- 3 Big Scoops

- Posts

- 🗞 Palantir Continues to Rally

🗞 Palantir Continues to Rally

and Boeing inks a labor deal

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

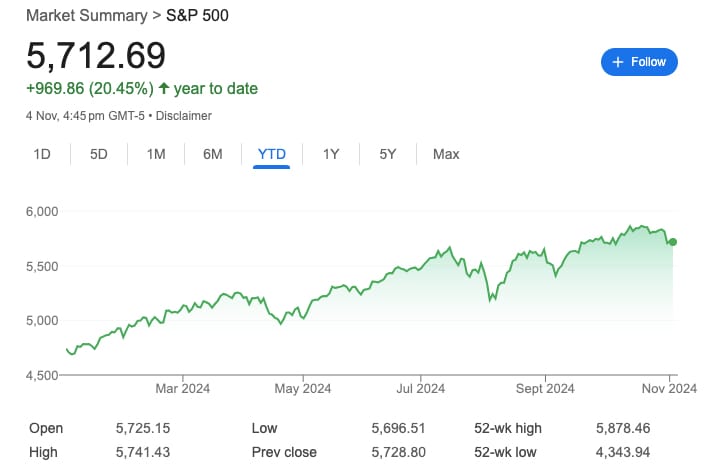

S&P 500 @ 5,712.69 ( ⬇️ 0.28%)

Nasdaq Composite @ 18,179.98 ( ⬇️ 0.33%)

Bitcoin @ $68,655.23 ( ⬆️ 1.06%)

Hey Scoopers,

Happy Tuesday! Are you ready for an exciting newsletter today?

👉 Palantir beat Q3 estimates

👉 Boeing strikes a deal

👉 MicroStrategy’s Bitcoin bet fattens

So, let’s go 🚀

Market Wrap

Stocks tumbled on Monday as trading was choppy throughout the day. The equity markets are volatile as investors gear up for the U.S. presidential election and a potential interest rate cut by the Federal Reserve this week.

Election results could be key in how the stock finishes in 2024. The latest poll from NBC News indicates a close race between former President Donald Trump and Vice President Kamala Harris.

Any market aftershocks will depend on which party takes control of Congress. If the control of the Senate and U.S. House of Representatives is divided, passing major legislative changes might be difficult.

Alternatively, a landslide victory by any party could lead to ambitious spending plans or a tax overhaul. So, expect stocks to remain highly volatile this week.

Trending Stocks 🔥

Nvidia - The stock rose almost 1% after it was announced that the chipmaker would replace Intel in the Dow Jones Industrial Average index.

Vista - The power producer tumbled 6% after regulators blocked Talen Energy from sending additional power from a nuclear plant in Pennsylvania to an adjacent data center.

Berkshire Hathaway - Shares fell over 2% after the conglomerate posted an operating income of $10.1 billion in Q3, down 6% year over year.

Palantir Surges Post Q3 Results

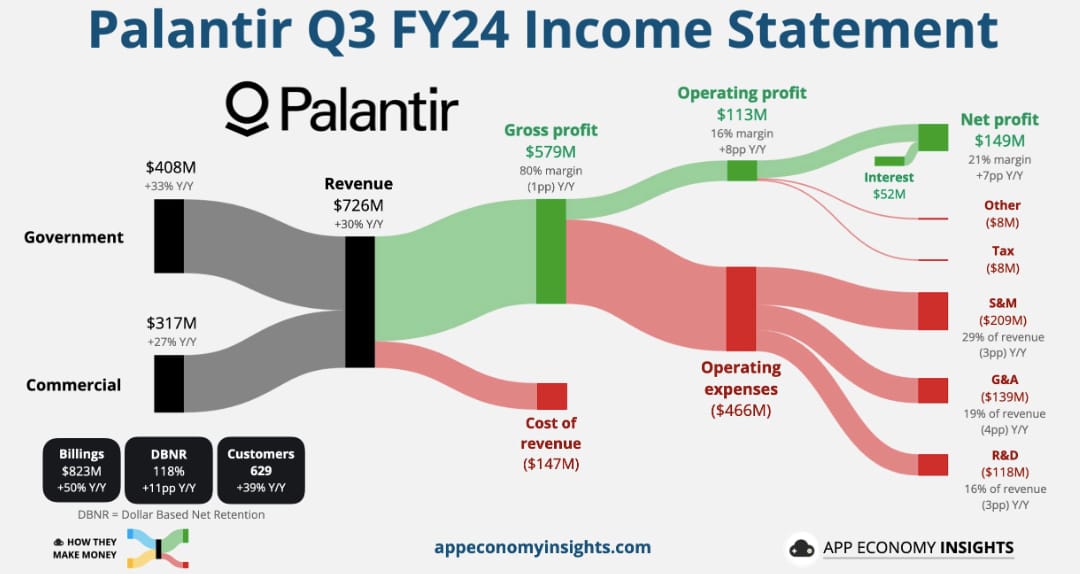

Palantir’s stock jumped 13% in after-hours trading on Monday after a monster Q3 report and a bullish outlook for the rest of the year.

