- 3 Big Scoops

- Posts

- Reddit's Blockbuster Debut

Reddit's Blockbuster Debut

PLUS: DoJ vs. Apple

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 5,241.53 ( ⬆️ 0.32%)

Nasdaq Composite @ 16,401.84 ( ⬆️ 0.20%)

Bitcoin @ $66,114.60 ( ⬆️ 0.71%)

Hey Scoopers,

TGIF! Here’s what is moving the markets

👉 Reddit surges post IPO

👉 Apple slumps over 4%

👉 Solana’s popularity is rising

So, let’s go 🚀

Market Wrap 📉

Stocks continued their impressive rally adding to the previous session’s gains, powering all three major indices to new record closing levels.

Micron Technology surged 14% on strong earnings, notching its best day in more than 12 years. The news lifted the semiconductor sector giants, with Nvidia, Broadcom, and Taiwan Semiconductor leading the gains.

The gains came as the Federal Reserve reiterated expectations for three interest rate cuts in 2024 but kept borrowing costs unchanged in March. The central did not elaborate on the timing of cuts but expects rates to ease once inflation data trends lower.

Alternatively, it's possible the market is getting overexcited about the prospect of multiple rate cuts this year. Bond rates could remain elevated, especially if inflation is not tamed.

Trending Stocks 🔥

Lululemon Athletica - Shares of the athleisure company dropped 10% after it posted weak guidance and reported growth is slowing in North America.

FedEx - Shares popped nearly 13% after the shipping company beat quarterly earnings expectations.

Dutch Bros - Shares of the coffee chain slumped 5% after the announcement of a secondary share offering.

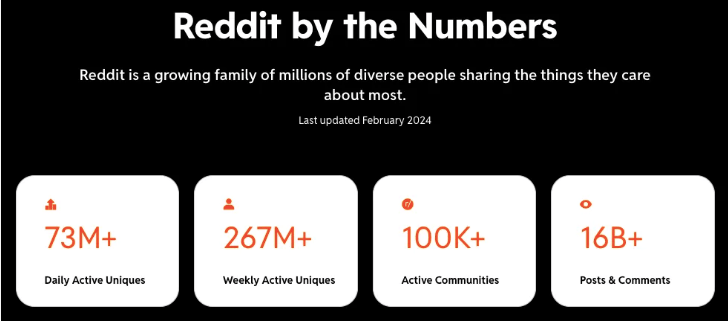

Reddit Surges 48% On Listing Debut

Reddit shares jumped 48% on their debut yesterday, in the first initial public offering (IPO) for a social media company since Pinterest’s listing in 2019.

Source: Reddit

Reddit priced its IPO at $34 a share, at the top of the expected range. It raised $750 million from the offering and closed at $50.44, valuing it at $9.5 billion by market cap. Reddit trades under the ticker symbol “RDDT.”

Reddit’s annual sales for 2023 rose 20% to $804 million, up from $667 million in 2023. Its net losses narrowed to $90.8 million from $158.6 million in 2022.

DoJ Sues Apple

The Department of Justice plans to sue Apple after accusing the tech giant of breaching antitrust laws by not allowing competitors to use certain iPhone features.

Source: Patently Apple

The Biden administration is challenging big tech companies, including Alphabet, Meta, and Amazon, for similar issues. It is the third time since 2019 that the DoJ has sued Apple.

Earlier this month, Apple was fined $1.8 billion by the European Union for limiting competition in music streaming services.

While the equity markets closed at all-time highs, Apple stock trades 14% below record levels, after it lost 4.1% or $113 billion in a single trading session yesterday.

Nike Plunges On Weak Outlook

Shares of Nike are down roughly 6% in pre-market trading today following its quarterly results. In fiscal Q3 of 2024 (ended in February), Nike reported:

Revenue of $12.43 billion vs. estimates of $12.28 billion

Earnings per share of $0.77 vs. estimates of $0.74

While Nike beat consensus estimates in Q3, the company’s sales slowed in China during the holiday quarter, which was offset by robust sales in North America and price changes.

Last December, Nike announced a broad restructuring plan to reduce costs by $2 billion over the next three years. It also cut sales guidance due to soft demand in the near term.

The retail giant trails the broader market and is down close to 50% from all-time highs.

AI for a healthier internet

Guess which AI company is one of the fastest-growing companies this year?

It's Otherweb! They've developed a new platform for news and social discussion, growing to over 8 million monthly active users in just 15 months.

In 1998, Google began solving the problem of how to find stuff on the internet and became one of the largest and most successful companies.

Nowadays, the actual problem is how to filter out unnecessary stuff... And it seems like Otherweb is on its way to solving it.

You have the chance to invest alongside 2000+ investors, including founders with $100M+ exits, VCs, angels, executives from Google and Amazon, and more.

Home sales, Manufacturing, and Jobless Claims

Existing home sales posted an unexpected surge in February despite a big jump in prices. According to a report from the National Association of Realtors, home sales rose by 9.5% from January, while analysts forecast a 1.3% decline. It was the largest jump in the last 12 months.

Median sales prices rose 5.7% year over year to $384,500, while the 30-year fixed-rate mortgage averaged 6.74%, down 0.14 percentage points on the month.

Source: Getty Images

Next up is manufacturing activity in the U.S., which hit a 22-month high in March. The index came in at 52.5 for March, up from estimates of 51.8.

On the services side, PMI declined by 0.6 points to 51.7 and was below estimates of 51.8.

Finally, flings for unemployment insurance changed marginally last week, indicating a strong job market. Jobless claims totaled 210,000 for the week ended on March 16, lower than estimates of 213,000.

Continuing claims, which run a week behind, edged up to 1.807 million, an increase of 4,000 and slightly higher than the 1.79 million estimate.

Solana Gains Traction In 2024

A report from CoinGecko Research stated that the Solana network is the most popular blockchain ecosystem in 2024, accounting for 49.3% of global crypto investor interest.

Earlier this week, Solana surged over $200, trading at its highest level since 2021, driven by a surge in network trading volume.

In the last 12 months, Solana has rallied over 700% and is now the fourth largest cryptocurrency globally.

A majority of Solana’s activity in 2024 has occurred on decentralized exchanges as traders are accumulating memecoins. In the last four months, Solana-based DEXs have been capturing market share from Ethereum DEXs such as Uniswap.

Headlines You Can't Miss!

Taiwan shares hit record high on AI boom

Sam Altman’s Reddit stake is worth over $600 million

This $418 million settlement could slash home-buying costs

Bank of England holds interest rates

Crypto exchange OKX exits India

Chart of The Day

The above chart shows us the 12 worst investment funds in the last decade. Its evident several of the funds are focused on emerging markets such as China or follow an inverse equity strategy.

The U.S. stock market has experienced an upward trend for close to 15 years despite pullbacks in 2020 (COVID-19 pandemic) and 2022 (rising interest rates).

According to Visual Capitalist, massive losses were experienced by the ProShares UltraPro Short QQQ (SQQQ), which seeks daily investment results that correspond to three times the inverse (-3x) of the daily performance of the Nasdaq-100.

China-focused funds have also performed poorly, as Chinese stocks have lost more than $6 trillion in market cap since 2021. The country is grappling with headwinds such as a sluggish economy, a troubled real estate market, and a crackdown on tech firms by officials.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.