hits $44,000

So, let’s go 🚀

Apple’s Market Cap Closes Above $3 Trillion

Apple shares climbed 2% yesterday to $193.42, allowing the tech giant to close with a market cap of $3 trillion for the first time since August.

Apple initially broke the $3 trillion barrier in June after briefly touching the milestone during intraday trading last December. AAPL stock hit a record high in July and remains the world's most valuable publicly traded company.

Apple’s recent surge showcases its durability as shares have gained close to 50% in 2023 despite a sluggish macro environment.

Apple is viewed as a fortress on Wall Street due to its strong branding and portfolio of products such as the iPhone, Apple Watch, and the Airpod.

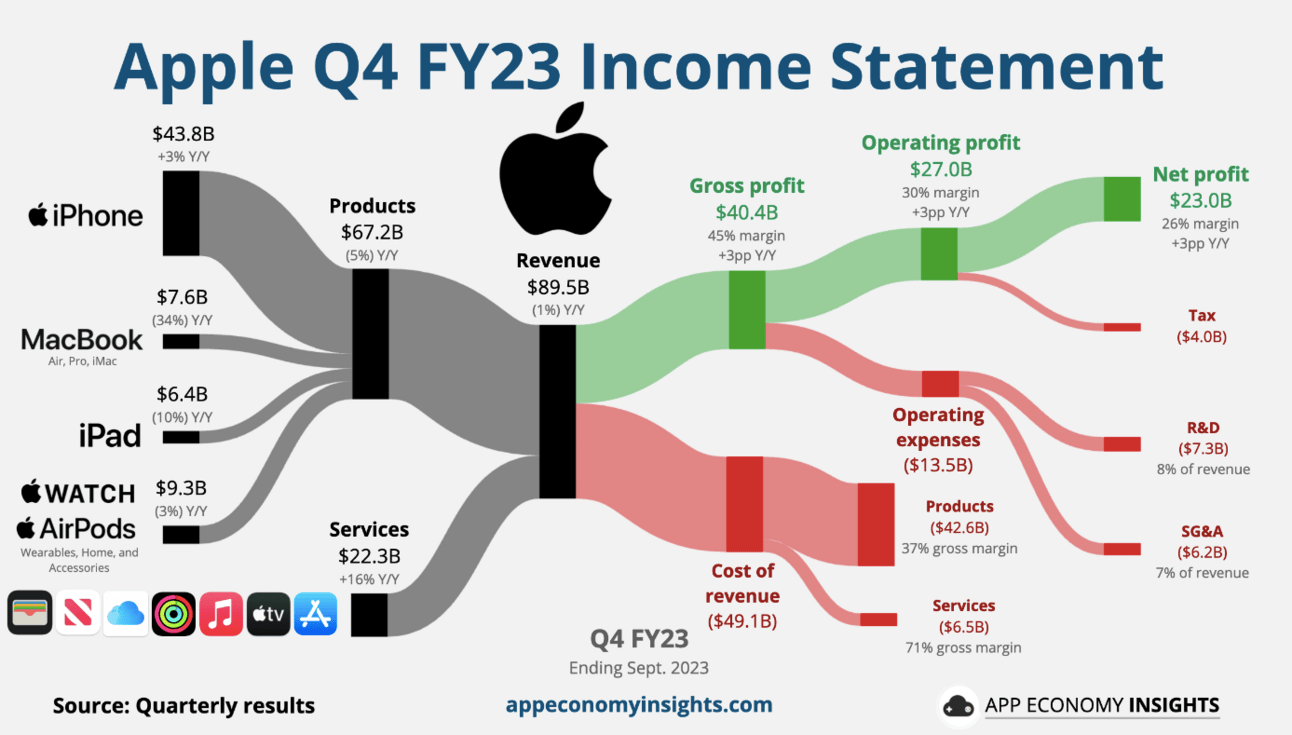

Over the years, Apple has diversified its revenue streams, with the Services business raking in $85 billion in the last 12 months.

Apple will release its Vision Pro virtual reality headset next year, its first major computing platform since introducing the Apple Watch in 2014.

Apple has been wrestling with slowing growth in markets such as China. In fiscal 2023, it reported revenue of $383.29 billion, down 3% from the prior year.

Moreover, last month, Apple warned it doesn’t expect sales to grow in the all-important December quarter, which is also the first full quarter with iPhone 15 sales.

