- 3 Big Scoops

- Posts

- Pepsi Lowers Full-Year Guidance

Pepsi Lowers Full-Year Guidance

PLUS: Rio Tinto acquires Arcadium Lithium

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

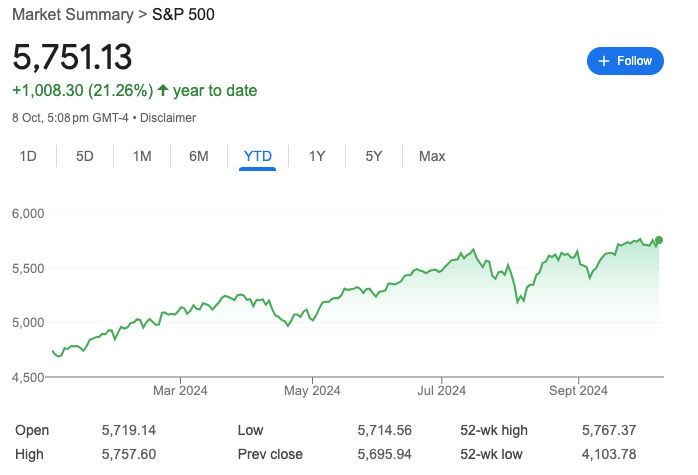

S&P 500 @ 5,751.13 ( ⬆️ 0.97%)

Nasdaq Composite @ 18,182.92 ( ⬆️ 1.45%)

Bitcoin @ $63,126.50 ( ⬇️ 0.03%)

Hey Scoopers,

Happy Wednesday! Are you ready to tackle the midweek mania?

👉 Pepsi disappoints Wall Street

👉 Rio Tinto’s $6.7 billion acquisition

👉 GM provides an update

So, let’s go 🚀

Market Wrap

Equities rebounded on Tuesday following a losing session on Wall Street as oil prices eased and investors assessed ongoing tensions in the Middle East.

West Texas Intermediate oil futures dropped 4.6% as traders monitored Israel’s expected retaliation to Iran's missile attacks and U.S. efforts to prevent a wider regional conflict.

The move pressured energy stocks, with the sector slumping by 2.6%, led by declines in Marathon Petroleum and Valero Energy.

Notably, refiner stocks are tumbling as Hurricane Milton is expected to depress gasoline demand in the coming days. Hurricane Milton will not disrupt oil infrastructure but could result in demand destruction as people drive less in the wake of a storm.

Elsewhere, tech stocks powered the index, with Nvidia and Broadcom gaining 4% and 3%, respectively.

Trending Stocks 🔥

Casino stocks - Shares of Wynn Resorts and Las Vegas Sands fell over 3% after China skipped new stimulus measures.

DocuSign - The e-signature stock rose over 5% on news that it will replace MDU Resources in the S&P 500 MidCap 400 index.

China stocks - Shares of Chinese companies such as Nio, PDD, JD.com, and Alibaba moved lower after the Asian giant failed to announce any new major stimulus plans.

Pepsi Lowers 2024 Outlook

Pepsi lowered its full-year outlook for organic revenue after its second straight quarter of weaker-than-expected sales.

The repercussions of the Quaker Foods North America recalls, weakening demand in the U.S., and business disruptions in some international markets weighed on the company’s performance in the quarter.

In Q3, Pepsi reported:

👉 Revenue of $23.32 billion vs. estimates of $23.76 billion

👉 Earnings per share of $2.31 vs. estimates of $2.29

The beverage giant now expects a low-single-digit rise in organic sales, down from its prior outlook of 4% growth. However, it reiterated its forecast for an increase of 8% in earnings per share.

Net sales fell 0.6% year over year as volume across its food and beverage divisions declined by 2%.

Weak demand in North America weighed on volume as shoppers snacked less and made fewer purchases at convenience stores. Quaker Foods North America reported a 13% drop in volume as it issued its first recall for potential salmonella contamination in late 2023.

