- 3 Big Scoops

- Posts

- Meta Partners With Google

Meta Partners With Google

and Netflix blows past Q1 estimates

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

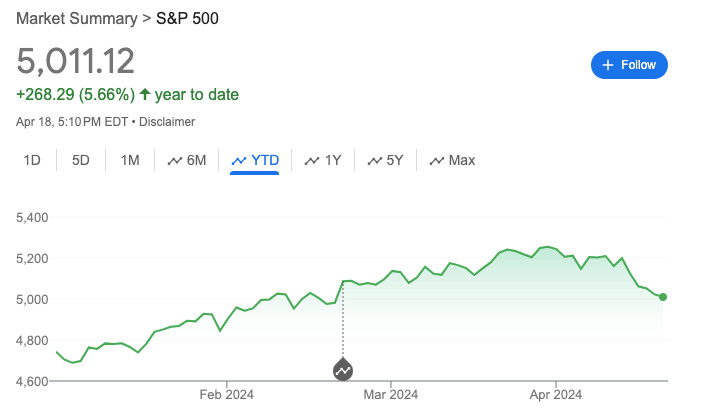

S&P 500 @ 5,011.12 (⬇️ 0.22%)

Nasdaq Composite @ 15,601.50 ( ⬇️ 0.52%)

Bitcoin @ $64,767.30 ( ⬆️ 2.71%)

Hey Scoopers,

TGIF! Here’s what is moving the markets.

👉 Meta inks deal with Google and Microsoft

👉 Netflix’s Q1 earnings beat

👉 Bitcoin miners gain big

So, let’s go 🚀

Market Wrap 📉

The S&P 500 index slipped for the fifth consecutive trading session on Thursday, its longest losing streak since October 2023.

It is also the longest negative run for the tech-heavy Nasdaq Composite index since January.

Further, the Russell 2000 is on track to notch its worst monthly performance since 2022, as small caps are also experiencing a sell-off.

The small-cap index is down 8% in April. If the decline holds through the end of the month, it would be the biggest monthly loss for the index since September 2022, when it pulled back by 9%.

The ongoing earnings season will be a key near-term driver for equity indices. Around 12% of the S&P 500-index listed companies have reported Q1 earnings, of which 73% have surpassed consensus estimates.

Trending Stocks 🔥

Tesla - The EV manufacturer fell 3.55% after Deutsche Bank downgraded the stock to a “hold” rating from a “buy” rating. The bank slashed the price target to $123 for TSLA stock, indicating a 20% downside from current levels.

Duolingo - The online language company jumped 7.5% after JPMorgan reiterated its “overweight” rating, citing its attractive risk-reward profile.

JetBlue Airways - Shares jumped 6.6% after JPMorgan upgraded the airline to “neutral” from “underperform” due to the company’s turnaround potential.

Meta’s Big AI Reveal

Yesterday, Meta announced that its artificial intelligence assistance tool, Meta AI, is rolling out across social media platforms such as Instagram, WhatsApp, Facebook, and Messenger. This is the tech giant’s biggest push into AI (until now!).

Source: CNBC

Meta AI is built on a large language model (LLM) called Meta Llama 3 and can answer questions, create animations, and generate images.

The AI tool competes directly with other LLMs, such as ChatGPT and Gemini. But in a unique twist, Meta announced a partnership with Alphabet and Microsoft to provide results from search engines such as Google and Bing.

For example, Meta explained users could ask Meta AI to plan a vacation, or provide restaurant recommendations.

Shares of Meta popped 1.5% following the announcement and have surged over 130% in the last 12 months.

