- 3 Big Scoops

- Posts

- Google Unveils Gemini

Google Unveils Gemini

Google, oil and BTC

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 4,549.34 ( ⬇️ 0.39%)

Nasdaq Composite @ 14,146.71 ( ⬇️ 0.58%)

Bitcoin @ $43,694.23 ( ⬇️ 0.28%)

Hey Scoopers,

Get ready! We have an exciting newsletter for you.

Here’s what is going on today:

👉 Google launches Gemini

👉 Oil prices slump below $70

👉 Bitcoin valued at $850 billion

So, let’s go 🚀

Google Takes on ChatGPT

Google just launched what it believes is the largest and most capable AI (artificial intelligence) model. The large language model called Gemini includes:

👉 Gemini Ultra- Its largest and most capable category

👉 Gemini Pro- Which scales across a wide range of tasks and

👉 Gemini Nano - Used for specific tasks and mobile devices

The tech giant plans to license Gemini to customers through Google Cloud. Developers and enterprise customers can access Gemini via an API in Google AI Studio or the Google Cloud Vertex AI.

Source: Bloomberg

Google emphasized companies can use Gemini for advanced customer service engagements via chatbots and production recommendations. Enterprises can also use it to identify trends for advertising campaigns.

The AI update by Google comes eight months after it first launched Bard and almost a year after OpenAI introduced ChatGPT to the world.

Google claimed that Gemini Pro outperformed GPT 3.5 but dodged questions about how it compared against GPT-4.

Google shares are up 2.6% in pre-market trading today. The AI war is heating up!

Why Are Crude Oil Prices Falling?

U.S. crude fell 4% on Wednesday, closing at the lowest level in almost five months. Further, gasoline prices hit the lowest point since January, just before the upcoming holiday shopping and travel season.

U.S. crude and the global benchmark have fallen for five consecutive days despite efforts by OPEC+ to boost prices by lowering supply in Q1 of 2024.

Oil prices have spiraled downwards after touching 2023 highs in September as the U.S. raised supply. Additionally, a sluggish global economy is also weighing heavily on oil demand.

For instance, China’s economy remains under pressure while Moody’s downgraded its outlook on the country’s government credit rating to negative from stable.

U.S. crude inventories were down by 4.6 million barrels last week, but gasoline inventories rose by 5.6 million barrels.

Oil traders are skeptical that OPEC+ will deliver on supply cuts of 2.2 million bpd in Q1 next year. After failing to agree on production targets, several OPEC+ members announced voluntary cuts last week.