Meanwhile, Pepsi continues to broaden its portfolio and recently announced a $1.2 billion acquisition of Siete Foods.

Rio Tinto Acquires Lithium Producer

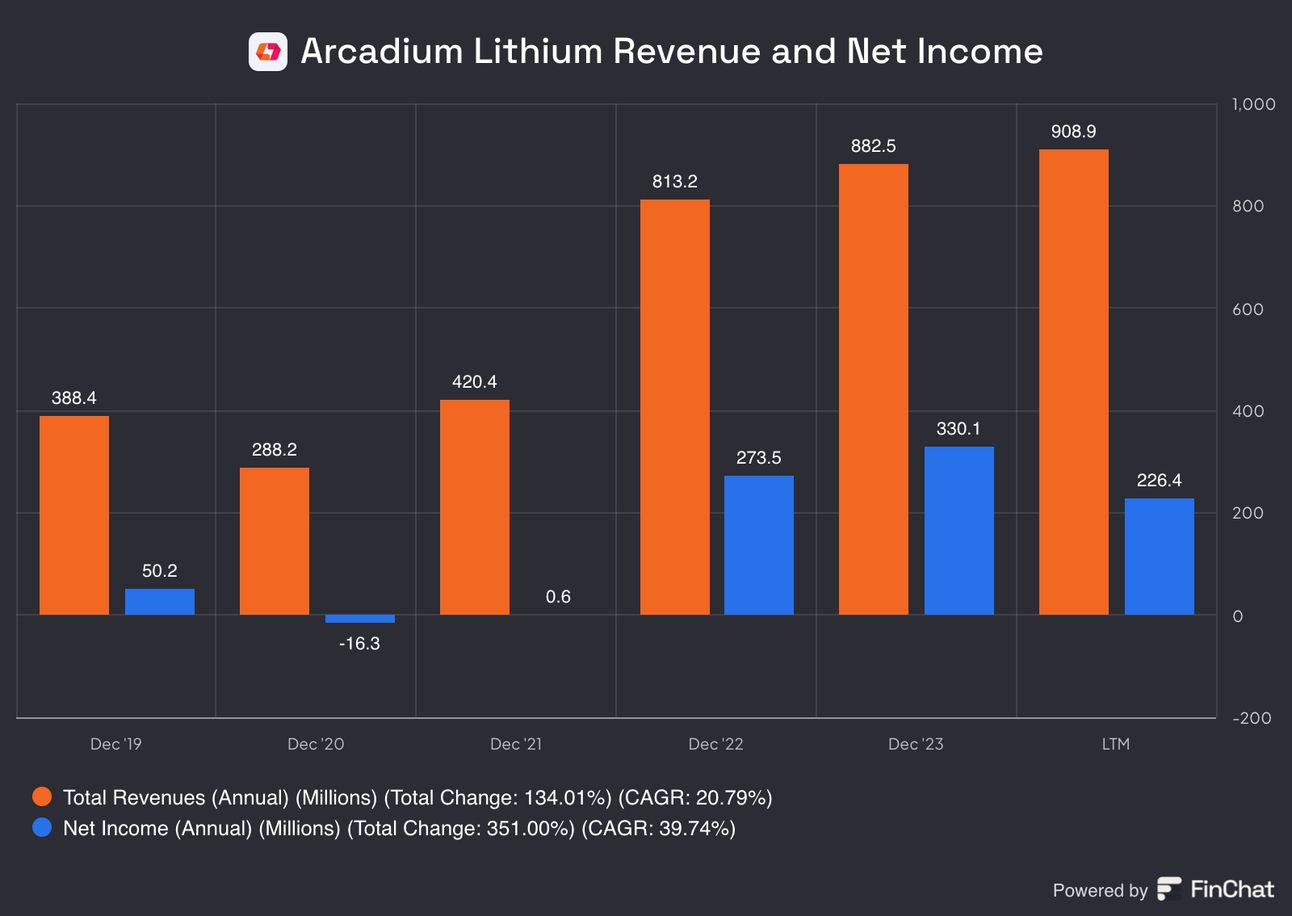

Rio Tinto, the world’s second-largest miner, announced it would acquire U.S. lithium producer Arcadium for $6.7 billion. The acquisition will create a world-class lithium business and complement Rio Tinto’s copper operations to supply materials needed for the energy transition.

