- 3 Big Scoops

- Posts

- Barclays is Bullish On Tesla

Barclays is Bullish On Tesla

Tesla, Intel, and Boeing

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

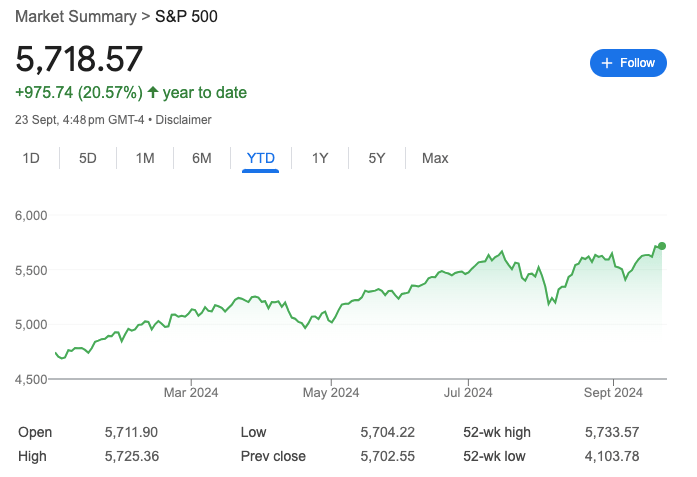

S&P 500 @ 5,718.57 ( ⬆️ 0.28%)

Nasdaq Composite @ 17,974.27 ( ⬆️ 0.14%)

Bitcoin @ $63,365.44 ( ⬇️ 0.12%)

Hey Scoopers,

Happy Tuesday! Here’s what we’re covering today:

👉 Barclays raises its price target for Tesla

👉 Apollo Global to invest in Intel

👉 Boeing aims to end labor union strike

So, let’s go 🚀

Market Wrap

The S&P 500 index climbed to a fresh record high on Monday as traders looked to build on last week’s gains following the Federal Reserve’s interest rate cut.

Market participants will be vigilant for economic data that could dampen hopes for a soft landing as Thursday's weekly jobless claims data will provide further insights into the economy and labor market.

According to historical trends, the S&P 500’s rally to record levels this month bodes well for Q4. For instance, when the broad index has reached all-time highs in September, it has gone on to be positive in the fourth quarter about 90% of the time.

Further, the S&P 500 has risen almost 5% on average in the fourth quarter for years with a positive September record.

Trending Stocks 🔥

Micron Technology - Shares edged higher by almost 3% after JPMorgan reiterated the stock as “overweight” ahead of the chipmaker’s upcoming earnings report this week.

AeroVironment - The defense contractor popped over 11% after the U.S. Army lifted a stop work order on a $990 million contract.

Snowflake - Shares of the data cloud company are down 3% in pre-market after it announced a proposed private placement of $2 billion of convertible senior notes.