Here’s the breakdown:

👉 Revenue of $726 million vs. estimates of $701 million

👉 EPS of $0.10 vs. estimates of $0.09

While sales rose by 30%, net income doubled year over year. So, what’s driving this growth?

Well, it’s artificial intelligence. Palantir CEO Alex Karp says requirements for the company’s data analytics and AI tech are “unrelenting” due to strong demand from U.S. government customers.

Palantir raised its 2024 revenue forecast to $2.807 billion, a 26% increase from last year. It expects U.S. commercial sales to surge over $687 million, gaining 24% year over year in 2024.

Not everything’s perfect, though. International commercial revenue dipped 7%, mainly due to weak performance in Europe and lower spending from a government-sponsored Middle East client.

Palantir has surged close to 150% in 2024, crushing broader market returns this year.

Boeing Strikes a Deal

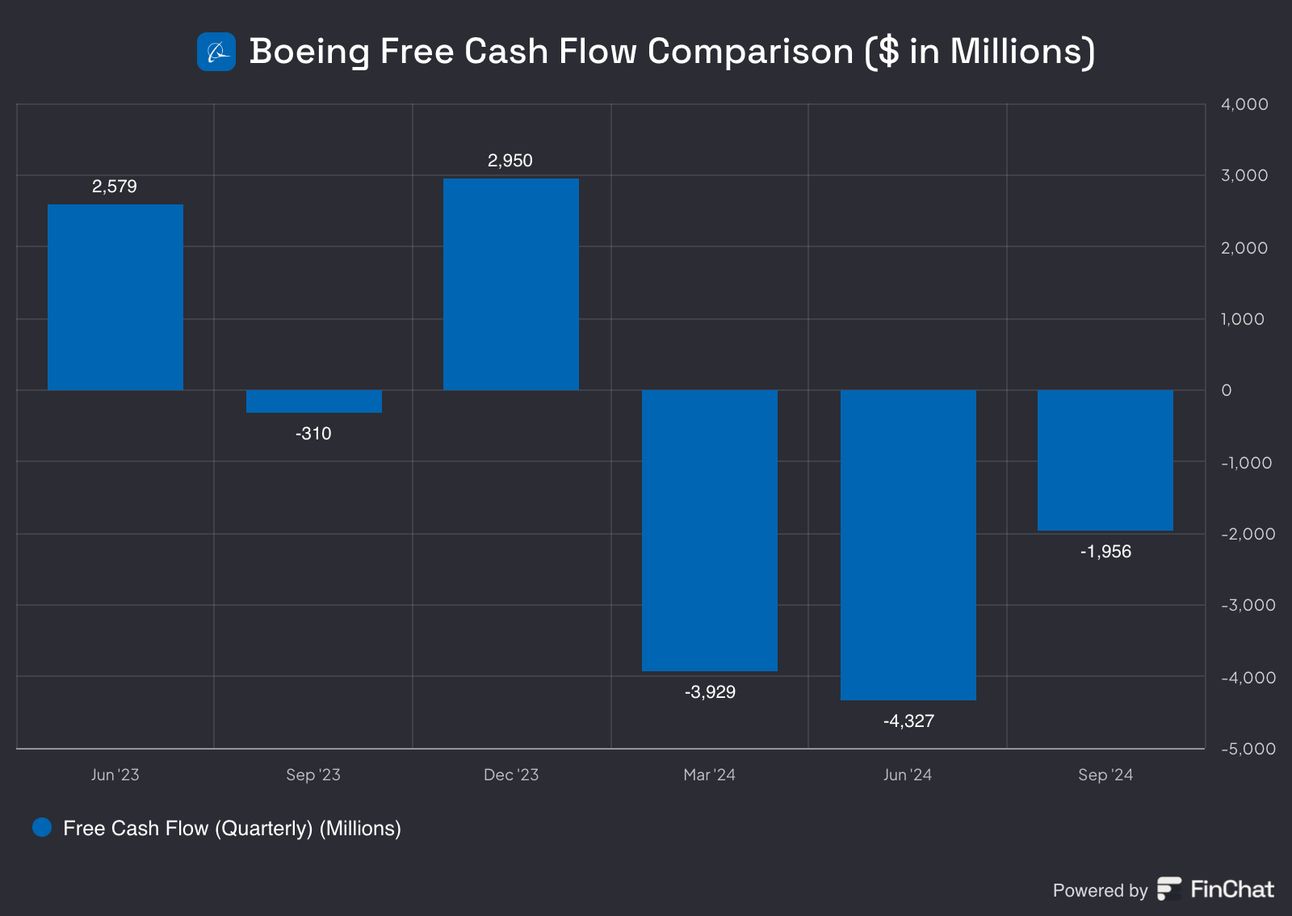

Boeing has finally approved a new labor deal, ending a seven-week machinist strike. So, what’s the deal?

