- 3 Big Scoops

- Posts

- A Santa Claus Rally In 2023?

A Santa Claus Rally In 2023?

Costco, China and Ethereum

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 4,719.55 ( ⬆️ 0.26%)

Nasdaq Composite @ 14,761.56 ( ⬆️ 0.19%)

Bitcoin @ $42,655.20 ( ⬇️ 0.51%)

Hey Scoopers,

Happy Friday!! The weekend is on the horizon, and we are wrapping up.

Here’s what’s on the menu for today:

👉 Costco’s earnings

👉 China’s industrial expansion numbers

👉 Ethereum’s falling supply

So, let’s go 🚀

Costco Beats Estimates

Big-box retail giant Costco just reported its results for fiscal Q1 of 2024 (ended in November). It ended Q1 with revenue of $57.8 billion and adjusted earnings of $3.48 per share.

Comparatively, Wall Street forecast revenue at $47.79 billion and earnings at $3.41 per share. While sales rose 6.1%, earnings surged by an impressive 16.6% year over year in the quarter.

Costco’s comparable sales rose by 3.9%, while e-commerce revenue was up 6.1%. The key drivers of the company’s sales in the November quarter were televisions, food, and appliances.

Costco enjoys a competitive moat and pricing power, allowing it to increase earnings amid a sluggish macro backdrop.

Additionally, its robust membership model enables Costco to benefit from repeat purchases and a loyal customer base.

With a global renewal rate of 90.5%, Costco’s membership fees were up 8%. Further, it ended Q3 with 72 million paid household members and 129.5 million cardholders, both of which rose 7% in Q1.

While Costco pays shareholders an annual dividend of $4.08 per share, it announced a special dividend of $15 per share worth $6.7 billion!!!

A Soft Landing on the Horizon?

Earlier this week, Fed Chairman Jerome Powell indicated plans to lower interest rates in 2024, increasing investor optimism in the process. But why does this matter?

Coz, lower interest rates will allow corporates to fuel their expansion plans at a cheaper rate. Wall Street expectedly cheered the news, driving the Dow Jones to record highs.

So far, The Fed has managed to avoid a full-blown recession, and its current strategy could lead to a “soft landing,” a scenario previously viewed with skepticism.

In 2023, the S&P 500 index has surged close to 24%, while the tech-heavy Nasdaq Composite index has gained a whopping 42%. Will a Santa Claus rally drive indices higher by the end of 2023?

China’s Industrial Output Gains Pace

China’s industrial output grew 6.6% year over year in November, well ahead of estimates of 5.6%. In October, the country’s industrial output surged by 4.6%.

Further, retail sales surged 10.1%, the fastest pace of growth in six months. However, it was below growth forecasts of 12.5%.

Source: Getty Images

China’s fixed asset investment in urban areas grew 2.9% in the first 11 months of 2023, just below estimates of 3%, while the urban unemployment rate stayed at 5%.

Our take

China’s post-COVID-19 recovery has fallen short of expectations due to rising debt and a real estate crisis. The world’s second-largest economy announced a slew of policy support measures that have failed to lift investor sentiments.

Why is Ethereum’s Supply Falling?