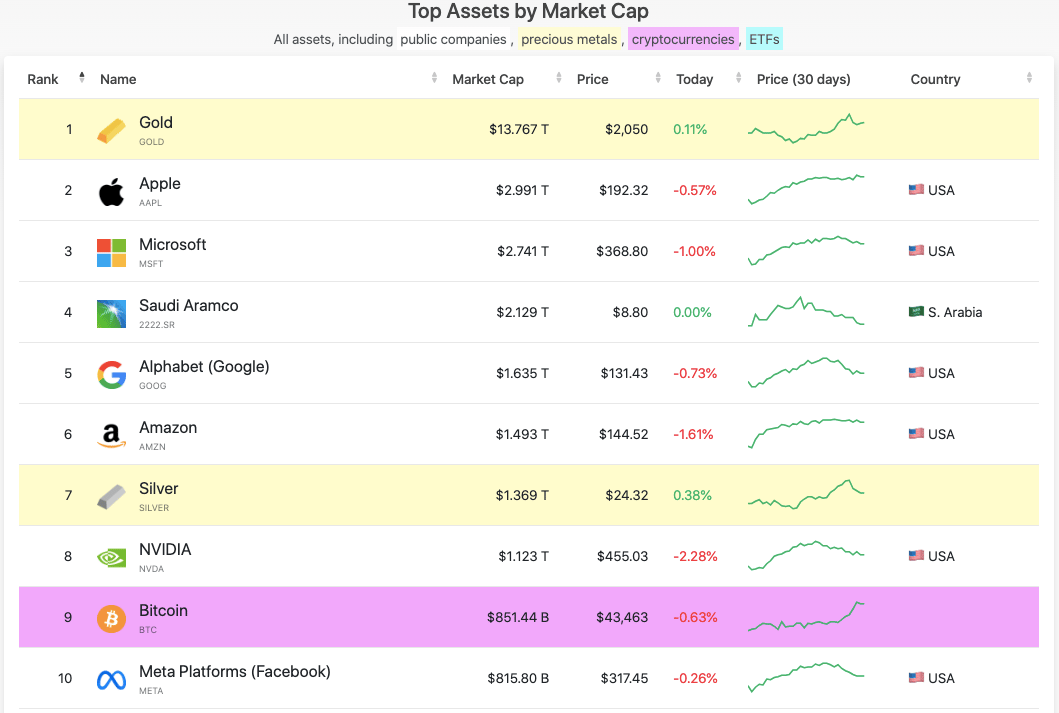

Bitcoin Breaks Into the Top 10

Bitcoin is now the ninth most valuable asset in the world, valued at $850 billion by market cap.

Source: companiesmarketcap.com

Launched 15 years back, the flagship cryptocurrency has taken investors on a roller coaster ride while generating massive wealth.

Since its launch in 2008, Bitcoin has:

Lost 80% in market value multiple times

Survived several “industry nukes,” including exchange hacks and the collapse of FTX and Luna

Been blamed for illicit activities such as money laundering

Been banned by countries, including China

Despite these headwinds, Bitcoin is among the top 10 most valuable assets in the world today.

Bullish!

Headlines You Can’t Miss!

China’s property market may take 4-6 years to resolve

Meta and Microsoft to buy AMD AI chips

AbbVie to acquire Cerevel Therapeutics for $8.7 billion

McDonald’s to open first CosMc’s spinoff restaurant

JPMorgan slams crypto

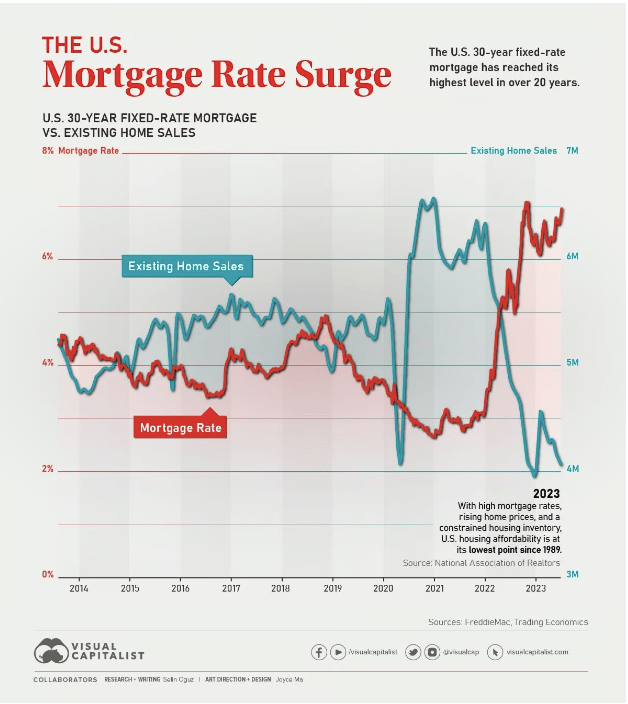

Chart of the Day

Mortgage rates in the U.S. are easing back toward the 7% threshold this month after rising more than 8% in October 2023, sparking interest in the refinancing space.

In the past week, the average contract interest rate for 30-year fixed-rate mortgages for loans up to $726,700 fell to 7.17% from 7.37%.

The pullback represented the lowest rate level seen since August. As rates moved lower, refinancing home loan applications surged 14% last week, 10% higher than the prior-year period.

It’s important to note that the current level of refinancing demand remains restrained, given that most borrowers had pursued refinancing during the onset of COVID-19 when interest rates nosedived.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own resea