- 3 Big Scoops

- Posts

- Nvidia Bullish on AI Chip Demand

Nvidia Bullish on AI Chip Demand

PLUS: Levi disappoints Wall Street

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

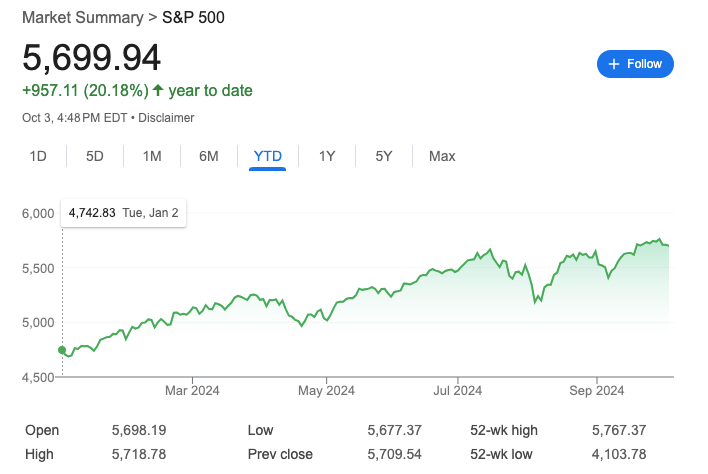

S&P 500 @ 5,699.94 ( ⬇️ 0.17%)

Nasdaq Composite @ 17,918.48 ( ⬇️ 0.037%)

Bitcoin @ $61,138.30 ( ⬇️ 0.28%)

Hey Scoopers,

Happy Friday! Are you ready for an exciting newsletter?

👉 Nvidia expects AI chip demand to remain robust

👉 Levi tanks over 7%

👉 Pepsi acquires Siete Foods

So, let’s go 🚀

Market Wrap

Equities fell on Thursday as concerns over Middle East tensions kept investors on edge while Wall Street awaits September’s nonfarm payrolls report.

Nonfarm payrolls are projected to grow by 150,000 from 142,000 in August, indicating an unemployment rate of 4.2%. Wages are forecast to increase 3.8% year over year with a monthly gain of 0.3%.

October trading is off to a rocky start. Geopolitical tensions have driven U.S. crude futures 8% higher this week, as growing fears tied to the Middle East have pushed up prices.

Energy stocks have rallied in tandem. The sector is up close to 6% in the last four trading sessions and is on pace for its best week in over a year.

Meanwhile, four of every five S&P 500 members traded in the red, with the small-cap index tumbling 0.7%.

Warner Bros. Discovery and Constellation Brands led the way with declines of almost 4%. On the other hand, utility giant Vistra jumped over 5.5%.

Trending Stocks 🔥

Hims & Hers Health - Shares of the health and wellness platform fell by 9.6% after the US FDA said the shortage of Eli Lilly's weight loss drugs has been resolved. Hims & Her Health had previously developed compound versions of the drugs to take advantage of the shortage.

Joby Aviation - Shares fell over 8%, paring back gains made in the previous session, where Joby rose nearly 28% after Toyota announced a $500 million investment in the company to support the certification and production of its electric air taxi.

Wolfspeed - The semiconductor stock fell 6% after Mizuho downgraded it to “underperform” from “neutral.” The firm sees pricing for semiconductor materials used in EVs to move lower in 2025. It also expects lower EV production to act as a potential headwind for the company.