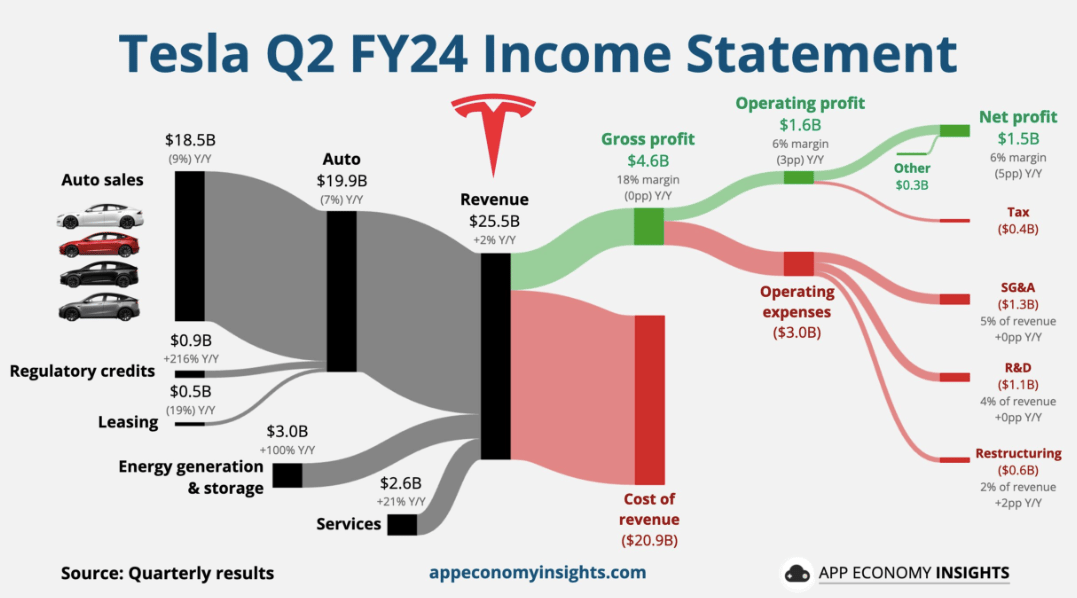

Tesla Stock Spikes Over 4.9%

Tesla shares rose by almost 5% as Barclays highlighted several potential catalysts that could boost the EV stock.

👉 In an investor note, Barclays stated Tesla could exceed expectations with vehicle deliveries in Q3.

👉 Barclays projects Tesla’s EV deliveries could reach 470,000 units in Q3, above estimates of 461,000 vehicles. The investment bank projects deliveries to rise by 8% year over year.

👉 It also expects Tesla to benefit from pricing initiatives and incentives in China as it competes with local EV manufacturers.

Moreover, Goldman Sachs analysts expect the upcoming robotaxi event to be a potential catalyst for TSLA stock, where the company is also likely to unveil a lower-cost vehicle.

The robotaxi event will provide insights into Tesla’s full self-driving capabilities and the potential structure of the robotaxi business. However, it's unlikely that Tesla will begin a robotaxi service until the next year.