Arcadum is currently valued at $3.31 billion, so the acquisition is offered at a 100% premium for shareholders. The deal would make Rio one of the world’s largest suppliers of the ultralight metal, behind Albemarle and SQM.

Lithium demand is expected to surge later this decade as more lithium-ion batteries are being used in EVs and consumer electronics.

Today, lithium prices are significantly below all-time highs due to China's oversupply of the elemental metal, making Arcadium an enticing acquisition target in 2024.

Rio would now gain access to lithium mines, processing facilities, and deposits across four continents, fueling decades of growth and supplying the commodity to customers such as Tesla and General Motors.

Arcadium generates 84% of its revenue from Asia and should benefit from secular tailwinds as EV projects ramp up in the Western Hemisphere.

General Motors Provides 2025 Guidance

General Motors expects adjusted earnings in 2025 to be in a “similar range” to 2024. In 2024, GM expects earnings before taxes to be $14 billion or $10 per share, above its previous guidance of $13.5 billion and $9.5 per share, respectively.

Auto industry sales and consumer spending have been slowing, and Wall Street expects the macro environment to become even more challenging for automakers in 2025.

General Motors emphasized that $2 billion to $4 billion in better earnings for EVs, in addition to growing sales and profits for legacy gas-powered vehicles, will assist earnings.

Based on current assumptions, GM will have eight vehicles next year, with an average EBIT margin nine points higher than previous comparable models.

Moreover, the auto giant will spend $11 billion in capital expenditures in 2024, which will be similar next year.

GM’s EV sales in Q3 rose by 60% year over year, and the tailwinds for this segment will be split between savings from increases in volume and lower costs, including for raw materials and battery production.

In the first nine months of 2024, GM reduced its EV variable profit by 30 points year over year. The automaker is on track to produce 200,000 EVs for North America in 2024 and achieve profitability on a contribution margin basis by the end of the year.

Headlines You Can't Miss!

Disneyland hikes prices for its highest-demand days

DoJ might consider Google breakup

Boeing withdraws contract offer after union talks end

China’s real estate stimulus raises optimism

Bitcoin might touch $150k in this bull cycle

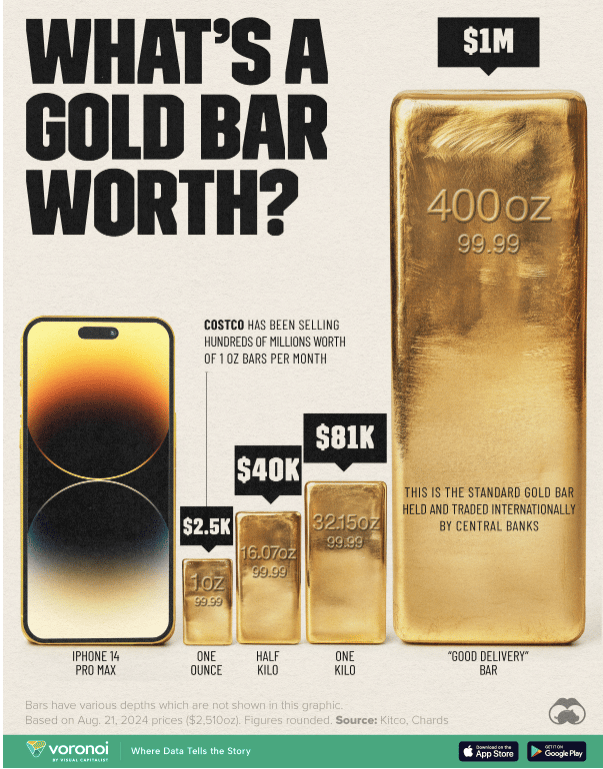

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.