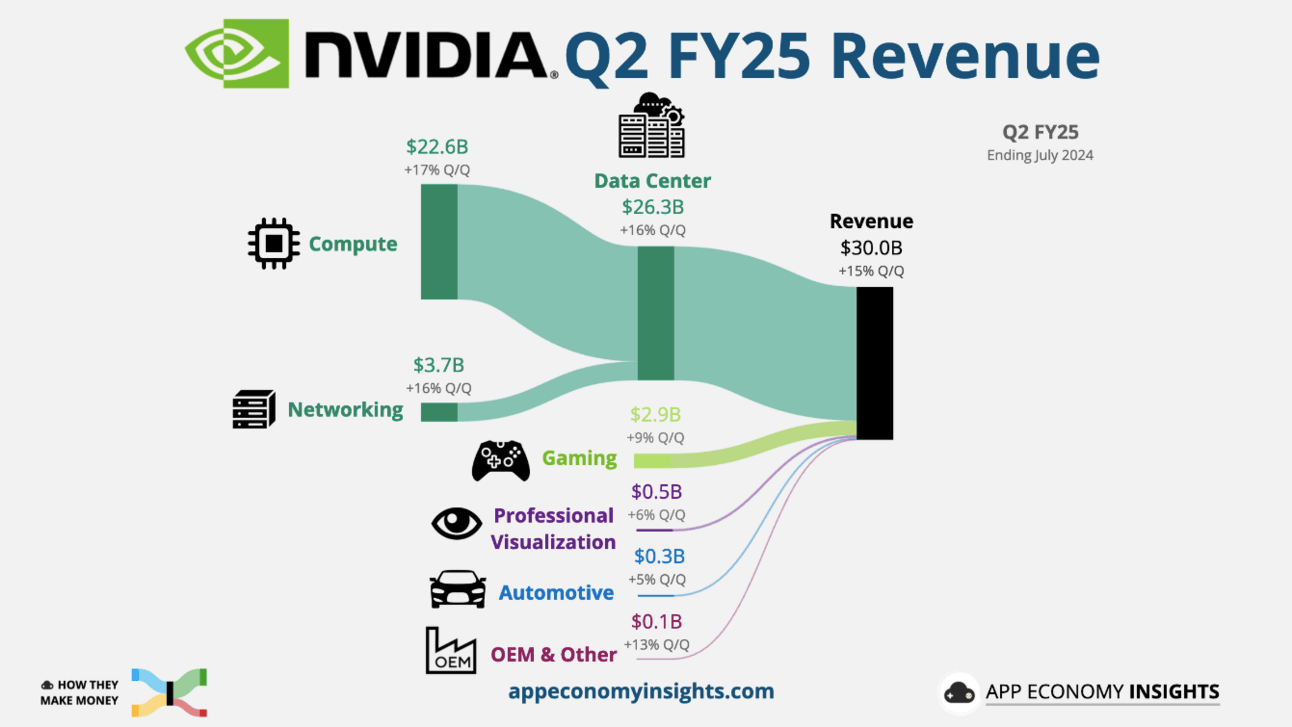

Nvidia States AI Chip Demand is “Insane”

In a CNBC interview, Nvidia CEO Jensen Huang said that demand for the company’s next-generation artificial intelligence Blackwell chip is “insane.”

The Blackwell chip is forecast to cost between $30,000 and $40,000 per unit. These chips are in hot demand from companies such as OpenAI, Microsoft, and Meta, which are building AI data centers to power products such as ChatGPT and Copilot.

