- 3 Big Scoops

- Posts

- 🗞 Boeing Continues to Disappoint

🗞 Boeing Continues to Disappoint

while gold continues to shine

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

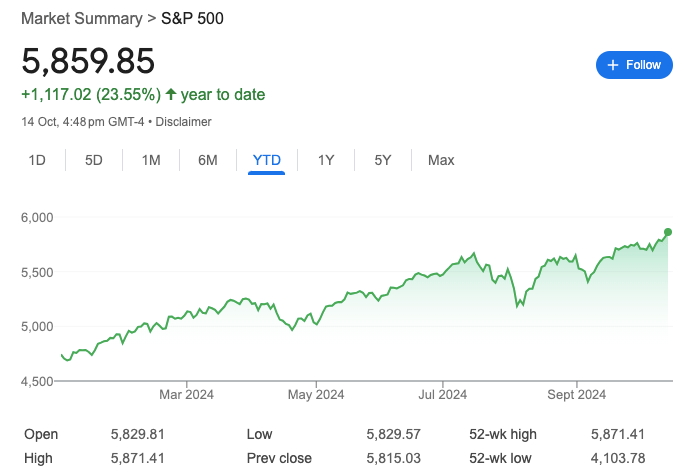

S&P 500 @ 5,859.85 ( ⬆️ 0.77%)

Nasdaq Composite @ 18,502.69 ( ⬆️ 0.87%)

Bitcoin @ $65,579.66 ( ⬆️ 2.88%)

Hey Scoopers,

Happy Tuesday! Are you ready for an exciting newsletter?

👉 Boeing to cut 17k jobs

👉 Will gold prices move higher in Q4?

👉 Bernstein is bullish on GE Aerospace

So, let’s go 🚀

Market Wrap

The S&P 500 and the Dow Jones Industrial Average rose to fresh record highs on Monday as investors await the next batch of key corporate earnings.

McDonald’s, United Health, and Apple led the Dow higher, while the tech sector powered the S&P 500.

Bank of America, Goldman Sachs, and Johnson & Johnson will report their latest results today, while United Airlines, Netflix, and Procter & Gamble are scheduled to post earnings this week.

So far, 30 S&P 500 companies have posted results, beating the earnings consensus by about 5% on average, better than the 3% beat this time last quarter. Still, investment firm Bernstein expects earnings per share growth to be lower than in Q2.

UBS expects S&P 500 EPS growth between 5% and 7% for the September quarter, compared with 11% in Q2 due to lower oil and gasoline prices. Moreover, full-year earnings growth is forecast at 11% due to steady corporate growth amid a resilient macro backdrop.

UBS reiterated its June 2025 price target for the S&P 500 at 6,200, 6% higher than current levels.

Meanwhile, Bernstein estimates Q3 earnings to grow by 3.6% year over year. It expects five of the 11 S&P 500 sectors to report positive earnings in the September quarter.

Trending Stocks 🔥

Crypto stocks - Stocks linked to cryptocurrencies, such as MicroStrategy and Coinbase, rose as Bitcoin surpassed $65,000.

Flutter Entertainment - The FanDuel parent company popped 4% after Wells Fargo upgraded shares to “overweight,” saying investors should consider buying the stock following the recent sell-off.

Caterpillar - The stock fell more than 2% after Morgan Stanley downgraded it to “underweight” and lowered its price target, citing troubles with the industrial giant’s construction industries business.

Boeing Slashes Its Workforce

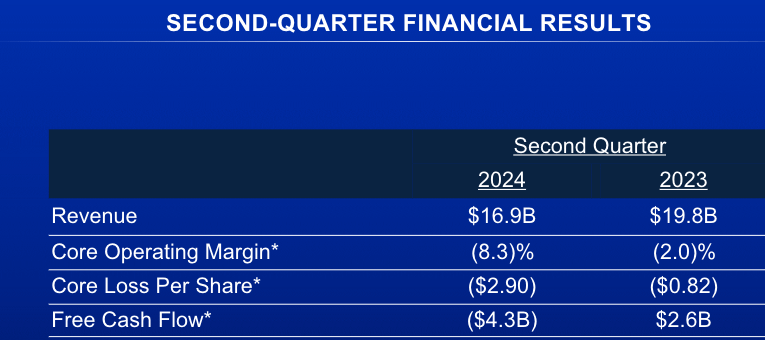

Boeing will cut 10% of its workforce, or about 17,000 people, as the company’s losses mount and a machinist strike that has idled its aircraft factories enters its fifth week. It will also push back the long-delayed launch of its new wide-body airplane.

