- 3 Big Scoops

- Posts

- Reddit Files for IPO

Reddit Files for IPO

PLUS: Housing demand is volatile

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

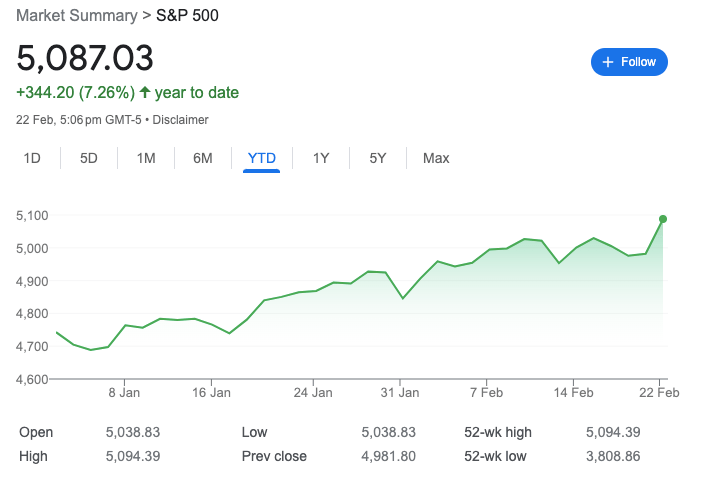

S&P 500 @ 5,087.03 (⬆️ 2.11%)

Nasdaq Composite @ 15,580.87 ( ⬆️ 2.96%)

Bitcoin @ $51,188.60 ( ⬇️ 0.12%)

Hey Scoopers,

Happy Friday! Here’s what’s making waves today:

👉 An upcoming IPO

👉 Interest rates and housing demand

👉 The Bitcoin rally

So, let’s go 🚀

Market Wrap 📉

Indices such as the S&P 500 and Nasdaq Composite just posted their best day in 14 months, powered primarily by Nvidia.

Shares of the chip giant soared 16% on the back of stellar quarterly results, driving the Nasdaq higher by almost 3%. The tech-heavy index is now within striking distance of all-time highs. The Dow Jones index gained 1.18%, closing at a record high.

Moreover, 10 of the 11 S&P sectors closed in the green yesterday, with utilities being the sole loser. Sectors such as industrials and healthcare closed at fresh record highs.

Trending Stocks 🔥

Block - Shares of the fintech company are up 14% in pre-market after Q4 revenue surpasses Wall Street estimates.

Carvana - The stock is up 24% after the used car retailer expects retail units to grow in 2024.

Booking Holdings - The online travel giant beat earnings and revenue estimates in Q4 but is down 4% in pre-market today. It also initiated a quarterly cash dividend of $8.75 per share.

Reddit Will List on the NYSE

Reddit, one of the largest social media platforms in the world, just filed for an IPO (initial public offering). The company will list on the New York Stock Exchange under the "RDDT" ticker.

The company should go public next month and will be the first major tech IPO of the year. It will also be the first social media IPO since Pinterest went public five years back.

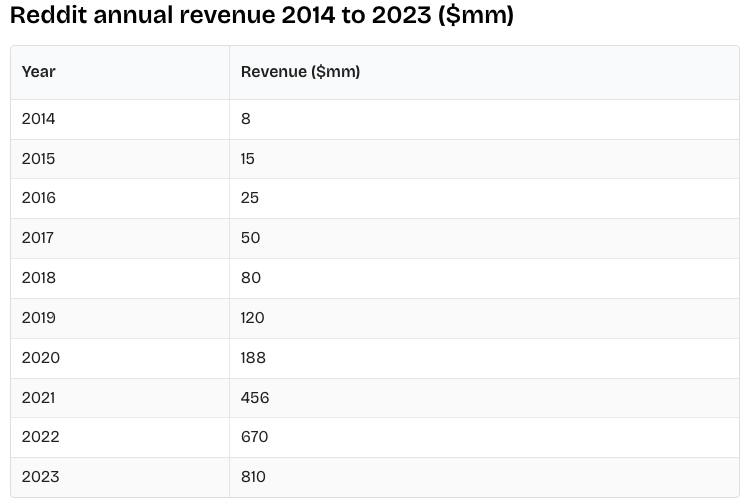

Source: BusinessofApps

Founded in 2005, Reddit ended 2023 with sales of $804 million, up from $666.7 million in 2022. Like other social media platforms, Reddit generates most of its revenue from online ads.