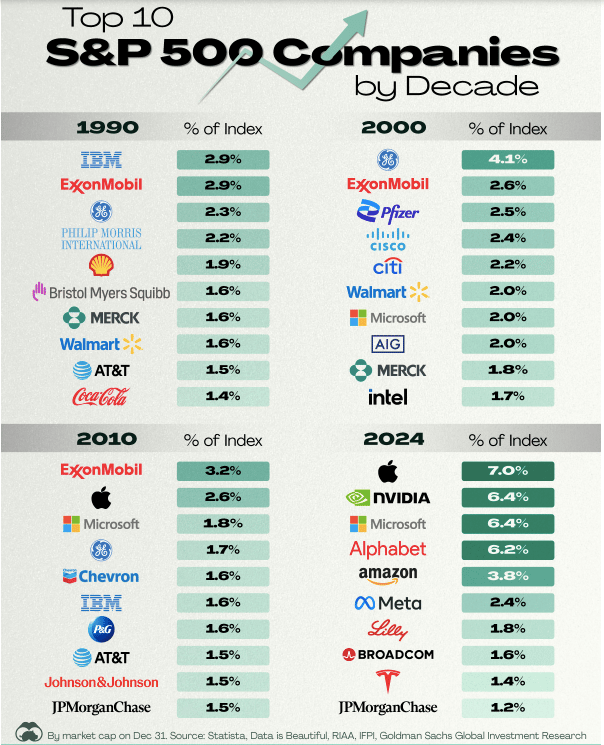

Nvidia is at the epicenter of the AI boom, with the stock up 150% year to date and 750% since the start of 2023.

The company’s revenue continued to surge in fiscal Q2 of 2025 (ended in July) to $30.04 billion, an increase of 122% year over year. It expects the top line to surge to $32.5 billion in the current quarter.

In addition to its strong revenue growth, Nvidia’s market-leading share in the AI chip segment allows it to benefit from competitive moats such as pricing power. Its gross margins in the last 12 months have risen to 76%, up from 62% in fiscal 2020.

Jensen emphasized that Nvidia plans to update its AI platform each year to increase performance by two to three times.

Levi Strauss Misses Revenue Estimates

While denim-crazed consumers are turning to Levi Strauss for new jeans, its overall business is being dragged down by its Dockers brand, which the company might soon offload.

Sales at Levi’s brand rose by 5% in fiscal Q3, the biggest gain in two years. However, total sales were flat year over year and missed consensus estimates, dragging the stock lower by 7% yesterday.

In fiscal Q3, Levi reported:

👉 Revenue of $1.52 billion vs. 1.55 billion

👉 Earnings per share of $0.33 vs. estimates of $0.31

In addition to its namesake brand, Levi also owns Dockers and Beyond Yoga. Dockers was started in 1986 and offered consumers an alternative to denim: khakis. Today, khakis have fallen out of fashion as Dockers sales were down 15% at $73.7 million.

Meanwhile, Levi acquired Beyond Yoga, an athleisure brand, in 2021 and saw sales grow by 19% to $32.2 million in Q3.

Levi believes offloading Dockers will help improve profit margins and minimize volatility in top-line growth. The retailer has onboarded Bank of America to lead the sale process.

D2C and China

Levi has shored up its profit margins by increasing D2C (direct-to-consumer) sales. In Q3, its gross margins rose by 4.4 percentage points due to its D2C selling strategy and lower input costs.

Levi’s direct channel grew by 10% due to strong sales in the U.S. and a 16% growth in e-commerce. Direct sales now account for 44% of total sales, and the company wants the number to touch 55%.

Like other retail companies, Levi is struggling with sluggish sales in China as the world’s second-largest economy faces macro headwinds and slower consumer spending.

PepsiCo Acquires Siete Foods

Earlier this week, Pepsi disclosed plans to acquire Siete Foods, a food company, for $1.2 billion, marking the beverage giant’s first acquisition in five years.

In recent years, Pepsi has focused on expanding into healthier options, primarily through acquisitions. Siete founder Veronica Garza started the company ten years ago and began selling grain-free tortillas.

Since then, its portfolio has grown to include tortilla chips, taco shells, salsas, and seasonings, often designed to accommodate different dietary restrictions. Retailers such as Target, Kroger, Whole Foods, and CVS carry Siete’s products.

The acquisition is expected to close within the first six months of 2025. Deal-making has picked up in 2024 for packaged food companies, who are turning to acquisitions to drive sales growth as shoppers buy less of their products.

In August, Mars announced the acquisition of Pringles parent Kellanova for $36 billion. Earlier this year, Campbell Soup completed its $2.7 billion acquisition of Sovos Brand.

Headlines You Can't Miss!

Port strike ends as workers agree to tentative wage deal

Crude oil could spike by 20%, says Goldman Sachs

China’s stimulus rally has sent stocks 25% higher

Mark Zuckerberg is the world’s second-richest person

Spirit Airlines might file for bankruptcy

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.