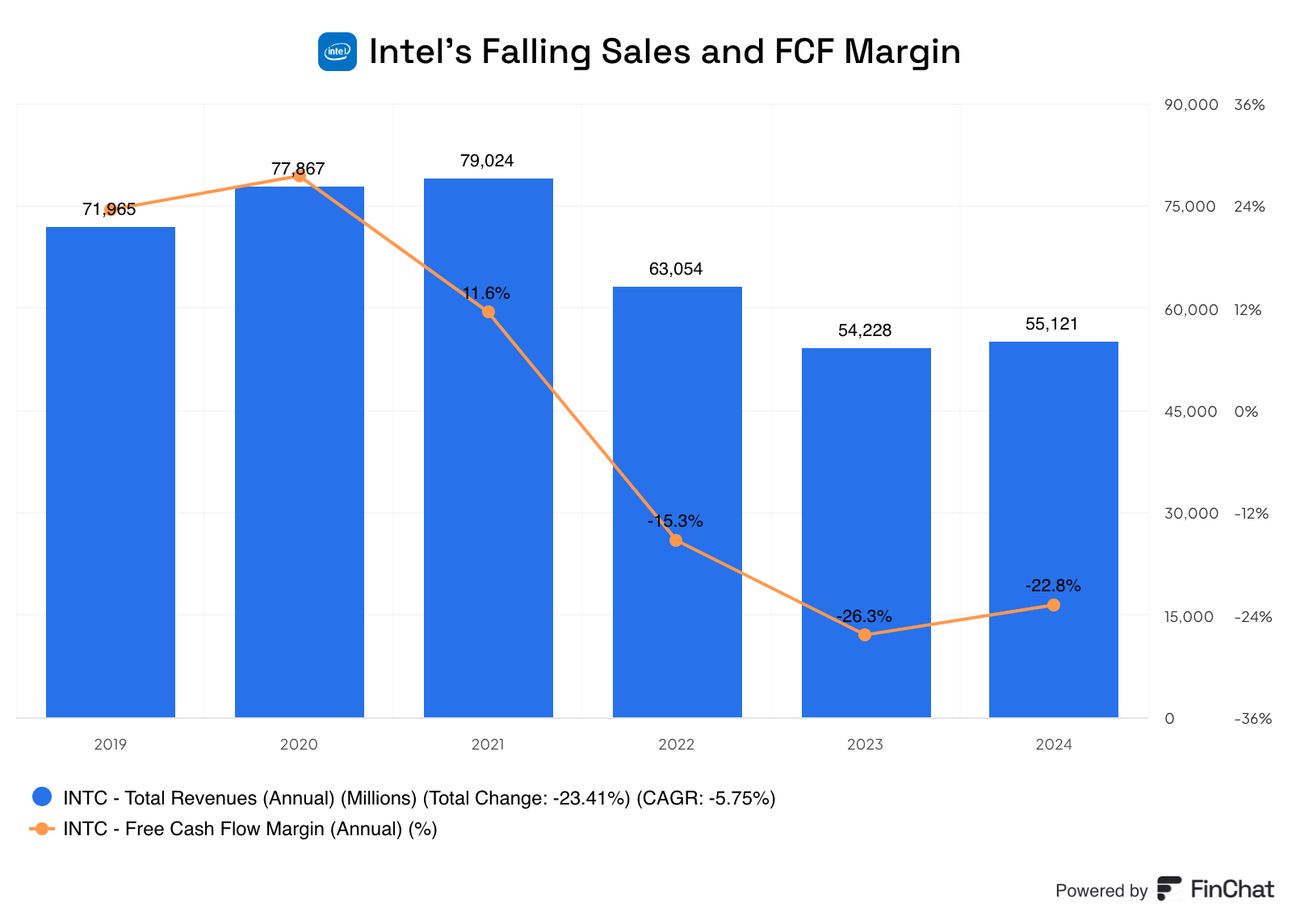

Apollo Global Management Might Invest In Intel

Apollo Global Management has offered to make a multi-billion dollar investment in Intel, which might help the struggling chip maker stage a turnaround and avoid a potential takeover bid from Qualcomm.

Apollo Global is an alternative asset manager and might invest around $5 billion in an equity-like investment in Intel. The two companies already have a pre-existing relationship, with Intel selling Apollo a $11 billion stake in its Ireland manufacturing facility.

Intel is lagging behind rivals such as Nvidia and Advanced Micro Devices, whose advanced AI chips have captured the interest of big tech companies.

Meanwhile, Intel is investing heavily in expanding the capabilities of its foundry business, where it manufactures chips for other companies. According to analysts, the foundry business is expected to remain unprofitable until 2027 and may be a high-risk venture.

Intel stock is down almost 60% in 2024 and is looking to lower costs by $10 billion on the back of layoffs and lower capital expenditures. Last week, reports suggested that Qualcomm is looking to acquire Intel in what could be the largest tech merger on Wall Street.