Moody’s Cuts China’s Credit Outlook

Moody’s downgraded its outlook on China’s government credit rating to negative from stable.

Source: Bloomberg

The agency expects government bailouts for distressed local governments and state-owned companies to diminish China’s fiscal, economic, and institutional strength.

However, Moody’s reiterated China’s “A1” long-term rating on its sovereign bonds while expecting China’s annual GDP growth to slow to 4% in the next two years and average 3.8% between 2026 and 2030.

In recent months, China has allowed local governments to borrow funds for the year ahead and announced a mid-year fiscal revision, including the issuance of $137 billion in government debt.

Will the credit outlook make raising debt from international markets an expensive ordeal for China?

Bitcoin Tops $44,000

Bitcoin continues to build on its upward momentum as prices of the flagship cryptocurrency topped $44,000 for the first time since April 2022 on Tuesday.

Bitcoin’s Price Chart

BTC prices have surged more than 150% in 2023 and are up 25% in the past month as the drumbeat for a spot bitcoin exchange-traded fund in the U.S. grows louder.

Additionally, investors expect the upcoming Bitcoin halving event and the possibility of lower interest rates to act as a crucial driver for BTC prices in the near term.

Bitcoin has been reaching new 2023 highs quite frequently in the past eight weeks. It broke through the $40,000 barrier over the weekend after beginning November at $34,000.

Valued at a market cap of $859 trillion, Bitcoin accounts for more than 50% of the total cryptocurrency market.

Headlines You Can’t Miss!

Is generative AI an issue for Big Tech?

U.S. jobs data suggests a soft landing is likely

Vietnamese companies eye IPO listings in the U.S.

China’s young buyers hunt for bargains as economy slows

Bitcoin scarcity to surpass that of gold

Chart of the Day

Source: Visual Capitalist

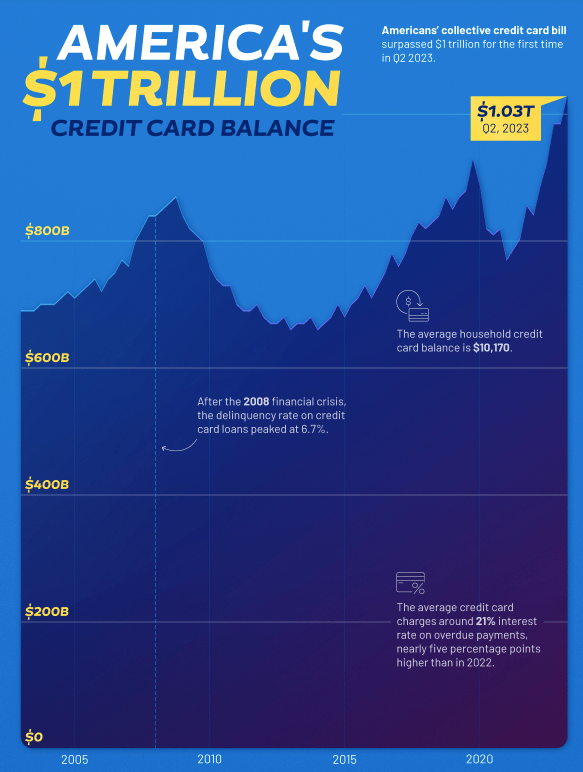

The cumulative credit card debt in the U.S. surpassed $1 trillion for the first time in Q2 of 2023. Total credit card balance rose by $45 billion in Q2 to $1.03 trillion.

Stimulus checks resulted in a sharp contraction of credit card debt at the onset of COVID-19. However, credit card balances have grown year over year for seven consecutive quarters.

Here are a few mind-boggling numbers surrounding the credit card industry in the U.S.:

Around 92 million new credit cards were issued each year between 2017 and 2019

The average household credit card balance stood at $10,173.87 in June, which was still $2,242.77 below the record set in Q4 of 2007.

The average interest rate charged by credit cards is 21%

The number of new credit card accounts has risen by 70 million since 2019

Around 69% of Americans possess at least one credit card

Credit card balances in Q2 saw the most significant increase across debt types such as mortgages, auto loans, and student loans.

Rising balances and higher interest rates present challenges for several borrowers. Further, the resumption of student loan payments has increased the financial strain on several student loan borrowers in 2023.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.