Boeing stated it will not deliver its 777X wide-body plane, which has customers including Lufthansa and Emirates, until 2026, putting it six years behind schedule.

In Q3 of 2024, Boeing expects to report a loss of $9.97 per share due to a pretax charge of $3 billion in the commercial airplane unit and $2 billion for its defense business. It also expects to report an operating cash outflow of $1.3 billion in Q3.

Boeing’s new CEO has embarked on job and cost cuts to stabilize operations amid a safety and manufacturing crisis.

Notably, credit rating agencies have warned that the company is at risk of losing its investment-grade rating, and Boeing has been burning through cash due to the headwinds mentioned above.

The machinist strike, which began last month, will lead to over $1 billion in losses as Boeing has failed to reach a tentative agreement with the union.

Boeing stock is down 40% in 2024 and has trailed the broader markets by a wide margin.

Gold Prices Are Near All-Time Highs

Gold prices touched an all-time high last month due to the possibility of multiple interest rate cuts and ongoing geopolitical tensions.

As we head towards a lower interest rate environment, gold remains attractive as zero-yield bullion is typically a preferred investment amid lower interest rates.

Historically, gold has been viewed as a store of value and a hedge against inflation. Moreover, the precious metal thrives amid periods of economic turbulence, offering portfolio diversification.

Costco started selling gold bars in June 2023 and sold $100 million worth of the yellow metal within three months. Additionally, 77% of the surveyed Costco outlets said that bullion bars were sold out in the first week of October 2024.

Gold has surged nearly 30% in 2024, making it one of the top-performing asset classes this year.

Gold is Reaching All-Time Highs — Are You Capitalizing on this Trend?

ESGold Corp (CSE: ESAU) (OTC: SEKZF) offers a prime opportunity to capitalize on the surging gold market with a project forecasted to generate CAD $112M in revenue. With just $8M needed to finish its Montauban plant, production is expected to kick off in just six months.

What sets ESGold apart? They're not only tapping into gold and silver, but also cleaning up the environment by processing toxic mine tailings and restoring natural ecosystems. It’s a win for both investors and the planet.

Already up over 50% in the last month, ESGold Corp is a public company gaining momentum.

Disclaimer: This ad is paid for and disseminated on behalf of ESGold Corp (it is sponsored content). We do not own any securities of ESGold Corp. This ad contains forward-looking statements, which are not historical facts. These statements are based on the current beliefs and expectations of ESGold Corp’s management and involve known and unknown risks, uncertainties, and other factors that could cause actual results or events to differ materially from those expressed or implied by such forward-looking statements. Words such as “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “potential,” and similar expressions often identify forward-looking statements. This is not financial advice, please do your own DD. See SEDAR+ for more information.

