- 3 Big Scoops

- Posts

- Nvidia Nosedives 10%

Nvidia Nosedives 10%

as tech stocks are under pressure

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 4,967.23 (⬇️ 0.88%)

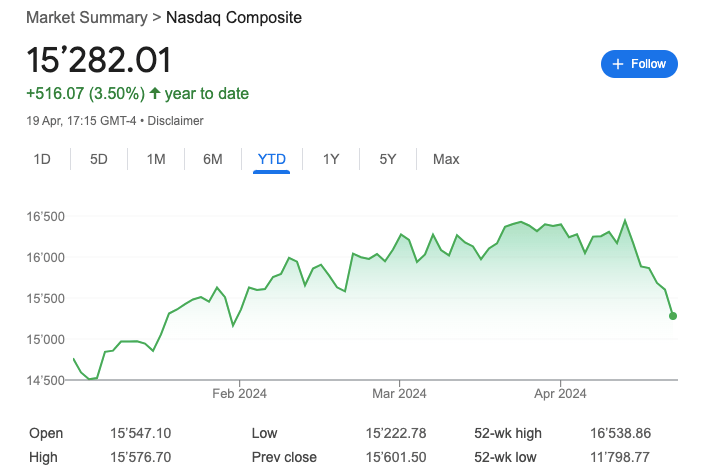

Nasdaq Composite @ 15,282.01 ( ⬇️ 2.05%)

Bitcoin @ $65,117.50 ( ⬆️ 0.73%)

Hey Scoopers,

Happy Monday! Here’s what we are covering today!

👉 Nvidia drives tech sell-off

👉 Shipping stocks gain pace

👉 The Bitcoin halving is complete

So, let’s go 🚀

Market Wrap 📉

The Nasdaq Composite index fell for a sixth straight session on Friday, notching its longest losing streak since December 2022. The pullback also marked the Nasdaq’s worst weekly performance since November 2022.

Moreover, the S&P 500 index posted its worst weekly performance in more than a year amid fears around the path of inflation and monetary policy. With a loss of 3%, the S&P 500 declined for the third consecutive week.

Chip stocks were under the pump on Friday, indicating that investors were rotating heavily out of the sector, which previously led to an astonishing bull run in the last 16 months.

While the tech sector put downward pressure on the market, market participants remained concerned over escalating conflicts in the Middle East following Israel’s limited strike on Iran.

Trending Stocks 🔥

Netflix - The streaming giant sank more than 9% after stating it would stop reporting subscriber growth in quarterly earnings starting 2025.

Super Micro Computer - Shares plunged over 23%, continuing a sharp weekly decline for the server maker. The company is forecast to announce Q3 results on April 30 but failed to provide preliminary results as it previously had.

Ulta Beauty - Shares fell over 2.7% after Jeffries downgraded the beauty retailer to a “hold” from a “buy” rating amid rising competition.

Nvidia Close to Bear Market Territory

Shares of semiconductor giant Nvidia fell 10% on Friday and are trading close to bear market territory. Generally, a stock enters a bear market when ti falls 20% from all-time highs.

