- 3 Big Scoops

- Posts

- Nvidia: Boom or Bust in 2024?

Nvidia: Boom or Bust in 2024?

PLUS: JPMorgan Turns Bullish on Ethereum

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 4,719.19 ( ⬇️ 0.0076%)

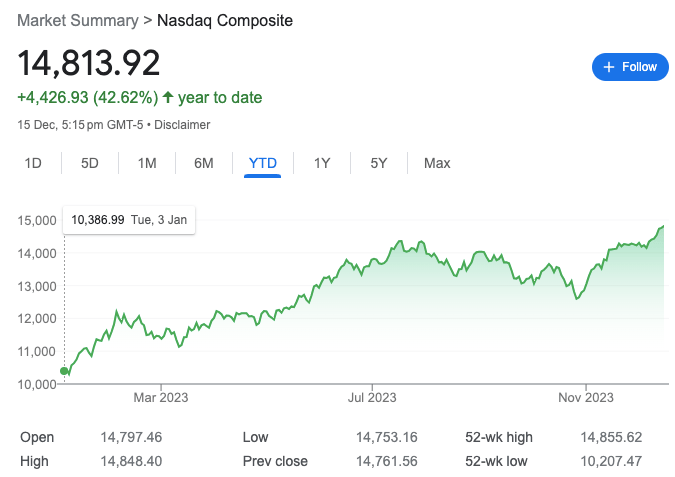

Nasdaq Composite @ 14,813.92 ( ⬆️ 0.35%)

Bitcoin @ $41,180.16 ( ⬇️ 1.37%)

Hey Scoopers,

Monday magic unleashed !!!!

Here’s what’s on the menu for today:

👉 What next for Nvidia in 2024?

👉 What next for stocks in 2024?

👉 What next for Ethereum in 2024?

So, let’s go 🚀

Can Nvidia Deliver Again In 2024?

Let’s not beat around the bush: your favorite stock – Nvidia – smashed it this year. AI blasted onto the scene, turning this quiet little company with its AI-powering chips into a must-own stock for investors everywhere.

With Nvidia’s shares up 240% this year, everyone wants to know whether next year can be anywhere near as good.

First, the obligatory glance back at 2023

Like most tech stocks, Nvidia had an abysmal 2022, falling 65% from its 2021 high.

Everything changed in January when Microsoft announced it had invested $10 billion into OpenAI, the startup behind ChatGPT. The news made the AI theme real and sparked a frenzy, sending Nvidia shares to the moon.

The firm’s graphics processing units (GPUs) are the accelerating semiconductors that enable all the super-computing needed to run large language models (LLMs) like ChatGPT.

And the cloud services providers – like Microsoft, Amazon, and Google – were falling over themselves to get their hands on them.

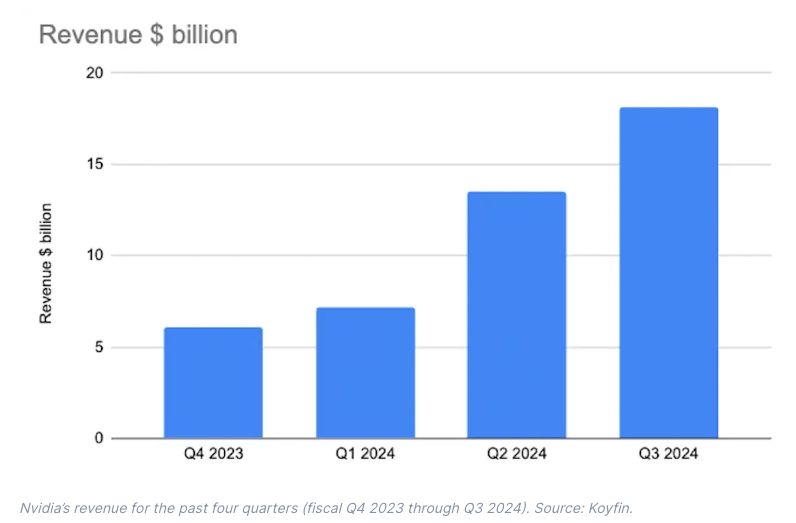

Take a look at Nvidia’s quarterly revenue progression (in the chart below) over this past year in the chart. It’s tripled.

Coming into this year, analysts predicted Nvidia’s full-year revenue (ending in January 2024) would be around $30 billion. Those same analysts now think it’ll be about twice that, with the firm pulling in $20 billion this quarter alone.

Next, let’s look ahead to 2024

It’s impossible to know exactly what 2024 has in store, but the best place to start is with what analysts expect.

At this point, you might shrug and say, “What use would that be?” given how “wrong” they were with their pessimistic stock views for this year.

Fair point. But AI’s sonic boom has caught everyone off guard, including Nvidia. My guess is that the level of upside surprise we saw this year probably won’t be repeated.