Netflix Post Strong Q1 Results

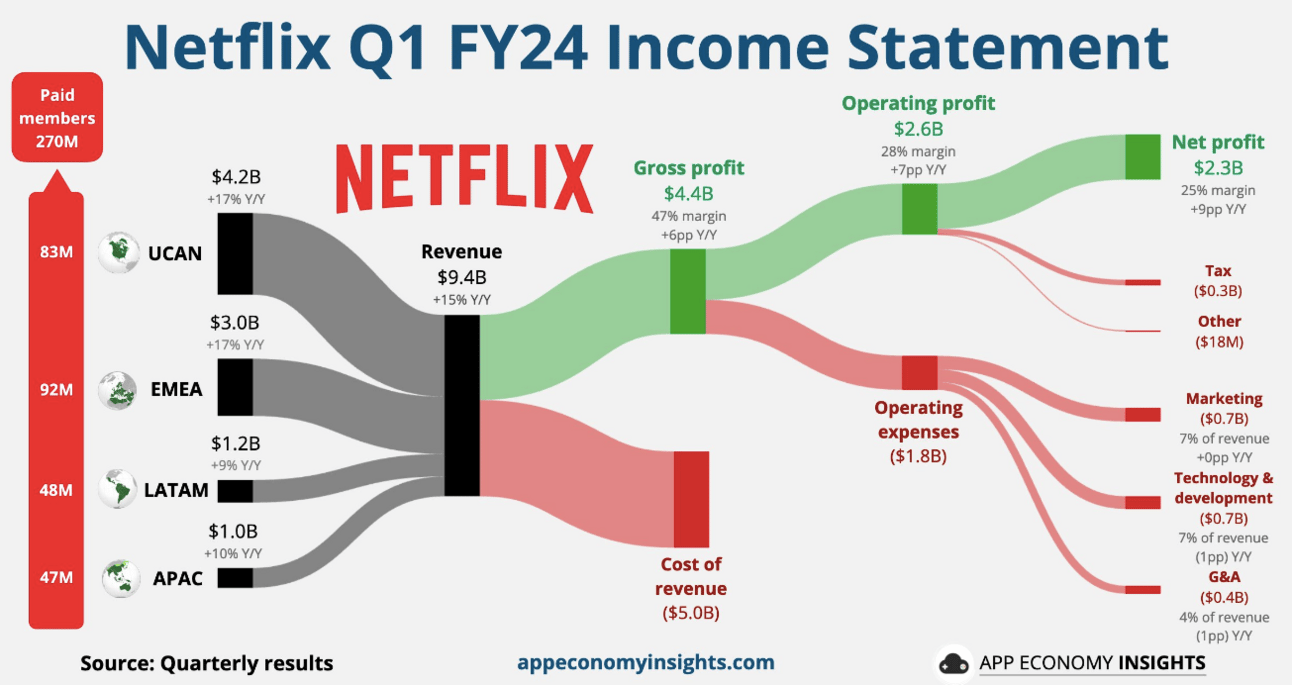

Netflix just released its Q1 results and reported:

👉 Revenue of $9.37 billion vs. estimates of $9.28 billion

👉 Earnings per share of $5.28 vs. estimates of $4.52

👉 Total memberships of 269.6 million vs. estimates of 264.2 million

The streaming giant reported revenue of $81.6 billion and earnings of $2.88 per share in the year-ago period.

However, Netflix stock is down over 6% in pre-market trading today after it forecast revenue of $9.49 billion in Q2, below consensus estimates of $9.54 billion.

Additionally, Netflix emphasized it would not provide quarterly membership numbers or average revenue per user starting next year. Netflix’s membership count rose 16% year over year in Q1.

Netflix is navigating its transformation from focusing on subscriber growth to diversifying its revenue base and growing the bottom line, driven by price hikes, a crackdown on password sharing, and the launch of an ad-supported tier.

Rise and grind, dollar bills!

Put your money to work in a high-yield cash account with up to $2M in FDIC† insurance through program banks.

Get started today, with as little as $10.

Home Sales On the Rise?

Existing home sales declined lower than expected in March as prices set a new record, according to a report from the National Association of Realtors.

Sales were down 4.3% on the month to 4.19 million, lower than estimates of a 4.8% decline.

Moreover, median existing home prices rose by 4.8% to $393,500. Comparatively, inventory rose by 1.11 million to the equivalent of 3.2 months of supply.

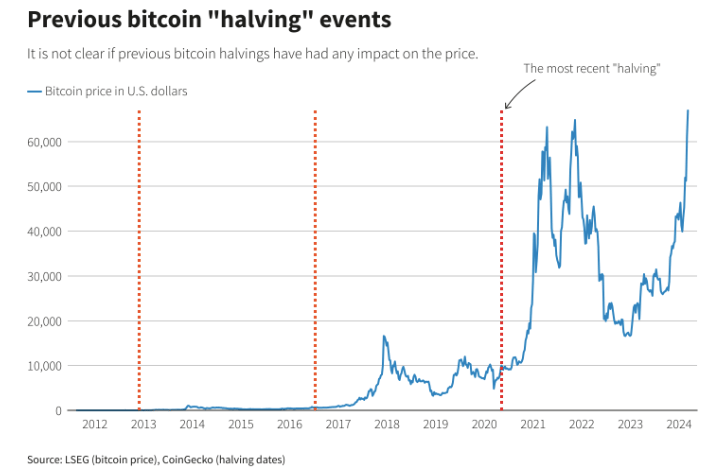

Bitcoin Mining Stocks Move Higher

Several Bitcoin mining stocks rose ahead of the upcoming “halving” event, which will cut mining revenue in half.

Source: Reuters

While Marathon Digital rose 7%, Riot Platform, Iris Energy, and CleanSpark gained 4%, 8%, and 13%, respectively, on Thursday.

BTC miners have been preparing for the halving event by investing in new mining equipment, increasing electricity capacity, and growing their hash rates.

Alternatively, uncertainty ahead of the closely followed event has pressurized mining stocks, most of which have declined by more than 10% in 2023.

Headlines You Can't Miss!

Oil and gold prices surge as Israel attacks Iran

China’s fiscal stimulus is losing its effectiveness

India kicks off the world’s largest elections

Japan’s March inflation slows to 2.6%

Tether expands beyond stablecoins

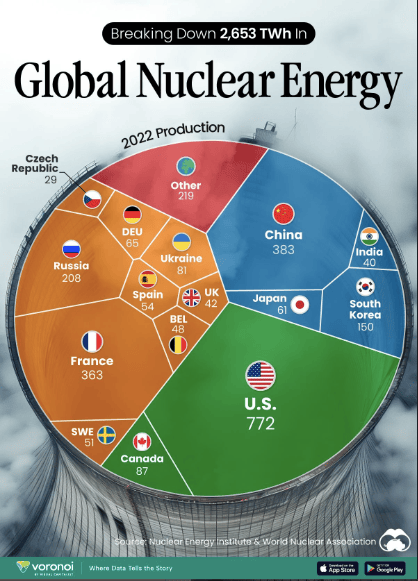

Chart of The Day

The global shift towards clean energy solutions is inevitable as countries invest trillions of dollars to fight climate change. Nuclear energy, along with solar, wind, and hydropower, will play a key role in this transition.

Currently, nuclear power accounts for 10% of the global electricity mix, and the number could rise to 25% over time. According to a report from Visual Capitalist, 436 nuclear reactors are operational worldwide, and 173 more are under development.

India has disclosed plans to invest heavily in nuclear energy. By 2032, the country plans to construct 18 reactors, boosting its nuclear generation to 2.42 gigawatts.

Meme of the Day

Source: @gavinuf7

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.