Boeing machinists will receive a 38% raise over the next four years, including a 13% wage bump right off the bat, plus bonuses that could reach up to $12,000. The union also bagged higher 401(k) contributions.

Boeing has been in a tough spot in recent weeks, as the strike resulted in mounting losses and production delays.

Last week, the company raised over $20 billion to help weather a storm of financial troubles. The labor deal will now allow the aircraft maker to get things back on track.

The deal is a massive win for new CEO Kelly Ortberg, who’s been trying to steer Boeing through its crises. Moreover, it’s also a win for the workers facing rising living costs and frustrations over stagnant pay.

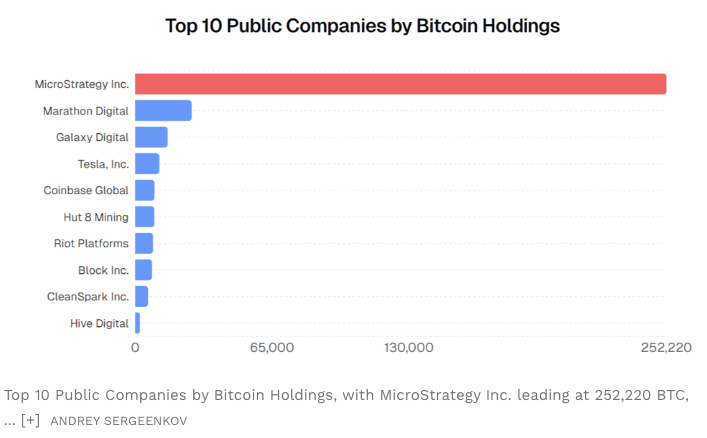

MicroStrategy’s Growing Bitcoin Balance

Last week, MicroStrategy disclosed plans to raise $42 billion in fresh capital to increase its Bitcoin balance through 2027. The software company currently holds 252,220 BTC on its balance sheet, making it the largest publicly traded company bitcoin holder globally.

MicroStrategy aims to increase shareholder value by leveraging the digital transformation of capital. The new capital raising initiative, the “21/21 Plan,” consists of $21 billion of equity and $21 billion of debt.

The capital raising schedule shows a steady increase:

2025: $10 billion planned ($5 billion equity, $5 billion bonds)

2026: $14 billion planned ($7 billion equity, $7 billion bonds)

2027: $18 billion planned ($9 billion equity, $9 billion bonds)

MicroStrategy uses a BTC yield metric to measure the efficiency of Bitcoin purchases against new share issuance.

For every 100 new shares issued, the company aims to buy enough bitcoin to maintain 106-110 bitcoins per share from 2025 to 2027. In 2024, they exceeded this goal, reaching almost 118 bitcoins per share.

Whiskey: The Tangible Asset for Your Portfolio

Most people fail to diversify their investments.

They invest all their money in intangible assets like stocks, bonds, and crypto.

The solution - fine whiskey.

Whiskey is a tangible asset, providing a unique appeal compared to other investments. Casks of whiskey have measurable attributes like size, age, and weight, making their value indisputable. This physical nature allows for clear identification of issues and adjustments to safeguard future value.

Vinovest’s expertise in managing these tangible assets ensures your whiskey casks are stored and insured to the highest standards, enhancing their worth over time. Discover how this tangible, appreciating asset can enhance your investment portfolio.

Headlines You Can't Miss!

Global traders focus on U.S. election day

Nintendo profit plunges 69% in Q3

Saudi Aramco Q3 profits drop 15%

China’s slowdown impacts U.S. earnings

Mt.Gox moves $2.2 billion to unmarked wallets

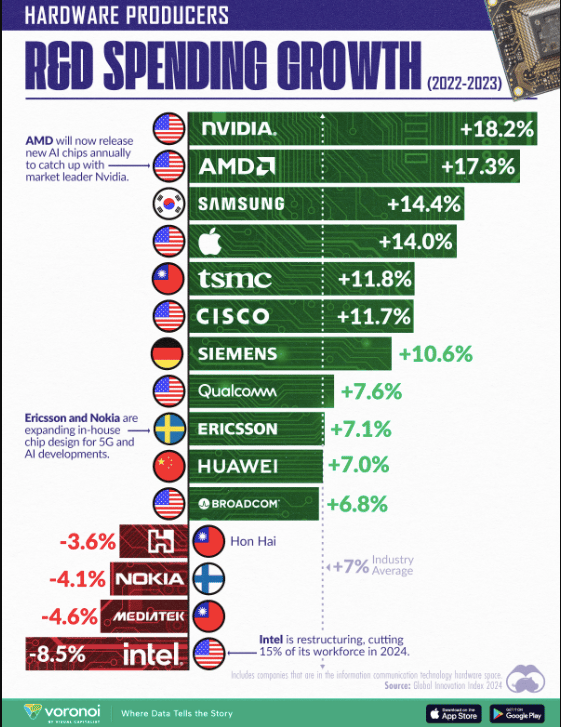

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.