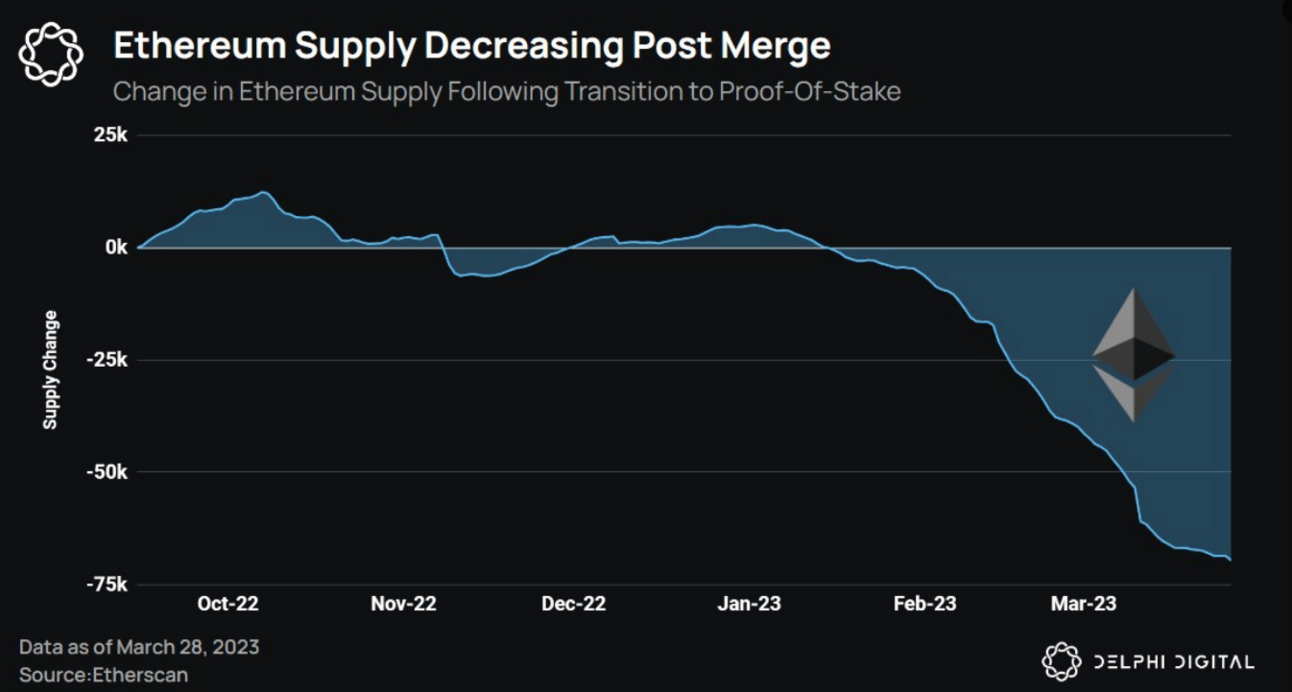

Ethereum’s supply is at its lowest since its transition to a proof-of-stake mechanism in mid-2022. Due to this “merge,” the second largest cryptocurrency has reduced energy consumption by 99.9%.

However, this has also resulted in lower blockchain rewards for stakers and a lower supply of ETH tokens. Ethereum’s burn mechanism has meant a few ETH tokens are “burnt” on each transaction.

It has also resulted in a 0.21% decline in ETH’s annual supply, which suggests more tokens are burnt than issued. ETH’s supply has declined by more than 315k, indicating $725 million less ETH is in supply than before.

Our take

Ethereum has trailed Bitcoin returns in 2023. But its supply mechanism might lead to a more substantial rally once demand returns as market sentiment improves.

Headlines You Can’t Miss!

Intel takes on Nvidia and AMD with new AI chip

GM to layoff 1,300 workers in Michigan

Bank of England holds policy

Amazon wins $270 million tax cut with EU

JPMorgan expects Ethereum to outshine Bitcoin in 2024

Chart of the Day

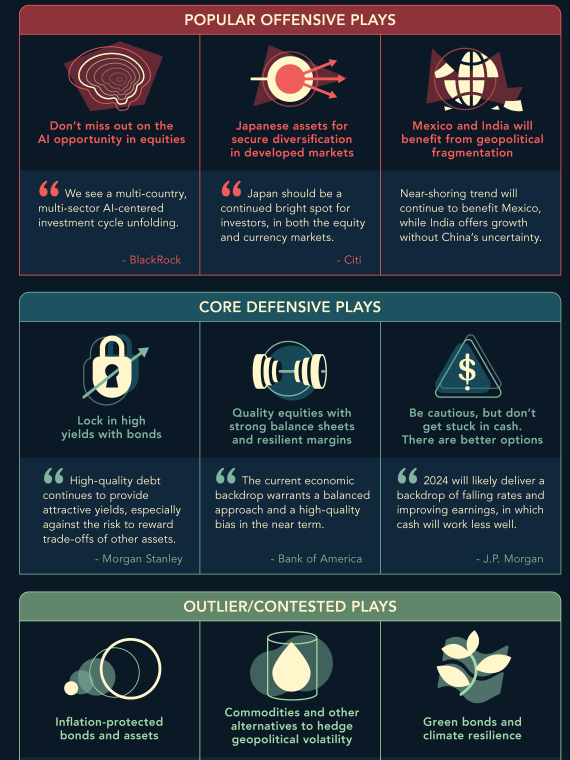

Source: Visual Capitalist

Investors are looking ahead to the global economic environment in 2024, which continues to wrestle with higher interest rates, geopolitical tensions, and sluggish growth.

So, let’s see what the largest investment banks and asset managers are advising investors.

👉 UBS expects government bond markets are overpricing the risk that high interest rates will represent the new normal. It expects yields to fall in 2024 and emphasizes investors should lock in yields in quality bonds right now.

👉 BlackRock and Bank of America highlight opportunities in inflation-lined bonds such as the TIPS (Treasury Inflation-Protection Securities), which offer stable income across durations while insulating you against inflation.

👉 Several banks also favor large-cap stocks with solid balance sheets and robust cash flows that can help them withstand an economic downturn.

👉 Artificial intelligence is a common investment theme or megatrend that the banks are betting on. You may look to gain exposure to underlying hardware and data center providers such as Microsoft and Nvidia.

👉 You can gain geographic diversification by investing in emerging markets such as India, which is poised to be the fastest-growing major economy in the world in the next decade.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.