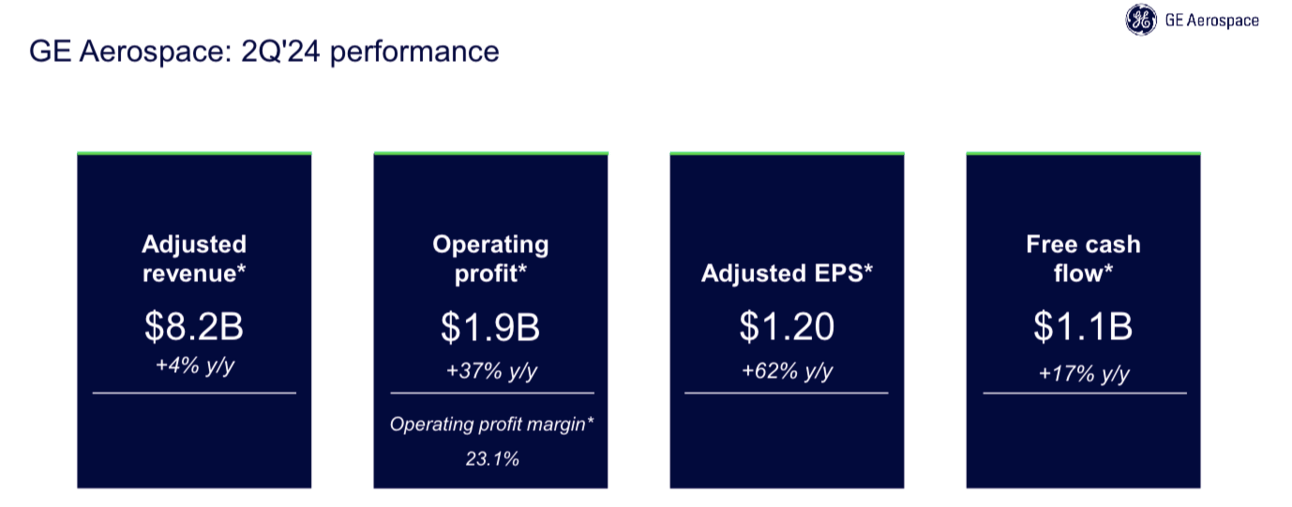

Bernstein in Bullish on GE Aerospace

Even as GE Aerospace contends with equipment shortages tied to the production of its LEAP engines heading into third-quarter results, Bernstein thinks the stock is still “winning either way” and is primed for outperformance.

In a Sunday note, the firm reiterated its outperformance on the aviation stock and raised its price target to $225 per share from $210. Bernstein’s forecast implies more than 17% upside from Friday’s $191.16 close.

Valued at $208 billion by market cap, GE stock has more than quadrupuled in the last five years as it benefits from a huge installed base, which drives a profitable aftermarket.

This aftermarket drives current margins higher and should extend for the next few years.

Headlines You Can't Miss!

Asian chip stocks gain as Nvidia touches a record highs

What to expect from Goldman Sachs in Q3?

Economic growth and inflation might remain strong

Tokyo Metro to raise $2.3 billion in Japan’s largest IPO since 2018

U.S. spot Bitcoin ETFs saw net inflows of $555 million yesterday

Chart of The Day

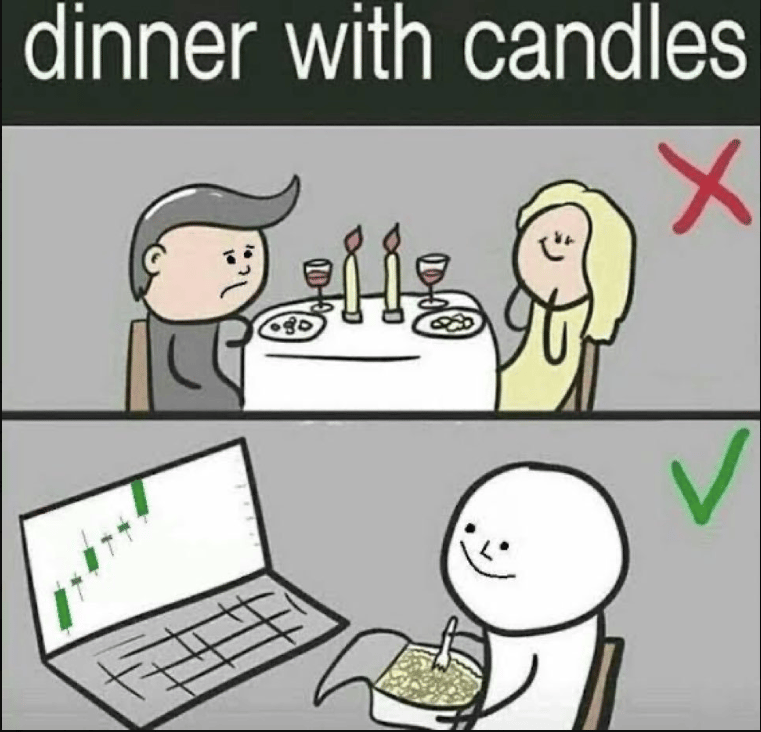

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.