The company remains unprofitable, reporting a net loss of $90.8 million, narrower than the year-ago loss of $158.6 million.

With more than 100k communities and 73 million daily active users, Reddit ended Q4 of 2023 with an average revenue per user (in the U.S.) of $5.51, below the year-ago figure of $5.92.

Reddit has raised $1.3 billion in funding to date and is valued at $10 billion, according to data from PitchBook.

Mortgage Rates Top 7%

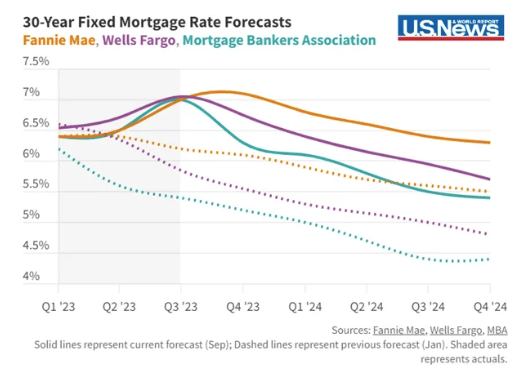

Mortgage rates increased last week and are at the highest level since December 2023, negatively impacting mortgage demand.

A report from the Mortgage Bankers Association stated that total application volume fell 10.6% compared with the previous week. Average contract rates for 30-year fixed-rate mortgages with conforming loan balances of less than $766k rose to 7.06% from 6.87%.

Mortgage applications to purchase a home plunged 10% for the week and were down 13% compared to the year-ago period. It’s evident that potential homeowners are sensitive to rate changes and higher home values in a market constrained by supply.

Mortgage rates jumped higher last Friday after a report on wholesale prices indicated inflation is persistent and remains higher than estimates.

JPMorgan believes the recent crypto rally is largely fueled by individual traders making impulsive decisions and not by market fundamentals. The GMCI 30 index, which holds the 30 largest cryptocurrencies, has risen 13% in 2024.

According to the investment bank, retail impulse buying is showcased by analyzing on-chain cumulative Bitcoin flows, distinguishing between small and large wallets.

Another indicator is the rise in popularity of AI and meme tokens, prices of which have rebounded in the last month.

Headlines You Can't Miss!

Ride-hailing giant Grab turns profitable

Builders FirstSource is bullish on housing demand

The Fed maintains a cautious stance on rate cuts

StanChart raises dividends, announces buyback

Nigeria blocks access to three major crypto exchanges

Chart of The Day

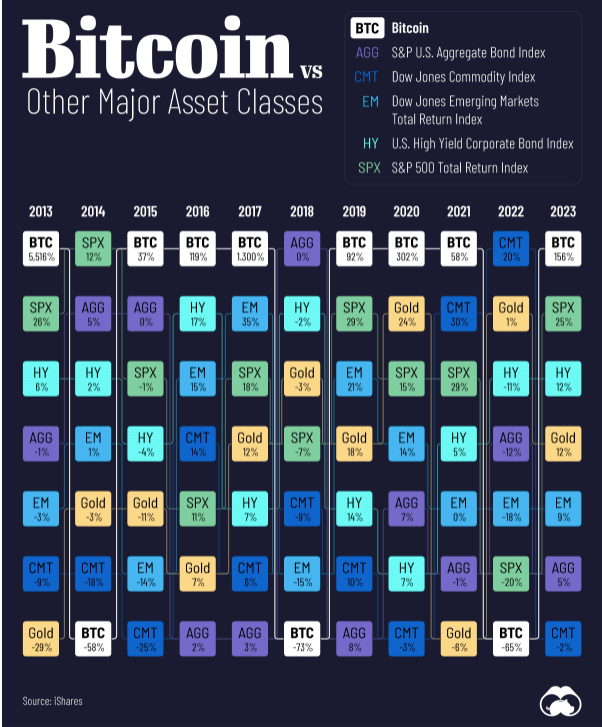

The crypto winter ended in 2023, with Bitcoin soaring 156% last year. The world’s largest cryptocurrency outperformed all major asset classes, recording its best year since 2020.

Several factors drove BTC prices higher, including the anticipated launch of 11 Bitcoin ETFs, making crypto accessible to a broader investor base.

Comparatively, the S&P 500 index returned 25% in 2023, much higher than its historical average of 11.5%, while U.S. bonds returned 5%.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research