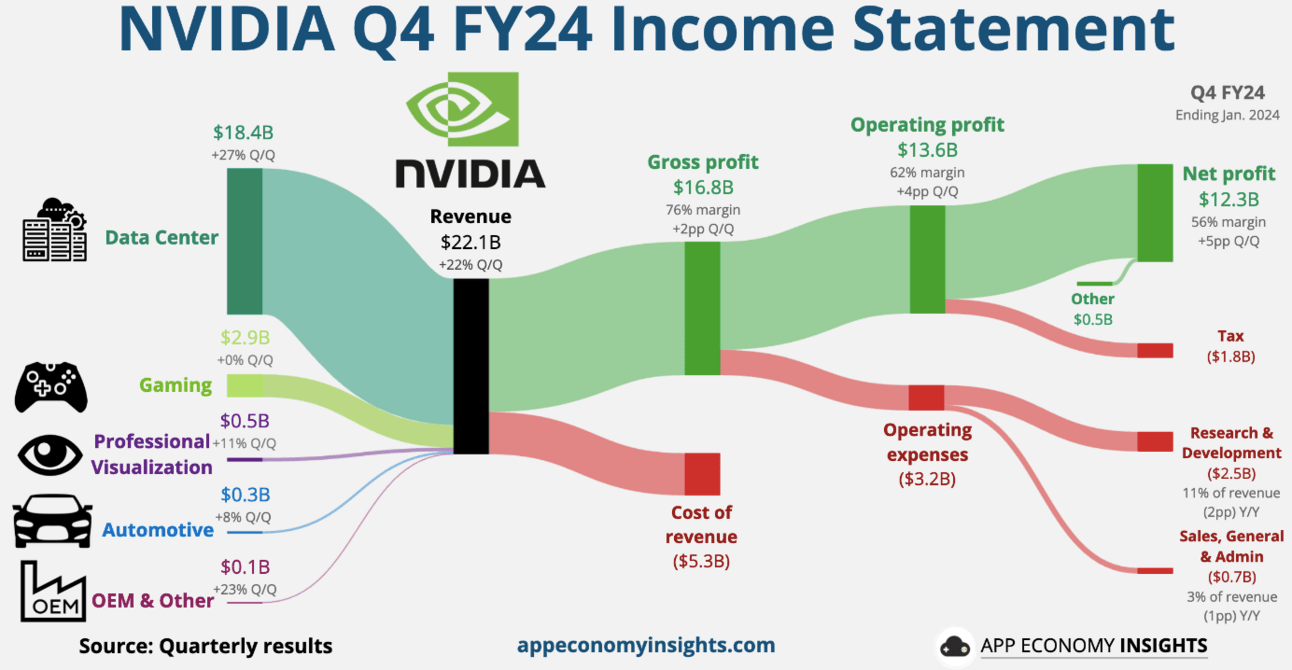

Nvidia is a chip manufacturer which produces GPUs or graphics processing units. In the last 15 months, it has been a key beneficiary of the AI (artificial intelligence) boom, boosting demand for its chips.

The company’s GPUs are used for compute-intensive AI applications, including ChatGPT, while its server chips are a key component of data centers that power these applications.

In the last 12 months, Nvidia has seen a 486% expansion in adjusted earnings, primarily due to huge chip demand from generative AI models.

According to investment research firm D.A. Davidson, the size of AI models is expected to shrink going forward, which will act as a headwind for Nvidia.

Moreover, maturing hyperscaler investments and increased reliance by Nvidia’s largest customers on building their own chips do not bode well for the tech giant.

Valued at a market cap of $1.90 trillion, Nvidia stock almost tripled in the last year.

Shipping Firms Rally After Israel Attacks Iran

Shares of Asian shipping firms rallied after news that Israel carried out an operation in Iran.

Japanese shippers Mistsui OskLines climbed 1.8%, while Kawasaki Kisen and Nippon Yusen were up 0.34% and 1.44 respectively.

Hong Kong shipping firms also surged, with the Pacific basin spiking 8.7%. Moreover, Cosco Shipping Holdings rose 4%, and international logistic firm OOIL stock climbed 4.5%.

Bitcoin Mining Stocks Move Higher

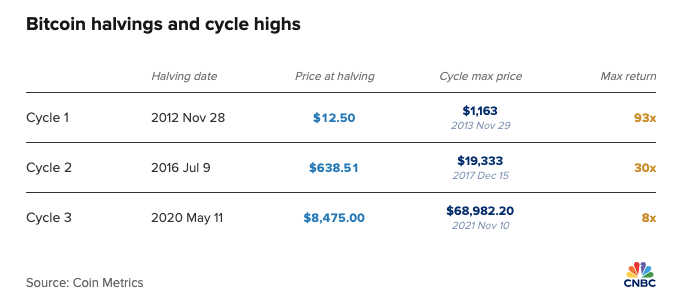

The Bitcoin network completed its fourth halving, reducing the reward earned by miners to 3.125 BTC from 6.25 BTC.

Technically, the halving shouldn’t affect the price of Bitcoin in the short term but many investors are expecting big gains in the months ahead.

After the 2012, 2016, and 2020 halvings, the bitcoin price ran up 93x, 30x, and 8x, respectively, from its halving day price to its cycle top.

The halving event has historically triggered a wave of consolidation and business closures for BTC mining companies.

Headlines You Can't Miss!

A potential TikTok ban is on the cards

Elon Musk delays visit to India

U.S. House to vote on $95 billion aid package

U.S. jury finds crypto trader guilty in $110 markets manipulation case

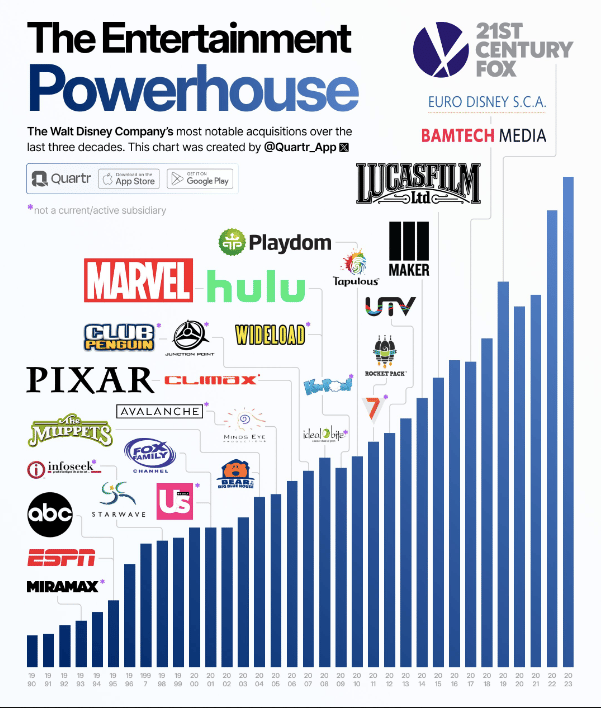

Chart of The Day

Source: Quartr

The Walt Disney Company is an entertainment giant valued at a market cap of $205 billion.

Over the years, Disney has grown via a combination of organic growth and accretive acquisitions. Some of the most accretive purchases for the House of Mouse include Pixar and Marvel.

Down 44% from all-time highs, Disney stock has grossly underperformed the broader markets in the last three years. Can it stage a comeback in 2024?

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.