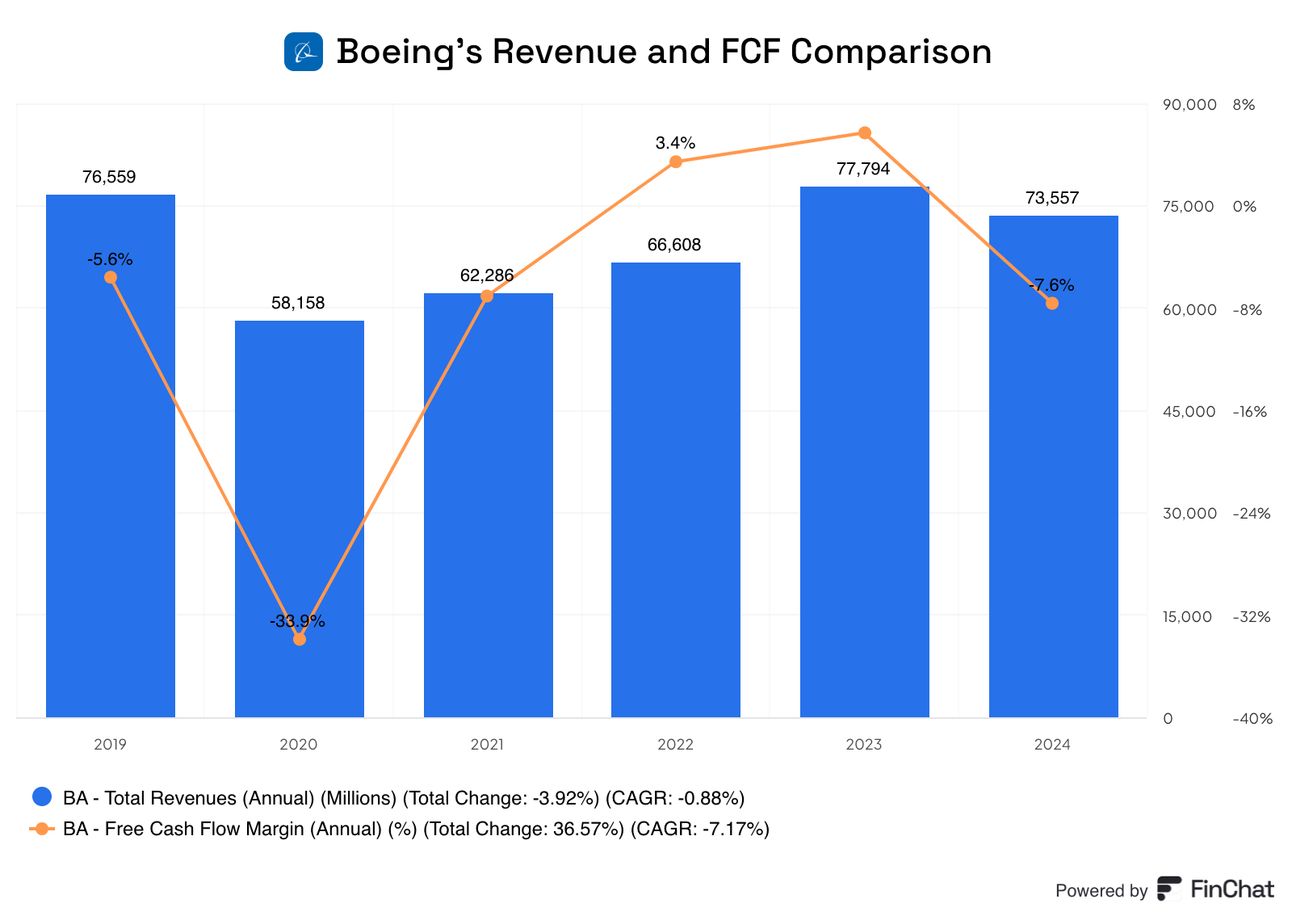

Boeing In Talks With Labor Unions

Yesterday, Boeing sweetened its contract offer and said it was its “best and final” proposal for more than 30,000 machinists on strike. Boeing has now halted its aircraft production for over a week as the labor union criticized the offer, claiming the aircraft maker didn’t negotiate terms and bypassed the union.

Boeing’s new offer would boost wages by 30% over four years, up from a previously proposed 25%. It also doubled the ratification bonus to $6,000, reinstated an annual machinist bonus, and raised the 401(k) match.

The new offer was Boeing’s latest attempt to end a costly strike as the pressure mounts on new CEO Kelly Ortberg to reach a deal. Some workers said in interviews that they have prepared for a long strike and have begun taking side jobs like delivering food or working in warehouses.

Bank of America analyst Ron Epstein estimated the strike is costing Boeing $50 million a day, and ratings agencies have said the company risks a downgrade the longer the strike lasts.

Headlines You Can't Miss!

Donald Trump threatens 200% tariffs on John Deere if it moves production to Mexico

China’s central bank aims to combat a slowing economy

Southwest Airlines is focused on improving profit margins

Hong Kong property stocks rally on mortgage stimulus

Celsius repays $2.5 billion to creditors

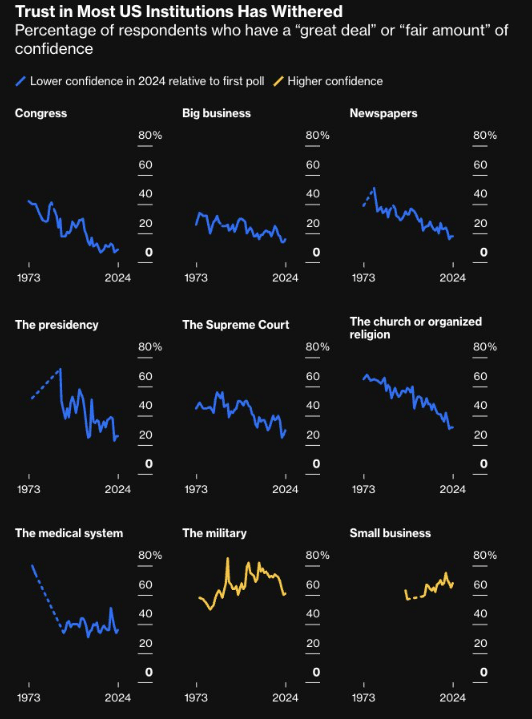

Chart of The Day

Source: Bloomberg

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.