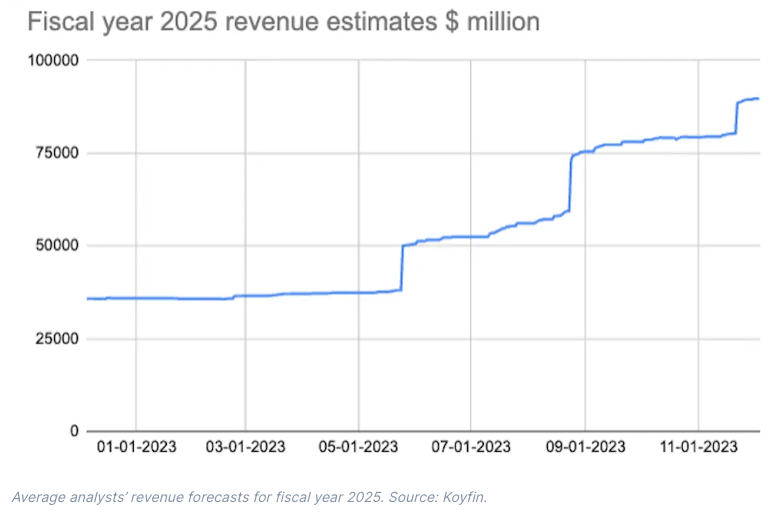

The following chart shows how next year’s revenue estimates (for the year ending January 2025) have progressed through this year. They started at around $35 billion; today, they stand at $90 billion.

That $90 billion would represent a 50% gain on what we’re likely to see this year. Profit is also forecast to keep piling up as Wall Street expects around $20 in earnings per share (EPS) next year – a 60% jump year over year.

Well, 50% revenue growth on a whopping $60 billion is a massive ask – there’s no getting away from that. It’d be a slowdown from this year’s 122% boom.

But as revenues get more significant, the growth hurdle gets higher. The other thing we know is how the market is currently valuing the shares.

Nvidia’s price-to-earnings (P/E) ratio using next year’s earnings forecast is below 24x, which is relatively cheap.

In fact, it puts it in a similar valuation range to mere-mortal stocks like Coca-Cola or Procter & Gamble and makes it cheaper than its “magnificent seven” peers, Microsoft, Amazon, and Apple.

Wall Street remains bullish and expects Nvidia shares to surge 20% in the next 12 months.

S&P 500 Earnings Forecast to Grow 12%

Stock-picking enthusiasts leap into January, hoping for steady macroeconomic conditions so they can focus squarely on sorting the good stocks from the bad.

And when you look at stock investing from that “bottom-up” perspective, things look remarkably sunny.

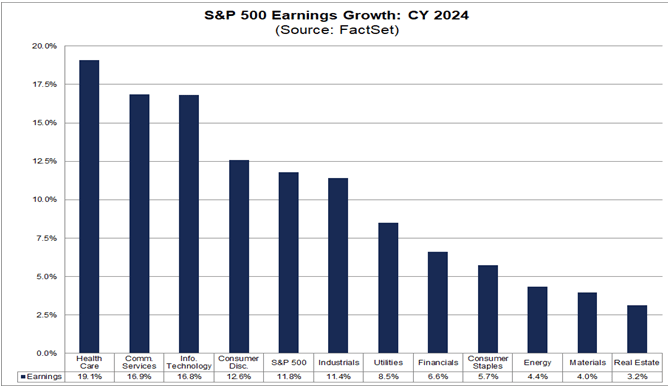

Take the forecasts for S&P 500 profit growth, for example. The latest analyst survey from data firm FactSet suggests profit growth of 12% for 2024, considerably better than the index’s long-run 8% average.

Looking a bit closer, those FactSet estimates see every sector in the S&P 500 index enjoying profit growth next year, from healthcare – forecast to churn out nearly 20% growth – down to real estate – predicted to grow 3%.

And another thing, while revenues are predicted to grow too, they’re expected to grow at about half the pace of profit. That can only happen if profit margins fatten up.

That’s a massive win for US companies and at least some proof that they can cope with whatever the economy throws at them. No wonder stock prices are breaking records.

JPMorgan recently released its cryptocurrency outlook for 2024 and expects Ethereum prices to outpace Bitcoin next year.

According to the investment bank, the regulatory approval of Bitcoin spot ETFs is unlikely to drive a significant upside.

On the other hand, it estimates the planned Ethereum upgrades will make the blockchain network more efficient and scalable.

JPMorgan emphasized the upcoming upgrade will add capacity to Ethereum, improve network bandwidth, and drive price gains versus Bitcoin and other altcoins.

Ethereum is the second-largest cryptocurrency in the world and is valued at $261 billion by market cap.

Headlines You Can’t Miss!

The Fed shouldn’t lower interest rates in 2024, warns former FDIC chair

59% of Gen Z women are financially ready for retirement

U.S. ports are getting a $21 billion upgrade

Are job losses rising due to AI?

Ledger CEO addresses community after crypto hack

Chart of the Day

Did you avoid the seduction of pessimism in 2023?

U.S. equity markets nosedived in 2022 as inflation touched 40-year highs. The Federal Reserve raised interest rates several times over the past 20 months to offset inflation. Right now, interest rates are at 22-year highs in the U.S.

Add in geopolitical tensions, a sluggish global economy, the slowdown in China, the threat of a recession, and rising debt levels in the U.S., and you had the perfect recipe for another disastrous year for stock market investors.

However, in 2023:

👉 The S&P 500 has surged 23.4% 🚀

👉 The Nasdaq Composite Index has gained 42.6% 💰

👉 The Dow Jones index has reclaimed all-time highs 💸

Yet again, it showcases how it makes little sense to time the market. Instead, dollar-cost averaging in low-cost passive index funds remains the best strategy for building long-term wealth.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.